Category: Crypto News

Why Solana Price May Fall 25% Amid Market Correction

Also Read: Grayscale Solana Trust Hits Record Premium Amid Bull Run

Will SOL Price $150 Support?

From the late January bottom of $80, the Solana (SOL) Price Prediction for April 2nd – Is Solana (SOL) price ready for further growth long-term? has witnessed an aggressive rally which propelled its price 166% to hit a 27-month high of $210. However, the recovery trend shifted sideways below this resistance amid the broader market consolidation.

On April 1st, the SOL price showcased its second reversal from $205 resistance, leading the 12% downfall trade at $179.8. According to the derivative market tracker, Coinglass, this downfall triggered a liquidation of $20 million in Long positions.

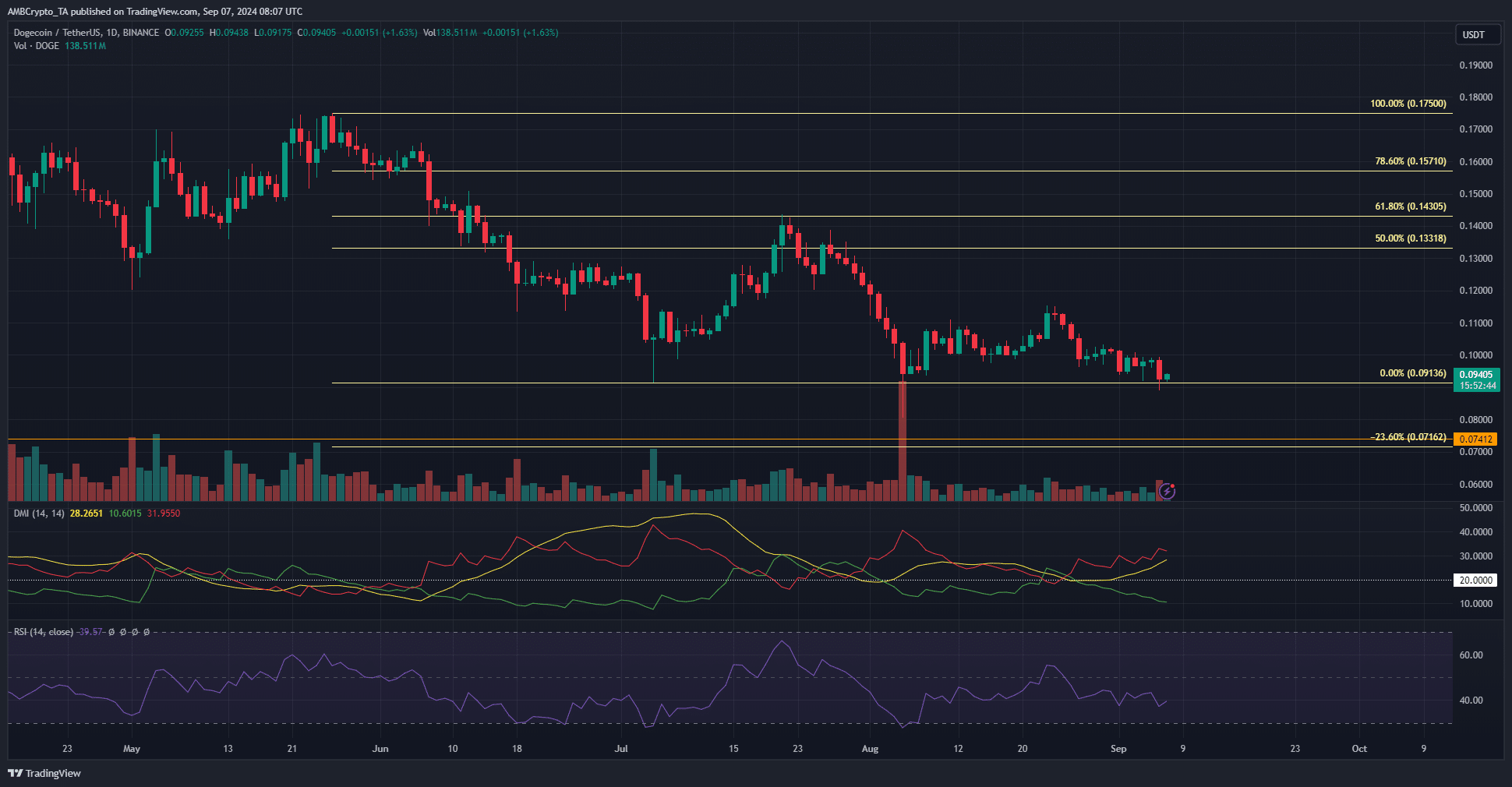

An analysis of the daily chart showed this reversal as the formation of a bearish reversal pattern called double top. This technical setup usually hits top formation in an asset followed by a significant correction trend.

If the pattern holds true, the Solana price may plunge 8.5% to challenge the combined support of $162.3 and 23.6% Fibonacci retracement level. Losing this support intensifies supply pressure and pushes the coin price to $136 or $111.5 support.

Related: Solana Memecoins Suffer 15% Outflows as Wider Market Falls

However, a look at the weekly chart shows the SOL coin is rising under the influence of the largest rounding bottom pattern, a classic reversal pattern indicating the maturity of a downtrend and emerging on a new bull run.

With sustained buying, the buyers may drive a rally to a $260 high.

Technical Indicator

- Exponential Moving Average: The 20-and-50-day EMA slopes stand as key pullback support for buyers during an occasional market correction.

- Directional Movement Index: The DI+(blue) and DI-(orange) slope on the verge of bearish crossover hints at an active correction trend developing in this altcoin.

Related Articles

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: