Category: Crypto News, News

Why XRP Price Is Going Down? Trump’s Tariffs Push XRP to Lowest Level in 5 Months

As of April

7, 2025, XRP, the cryptocurrency tied to Ripple Labs, has plunged to $1.6775—its

lowest level since November 2024. This sharp decline has left investors

scrambling for answers: Why is XRP price falling and how far can it go? What’s

driving this sudden drop in a market that seemed poised for growth earlier this

year?

The answer

lies in a confluence of macroeconomic forces, with U.S. President Donald

Trump’s sweeping tariffs and the escalating global trade war taking center

stage. Cryptocurrencie like Bitcoin (BTC) and Ethereum (ETH) are also feeling

the “trade war pain,” with Bitcoin shedding 7% to $77,077 and Ethereum

dropping to $1,538 in a risk-off market sell-off. XRP, often correlated with

broader crypto trends, is no exception.

This

article dives deep into the reasons behind recent decline, analyzing the chart

from the technical perspective and checking the most up-to-date XRP price

prediction for 2025 and beyond.

XRP Price Today in USD Hits Lowest Level Since November 2025

XRP, the

fourth-largest cryptocurrency by market capitalization, has lost over 25% of

its value in the past month. As of the time of writing this text, Monday, April

7, 2025, one XRP is priced at $1.67—the lowest level since November 2024 (five

months ago).

The

cryptocurrency’s market cap has slid by 17% to $102.5 billion, though trading

volumes over the last 24 hours remain exceptionally high due to significant

selling activity, currently standing at $7.65 billion, up 261%.

On Sunday, XRP price today in USD is falling sharply. Source: CoinMarketCap.com

the XRP price fell by 10.4%, with an additional 12.3% drop on Monday.

According

to Coinglass data, $968 million in bullish crypto wagers were liquidated in the

past 24 hours, including $321 million for Bitcoin and $269 million for Ether,

highlighting the scale of the market panic. For XRP, the liquidation figures

are smaller but still elevated, reaching $47 million.

Liquidation data heat map. Source: Coinglass.com

You may also like: Why S&P 500, and Nasdaq 100 Futures Plummet to 6-Month Lows Amid Trump’s Tariff Turmoil

Why XRP Is Falling?

Trump’s Tariff Onslaught

On April 2,

2025, President Trump rolled out what he dubbed “Liberation Day”

tariffs, imposing steep duties on imports from major trading partners like

Canada, Mexico, and China. A blanket 20% tariff on Chinese goods, 25% on steel

and aluminum imports, and additional levies on automobiles have sparked fears

of a full-blown trade war. Bloomberg reports that these measures have

already “wiped trillions in value from U.S. equities,” with U.S.

equity-index futures slumping and the yen surging as investors flee risk

assets. CNBC notes that global stocks lost $7.46 trillion in market

value in just two sessions following the tariff announcement, including $5.87

trillion in the U.S. alone.

Trump’s new announced tariffs- basically add 20% to the cost of any product you buy. This is going to be horrible pic.twitter.com/1oHX2hx9Pt

— Maya Luna (@envisionedluna) April 2, 2025

For

cryptocurrencies, this macroeconomic turbulence has been a gut punch. Bitcoin,

the market leader, fell below $78,000 on Sunday evening, April 6, erasing gains

that had kept it above $80,000 for most of 2025. Ether and Solana tokens

tumbled by 12% each, while XRP followed suit, dropping to $1.6775 by Monday

morning.

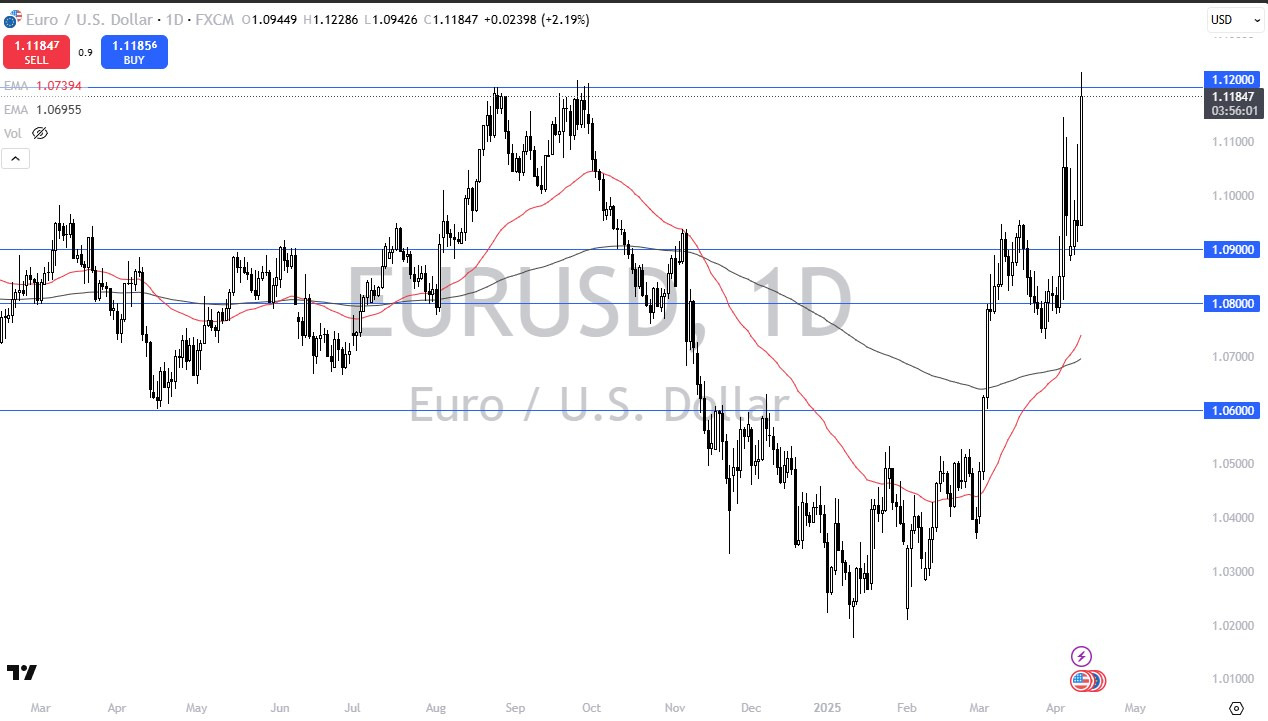

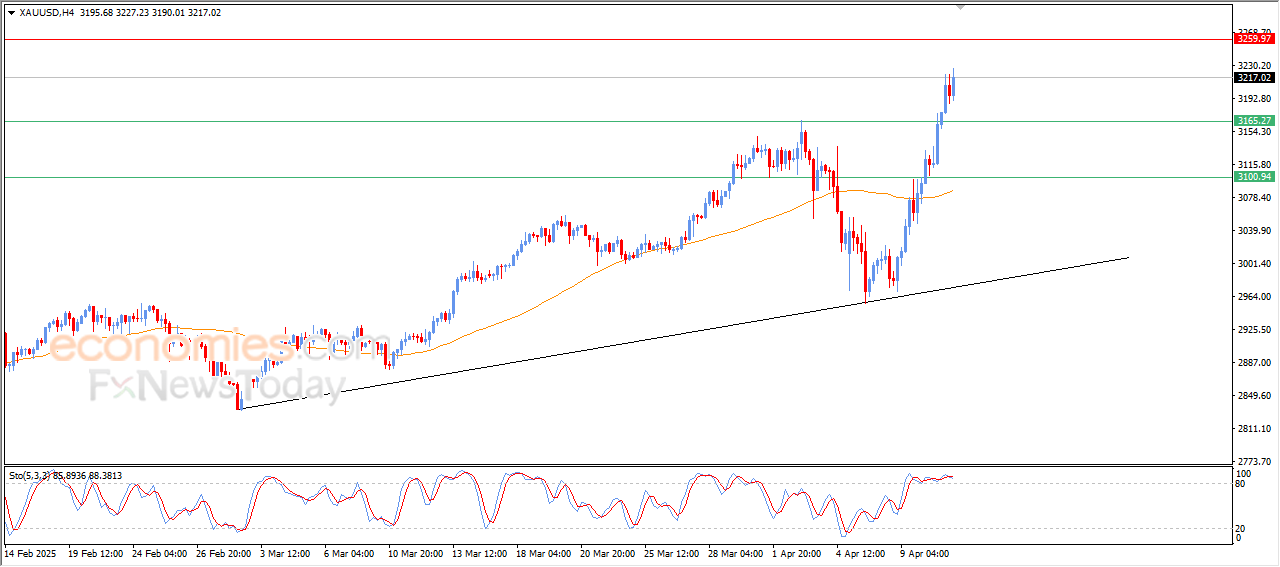

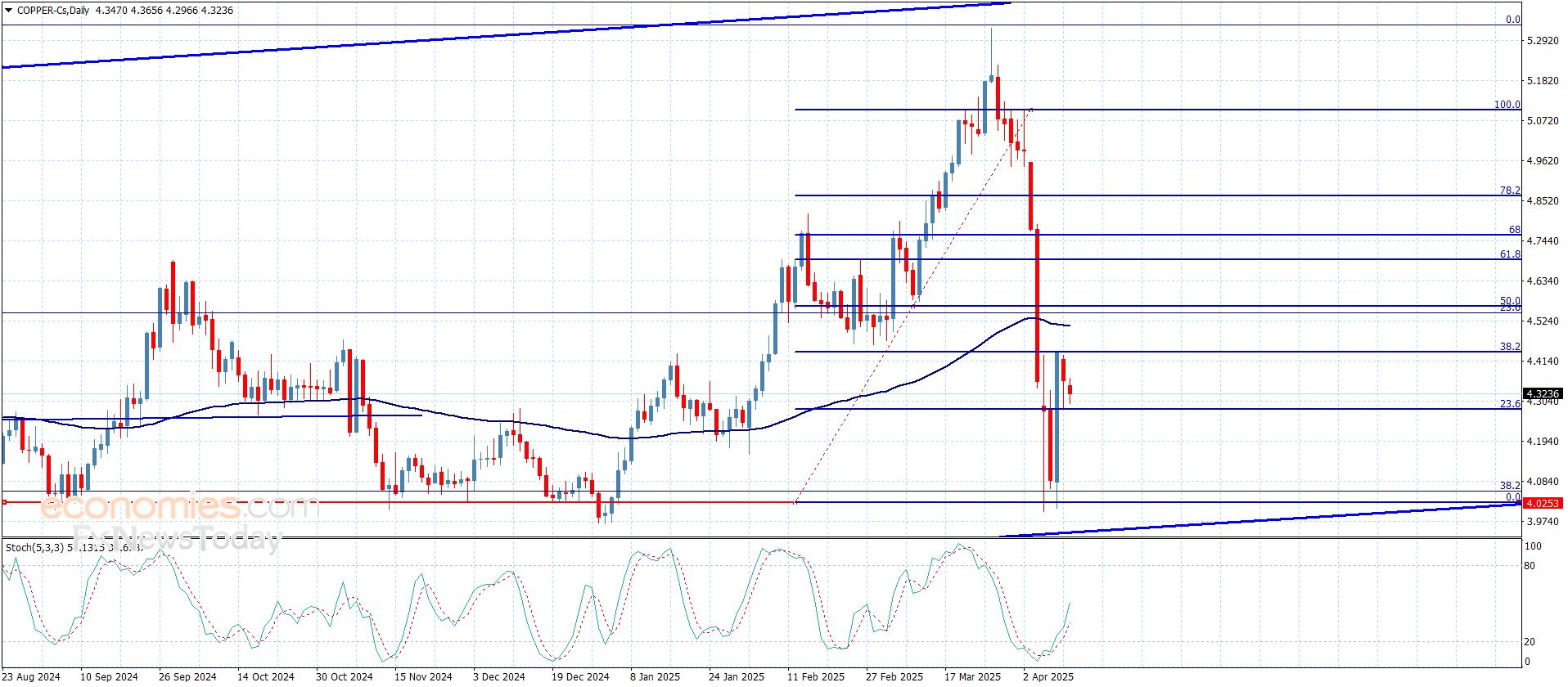

Why Trade Wars Hurt Crypto

Financial

theory tells us that cryptocurrencies like XRP are risk assets, meaning their

prices tend to rise in bullish, low-interest-rate environments and fall when

investors turn risk-averse. Trump’s tariffs threaten higher inflation and

slower global growth—conditions that reduce liquidity and push capital toward

safe havens like gold or the U.S. dollar.

Bloomberg’s

Suvashree Ghosh and Sidhartha Shukla highlight a “clear risk-off sentiment

across markets,” with options markets signaling continued selling

pressure. For instance, Sean McNulty of FalconX told Bloomberg that

Bitcoin’s key support level is $75,000, with growing demand for put options at

$70,000—a sign traders expect further declines.

Crypto markets in trade wars:

Since trade war worries began on January 20th, crypto markets have erased -$800 BILLION.

For 10+ years, Bitcoin was viewed as a decentralized HEDGE against uncertainty, but something changed.

Why is crypto falling? Let us explain.

(a thread) pic.twitter.com/NQiRiD5Be5

— The Kobeissi Letter (@KobeissiLetter) February 27, 2025

XRP,

despite its utility in cross-border payments, isn’t immune. Its high

correlation with Bitcoin (often exceeding 0.8 since the Covid-19 pandemic)

means it moves in tandem with the broader crypto market. When Bitcoin routs, as

it has amid this trade war, XRP feels the ripple effects—pun intended.

XRP Price Technical

Analysis

From my

technical analysis, the price of XRP, following strong two-day declines on

Sunday and Monday, has once again reached the lower boundary of a bearish

regression channel, which has been drawn on the chart since the peaks of

January 2025. While this line has so far prevented steeper drops and acted as

support, it’s worth noting that XRP/USDT is currently also breaching the zone

of intraday lows established by the troughs on February 3. If Monday’s session

closes below the $1.77 level, there’s an increased risk that the trendline will

also “break.”

In such a XRP price technical analysis. Source: Tradingview.com

scenario, in my opinion, the price of XRP could pave the way for much sharper

declines toward 1.50, or even the psychological level of 1 dollar. Why do I

believe bears will dominate XRP? Primarily due to the breach of the $2.00–2.01 level,

which had been a key support zone uninterrupted since early December,

repeatedly tested—including at the beginning of April. However, Sunday brought

its dynamic breakdown, and Monday clearly confirmed its rejection.

For

journalistic integrity, I’ll also mention resistance levels, though there’s

currently no indication that XRP will rise. Beyond $2.01, I identify $2.92 on

the chart, which corresponds to February’s lows. The next level is around $2.86,

aligning with the highs from early December. The ultimate target for bulls,

should they regain market favor, would be $3.37—the January highs.

XRP Price Prediction 2025 Table

Despite the

current downturn, analysts, banks, and real people remain optimistic about

XRP’s long-term potential, driven by Ripple’s institutional adoption and

regulatory developments. Below is a table summarizing XRP price predictions for

2025 and beyond, followed by detailed insights.

|

Source |

2025 Prediction |

2030 Prediction |

Notes |

|

Changelly |

$3.32 (avg) |

$26.09 (avg) |

Assumes |

|

DigitalCoinPrice |

$3.51 (avg) |

$80.57 (max) |

Optimistic, |

|

Bitwise (via TheCryptoBasic) |

$3.50–$4.00 |

$30 (max) |

Conservative |

|

CoinPriceForecast |

$2.05–$2.50 |

$50.00 (max) |

Steady |

|

Shannon Thorp (ex-Citi) |

$100–$500 |

N/A |

Long-term |

|

Telegaon |

$3.75–$6.87 |

$48 (max) |

Bullish |

Analysts

offer a wide range for 2025, reflecting both caution and optimism. Changelly

forecasts an average of $3.32, with a minimum of $2.12 and a maximum of $4.52,

based on historical price trends and Ripple ’s growing role in payments.

DigitalCoinPrice is slightly more bullish at $3.51, citing ongoing interest

despite the trade war slump. Bitwise, as reported by TheCryptoBasic on April 3,

2025, projects $3.50–$4.00, a conservative estimate for institutional clients

following their XRP ETF filing.

Looking

further ahead, optimism grows. Changelly sees XRP averaging $26.09 by 2030,

while DigitalCoinPrice’s high-end projection of $80.57 assumes mass adoption.

Bitwise’s $30 maximum for 2030 aligns with institutional uptake, bolstered by

Ripple’s partnerships with banks like SBI Holdings and Bank of America.

CoinPriceForecast predicts $50, reflecting a strong but realistic growth

trajectory. Telegaon’s $48 maximum for 2030 and $235 average by 2040 hinge on

XRP becoming a cornerstone of global finance. Shannon Thorp, a former Citi

specialist, offers a speculative $100–$500 range, however the timeline was not

specified.

You may also like: Will XRP Reach $10? Latest XRP Price Prediction for 2025 Says Yes

What’s Next for XRP

Investors

XRP’s fall

to $1.6775 on April 7, 2025, marks a challenging moment for the cryptocurrency,

driven by Trump’s tariffs and the ensuing trade war. The risk-off sentiment

battering crypto markets, has exposed XRP’s vulnerabilities—its reliance on

global trade and sensitivity to Bitcoin’s movements.

For

investors, the path forward requires vigilance. Monitor tariff developments,

Ripple’s regulatory progress, and technical levels like $1.70 support. Whether

you’re a beginner crypto enthusiast or a seasoned trader, now’s the time to

reassess your strategy—consider diversifying or holding steady for a potential

rebound.

XRP News and Price, FAQ

Why Is XRP Declining?

XRP is

declining primarily due to macroeconomic pressures from U.S. President Donald

Trump’s sweeping tariffs, which have triggered a global trade war and a

risk-off sentiment across financial markets. As of April 7, 2025, XRP has

fallen to $1.7504, losing over 25% in the past month, with a 10.4% drop on

Sunday and an additional 12.3% on Monday.

Will XRP Go Back Up?

Yes. XRP’s

potential recovery depends on resolving trade war tensions and crypto-specific

catalysts. Analysts remain cautiously optimistic: Changelly predicts an average

of $3.32 by year-end 2025. Ripple’s RLUSD stablecoin and potential U.S.

regulatory tailwinds could also lift prices.

Is It Worth Investing in

XRP Now?

Yes. However,

investing in XRP at $1.7504 carries both risks and opportunities. The current

price is a steep discount from its January 2025 peak of $3.37, appealing to

risk-tolerant investors betting on a rebound. With high selling volumes ($7.65

billion in 24 hours, up 261%) and a bearish technical outlook (possible drop to

1.50 if 1.77 fails), caution is advised.

Why Has XRP Just Crashed?

XRP’s

recent crash—down 10.4% on Sunday and 12.3% on Monday, hitting $1.7504—stems

from a broader crypto market rout fueled by Trump’s tariffs. CNBC reports

global stocks lost $7.46 trillion in two sessions, driving investors away from

risk assets like XRP. The breach of the 2.00–2.01 support, tested since

December, triggered a dynamic sell-off, with Monday confirming its rejection.

Coinglass data show $47 million in XRP bullish liquidations, reflecting panic

selling.

Stay

informed with the latest FinanceMagnates.com

market news, and don’t let fear dictate your decisions.

As of April

7, 2025, XRP, the cryptocurrency tied to Ripple Labs, has plunged to $1.6775—its

lowest level since November 2024. This sharp decline has left investors

scrambling for answers: Why is XRP price falling and how far can it go? What’s

driving this sudden drop in a market that seemed poised for growth earlier this

year?

The answer

lies in a confluence of macroeconomic forces, with U.S. President Donald

Trump’s sweeping tariffs and the escalating global trade war taking center

stage. Cryptocurrencie like Bitcoin (BTC) and Ethereum (ETH) are also feeling

the “trade war pain,” with Bitcoin shedding 7% to $77,077 and Ethereum

dropping to $1,538 in a risk-off market sell-off. XRP, often correlated with

broader crypto trends, is no exception.

This

article dives deep into the reasons behind recent decline, analyzing the chart

from the technical perspective and checking the most up-to-date XRP price

prediction for 2025 and beyond.

XRP Price Today in USD Hits Lowest Level Since November 2025

XRP, the

fourth-largest cryptocurrency by market capitalization, has lost over 25% of

its value in the past month. As of the time of writing this text, Monday, April

7, 2025, one XRP is priced at $1.67—the lowest level since November 2024 (five

months ago).

The

cryptocurrency’s market cap has slid by 17% to $102.5 billion, though trading

volumes over the last 24 hours remain exceptionally high due to significant

selling activity, currently standing at $7.65 billion, up 261%.

On Sunday, XRP price today in USD is falling sharply. Source: CoinMarketCap.com

the XRP price fell by 10.4%, with an additional 12.3% drop on Monday.

According Liquidation data heat map. Source: Coinglass.com

to Coinglass data, $968 million in bullish crypto wagers were liquidated in the

past 24 hours, including $321 million for Bitcoin and $269 million for Ether,

highlighting the scale of the market panic. For XRP, the liquidation figures

are smaller but still elevated, reaching $47 million.

You may also like: Why S&P 500, and Nasdaq 100 Futures Plummet to 6-Month Lows Amid Trump’s Tariff Turmoil

Why XRP Is Falling?

Trump’s Tariff Onslaught

On April 2,

2025, President Trump rolled out what he dubbed “Liberation Day”

tariffs, imposing steep duties on imports from major trading partners like

Canada, Mexico, and China. A blanket 20% tariff on Chinese goods, 25% on steel

and aluminum imports, and additional levies on automobiles have sparked fears

of a full-blown trade war. Bloomberg reports that these measures have

already “wiped trillions in value from U.S. equities,” with U.S.

equity-index futures slumping and the yen surging as investors flee risk

assets. CNBC notes that global stocks lost $7.46 trillion in market

value in just two sessions following the tariff announcement, including $5.87

trillion in the U.S. alone.

Trump’s new announced tariffs- basically add 20% to the cost of any product you buy. This is going to be horrible pic.twitter.com/1oHX2hx9Pt

— Maya Luna (@envisionedluna) April 2, 2025

For

cryptocurrencies, this macroeconomic turbulence has been a gut punch. Bitcoin,

the market leader, fell below $78,000 on Sunday evening, April 6, erasing gains

that had kept it above $80,000 for most of 2025. Ether and Solana tokens

tumbled by 12% each, while XRP followed suit, dropping to $1.6775 by Monday

morning.

Why Trade Wars Hurt Crypto

Financial

theory tells us that cryptocurrencies like XRP are risk assets, meaning their

prices tend to rise in bullish, low-interest-rate environments and fall when

investors turn risk-averse. Trump’s tariffs threaten higher inflation and

slower global growth—conditions that reduce liquidity and push capital toward

safe havens like gold or the U.S. dollar.

Bloomberg’s

Suvashree Ghosh and Sidhartha Shukla highlight a “clear risk-off sentiment

across markets,” with options markets signaling continued selling

pressure. For instance, Sean McNulty of FalconX told Bloomberg that

Bitcoin’s key support level is $75,000, with growing demand for put options at

$70,000—a sign traders expect further declines.

Crypto markets in trade wars:

Since trade war worries began on January 20th, crypto markets have erased -$800 BILLION.

For 10+ years, Bitcoin was viewed as a decentralized HEDGE against uncertainty, but something changed.

Why is crypto falling? Let us explain.

(a thread) pic.twitter.com/NQiRiD5Be5

— The Kobeissi Letter (@KobeissiLetter) February 27, 2025

XRP,

despite its utility in cross-border payments, isn’t immune. Its high

correlation with Bitcoin (often exceeding 0.8 since the Covid-19 pandemic)

means it moves in tandem with the broader crypto market. When Bitcoin routs, as

it has amid this trade war, XRP feels the ripple effects—pun intended.

XRP Price Technical

Analysis

From my

technical analysis, the price of XRP, following strong two-day declines on

Sunday and Monday, has once again reached the lower boundary of a bearish

regression channel, which has been drawn on the chart since the peaks of

January 2025. While this line has so far prevented steeper drops and acted as

support, it’s worth noting that XRP/USDT is currently also breaching the zone

of intraday lows established by the troughs on February 3. If Monday’s session

closes below the $1.77 level, there’s an increased risk that the trendline will

also “break.”

In such a XRP price technical analysis. Source: Tradingview.com

scenario, in my opinion, the price of XRP could pave the way for much sharper

declines toward 1.50, or even the psychological level of 1 dollar. Why do I

believe bears will dominate XRP? Primarily due to the breach of the $2.00–2.01 level,

which had been a key support zone uninterrupted since early December,

repeatedly tested—including at the beginning of April. However, Sunday brought

its dynamic breakdown, and Monday clearly confirmed its rejection.

For

journalistic integrity, I’ll also mention resistance levels, though there’s

currently no indication that XRP will rise. Beyond $2.01, I identify $2.92 on

the chart, which corresponds to February’s lows. The next level is around $2.86,

aligning with the highs from early December. The ultimate target for bulls,

should they regain market favor, would be $3.37—the January highs.

XRP Price Prediction 2025 Table

Despite the

current downturn, analysts, banks, and real people remain optimistic about

XRP’s long-term potential, driven by Ripple’s institutional adoption and

regulatory developments. Below is a table summarizing XRP price predictions for

2025 and beyond, followed by detailed insights.

|

Source |

2025 Prediction |

2030 Prediction |

Notes |

|

Changelly |

$3.32 (avg) |

$26.09 (avg) |

Assumes |

|

DigitalCoinPrice |

$3.51 (avg) |

$80.57 (max) |

Optimistic, |

|

Bitwise (via TheCryptoBasic) |

$3.50–$4.00 |

$30 (max) |

Conservative |

|

CoinPriceForecast |

$2.05–$2.50 |

$50.00 (max) |

Steady |

|

Shannon Thorp (ex-Citi) |

$100–$500 |

N/A |

Long-term |

|

Telegaon |

$3.75–$6.87 |

$48 (max) |

Bullish |

Analysts

offer a wide range for 2025, reflecting both caution and optimism. Changelly

forecasts an average of $3.32, with a minimum of $2.12 and a maximum of $4.52,

based on historical price trends and Ripple ’s growing role in payments.

DigitalCoinPrice is slightly more bullish at $3.51, citing ongoing interest

despite the trade war slump. Bitwise, as reported by TheCryptoBasic on April 3,

2025, projects $3.50–$4.00, a conservative estimate for institutional clients

following their XRP ETF filing.

Looking

further ahead, optimism grows. Changelly sees XRP averaging $26.09 by 2030,

while DigitalCoinPrice’s high-end projection of $80.57 assumes mass adoption.

Bitwise’s $30 maximum for 2030 aligns with institutional uptake, bolstered by

Ripple’s partnerships with banks like SBI Holdings and Bank of America.

CoinPriceForecast predicts $50, reflecting a strong but realistic growth

trajectory. Telegaon’s $48 maximum for 2030 and $235 average by 2040 hinge on

XRP becoming a cornerstone of global finance. Shannon Thorp, a former Citi

specialist, offers a speculative $100–$500 range, however the timeline was not

specified.

You may also like: Will XRP Reach $10? Latest XRP Price Prediction for 2025 Says Yes

What’s Next for XRP

Investors

XRP’s fall

to $1.6775 on April 7, 2025, marks a challenging moment for the cryptocurrency,

driven by Trump’s tariffs and the ensuing trade war. The risk-off sentiment

battering crypto markets, has exposed XRP’s vulnerabilities—its reliance on

global trade and sensitivity to Bitcoin’s movements.

For

investors, the path forward requires vigilance. Monitor tariff developments,

Ripple’s regulatory progress, and technical levels like $1.70 support. Whether

you’re a beginner crypto enthusiast or a seasoned trader, now’s the time to

reassess your strategy—consider diversifying or holding steady for a potential

rebound.

XRP News and Price, FAQ

Why Is XRP Declining?

XRP is

declining primarily due to macroeconomic pressures from U.S. President Donald

Trump’s sweeping tariffs, which have triggered a global trade war and a

risk-off sentiment across financial markets. As of April 7, 2025, XRP has

fallen to $1.7504, losing over 25% in the past month, with a 10.4% drop on

Sunday and an additional 12.3% on Monday.

Will XRP Go Back Up?

Yes. XRP’s

potential recovery depends on resolving trade war tensions and crypto-specific

catalysts. Analysts remain cautiously optimistic: Changelly predicts an average

of $3.32 by year-end 2025. Ripple’s RLUSD stablecoin and potential U.S.

regulatory tailwinds could also lift prices.

Is It Worth Investing in

XRP Now?

Yes. However,

investing in XRP at $1.7504 carries both risks and opportunities. The current

price is a steep discount from its January 2025 peak of $3.37, appealing to

risk-tolerant investors betting on a rebound. With high selling volumes ($7.65

billion in 24 hours, up 261%) and a bearish technical outlook (possible drop to

1.50 if 1.77 fails), caution is advised.

Why Has XRP Just Crashed?

XRP’s

recent crash—down 10.4% on Sunday and 12.3% on Monday, hitting $1.7504—stems

from a broader crypto market rout fueled by Trump’s tariffs. CNBC reports

global stocks lost $7.46 trillion in two sessions, driving investors away from

risk assets like XRP. The breach of the 2.00–2.01 support, tested since

December, triggered a dynamic sell-off, with Monday confirming its rejection.

Coinglass data show $47 million in XRP bullish liquidations, reflecting panic

selling.

Stay

informed with the latest FinanceMagnates.com

market news, and don’t let fear dictate your decisions.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: