Category: Forex News, News

XAG/USD rises to near $76.50 but eyes third weekly decline

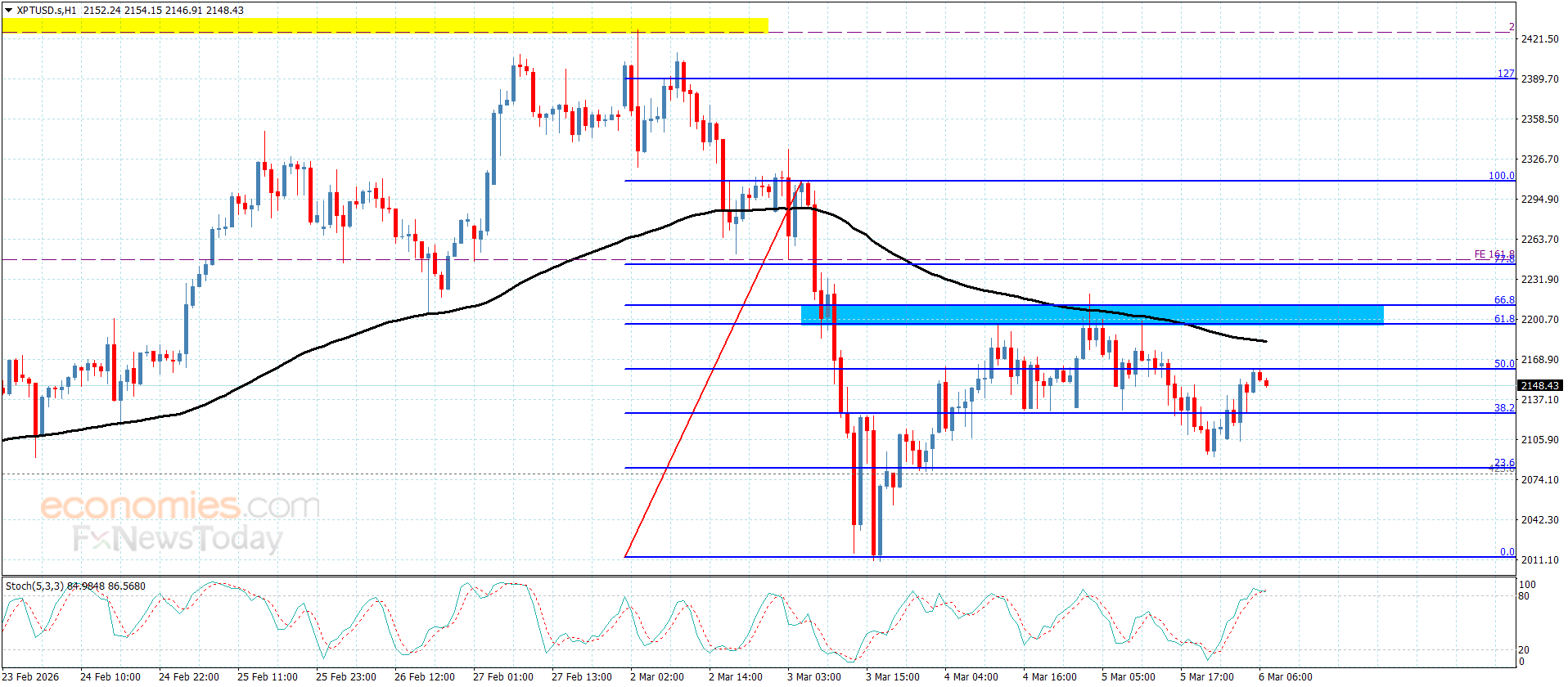

Silver price (XAG/USD) gains ground after registering 11.5% losses in the previous session, trading around $76.60 per troy ounce during the early European hours on Friday. However, the silver price is poised for a third consecutive weekly decline as volatility resurfaces.

Traders had no clear catalyst to explain Thursday’s drop, but parallel losses in equities and cryptocurrencies suggest broad forced liquidation, likely intensified by systematic and algorithmic trading flows.

Investors are now focused on the latest US consumer inflation data, which could help shape expectations for Federal Reserve policy. Headline Consumer Price Index (CPI) inflation is forecast to ease to 2.5% from 2.7%, while core CPI inflation is expected to slow to 2.5% from 2.6%. A softer print could give the Federal Reserve (Fed) room to resume rate cuts after holding steady at its first meeting of the year.

However, the CME FedWatch tool suggests that financial markets are now pricing in nearly a 92% probability that the Fed will leave rates unchanged at its March meeting, up from 82% the previous week.

The Fed is expected to deliver roughly two 25-basis-point rate cuts by year-end, with markets now pricing in a first move in June.

The safe-haven demand for Silver weakens as US President Donald Trump indicated that negotiations with Iran could continue for up to a month, lowering the immediate risk of military action. Trump is currently pursuing a diplomatic strategy aimed at curbing Iran’s nuclear program.

(This story was corrected on February 13 at 08:52 GMT to say that markets are now pricing in a first interest rate move in June, not July.)

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold’s moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: