Category: Forex News, News

XAG/USD steadies near $36.60 up over 1.80% weekly

- Silver trades flat in early Asia after hitting $36.83 weekly high; poised for 1.80% weekly gain.

- Bullish trend intact with higher highs and lows; RSI shows buyers consolidating.

- Key resistance lies at $37.00 and $37.31 YTD high; support seen at $36.00 and $35.29.

Silver price turns flat as Friday’s Asian session begins, trades near $36.60, virtually unchanged, compared to Thursday’s June 26 daily close. The XAG/USD appears poised to close the week with gains of over 1.80%.

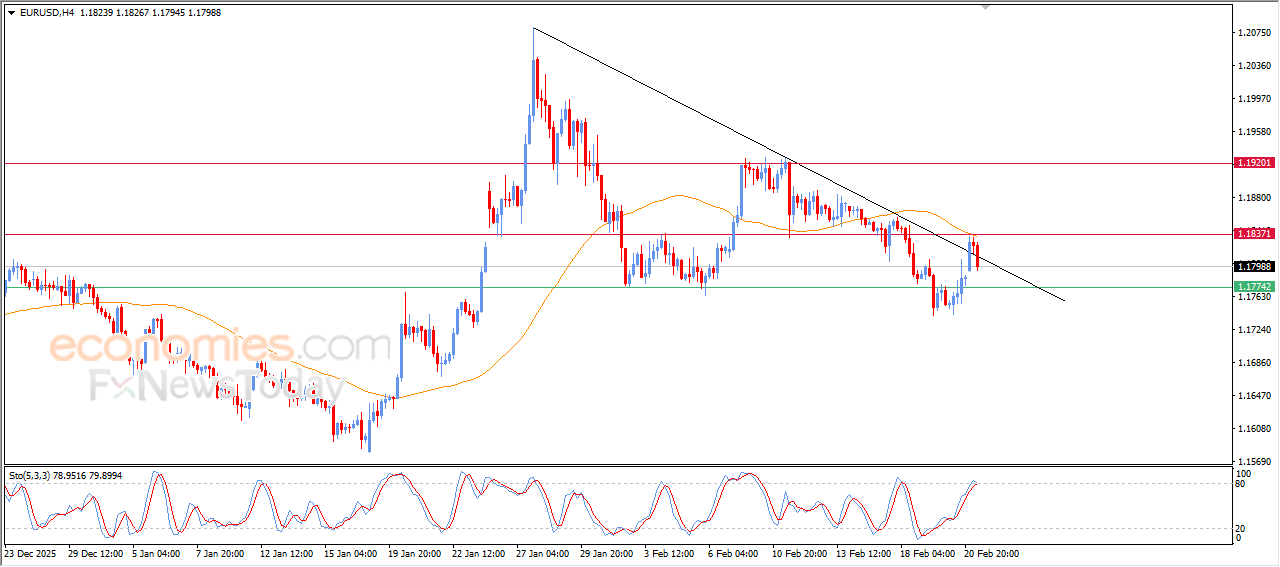

XAG/USD Price Forecast: Technical outlook

Silver remains upward biased as Friday’s Asian session begins, posting back-to-back bullish days, which pushed the grey metal towards a weekly high of $36.83. XAG/USD has achieved a successive series of higher highs and higher lows, hinting that the grey metal is headed upwards.

The Relative Strength Index (RSI) turned flatlines after edging higher for three consecutive days, in bullish territory. This indicates that buyers are taking a respite ahead of testing higher prices.

If XAG/USD climbs past $37.00, look for the next resistance at the yearly peak of $37.31. A breach of the latter will expose the $38.00 figure. Conversely, if Silver slides below $36.50, expect a test of $36.00. Further downside lies in the June 24 daily low of $35.68, followed by the latest cycle low of $35.29.

XAG/USD Price Chart – Daily

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold’s moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: