Category: Forex News, News

XAU/USD facing decisive catalysts around $4,000

XAU/USD Current price: $3,996.70

- The Bank of Canada delivered a 25-basis-point interest rate cut as expected.

- The Federal Reserve and the Bank of Japan are next in line to announce monetary policy decisions.

- XAU/USD struggles to run past $4,000, near-term risk skewed to the downside.

Spot Gold recovered the $4,000 mark after bottoming at $3,886.62 earlier in the week, but is currently hovering around the $4,000 mark. Financial markets are all about central banks on Wednesday, with the Bank of Canada (BoC) already announcing its decision and the Federal Reserve (Fed) and the Bank of Japan (BoJ) coming up next.

The BoC cut its policy rate by 25 basis points to 2.25% as widely anticipated, pushing the Canadian Dollar (CAD) sharply up and maintaining the US Dollar (USD) on the back foot. Policymakers “cut rates to support the economy through adjustment to US trade policy,” according to the accompanying statement.

Coming up next is the Fed, widely anticipated to cut the benchmark rate by 25 bps. It would be interesting to see what Chairman Jerome Powell has to say amid the ongoing government shutdown and the lack of updated data before the announcement. Could the Fed hold its fire? Seems unlikely as it would be an unexpected shock to financial markets, a risk Fed officials are unwilling to take.

Other than that, the BoJ will announce its monetary policy decision early in the Asian session, and is likely to hold interest rates unchanged, although market participants will be looking for hints on interest rate hikes. At the end of the day, the Gold price will react to the market’s sentiment after policymakers unveil their thoughts on economic performance and future monetary policies.

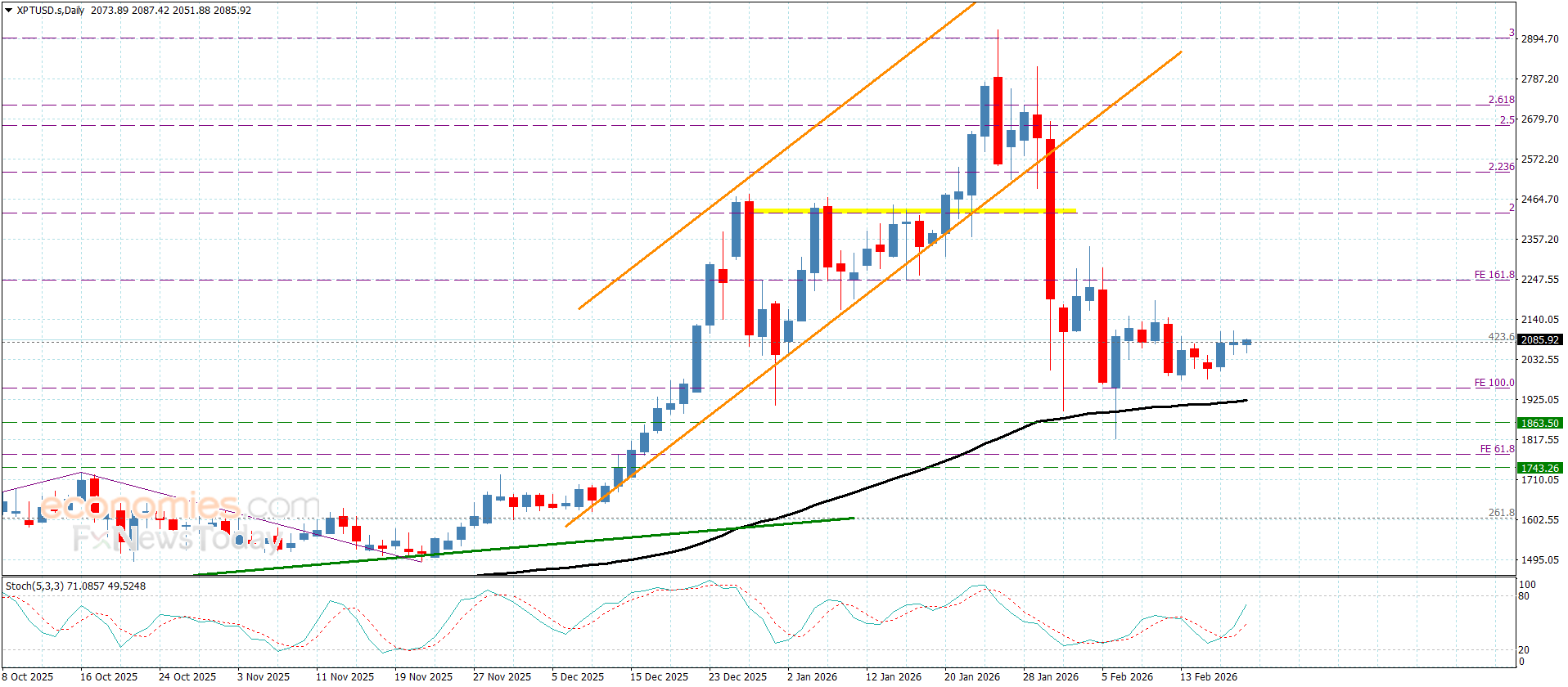

XAU/USD short-term technical outlook

On the 4-hour chart, XAU/USD is currently trading around $3,992, up $27 for the day. A bearish 20 SMA slides south below the 100 SMA, while providing near-term resistance at $4,006, followed by the 100 SMA at $4,113. Conversely, the 200 SMA is advancing and stands at $3,947 beneath the current level, underpinning the broader bias while providing critical support. The Momentum indicator has recovered markedly and now hovers near its midline, lacking sustained directional strength, while the RSI remains flat at 43, suggesting a bearish tilt within consolidation. A sustained move above $4,006 would likely ease selling pressure and open the door to a test of $4,113; failure to reclaim the short-term average would keep risks skewed toward a pullback to the $3,947 support.

In the daily chart, XAU/USD is developing below a bullish 20 SMA that runs above the longer ones, in line with the dominant bullish momentum and hinting at additional gains ahead; the 20 SMA, however, stands at $4,075, acting as dynamic resistance. The 100 SMA is also bullish, advancing at $3,572, while the 200 SMA continues to rise at $3,334. At the same time, the Momentum indicator has reversed decisively, plunging well below the 100 midline, and pointing to strong bearish pressure in the short term. Meanwhile, the RSI has cooled to 50, signaling neutral conditions after earlier overbought extremes. The mix suggests consolidation or a corrective pullback may persist while below $4075; a sustained push above that barrier would likely revive the bullish bias, whereas failure to stabilize risks a deeper slide toward the 100-day SMA at $3,572, with the 200-day at $3,334 next support.

(This content was partially created with the help of an AI tool)

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: