Category: Forex News, News

XAU/USD finds demand ahead of US-Ukraine Summit

- Gold price bounces to near $2,900, awaiting the US-Ukraine Summit for fresh directives.

- Gold price capitalizes on the US Dollar and US Treasury bond yields selling spiral.

- Gold price breaches 21-day SMA at $2,909, but the downside seems limited as the daily RSI stays bullish.

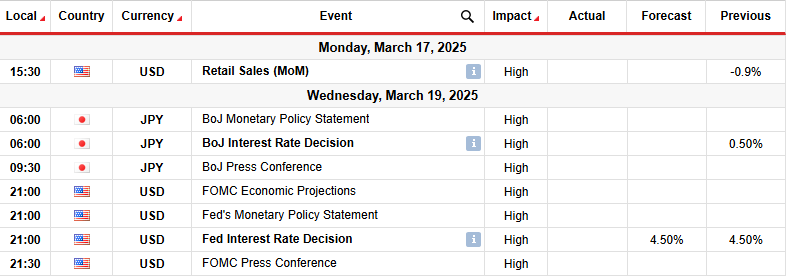

Gold price is licking its wounds below $2,900 early Tuesday, following three consecutive days of sellers’ rejoicing. All eyes now turn to the US economic data releases for fresh trading impetus, with the JOLTS Job Openings data due later on Tuesday, while the key Consumer Price Index (CPI) report will be published on Wednesday.

Gold price looks to US-Ukraine peace talks and US inflation

Gold traders resorted to profit-taking on their long positions, gearing up for the high-impact US inflation data this week and contributing to the recent losses in the bright metal. No further developments on the trade policies front by US President Donald Trump also gave an excuse to take profits off the table.

Due to Trump’s protectionism, markets remain wary of mounting concerns over a potential US recession, which could prompt the US Federal Reserve (Fed) to proceed with the interest rate cuts this year. This narrative keeps the bearish pressure intact on the US Dollar (USD) and the US Treasury bond yields, limiting the downside in the Gold price.

In a Fox News interview on Sunday, President Trump talked about a “period of transition” while declining to predict whether his tariffs would result in a US recession, which has weighed heavily on risk sentiment. He said they are “looking at a lot of things concerning tariffs on Russia.

President Trump issued a fresh tariff threat on Canadian lumber on Friday, noting that it may or may not come today, or on Monday, or on Tuesday.

Meanwhile, China’s up to 15% tariffs on US farm products took effect on Monday. Increased risks of a tit-for-tat tariff war globally will continue to keep Gold buyers hopeful.

However, Gold prices could face headwinds if the US-Ukraine Summit in Saudi Arabia later on Tuesday culminates with a bilateral minerals deal, eventually leading to the end of the Ukraine-Russia conflict.

Tensions remain high heading into the US-Ukraine peace talks since a February 28 Oval Office meeting between Ukraine’s President Volodymyr Zelenskyy and Trump descended into an argument, leading to the US suspending all military aid to Ukraine.

Gold markets will also take account of the US JOLTS Job Openings data after Friday’s disappointing February labor market report. The data could impact the US dollar’s performance and influence the Gold price movement.

Gold price technical analysis: Daily chart

Despite closing Monday below the 21-day Simple Moving Average (SMA), then at $2,911, the Gold price remains a ‘buy-the-dips’ trade.

The 14-day Relative Strength Index (RSI) points higher above the 50 level, backing the bullish potential.

Immediate resistance is at the 21-day SMA, now at $2,909. Acceptance above that level will challenge the February 26 high of $2,930.

The next topside barriers are at an all-time high of $2,956 and the $2,970 round level.

If Gold sellers refuse to give up, immediate support is seen at the $2,850 psychological barrier, below which the demand area near $2,835 could be a tough nut to crack.

Additional declines will likely test the 50-day SMA at $2,810.

(This story was corrected on March 11 at 3:26 GMT to say that “Gold price bounces to near $2,900,” not Gold price nurses losses below $2,900.)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: