Category: Forex News, News

XAU/USD yearns for acceptance above the $5,000 mark

Gold struggles below $5,000 in Thursday’s Asian trades as buyers take a breather after the 2% rally on Wednesday.

Gold remains supported by haven demand

Gold stood tall on Wednesday, despite the solid recovery in the US Dollar (USD) and US Treasury bond yields, fuelled by somewhat hawkish Minutes of the US Federal Reserve’s (Fed) January monetary policy meeting.

The Minutes suggested that the Fed remains in no rush to cut interest rates, with several policymakers open to rate hikes if inflation remains elevated, others inclined to support further cuts if inflation recedes.

However, the markets’ pricing for three 25 basis points (bps) Fed rate cuts this year remained intact, which seems to have supported the non-yielding Gold.

The main catalyst behind Gold’s upswing was the return of haven demand due to renewed geopolitical tensions. Two days of peace talks in Geneva between Ukraine and Russia ended without a breakthrough. Ukraine’s President Volodymyr Zelenskiy said he was dissatisfied with the outcome.

Meanwhile, CBS News reported, citing sources familiar with internal discussions, a potential US military strike on Iran could come as early as Saturday.

This comes after Iran’s Foreign Minister Abbas Araqchi said on Tuesday that Tehran has agreed with the US ‘on guiding principles’ for the deal, following their Geneva talks.

Against this backdrop, Gold seems to continue its recent upside but the US Dollar could have an upper hand heading toward Friday’s US PCE inflation and Gross Domestic Product (GDP) data.

The Greenback also draws support from the latest data released by the US Treasury Department, which showed a net inflow of $44.9 billion in Treasury International Capital (TIC) for December 2025. The data increased foreign appetite for US assets.

Next of note for Gold traders remains the US Jobless Claims, Pending Home Sales data and Fedspeak scheduled later in the North American session on Thursday.

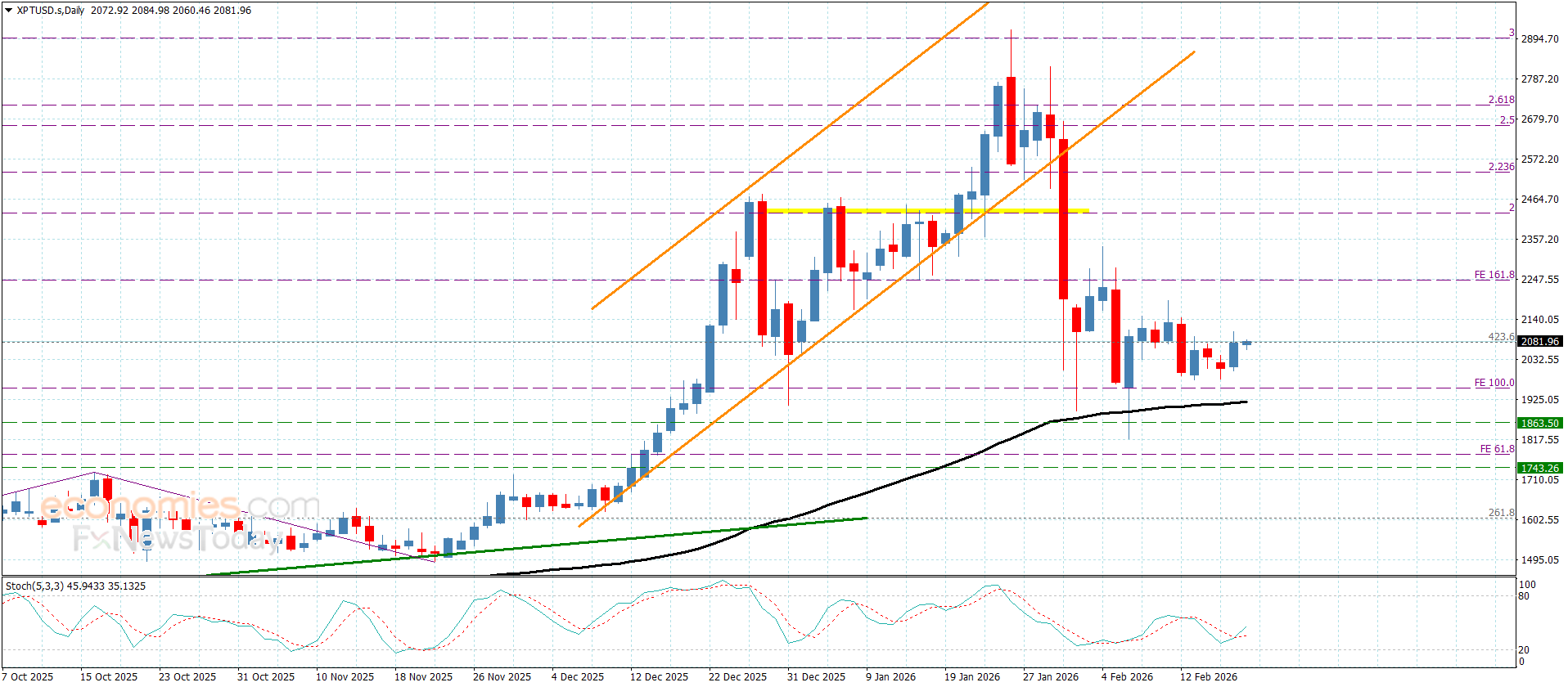

Gold price technical analysis: Daily chart

The 21-day Simple Moving Average (SMA) rises above the 50-, 100- and 200-day SMAs, preserving a bullish alignment. Price holds below the 21-day SMA at $5,001.04 but remains above the 50-day SMA at $4,688.83 and the longer baselines, keeping the broader bias upward. The Relative Strength Index (14) sits at 53 (neutral), reflecting steady momentum. Measured from the $5,597.89 high to the $4,401.99 low, the 50% retracement at $4,999.94 acts as immediate resistance.

A daily close above $4,999.94 would expose the 61.8% retracement at $5,141.05, where recovery attempts could stall. Failure to reclaim the 21-day SMA would leave the rebound vulnerable, bringing the 38.2% retracement at $4,858.82 into view, while the rising 100-day SMA at $4,393.61 underpins the medium-term trend.

(The technical analysis of this story was written with the help of an AI tool.)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: