Category: Crypto News, News

XRP futures realize $2.4 million trading volume on CME launch

- XRP slides for two consecutive days as sentiment in the broader market remains cautious.

- In its debut, the XRP futures launch on CME Group’s derivatives platform exceeded $2.4 million in trading volume.

- XRP’s stance above the 50-day, 100-day and 200-day EMAs signals a brief pause before the next breakout attempt.

Ripple (XRP) price trades broadly sideways around $2.34 on Tuesday, marking its second straight day of minor declines. This tight, range-bound action coincides with the launch of XRP futures on CME Group’s derivatives platform. CME Group received the green light to list XRP futures contracts after the Commodity Futures Trading Commission (CFTC) categorised XRP as a commodity. The product targeting institutional and retail traders is cash settled and relies on the CME’s reference data, which is updated daily.

XRP’s price remained relatively flat even as other major assets, including Bitcoin (BTC) and Ethereum (ETH), ticked higher during the late American session on Monday and the Asian session on Tuesday.

The uptick followed a call between United States (US) President Donald Trump and Russia’s President Vladimir Putin on Monday. President Trump hinted at a Russia-Ukraine ceasefire, with the two conflicting nations expected to begin talks immediately.

XRP futures CME debut attracts over $2.4 million in volume

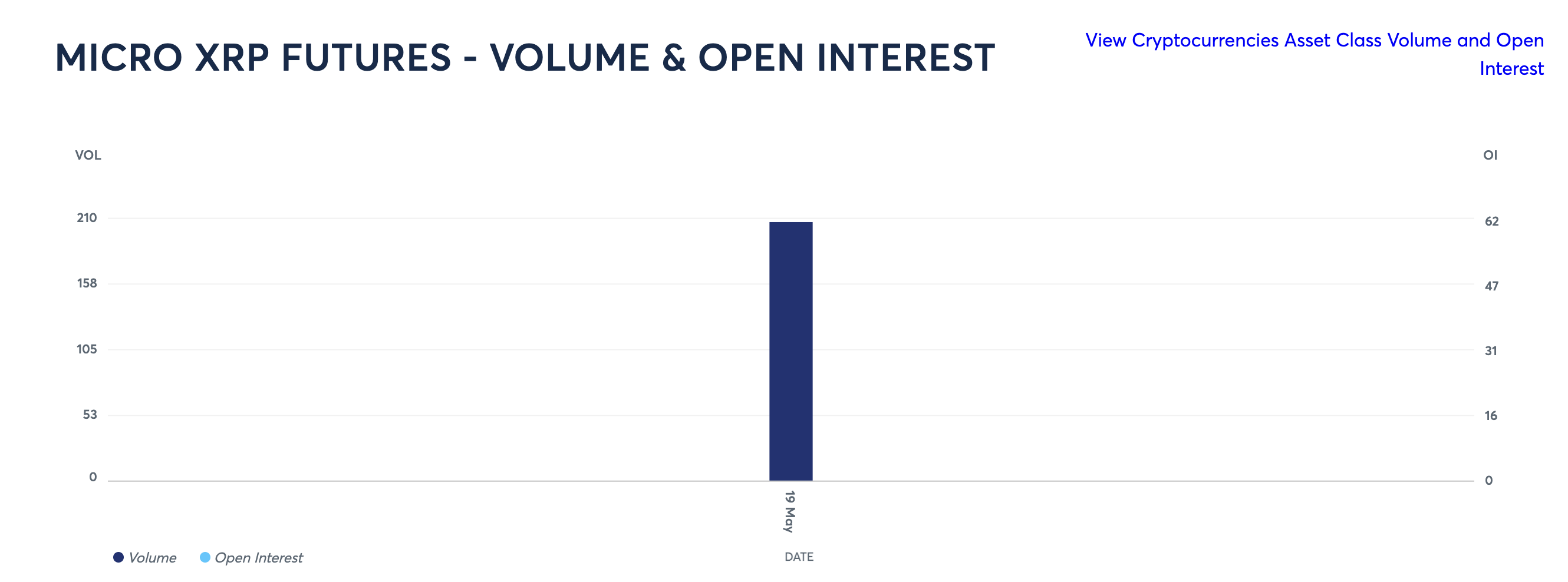

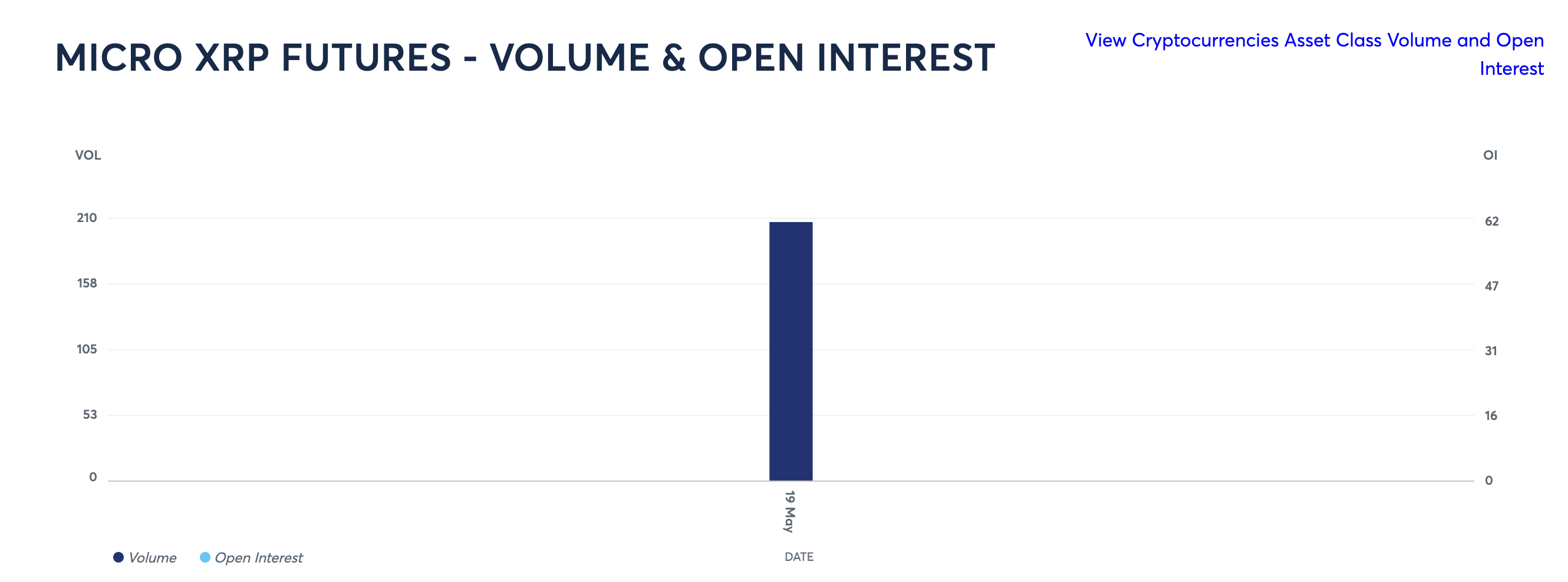

XRP futures contracts started trading on the CME Group’s derivatives platform on Monday, posting an impressive $2.4 million in trading volume during their first session.

CME data shows nine standard XRP futures (each accounting for 50,000 XRP) traded on the first day, summing to approximately $1 million in notional volume at an average price of $2.35.

The lion’s share of trading activity was linked to micro contracts, which reached 236 at the end of the session (each accounting for 2,500 XRP), totalling over $1.38 million in volume.

XRP futures contracts | Source: CME Group

The XRP futures contracts are cash-settled and benchmarked to the CME CF XRP-Dollar Reference Rate, which is established daily. This product, which has been designed for institutional and retail traders, boasts flexible hedging and trading strategies.

XRP futures contracts | Source: CME Group

Ripple’s CEO Brad Garlinghouse said in a post on X on Monday that “the launch of regulated XRP futures on CME Group marks a key institutional milestone for XRP.”

Sentiment around XRP has been shifting frequently in the past few weeks, affecting market dynamics. This sentiment has been a product of Judge Analisa Torres’ denial of a joint motion by Ripple and the Securities & Exchange Commission (SEC) seeking an indicative ruling to dissolve the $125 million penalty imposed in 2024 in favour of a $50 million settlement fee.

XRP’s uptrend falters, tests key support levels

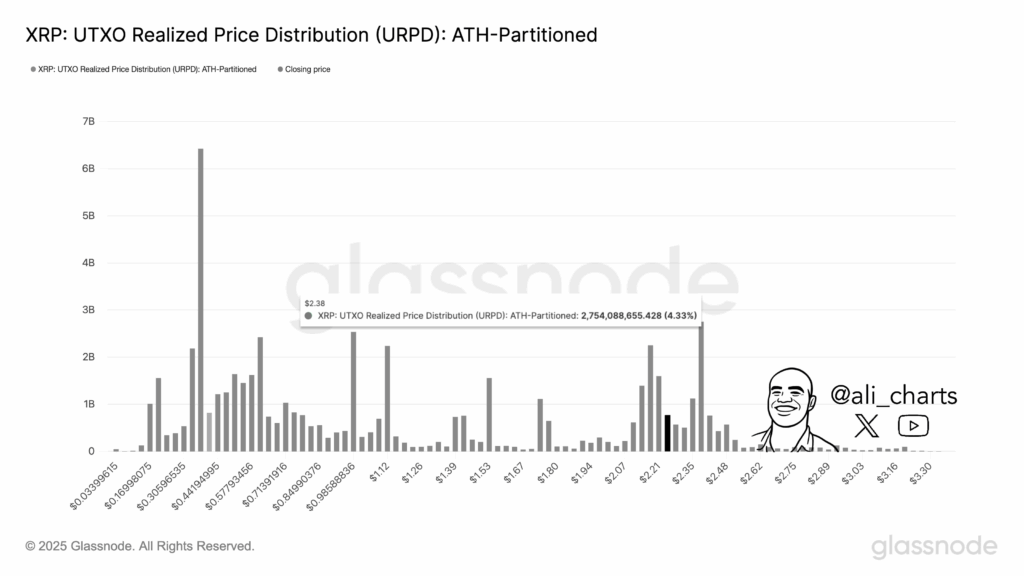

XRP’s price hovers around $2.34 at the time of writing, after extending the decline from highs that reached $2.65 last week. The cross-border remittance token holds above a key support at the 50-day Exponential Moving Average (EMA) around $2.28.

If this level gives way, the 100-day EMA at roughly $2.26 could provide the next line of defence. Further declines might see XRP test the 200-day EMA near $2.04.

The Moving Average Convergence Divergence (MACD) indicator has confirmed a sell signal on the daily chart below, signaling a heavy upside likely to extend the pullback. A sell signal manifests with the MACD line (blue) crossing beneath the signal line (red).

The downward trending Relative Strength Index (RSI) indicator at 51 reflects XRP’s correction from recent highs. If XRP drops below the initial support at $2.26, the RSI could fall under the 50 midline, indicating stronger bearish momentum.

XRP/USD daily chart

On the other hand, the SuperTrend indicator flaunts a buy signal, defying the ongoing drop in the price of XRP. This indicator utilises the Average True Range (ATR) to gauge volatility in the market. It can be used as a dynamic support and resistance line as it sends a buy signal when the price flips above the SuperTrend line and changes its colour from red to green.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: