Category: Crypto News, News

XRP News Today: Ripple vs. SEC – Will the Agency Pursue an Appeal? BTC at $98k

Unlock Exclusive XRP Price Insights: Discover what the SEC’s next move could mean for XRP’s future. Don’t miss our expert analysis here – read now!

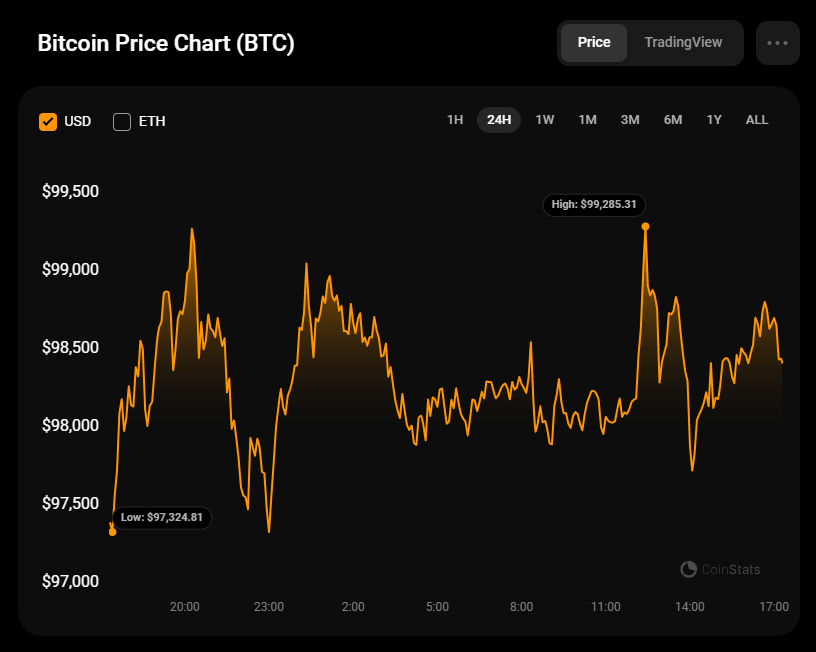

Bitcoin Eyes $100K Amid Market Speculation

On Tuesday, bitcoin (BTC) broke a three-day losing streak, rising to a session high of $99,434. Speculation about one of the Magnificent 7 acquiring BTC contributed to the positive session.

The Kobeissi Letter discussed the prospects of US firms purchasing BTC, saying,

“There is now a 77% chance of at least one Magnificent 7 company buying bitcoin in 2025. The odds of a Magnificent 7 company buying bitcoin before 2026 have jumped from 49% to 77%, according to Kalshi. This comes as Michael Saylor has called on Microsoft, and other technology giants, to buy bitcoin. Prediction markets see more bitcoin adoption ahead. What’s your 2025 bitcoin target?”

Microsoft (MSFT) shareholders recently voted against the tech giant adopting BTC as a balance sheet asset at December’s annual shareholders’ meeting.

Microsoft currently opposes adopting BTC as a balance sheet asset. However, one MAG7 company approving BTC could open the floodgates.

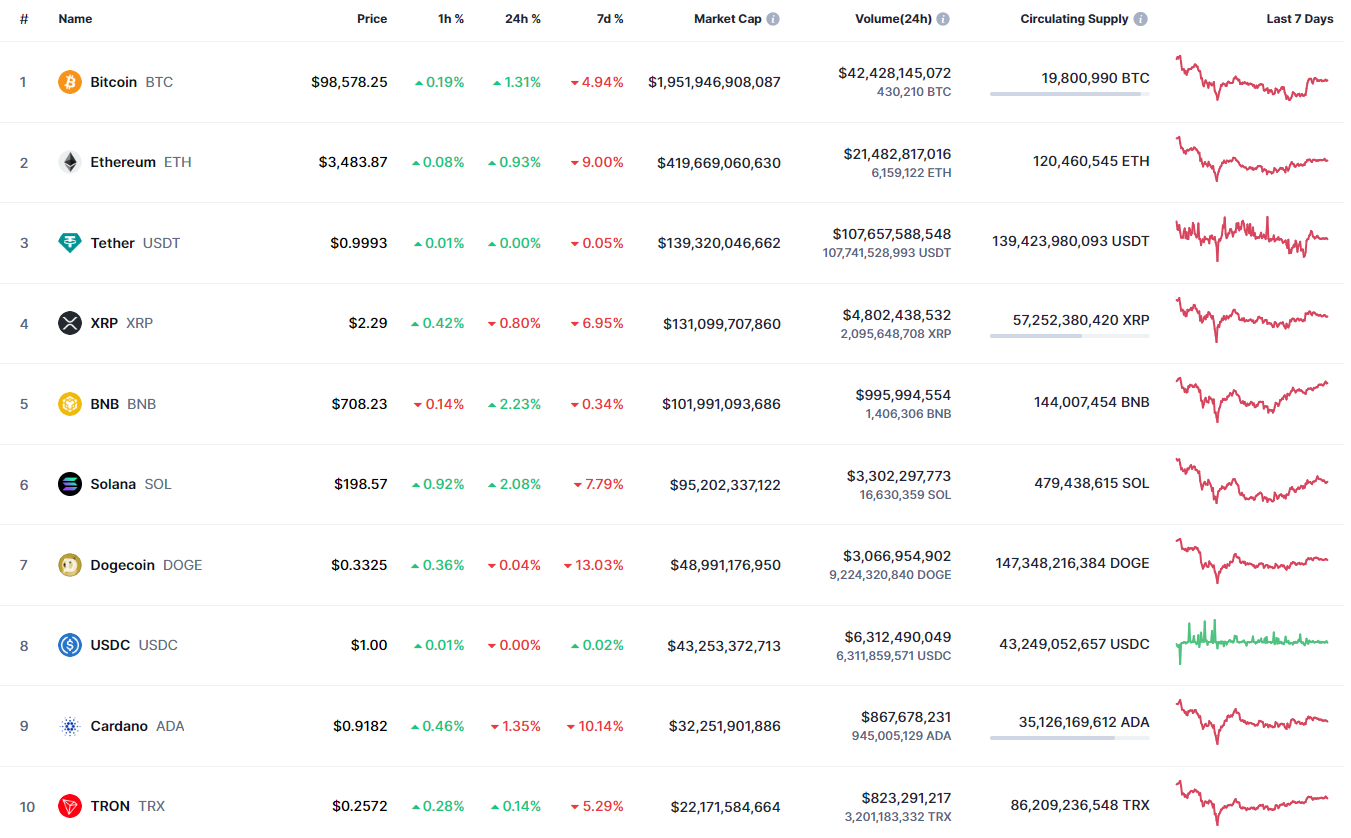

US BTC-Spot ETF Market Gets No Holiday Cheer

Despite Tuesday’s gains, the US BTC-spot ETF market faced a fourth day of net outflows ahead of the holidays. According to Farside Investors:

- Fidelity Wise Origin Bitcoin Fund (FBTC) saw net outflows of $83.2 million.

- ARK 21Shares Bitcoin ETF (ARKB) reported net outflows of $75.0 million.

Excluding BlackRock’s (BLK) iShares Bitcoin Trust’s (IBIT) flow data, the US BTC-spot ETF market had net outflows of $149.7 million. The current outflow trend follows Wednesday’s Fed rate cut and projection of fewer rate cuts in 2025, weighing on spot-ETF demand.

Tuesday’s outflows could pressure BTC early in the Wednesday session, particularly if IBIT fails to end the outflow streak.

Bitcoin Price Outlook

On Tuesday, December 24, BTC gained 4.06%, reversing a 0.50% loss from Monday, closing at $98,678.

Near-term BTC price trends will remain hinged on US BTC-spot ETF flow trends and SBR-related news.

Continued spot ETF outflows could weigh on BTC demand, potentially pulling BTC toward the $90,742 support level. Conversely, rising bets on a Q1 2025 Fed rate hike and progress toward an SBR may reignite demand for spot ETF inflows and BTC.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: