Category: Crypto News, News

XRP News Today: XRP Climbs to $2.30 as Bullish Metrics and Market Sentiment Point Toward $3.40

XRP is gaining renewed bullish traction this week as the token climbs to $2.30, backed by a mix of strong on-chain metrics, favorable technical indicators, and growing institutional interest.

After consolidating for over a month, XRP has rallied more than 20% over the last 16 days, sparking renewed confidence in a potential move toward the much-anticipated $3.40 target.

XRP Price Holds Momentum Near 7-Week High

As of July 8, XRP price today hovers around $2.30, marking its highest level since late May. This recent surge comes after weeks of tight-range trading and signals a potential breakout in progress. XRP is now showing firm support in the $2.25–$2.26 zone, an area that has consistently absorbed sell pressure and helped fuel the current upward momentum.

XRP was trading at around $2.30 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

A key resistance zone has formed between $2.33 and $2.38, which traders are watching closely. A clean break above this band could pave the way for further gains toward $3.04, and ultimately the $3.40 target, if bullish momentum sustains.

Additionally, XRP is forming a symmetrical triangle pattern that has been building since its $3.32 peak in March. With both trendlines nearing convergence, volatility tightening, and volume on the rise, a breakout appears increasingly likely.

XRP Technical Indicators Point to Continued Upside

Several technical factors support the bullish XRP price prediction. The MACD recently flashed a golden cross for the first time since May, suggesting a shift back to mid-term bullish momentum. Meanwhile, the Relative Strength Index (RSI) has reclaimed the neutral 50 level, indicating strengthening buying pressure.

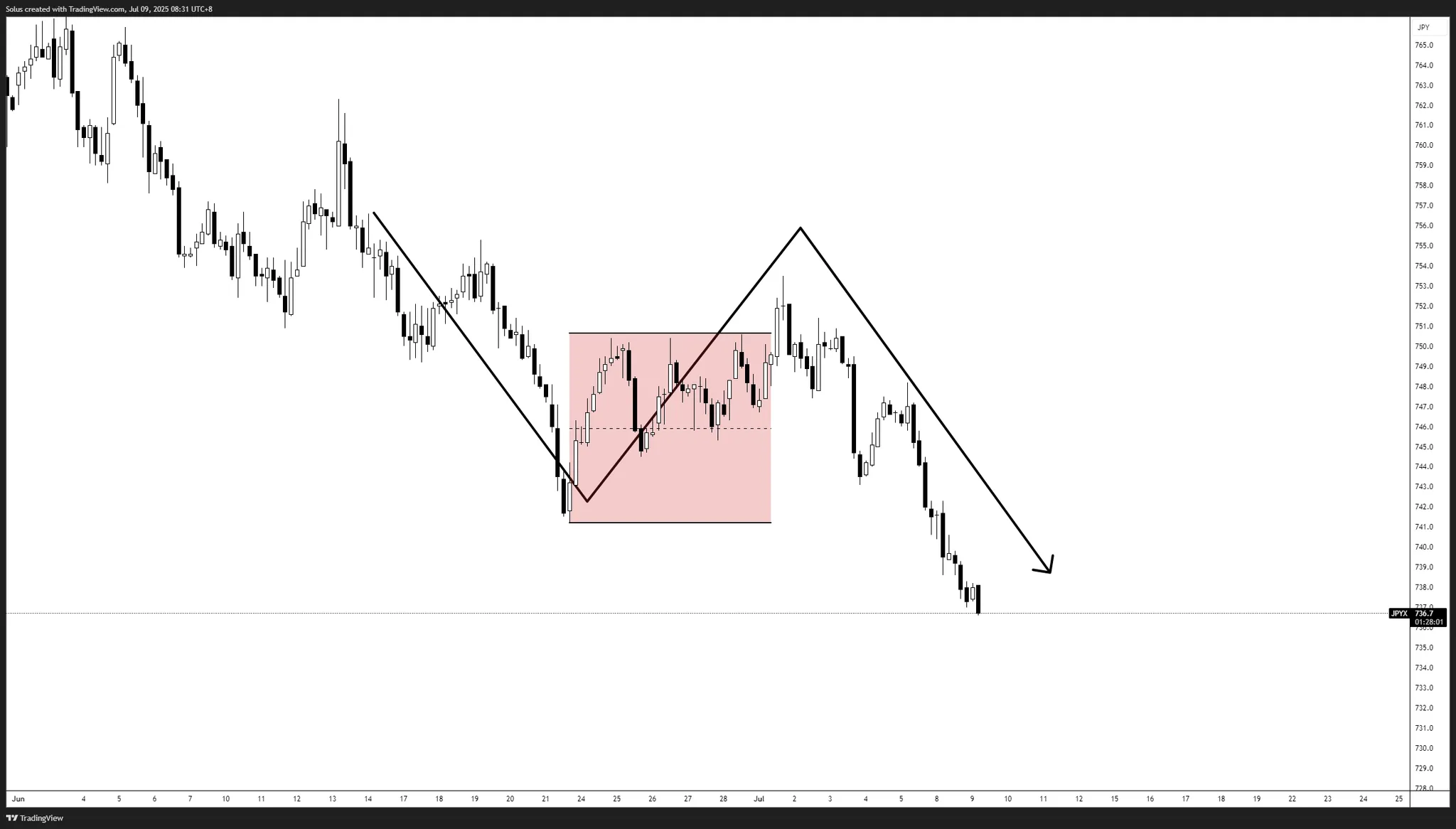

While many anticipate a major XRP breakout, repeated daily closes below the 170-day trendline and a looming gravestone doji suggest a potential downside reversal. Source: VIAQUANT on TradingView

A crucial sign of market confidence lies in the trading volume. During peak activity on July 8, over 182 million XRP tokens changed hands, a clear signal that both retail and institutional investors are entering the market. This surge in participation comes as derivatives volume rose by 165%, with funding rates flipping positive—a traditional precursor to breakout rallies.

Renowned crypto analyst Ali Martinez pointed to a classic inverse head and shoulders pattern on the charts. If XRP successfully reclaims the $2.33 resistance, it could trigger a 12% rally, further reinforcing bullish expectations.

Institutional Support and Regulatory Developments Fuel Confidence

Beyond technicals, the XRP narrative is also being shaped by fundamental developments. Among the most impactful of these is the addition of XRP into Grayscale’s Digital Large Cap Fund, the asset’s return to institutions from prior regulatory limitations.

XRP appears to be forming an inverse head and shoulders pattern, indicating a potential breakout toward $2.60. Source: Ali Martinez via X

At the same time, Ripple’s pursuit of a US national bank charter is seen as a tipping point moment. If successful, Ripple would be permitted to operate as a federal-regulated trust bank, further tightening the integration of its services with traditional finance and cementing the long-term case for Ripple XRP usage in cross-border payments.

Following this bullish foundation is ongoing positivity regarding XRP spot ETF approvals. Ten XRP ETFs are pending approval by the U.S. Securities and Exchange Commission, with a likely announcement within October 2025. Approvals of such ETFs would unlock a wave of institutional fund inflows, potentially further increasing the XRP price projection 2025.

XRP Price Prediction 2025: What Next?

Looking ahead, analysts are largely optimistic about XRP’s trajectory. If it can hold above the $2.25 support area, XRP would push towards intermediate resistance at $2.69 and $3.04, before taking on the longer-term target at $3.40. A clear break above this level would place XRP in “blue skies” with minimal overhead resistance.

XRP price is likely to test the $2.33-$2.48 resistance zone following the current bullish momentum. Source: FenzoFxBroker on TradingView

In a longer-term bull story, technical targets via Fibonacci extensions point to the possibility of a rally to $4.36, nearly a 90% rise from here. Traders caution that momentum will have to be supported by either a regulatory spark like ETF approval or a significant rise in institutional demand, though.

Final Thoughts

The combination of positive technical patterns, growing institutional support, and long-term holder conviction is positioning XRP for a potentially explosive move. While resistance near $2.38 remains a hurdle, the broader setup—both on-chain and off—suggests that the current rally has deeper roots than speculative hype.

With regulatory clarity improving and the Ripple vs SEC court saga largely behind it, XRP is emerging as one of the most structurally bullish assets in the current crypto cycle. Whether it reaches $3.40 or beyond may depend on how quickly the next wave of capital arrives—and how resilient buyers remain in the face of volatility.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: