Category: Crypto News, News

XRP News Today: XRP Strengthens Above $2.15 as Analysts Eye Key Levels and Positive Regulatory Signals

The price of XRP has surged past the $2.15 mark, reigniting investor enthusiasm and speculation around a potential spot ETF approval and a long-anticipated settlement in the XRP lawsuit with the U.S. Securities and Exchange Commission (SEC).

The digital asset has emerged as a market leader in recent days, gaining momentum from both macroeconomic developments and optimism surrounding regulatory clarity.

Regulatory Pause Fuels Settlement Optimism

XRP’s latest rally comes amid significant legal and political developments. The Ripple vs. SEC lawsuit, ongoing since late 2020, may finally be nearing resolution. Ripple and the SEC have jointly requested a suspension of the appeal process, a move widely interpreted as groundwork for a settlement. Ripple CEO Brad Garlinghouse confirmed that an agreement with SEC staff has been reached, though a final vote by the Commission is still pending.

A potential SEC v. Ripple settlement is pending commission approval, with no brief to be filed on April 16th. Source: JackTheRippler via X

Market watchers believe that a settlement decision could hinge on the confirmation of Paul Atkins as SEC Chair. Known for his pro-crypto stance, Atkins’ swearing-in is expected to shift the regulatory balance. Legal analysts suggest the delay is strategic, allowing time for Atkins to be officially instated, potentially leading to a 3-1 vote in favor of dismissing the case.

“This pause is not just procedural—it could be pivotal,” noted one pro-crypto legal expert. “With Atkins in place, the SEC may finally pivot away from its combative stance on Ripple.”

XRP ETF Hopes Spark Institutional Interest

Beyond the legal landscape, XRP is riding a wave of anticipation over the launch of a U.S.-listed XRP exchange-traded fund (ETF). The recent debut of a leveraged XRP ETF by Vermont-based Teucrium attracted $36 million in investor inflows over just five days. While modest compared to Bitcoin ETFs, the fund’s performance signals growing institutional appetite for XRP.

The possibility of a dedicated spot ETF remains a major catalyst. If approved, it could unlock new liquidity and push the XRP price closer to its 2021 high of $3.55. “A spot XRP ETF could be a game-changer,” said Bloomberg Intelligence analyst Eric Balchunas. “It’s the bridge that connects crypto-native assets to traditional finance.”

Ripple Expands Its Global Footprint

Meanwhile, Ripple continues to strengthen its ecosystem through international partnerships and strategic expansion. The company recently deepened its ties with Revolut and Zero Hash, aiming to rival major stablecoins like USDT and USDC. In Portugal, Ripple is working with Unicâmbio to facilitate instant digital payments with Brazil, while in South Korea, BDACS has adopted Ripple Custody for safeguarding XRP and RLUSD.

Ripple also plans to enable Japanese banks to utilize the XRP Ledger for cross-border payments by 2025. In parallel, it is collaborating with Chainlink to bring RLUSD into Ethereum’s DeFi infrastructure—further demonstrating Ripple’s push toward greater utility and adoption.

Technical Levels and Price Predictions

Market analysts are closely watching XRP’s technical indicators to identify its next move. The cryptocurrency has maintained an uptrend, recently bouncing off a key trendline. According to analyst Casi Trades, the $1.90 and $1.55 zones are critical support levels based on Fibonacci retracement levels and Elliott Wave Theory.

XRP needs to break above $2.15 to confirm a bullish reversal. Source: TheSignalyst on TradingView

“Any drop to these levels could trigger a short-term bounce,” said Casi, “but traders should stay grounded and focus on the larger market structure.”

Meanwhile, prominent analyst Egrag Crypto warned of a potential dip to $1.85 if XRP fails to hold above the $2.30–$2.50 range. Despite the cautious tone, Egrag remains bullish in the long term, forecasting future targets of $7.50, $13, and even $27, citing macroeconomic tailwinds and historical market patterns.

SWIFT Integration Speculation Adds to Bullish Sentiment

Adding to the Ripple news cycle is speculation around a possible partnership between Ripple and SWIFT, the global payment messaging network. A former SWIFT employee claimed that banks have tested XRP’s compatibility with SWIFT’s infrastructure. While neither Ripple nor SWIFT have confirmed these reports, market analyst John Squire recently predicted a formal announcement within a week.

Such an integration would mark a significant milestone, potentially allowing major banks to use XRP for cross-border settlements—a goal Ripple has long pursued. “The SWIFT rumors, if validated, could supercharge Ripple’s role in global finance,” said a market observer.

Contrasting Signals in Market Behavior

Despite these bullish drivers, some metrics suggest cautious optimism. XRP’s trading volume has dipped by 13% in the past 24 hours, and open interest in futures markets has declined by 5.3%, according to Coinglass. However, XRP remains one of the few digital assets to attract institutional inflows last week, according to CoinShares, hinting at its growing appeal among serious investors.

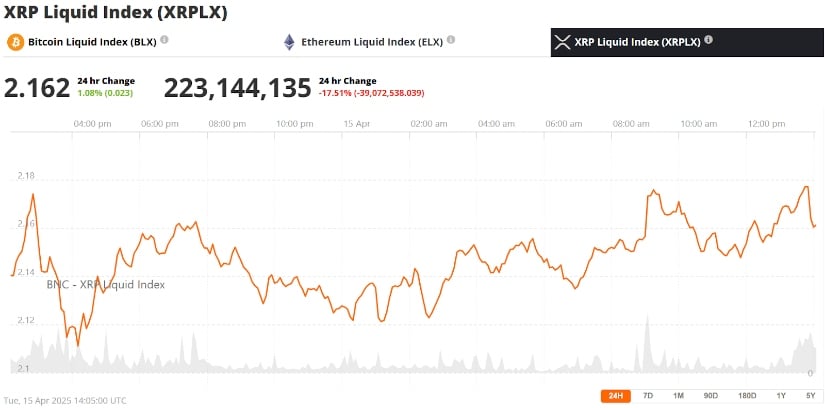

Ripple (XRP) was trading at around $2.16, up 1.08% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The XRP/USDT daily chart shows neutral Relative Strength Index (RSI) readings, reflecting balanced buying and selling pressure. Bollinger Bands indicate decreasing volatility, often a precursor to sharp price moves.

What’s Next for Ripple XRP?

As XRP hovers above $2.15, the road ahead will be shaped by legal outcomes, ETF approvals, and macroeconomic signals. President Trump’s temporary tariff relief has boosted risk-on sentiment in markets, aiding crypto prices across the board. A potential Fed rate cut later this year may add further momentum.

Still, community voices urge caution. “If you’re waiting for the lawsuit to end before investing, you might be too late,” said an influential XRP community member. “The real value will come from what Ripple does next—adoption, partnerships, and ecosystem growth.”

With regulatory clarity seemingly within reach and investor confidence growing, XRP may be approaching a pivotal turning point—one that could define its role in the evolving world of digital finance.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: