Category: Crypto News, News

XRP Price Prediction: Will XRP Defy the Odds and Surge Toward $10 in This Cycle?

With the Ripple-backed token consolidating above $2.00 and optimism building around ETF approvals and institutional adoption, many investors are asking the same question: Can XRP climb to $10 during this market cycle?

The road ahead is far from certain, but a mix of improved fundamentals, regulatory clarity, and rising demand may just set the stage for one of the most ambitious price rallies in XRP’s history.

XRP Holds Steady While Investors Anticipate a Major Breakout

XRP is once again in the spotlight as traders and analysts debate whether the Ripple-backed token can reach the long-anticipated $10 mark in this market cycle. After a staggering 600% rally from late 2024, the XRP price is now consolidating around $2.05, holding key support while preparing for its next potential move. According to recent Ripple XRP news, technical and fundamental indicators point to a mixed, yet increasingly optimistic, outlook.

XRP is under a bullish momentum following the rejection from the $2.15 support. Source: Andrevella on TradingView

At present, XRP trades within a narrow range, finding support between $2.05 and $2.10, with resistance near $2.30 to $2.40. Analysts note that a sustained breakout above $2.60 could open the door to further gains. On the downside, a break below $2.05 might drag the price toward $1.90 or even $1.80.

“XRP is showing resilience at these support levels,” noted a crypto market strategist. “But for any significant bullish momentum, we need to see increased volume and a clear break above resistance.”

Ripple’s RLUSD Stablecoin Fuels Optimism

Adding to the bullish sentiment is Ripple’s newly launched stablecoin, RLUSD, which has rapidly gained traction. In just two weeks, the market capitalization of RLUSD increased from $310 million to $450 million. Such growth indicates growing demand for Ripple products and contributes to long-term trust in the XRP universe.

The U.S. Senate will vote on the Genius Act on June 17, a key decision that could significantly impact stablecoin regulation and projects like XRP and RLUSD. Source: BULLRUNNERS via X

The success of the stablecoin would also translate into more utility and visibility for XRP, especially with Ripple still trying to bridge traditional finance and blockchain-based solutions.

“The growth of Ripple’s presence in the stablecoin space is a positive across the board for XRP,” noted one observer. “As demand rises for RLUSD, XRP may experience greater liquidity and usage on the network.”.

XRP Lawsuit Resolution Clears Regulatory Overhang

The Ripple-SEC case, which had loomed over XRP for decades like a shadow, finally found resolution in 2025. Ripple would settle the case by paying a reduced $50 million fine. The action removed one of the largest obstacles that had served as a deterrent to institutional investors from coming into XRP.

XRP was trading at around $2.20, up $2.14% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The resolution of the XRP SEC lawsuit has again fueled investor interest and enhanced the legitimacy of Ripple as a cross-border payments leading player. The regulatory clarity now paves the way for broader adoption of XRP, particularly in institutional corridors.

The settlement of the Ripple lawsuit was a tipping point moment,” Ripple CEO Brad Garlinghouse said in a recent interview. “It opens the door to more mainstream financial institution participation and positions XRP for utility globally.”.

Growing Institutional Use and ETF Hype

Beyond legal clarity, institutional adoption of the Ripple Ledger is also gaining pace. RippleNet’s On-Demand Liquidity (ODL) platform is increasingly used by financial institutions in Latin America, Japan, and the Middle East for faster, cost-effective cross-border payments. This widespread adoption strengthens Ripple’s position in the evolving remittance landscape.

XRP is also riding a wave of ETF optimism. Futures-based XRP ETFs have already launched in 2025, and analysts at Bloomberg estimate an 81% probability of a spot XRP ETF being approved within the next year. Such a move could flood the Ripple market with institutional capital and fuel a fresh rally.

“An XRP spot ETF would be a game-changer,” commented one analyst. “It could do for XRP what ETFs did for Bitcoin and Ethereum—unlocking massive inflows and market expansion.”

Long-Term XRP Price Predictions: $10 and Beyond?

The long-term future for XRP is positive but guarded. Several credible forecasts suggest that XRP could reach $5.50 to $12.50 in 2028, with Standard Chartered setting one of the most aggressive targets. Their forecast is contingent on continued regulatory progress, ETF approval, and increased usage of Ripple’s cross-border payment solutions.

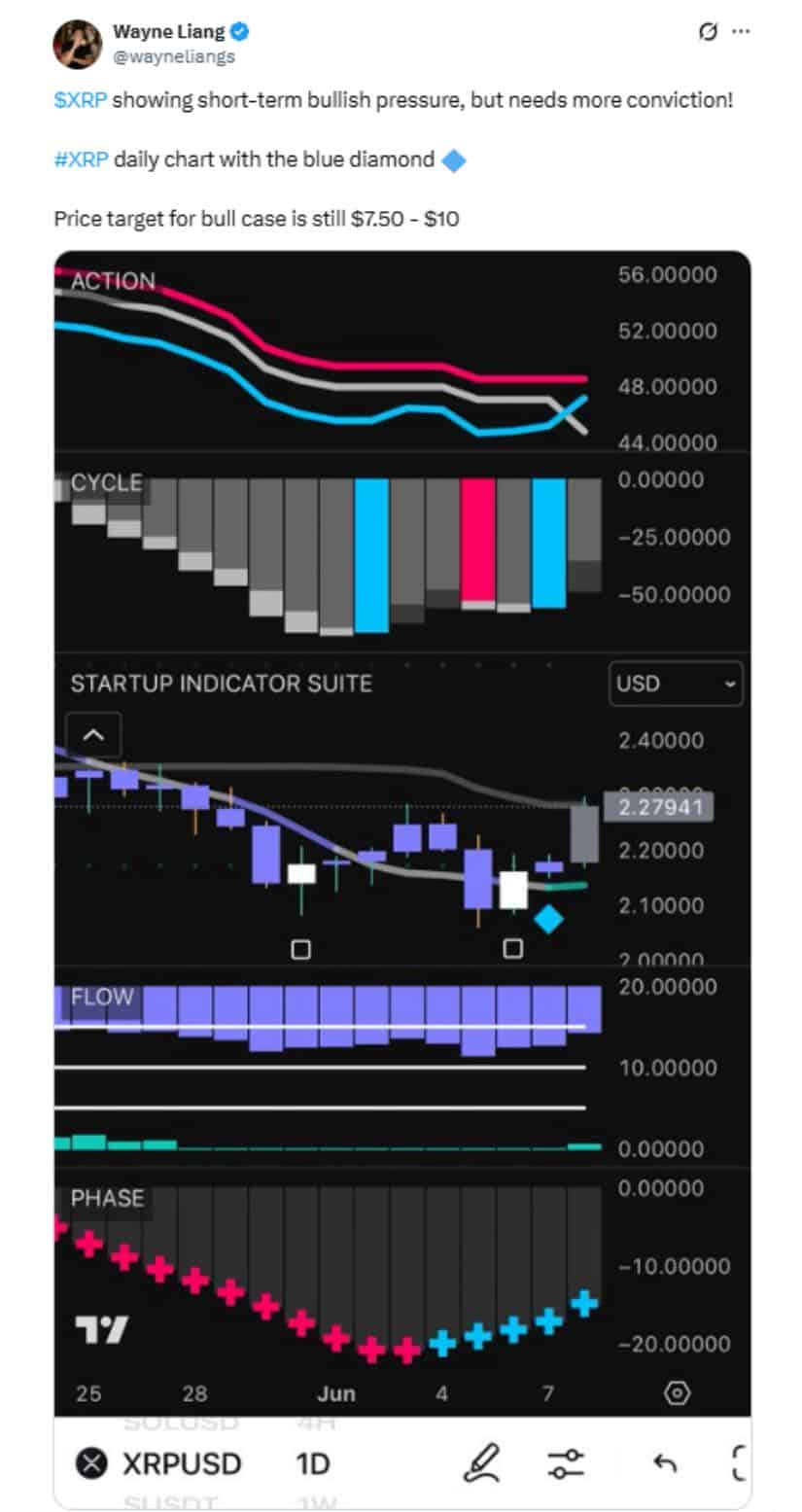

XRP is exhibiting short-term bullish momentum, but stronger confirmation is needed to support the projected $7.50–$10 price target. Source: Wayne Liang via X

CoinPedia is expecting XRP to reach $5.81 by 2025, while Changelly is predicting a more modest $2.05 for the current year and $7.10 for 2028. Crypto analyst Egrag Crypto has meanwhile envisioned an ambitious $17 price level on the assumption of a technical breakout above $3.40.

However, most analysts agree that penetration of the $10 level won’t be done on hype alone—it will require enduring market strength and growing utility.

Risks That Could Weigh on XRP’s Ascent

Although the case is compelling, XRP does have a few headwinds. Opponents point to a comparatively less advanced developer ecosystem than Ethereum and that it will suppress innovation on the XRP Ledger. In addition, the overall macroeconomic environment in the world continues to be tenuous and additional competition in the way of other digital payments systems, including SWIFT’s blockchain overhaul and other stablecoins, could limit XRP’s market share.

There is also the issue of ownership concentration. Ripple and associated insiders are estimated to hold 50% to 70% of the total supply of XRP, which is a problem of centralized control and price fixing.

Final Thoughts: Is XRP a $10 Token in the Making?

From settled legal battles and explosive stablecoin growth to increasing ETF speculation and real-world adoption, XRP has many catalysts in its favor. While its price today is very far removed from the $10 level, the journey is not impossible if market forces align.

Whether XRP eventually overcomes the odds is contingent on general adoption, regulatory support, and stable investor appetite. For the time being, XRP is among the most closely followed digital currencies—one that holds substantial upside as well as built-in risk.

As always, investors are urged to conduct thorough research and diversify their portfolios in the wake of the ever-shifting tides of the crypto market.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: