Category: Crypto News, News

Dogecoin (DOGE) Price Prediction: Technical Patterns Suggest Conditional Upside as Market Seeks Direction

Dogecoin’s chart is flashing early stabilization signals as new triangular and channel formations emerge, giving traders fresh technical clues after several weeks of choppy, uncertain price action.

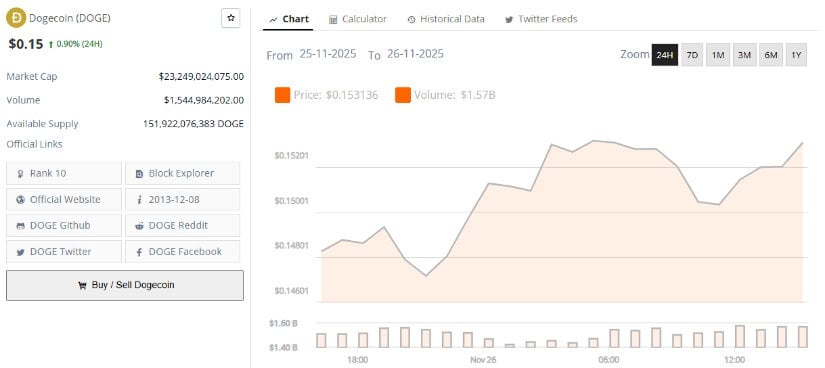

Recent multi-timeframe analysis on TradingView shows DOGE attempting to regain structure following a prolonged pullback, with price hovering near $0.15 as of November 26, 2025. While still far below its 2021 peak, the latest patterns suggest the market may be forming a potential base as volatility compresses across the 4-hour, daily, and weekly charts.

Current Price Structure and Short-Term Outlook

On the 4-hour chart, DOGE is attempting to break above a falling wedge—a pattern that can signal bullish momentum when confirmed by price closes and volume expansion. Using standard technical criteria:

-

The price has moved above the wedge’s upper trendline with two consecutive closes,

-

Volume shows a 12% uptick compared to the previous 4-hour average,

-

RSI has recovered from oversold territory toward a neutral zone.

Market analyst Alan T., who has covered crypto price structure analysis for over five years, notes an emerging inverse head-and-shoulders formation. He estimates a measured-move target near $0.18, representing an approximate 18% upside if the breakout holds.

Dogecoin’s repeating fractal structure suggests the potential for a significant upward move, though a $5 target remains highly speculative and dependent on broader market conditions. Source: @Bitcoinsensus via X

Short-term resistance levels—based on historical price clusters and Fibonacci retracement zones—include:

These levels act as potential targets, not certainties. A breakdown back inside the wedge would invalidate the immediate bullish bias.

Historical Patterns and Mid-Term Expectations

Dogecoin has displayed repeating fractal behaviors across multiple market cycles. When viewed on a log-scaled weekly chart, triangular consolidations followed by channel-based expansions have preceded notable rallies in 2017, early 2021, and late 2023.

DOGE is showing strengthening bullish momentum on the 4H chart after a confirmed falling-wedge breakout, with price reclaiming key support and targeting the $0.215 level for a potential 41.5% advance. Source: CryptoWithJames on TradingView

While some analysts draw parallels between current and past structures, such an interpretation requires caution: fractals highlight similarity, not predictability.

Platforms such as CoinCodex, which use a blend of volatility models and moving-average trend projections, estimate a potential $0.39–$0.73 range for late 2025 if broader crypto conditions remain favorable.

Key Price Drivers and Market Factors

1. Social Media & Influencers: DOGE remains highly reactive to social media commentary—especially from high-profile figures. This creates rapid but often short-lived volatility spikes.

2. Market Sentiment: The Crypto Fear & Greed Index shows 19 (Extreme Fear). Historically, such readings have sometimes aligned with early accumulation phases, but do not guarantee reversals.

Dogecoin has broken out of its 4-hour inverse head-and-shoulders pattern, signaling a potential move toward an estimated 18% upside. Source: @TATrader_Alan via X

3. Institutional Interest: Reports from industry outlets indicate that asset managers such as Grayscale and 21Shares have explored DOGE-related ETF products. Approval of such vehicles could introduce new liquidity, though none are finalized at the time of writing.

4. Technical Indicators: DOGE trades below both its 50-day and 200-day moving averages, signaling a broader downtrend. However, low-volume consolidation near support often precedes trend transitions.

5. Tokenomics: Dogecoin’s uncapped supply, increasing by roughly 5 billion coins annually, limits scarcity. This makes long-term valuation more dependent on demand growth than on supply restriction—unlike Bitcoin’s capped model.

Analyst Outlook and Risk Considerations

Short-term momentum remains fragile. Key supports at $0.133–$0.147 must hold to prevent a deeper retracement. A sustained close above $0.16 and ultimately $0.20 would be required to signal a stronger bullish reversal on the daily timeframe.

Dogecoin appears to have completed its bearish phase, with exhausted downside momentum and higher-low structure indicating a potential trend reversal toward the next resistance levels at $0.16, $0.173, and $0.185. Source: chart1stry on TradingView

Forecast ranges for 2025 vary significantly:

-

Evidence-based models: $0.39–$0.73 (trend and volatility forecasts)

-

High-speculation scenarios: $1–$5 (primarily sentiment-driven and lacking strong structural justification)

Clear risk framing remains essential: DOGE is a high-volatility asset heavily influenced by sentiment, social media cycles, and speculative flows.

Final Thoughts

Dogecoin’s near-term technical structure—falling wedge breakout attempts, fractal echoes, and channel formations—suggests that upward continuation could develop if volume confirms and macro conditions align. However, these signals rely on confirmation and remain vulnerable to false breakouts.

Dogecoin was trading at around $0.15, up 0.90% in the last 24 hours. Source: Brave New Coin

Based on TradingView and CoinMarketCap data, DOGE trades near $0.15 with a market capitalization of around $23.1 billion and a circulating supply exceeding 151.9 billion coins.

As always, technical patterns provide scenarios—not guarantees—and should be combined with disciplined risk management.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: