Category: Forex News

Another test of 0.6700 emerges on the horizon

Get Premium without limits for only $9.99 for the first month

Access all our articles, insights, and analysts. Your coupon code

UNLOCK OFFER

- AUD/USD extends its strong recovery beyond 0.6600.

- Immediately to the upside comes the March high near 0.6670.

- Australian Services sector remained healthy in March.

The heightened downward pressure on the US Dollar (USD) maintained the strong recovery in AUD/USD well in place, motivating the pair to finally reclaim the 0.6600 barrier and beyond on Thursday.

Concurrently, the Australian dollar’s extra advance came in tandem with the ongoing rise in copper prices, reaching levels last seen in June 2022 past the $800.00 mark, vs. a slight drop in iron ore prices, which appear to have shifted their focus to the crucial $100.00 level per tonne.

Meanwhile, recent positive outcomes from Chinese PMIs also contributed to the AUD’s recovery along with lingering news of potential stimulus measures from both the government and the PBoC, as sustained improvements in economic indicators are vital to strengthen the Australian currency and potentially initiate a more lasting uptrend in AUD/USD.

Regarding the Reserve Bank of Australia (RBA), the release of its March meeting Minutes earlier in the week confirmed the central bank’s departure from considering tightening monetary policy. Unlike the February session, there was no discourse about raising the cash rate target in March. Instead, members agreed that characterizing the policy outlook as uncertain regarding future adjustments to the cash rate target was appropriate. RBA cash rate futures still imply an expectation of just under 50 bps of policy rate cuts in 2024.

It’s noteworthy that the RBA is one of the final G10 central banks expected to contemplate interest rate adjustments this year.

Due to the differing timelines for monetary policy adjustments between the RBA and the Fed, the Australian dollar may gather momentum later in the year, potentially leading to further strengthening in AUD/USD. If the pair surpasses the December 2023 peak of 0.6871, it could aim for a significant level of 0.7000 in the near term.

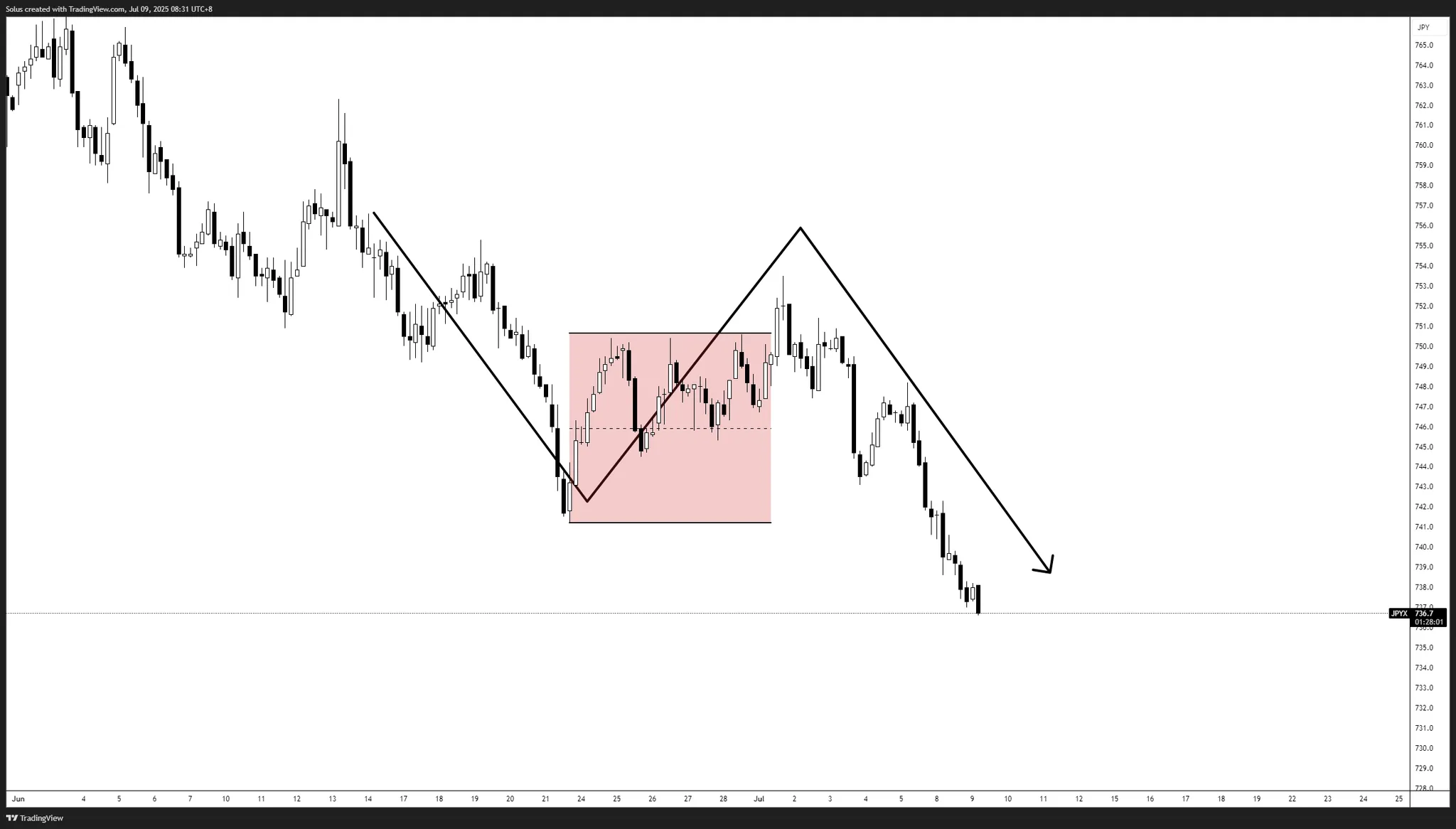

AUD/USD daily chart

AUD/USD short-term technical outlook

Further upward momentum in AUD/USD should now test its March high of 0.6667 (March 8) before hitting its December 2023 top of 0.6871 (December 28). Further north, monthly peaks of 0.6894 (July 14) and 0.6899 (June 16) occur prior to the critical 0.7000 level.

If sellers regain control, the pair could fall to its April low of 0.6480 (April 1), then the March low of 0.6477 (March 5), and lastly the 2024 low of 0.6442 (February 13). Breaking below this level may result in a test of 2023’s lowest level, 0.6270 (October 26), before the round level of 0.6200.

Looking at the big picture, the pair is projected to continue its bullish trend if it successfully surpasses the important 200-day SMA.

On the 4-hour chart, the pair’s constructive bias appears intact for the time being. Against this, there is initial resistance at 0.6634, followed by 0.6638 and finally 0.6667. On the other hand, fresh losses may drive the pair to retest 0.6480, ahead of 06477, and finally 0.6442. Furthermore, the MACD entered the positive zone, and the RSI increased past 74.

- AUD/USD extends its strong recovery beyond 0.6600.

- Immediately to the upside comes the March high near 0.6670.

- Australian Services sector remained healthy in March.

The heightened downward pressure on the US Dollar (USD) maintained the strong recovery in AUD/USD well in place, motivating the pair to finally reclaim the 0.6600 barrier and beyond on Thursday.

Concurrently, the Australian dollar’s extra advance came in tandem with the ongoing rise in copper prices, reaching levels last seen in June 2022 past the $800.00 mark, vs. a slight drop in iron ore prices, which appear to have shifted their focus to the crucial $100.00 level per tonne.

Meanwhile, recent positive outcomes from Chinese PMIs also contributed to the AUD’s recovery along with lingering news of potential stimulus measures from both the government and the PBoC, as sustained improvements in economic indicators are vital to strengthen the Australian currency and potentially initiate a more lasting uptrend in AUD/USD.

Regarding the Reserve Bank of Australia (RBA), the release of its March meeting Minutes earlier in the week confirmed the central bank’s departure from considering tightening monetary policy. Unlike the February session, there was no discourse about raising the cash rate target in March. Instead, members agreed that characterizing the policy outlook as uncertain regarding future adjustments to the cash rate target was appropriate. RBA cash rate futures still imply an expectation of just under 50 bps of policy rate cuts in 2024.

It’s noteworthy that the RBA is one of the final G10 central banks expected to contemplate interest rate adjustments this year.

Due to the differing timelines for monetary policy adjustments between the RBA and the Fed, the Australian dollar may gather momentum later in the year, potentially leading to further strengthening in AUD/USD. If the pair surpasses the December 2023 peak of 0.6871, it could aim for a significant level of 0.7000 in the near term.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further upward momentum in AUD/USD should now test its March high of 0.6667 (March 8) before hitting its December 2023 top of 0.6871 (December 28). Further north, monthly peaks of 0.6894 (July 14) and 0.6899 (June 16) occur prior to the critical 0.7000 level.

If sellers regain control, the pair could fall to its April low of 0.6480 (April 1), then the March low of 0.6477 (March 5), and lastly the 2024 low of 0.6442 (February 13). Breaking below this level may result in a test of 2023’s lowest level, 0.6270 (October 26), before the round level of 0.6200.

Looking at the big picture, the pair is projected to continue its bullish trend if it successfully surpasses the important 200-day SMA.

On the 4-hour chart, the pair’s constructive bias appears intact for the time being. Against this, there is initial resistance at 0.6634, followed by 0.6638 and finally 0.6667. On the other hand, fresh losses may drive the pair to retest 0.6480, ahead of 06477, and finally 0.6442. Furthermore, the MACD entered the positive zone, and the RSI increased past 74.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: