Category: Forex News

AUD to USD Forecast: Aussie Retail Sales and the RBA Interest Rate Path

Economists forecast initial jobless claims to increase from 210k to 215k in the week ending March 23. According to preliminary numbers, the Michigan Consumer Sentiment Index slipped from 76.9 to 76.5 in March.

Other stats include Chicago PMI and pending home sales data. However, barring sizeable deviations from forecasts, these will likely play second fiddle to the jobless claims and sentiment numbers.

Beyond the numbers, investors must consider FOMC member speeches. Recent Fed speeches created uncertainty about the timing of a Fed interest rate cut.

Short-Term Forecast

Near-term AUD/USD trends will hinge on Australian retail sales and US inflation figures. Soft Aussie retail sales figures could end bets on an RBA rate hike. Conversely, hotter-than-expected US inflation numbers could impact the number of Fed rate cuts in 2024. The net effect could be an AUD/USD drop below the $0.64500 handle.

AUD/USD Price Action

Daily Chart

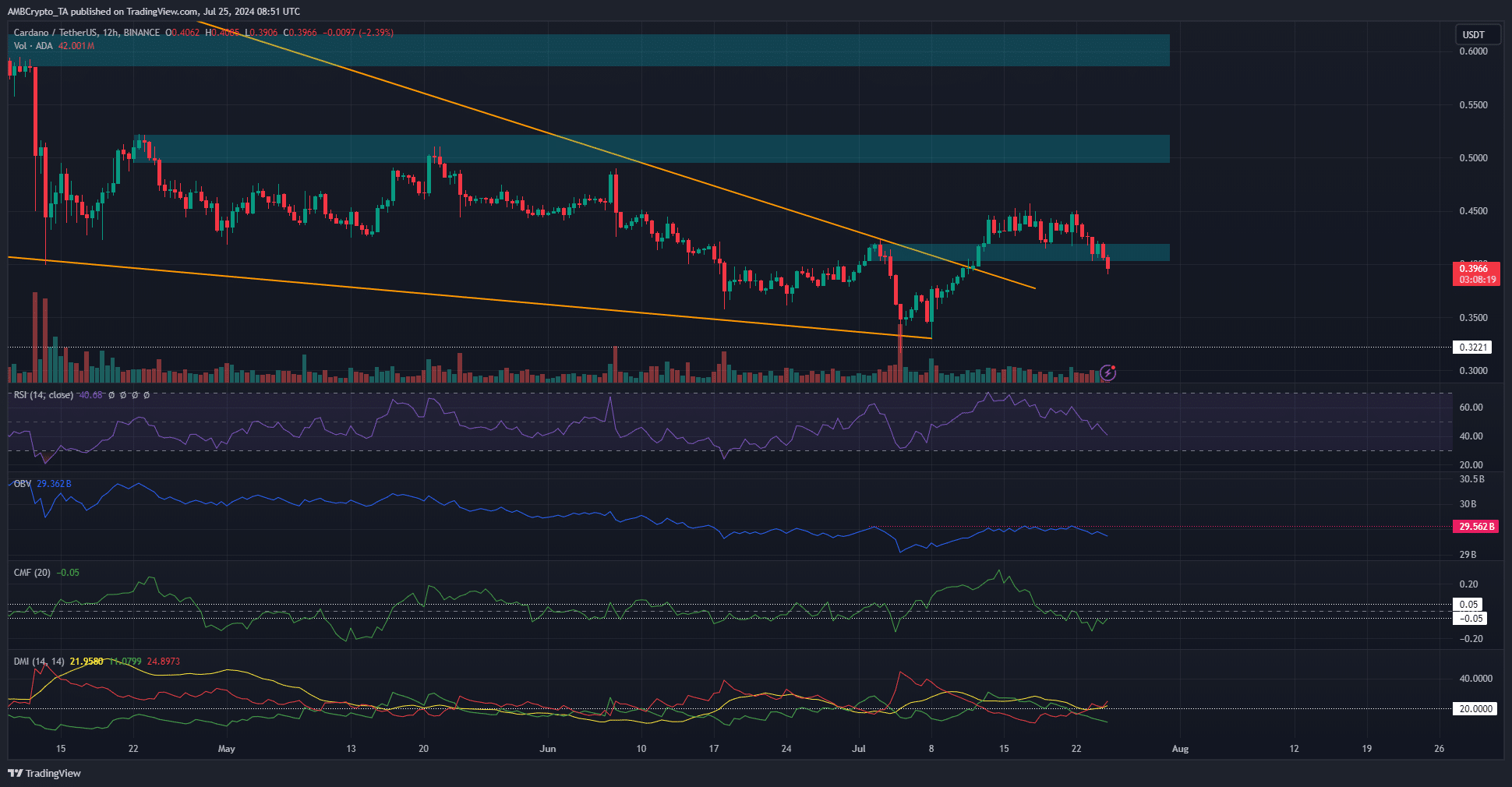

The AUD/USD remained below the 50-day and 200-day EMAs, confirming the bearish price trends.

An Aussie dollar return to the $0.65500 handle would give the bulls a run at the 50-day EMA. A breakout from the 50-day EMA could bring the $0.65760 resistance level and the 200-day EMA into play.

Aussie retail sales and the US economic calendar need consideration.

Conversely, an AUD/USD drop below the $0.65 handle could give the bears a run at the $0.64582 support level.

With a 14-period Daily RSI reading of 44.36, the AUD/USD could fall through the $0.64582 support level before entering oversold territory.

Source link

Discover more from BIPNs

Subscribe to get the latest posts sent to your email.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article:

Discover more from BIPNs

Subscribe to get the latest posts sent to your email.