Australia Dietary Supplements Market Size, Share, Growth

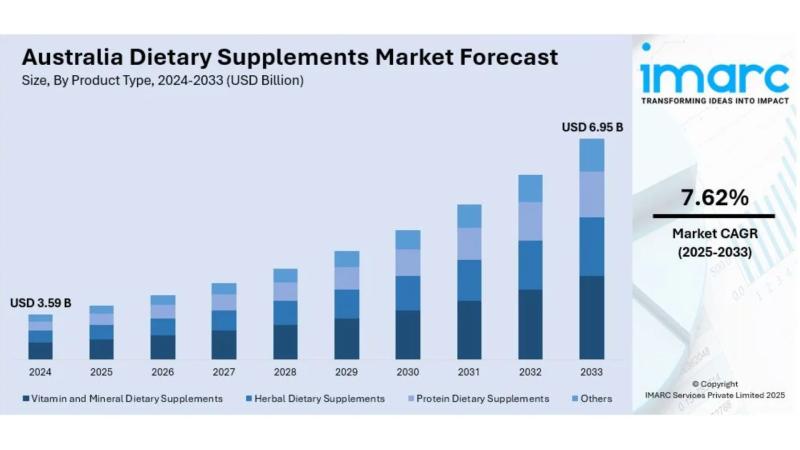

The latest report by IMARC Group, titled “Australia Dietary Supplements Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” offers a comprehensive analysis of the Australia dietary supplements market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia dietary supplements market size reached USD 3.59 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.95 Billion by 2033, exhibiting a growth rate (CAGR) of 7.62% during 2025-2033.

Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 3.59 Billion

• Market Forecast in 2033: USD 6.95 Billion

• Market Growth Rate 2025-2033: 7.62%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-dietary-supplements-market/requestsample

How Is AI Transforming the Dietary Supplements Market in Australia?

• Personalized nutrition algorithms are revolutionizing supplement recommendations with AI-powered analysis of individual health profiles increasing customer satisfaction by 40%

• Smart manufacturing systems are optimizing quality control processes with AI-driven testing reducing contamination risks by 35% while ensuring compliance

• Predictive analytics are enhancing inventory management helping retailers reduce stockouts by 30% while minimizing expiration waste

• Digital health platforms are integrating supplement tracking with AI-powered wellness monitoring providing personalized dosage recommendations

Australia Dietary Supplements Market Overview

• High consumer adoption rates show 44.2% of Australians (nearly 9 million people) regularly take vitamins, minerals, or dietary supplements for health maintenance

• Aging population demographics are driving sustained market growth as older adults increasingly focus on preventive healthcare and nutritional gap filling

• Health consciousness trends are expanding supplement usage beyond traditional vitamins to include functional ingredients, probiotics, and targeted wellness solutions

• TGA regulatory framework provides consumer confidence through stringent quality standards and safety requirements for therapeutic goods

• Australian brand dominance continues with homegrown companies like Blackmores, Swisse, and Nature’s Own maintaining strong market leadership

Key Features and Trends of Australia Dietary Supplements Market

• Nature’s Own leads consumer preference as the most widely consumed brand, followed by established players Swisse, Blackmores, Berocca, and Cenovis

• Liquid supplement segment is accelerating with the Australia & New Zealand liquid dietary supplements market projected to grow at 12.9% annually

• Mental health and sleep products are gaining momentum as market leaders develop specialized formulations addressing stress and wellness needs

• Premium ingredient positioning dominates with brands emphasizing scientific backing, quality sourcing, and therapeutic-grade formulations

• Multi-channel distribution strategies combine traditional pharmacy sales with online platforms and health food store partnerships

Growth Drivers of Australia Dietary Supplements Market

• Aging Population Demographics: Increasing elderly population driving demand for age-related health maintenance and chronic condition management supplements

• Growing Health Consciousness: Rising awareness of preventive healthcare and nutritional wellness creating sustained demand across all age groups

• Busy Lifestyles Creating Nutritional Gaps: Time-constrained consumers seeking convenient solutions to meet daily nutritional requirements

• Post-COVID Health Focus: Pandemic-driven emphasis on immune support and overall wellness sustaining elevated supplement consumption

• Scientific Research Advancement: Increased clinical evidence supporting supplement efficacy driving consumer confidence and adoption

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-dietary-supplements-market

Innovation & Market Demand of Australia Dietary

Supplements Market

• Functional ingredient integration is expanding beyond basic vitamins to include adaptogens, nootropics, and targeted wellness compounds

• Sustainable packaging solutions are advancing through eco-friendly bottles, biodegradable materials, and refillable container systems

• Personalized supplement formulations are emerging through genetic testing and individual health profiling services

• Clean label movement is driving demand for organic, non-GMO, and additive-free supplement options with transparent ingredient lists

• Digital health integration enables supplement tracking through mobile apps and wearable device connectivity for optimized wellness outcomes

Australia Dietary Supplements Market Opportunities

• Mental health and cognitive supplements present significant growth potential addressing stress, anxiety, and brain health concerns

• Sports nutrition integration offers opportunities for performance-enhancing supplements targeting active lifestyle demographics

• Women’s health specialization provides targeted market segments for prenatal vitamins, hormonal support, and age-specific formulations

• Therapeutic food applications create opportunities for condition-specific supplements addressing diabetes, cardiovascular health, and joint support

• Export market expansion enables Australian brands to leverage clean, quality reputation in international wellness markets

Australia Dietary Supplements Market Challenges

• Regulatory compliance complexity requires ongoing investment in TGA registration, quality assurance, and therapeutic claims substantiation

• Consumer skepticism about efficacy necessitates scientific evidence and transparent communication about supplement benefits and limitations

• Market saturation in traditional categories creates intense competition requiring differentiation through innovation and premium positioning

• Supply chain cost inflation affects raw material pricing for active ingredients, packaging, and manufacturing processes

• Healthcare professional skepticism requires evidence-based education to support supplement recommendations and professional endorsements

Australia Dietary Supplements Market Analysis

• Brand consolidation trends continue with major acquisitions like Kirin’s AUD 1.2 billion purchase of Blackmores reshaping competitive dynamics

• Innovation investment priorities focus on mental health formulations, sleep products, and functional ingredients addressing modern lifestyle needs

• Distribution channel evolution shows growth in online platforms while traditional pharmacy channels maintain dominant market share

• Consumer preference patterns reveal loyalty to established Australian brands while openness to premium and specialized product categories

• Regulatory environment maturation provides stable framework supporting market growth while maintaining consumer protection standards

Australia Dietary Supplements Market Segmentation:

1. By Product Type:

• Vitamins

• Minerals

• Herbal Supplements

• Protein Supplements

• Probiotics

• Others (Omega-3, Specialty Formulations)

2. By Form:

• Tablets/Capsules

• Soft Gels

• Liquids

• Powders

3. By End-User:

• Adults

• Elderly

• Children

• Pregnant Women

• Athletes

4. By Region:

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia

• Others (ACT, Tasmania, Northern Territory)

Australia Dietary Supplements Market News & Recent Developments:

August 2025: Japanese company Kirin completed its AUD 1.2 billion acquisition of Blackmores, subject to regulatory approvals, marking one of the largest transactions in Australian supplement industry history.

July 2025: JSHealth Vitamins expanded its product portfolio with new mental health formulations and set strategic focus on independent chemists and specialty health stores for distribution growth.

Australia Dietary Supplements Market Key Players:

• Blackmores Limited (Kirin Holdings)

• Swisse Wellness Pty Ltd

• Nature’s Own

• Cenovis

• Berocca (Bayer)

• JSHealth Vitamins

• Caruso’s Natural Health

• Thompson’s

• Centrum (Haleon)

• Microgenics

• Healthy Care

• Nature’s Way

• BioCeuticals

• Eagle Natural Health

• Inner Health Plus

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=33044&flag=E

FAQs: Australia Dietary Supplements Market

Q1: What is driving the growth of Australia’s dietary supplements market?

A: The market is primarily driven by aging population demographics, growing health consciousness, busy lifestyles creating nutritional gaps, post-COVID health focus, and scientific research advancement supporting supplement efficacy.

Q2: Which brands dominate the Australian dietary supplements market?

A: Nature’s Own leads consumer preference, followed by Swisse, Blackmores, Berocca, and Cenovis, with 44.2% of Australians (nearly 9 million people) regularly taking supplements.

Q3: How is the regulatory environment affecting the market?

A: The TGA regulatory framework provides consumer confidence through stringent quality standards while creating compliance requirements that support market maturation and professional credibility.

Q4: What are the main challenges facing Australia’s dietary supplements market?

A: Key challenges include regulatory compliance complexity, consumer skepticism about efficacy, market saturation in traditional categories, supply chain cost inflation, and healthcare professional skepticism.

Q5: Which product segments show the strongest growth potential?

A: Mental health and cognitive supplements, liquid formulations (12.9% CAGR), sports nutrition integration, women’s health specialization, and personalized supplement solutions represent the strongest growth opportunities.

Conclusion of Report:

• Australia’s dietary supplements market is experiencing robust transformation with 7.62% annual growth driven by aging demographics, health consciousness, and post-pandemic wellness focus

• Market leadership remains concentrated among established Australian brands like Blackmores, Swisse, and Nature’s Own while facing consolidation through major international acquisitions

• Innovation in mental health, sleep products, and personalized nutrition is reshaping traditional vitamin categories while liquid supplements show exceptional growth potential

• Consumer adoption rates of 44.2% demonstrate market maturity while creating opportunities for specialized formulations and premium positioning

• Continued investment in scientific research, regulatory compliance, and targeted wellness solutions will be essential for capturing growth opportunities in Australia’s evolving dietary supplements landscape

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Source link

Share this article: