Report Overview

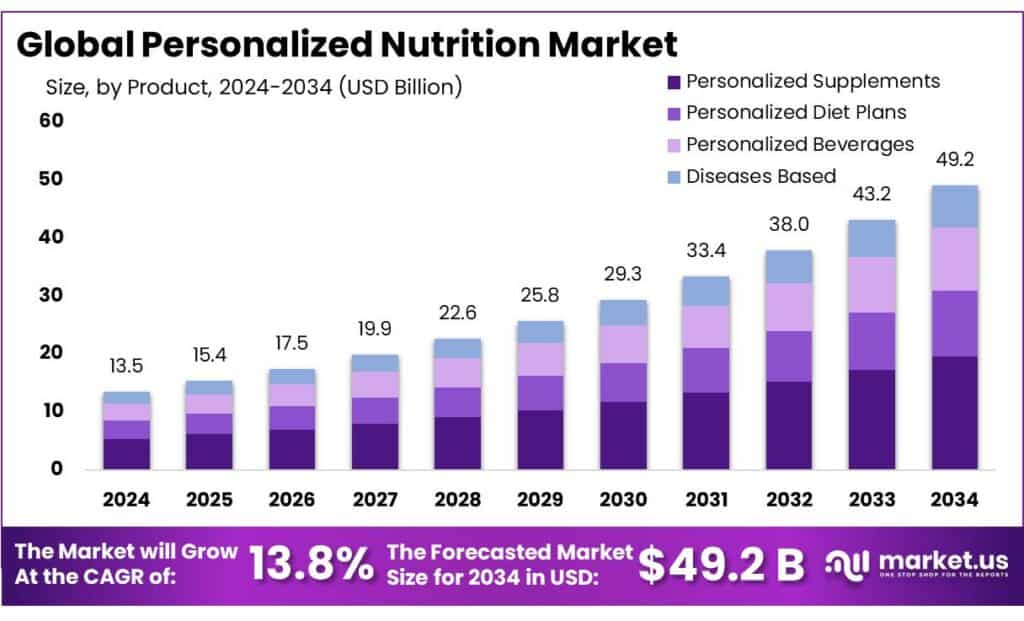

The Global Personalized Nutrition Market size is expected to be worth around USD 49.2 Billion by 2034, from USD 13.5 Billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.2% share, holding USD 5.2 Billion in revenue.

Personalized nutrition is moving from a niche “DNA test + supplement pack” concept into an industry-wide capability that blends food science, digital health, and preventive care. In practice, it means tailoring dietary advice, functional foods, and supplementation to an individual’s goals and data—such as lifestyle, biomarkers, microbiome signals, or medical history—while still meeting mainstream expectations on taste, convenience, and trust. For example, the IFIC Food & Health Survey reports that nearly 6 in 10 Americans say they followed a specific diet in the past year, and leading diet goals include “Energy/less fatigue” (40%) and “Weight loss/weight maintenance” (40%).

A major driver is the expanding availability of large, diverse health datasets that help translate biology into practical recommendations. The U.S. NIH “All of Us” Research Program reports roughly 862,000 enrolled participants by April 2025, and notes that 15,000+ researchers across all 50 states and 1,000+ organizations worldwide are registered to use its research platform—momentum that supports better evidence-building for precision approaches over time. In Europe, the 1+ Million Genomes (1+MG) initiative was signed by 25 EU countries plus the United Kingdom and Norway, building infrastructure to enable secure cross-border access to genomics and related clinical data—an enabling backbone for future “genomics-aware” nutrition pathways.

Industrially, the ecosystem now resembles a multi-layer value chain. Upstream, testing and data capture include blood biomarkers, continuous glucose monitoring, microbiome kits, and increasingly large research cohorts feeding algorithm development. In the U.S., the NIH’s “Nutrition for Precision Health” program is backed by $170 million over 5 years and targets 10,000 participants to build predictive nutrition algorithms. This sits alongside scale-building infrastructure like All of Us, which reports roughly 862,000 enrolled participants.

Several demand-side drivers are converging. First, consumers are already in “active management” mode: in 2025, 57% of Americans said they followed a specific eating pattern or diet in the past year, with “high protein” reported by 23%. Second, supplement behavior supports personalization economics: 75% of Americans take dietary supplements, providing an established channel for tailored packs and condition-focused regimens. Third, the clinical imperative is intensifying—IDF reports 589 million adults living with diabetes worldwide and at least USD 1 trillion in health expenditure tied to diabetes.

Government and trusted institutional initiatives are also accelerating the ecosystem. In the U.S., the NIH “All of Us” Research Program reports more than 849,000–850,000 participants enrolled (public updates), supporting large-scale research that can improve how nutrition advice is tailored to diverse populations. In Europe, the Commission has funded digital-personalisation research directly; for instance, the EU-funded PROTEIN project (CORDIS) listed a total cost of €8,138,951.25 with an EU contribution of €6,999,472.50 to develop ICT-based personalised nutrition systems.

Key Takeaways

- Personalized Nutrition Market size is expected to be worth around USD 49.2 Billion by 2034, from USD 13.5 Billion in 2024, growing at a CAGR of 13.8%.

- Personalized Supplements held a dominant market position, capturing more than a 39.6% share.

- Active Measurement held a dominant market position, capturing more than a 61.2% share.

- Direct Consumers held a dominant market position, capturing more than a 44.8% share.

- Online held a dominant market position, capturing more than a 39.7% share.

- North America emerged as the dominant region in the personalized nutrition market, capturing 39.20% of global share and generating approximately US$5.2 billion.

By Product Type Analysis

Personalized Supplements lead with 39.6% as consumers seek tailored daily nutrition

In 2024, Personalized Supplements held a dominant market position, capturing more than a 39.6% share, driven by rising consumer preference for nutrition products designed around individual health goals, lifestyle, and genetic profiles. This segment benefited from strong demand for customized vitamins, minerals, probiotics, and functional blends that address specific needs such as immunity, gut health, energy, and aging. The growth of digital health tools, including online assessments and at-home testing kits, made personalized supplement plans easier to access and understand, supporting wider adoption.

Moving into 2025, the segment continued to expand as awareness of preventive healthcare increased and consumers shifted away from one-size-fits-all supplements toward more precise nutrition solutions. Improvements in formulation accuracy, ingredient traceability, and data-driven recommendations further strengthened trust in personalized supplements. As a result, this product type remained central to the personalized nutrition market, supported by consistent consumer engagement and long-term wellness-focused buying patterns.

By Measurement Method Analysis

Active Measurement leads with 61.2% as real-time health tracking gains trust

In 2024, Active Measurement held a dominant market position, capturing more than a 61.2% share, supported by strong consumer demand for real-time and data-driven nutrition insights. This method relies on direct inputs such as blood tests, DNA analysis, microbiome assessments, and wearable-based biomarker tracking, which allow nutrition plans to be adjusted based on actual physiological data rather than assumptions. The growing use of at-home testing kits and connected devices made these measurements more accessible and easier to repeat over time.

Moving into 2025, adoption continued to rise as accuracy improved and turnaround times shortened, helping users refine their nutrition programs more frequently. Active measurement also supported subscription-based personalized nutrition models, encouraging long-term engagement rather than one-time purchases. As a result, this measurement method remained the backbone of personalized nutrition services, driven by its ability to offer precise, actionable, and continuously updated dietary recommendations.

By End-use Analysis

Direct Consumers lead with 44.8% as personalized nutrition becomes part of daily wellness

In 2024, Direct Consumers held a dominant market position, capturing more than a 44.8% share, driven by the growing shift toward self-managed health and nutrition solutions. Individuals increasingly preferred direct access to personalized nutrition services through digital platforms, mobile apps, and subscription-based programs without intermediaries.

By 2025, repeat usage increased as consumers became more engaged with data-backed nutrition insights and progress tracking. The direct consumer model also benefited from faster feedback loops, enabling quick adjustments to nutrition plans based on personal results. As awareness of preventive healthcare rose, direct consumer participation remained strong, reinforcing this segment’s leadership through convenience, personalization, and continuous engagement.

By Sales Channel Analysis

Online sales lead with 39.7% as digital access reshapes nutrition buying habits

In 2024, Online held a dominant market position, capturing more than a 39.7% share, supported by the rapid shift of consumers toward digital health and wellness platforms. Online channels made it easier for users to access personalized nutrition services, complete assessments, and receive tailored recommendations from home. The ability to compare options, review nutrition data, and track progress digitally increased user confidence and repeat purchases.

By 2025, online sales continued to strengthen as brands invested in AI-driven personalization, faster delivery, and improved customer engagement tools. Secure payment systems and flexible pricing plans further encouraged adoption. Overall, the online channel remained a key driver of market growth due to convenience, wider reach, and seamless integration with personalized nutrition technologies.

Key Market Segments

By Product Type

- Personalized Supplements

- Personalized Diet Plans

- Personalized Beverages

- Diseases Based

By Measurement Method

- Active Measurement

- Standard Measurement

By End-use

- Direct Consumers

- Patients/Healthcare Users

- Sports & Fitness Users

- Corporates & Insurers

By Sales Channel

- Wellness and fitness Centers

- Hospitals & Clinics

- Pharmacies

- Online

- Retail Stores

Emerging Trends

Wearables and CGMs Are Powering “Real-Time” Personalized Nutrition

A clear latest trend in personalized nutrition is the move from one-time quizzes to real-time personalization using wearables—especially continuous glucose monitoring (CGM)—so advice can change based on what a person’s body is doing today. The reason this is taking off is practical: people want feedback they can feel and measure, not generic rules. At the same time, chronic metabolic conditions are common enough that many consumers already have a reason to track. In the U.S., 38.4 million people—about 11.6% of the population—had diabetes. When a health issue touches that many households, tools that translate daily data into daily food choices become much easier to sell—and easier for clinicians to recommend.

Consumer behavior is lining up with this “track and adjust” style of eating. IFIC’s food and nutrition findings show that in 2025, 57% of Americans said they followed a specific eating pattern or diet in the past year, up from 36% in 2018. The same IFIC summary notes the top reported diets in 2025 were high protein (23%) and mindful eating (19%)—both patterns that pair naturally with wearable feedback because people want to connect actions (what I ate) with outcomes (how I feel, how I perform, what my readings show).

On the science and credibility side, government-backed research is pushing this trend toward stronger evidence. The NIH announced $170 million over five years for “Nutrition for Precision Health,” powered by the All of Us Research Program. NIH stated the study aims to recruit 10,000 participants to help develop algorithms that predict individual responses to foods and dietary patterns. That kind of national-scale work matters because it helps shift wearable-led nutrition from “interesting insights” to repeatable models that can be validated across diverse groups.

Drivers

Consumers Want Health Solutions That Feel Personal

One major driver behind personalized nutrition is a simple change in buyer behavior: people no longer shop for “healthy” in general—they shop for what feels right for them. When consumers actively follow eating patterns, track goals, and adjust habits, they become far more open to tailored foods, supplements, and services. The International Food Information Council (IFIC) found that 54% of Americans followed a specific eating pattern or diet in 2024.

This is not a short-term fad; it has built over time. IFIC’s 2018 Food and Health Survey showed 36% followed a specific eating pattern in the past year. Moving from 36% (2018) to 54% (2024) indicates a broader cultural shift: more people are experimenting, measuring outcomes, and switching approaches when something doesn’t work. That trial-and-learn mindset is the fuel personalized nutrition companies need, because it reduces the “education burden.” Consumers already accept that two people can eat differently and still be “doing it right.”

Supplements make this driver even stronger because they provide a practical entry point to personalization without forcing a full lifestyle reset. The Council for Responsible Nutrition (CRN) reported that 75% of Americans use dietary supplements. In market terms, this creates a large installed base for personalization: once people are already buying supplements, it’s easier to introduce customized packs, timed routines, or biomarker-linked recommendations. This is why many personalized nutrition models start with “daily packs” and coaching, then expand into functional foods and medical nutrition partnerships.

Government-backed data infrastructure is also reinforcing this demand-led driver by improving credibility and future clinical alignment. The NIH “All of Us” Research Program’s public snapshots show 862,000 participants enrolled by April 2025. While All of Us is not a nutrition program, it strengthens the ecosystem that personalized nutrition relies on: large-scale, diverse health data that can support better evidence on how different people respond to interventions. Over time, that reduces uncertainty for brands and healthcare partners, and it helps move personalization from “wellness advice” toward more medically credible pathways.

Restraints

Data Privacy and Trust Gaps Slow Adoption

A major restraint for personalized nutrition is that it often needs personal data—food habits, health goals, wearable metrics, lab results, even genetics—and many people simply don’t feel comfortable handing that over. When trust is weak, consumers hesitate to share enough information for “personalization” to feel truly personal, and companies are forced to offer lighter, less precise recommendations. A large Pew Research Center survey of 5,101 U.S. adults (May 15–21, 2023) found that 73% of Americans feel they have little to no control over what companies do with data collected about them, and 67% say they understand little to nothing about what companies are doing with their personal data.

This matters because personalized nutrition is not like buying a standard vitamin bottle. People are being asked to connect apps, answer sensitive questionnaires, and sometimes submit samples. Yet the same Pew findings show that 56% of Americans frequently click “agree” on privacy policies without reading them, and 61% think privacy policies are ineffective at explaining how companies use personal data. In plain terms: many consumers feel rushed and confused in digital consent, so they either opt out—or participate with skepticism. That skepticism shows up as lower conversion, shorter subscription duration, and higher churn for personalized programs.

Even trusted public initiatives that could strengthen personalized health solutions depend on confidence and governance. For example, the NIH All of Us Research Program shows 862,000 participants enrolled by April 2025, and notes 100+ funded partner organizations supporting the program. Europe’s “1+ Million Genomes” initiative similarly focuses on building secure, federated access frameworks; it was signed by 25 EU countries plus the UK and Norway. These initiatives underline a key point: personalization can scale responsibly, but only when data handling is transparent, secure, and socially accepted.

Opportunity

Clinical Partnerships Can Turn Personalization into Standard Care

One of the biggest growth opportunities in personalized nutrition is moving from “wellness advice” into healthcare-linked programs that people can trust and stick with. Today, many personalized plans live inside apps or supplement subscriptions, which can feel optional. The opportunity is to anchor personalization in clinics, insurers, employers, and dietitian networks, where health goals are already being tracked and where outcomes matter. This shift is timely because the science infrastructure is getting stronger and more organized, especially through government-backed research.

A clear signal comes from the U.S. National Institutes of Health (NIH). NIH announced it is awarding $170 million over five years to support “Nutrition for Precision Health” (NPH), a national effort designed to develop algorithms that predict how individuals respond to diets. Importantly, NPH is not a small pilot; the All of Us program announcement describes NPH working with 14 sites across the U.S. to engage 10,000 participants from diverse backgrounds. That scale matters because healthcare partners and large food/supplement brands are more likely to adopt models that are built on robust datasets rather than small, single-center studies.

NPH also benefits from the wider All of Us infrastructure, which already has deep participant coverage and research readiness. A public NIH program update reports more than 832,000 All of Us participants as of August 24, 2024, alongside more than 452,000 electronic health records and more than 586,000 biosamples. For personalized nutrition companies, this creates a growth runway: better evidence can translate into more credible product claims, clearer segmentation (who benefits most), and stronger clinician confidence—especially when recommendations can be explained using real-world data rather than generic lifestyle tips.

Finally, Europe is funding the upstream science that can feed future product pipelines. EU CORDIS lists the PROTEIN personalized nutrition project with a total cost of €8,138,951.25, and NUTRISHIELD with a total cost of €8,732,209.59—evidence that public investment is supporting validated personalization approaches, not just marketing-led ideas.

Regional Insights

North America leads with 39.2% share and US$5.2 Bn in 2024, supported by high health awareness and digital adoption

In 2024, North America emerged as the dominant region in the personalized nutrition market, capturing 39.20% of global share and generating approximately US$5.2 billion in market value. This leadership was largely driven by well-established health and wellness trends, widespread consumer awareness of preventive healthcare, and early adoption of digital health technologies. In key markets such as the United States and Canada, high per-capita spending on dietary supplements, tailored health programs, and tech-enabled nutrition services underpinned strong regional demand.

The growth of online health platforms, telehealth consultations, and at-home testing kits further expanded access to personalized nutrition, with many consumers using smartphone apps or web portals to track progress and adjust nutrition plans in real time. In 2024, the integration of AI and data analytics into personalized nutrition solutions enabled more precise formulation of nutrient mixes, enhancing user confidence and driving repeat usage. Retail partnerships and fitness-tech collaborations also helped bridge e-commerce and in-store experiences, broadening product reach.

Key Regions and Countries Insights

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Telomere Diagnostics, Inc. advanced personalized nutrition through its TeloYears® test, which evaluates biological aging to inform lifestyle and nutrition interventions. The company reported over 100,000 tests administered, helping users tailor nutrition and wellness plans based on cellular health indicators and supporting data-driven health decisions.

In 2024, Nutrigenomix Inc. remained a key provider of genetic testing for personalized nutrition guidance, enabling diet plans tailored to individual genotypes. The company completed over 250,000 genetic tests worldwide, delivering actionable dietary insights to healthcare providers, nutritionists, and consumers seeking precision nutrition recommendations.

In 2024, BASF SE supported personalized nutrition through specialty ingredients and formulation systems that enhance nutrient delivery and product performance. The company posted group revenues of €75.9 billion, with its Nutrition & Care segment delivering around €6.7 billion. BASF’s excipient and bioavailability technologies helped brands create tailored supplements and functional nutrition solutions.

Top Key Players Outlook

- Nestlé S.A.

- BASF SE

- General Mills, Inc.

- Nutrigenomix Inc.

- Telomere Diagnostics, Inc.

- Habit Food Personalized, LLC.

Recent Industry Developments

In 2024, Nestlé S.A. further strengthened its presence in the personalized nutrition sector through the activities of Nestlé Health Science, the company’s science-driven health and wellness division focused on tailored nutritional solutions. Nestlé Health Science delivered total sales of approximately CHF 6.74 billion in 2024, growing organically as supply challenges eased and consumer demand for targeted health products increased.

In 2024, General Mills, Inc. continued to adapt its broad food portfolio toward evolving nutrition preferences, including products that support personalized and health‑forward eating habits. While the company is best known for brands such as Cheerios, Nature Valley and Betty Crocker, it has increasingly responded to consumer interest in tailored nutrition by expanding high‑protein and functional products like Cheerios Protein and Nature Valley Protein Bars, which generated over USD 100 million in retail sales during the year.

Report Scope