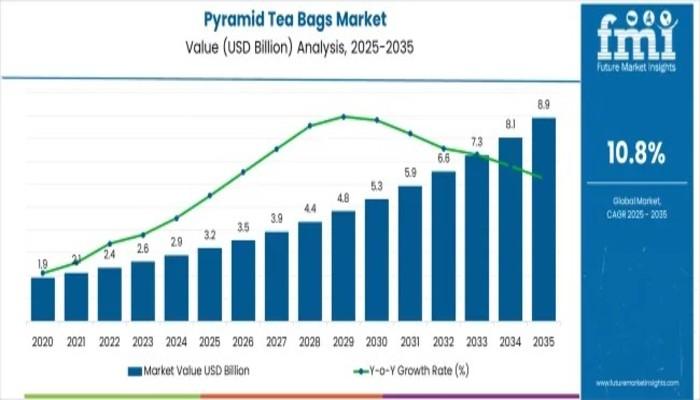

The global pyramid tea bags market is entering a decade of transformative expansion, projected to rise from USD 3.2 billion in 2025 to USD 8.9 billion by 2035. This represents an impressive 178.1% total growth, driven by consumers’ increasing preference for premium tea formats, transparent brewing experiences, and whole-leaf infusion solutions. With a robust CAGR of 10.8%, the industry is gearing up for significant innovation, investment, and technology adoption from both established and emerging tea manufacturers.

Rising Popularity of Premium Tea Bags Fuels Market Expansion

Between 2025 and 2030, the market is set to grow by USD 2.1 billion, accounting for nearly 36.8% of the decade’s total rise. This momentum is strengthened by the growing shift toward visible leaf infusions, specialty tea categories, and the rapid expansion of retail and hospitality offerings. The period from 2030 to 2035 will further accelerate growth, adding USD 3.6 billion as brands increasingly adopt biodegradable mesh materials, introduce innovative flavor blends, and elevate luxury tea experiences.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates – https://www.futuremarketinsights.com/reports/sample/rep-gb-4814

Quick Market Snapshot

• Market Value 2025: USD 3.2 billion

• Market Forecast 2035: USD 8.9 billion

• CAGR (2025-2035): 10.8%

• Leading Product Category: Premium Pyramid Bags (58%)

• Key Regions: North America, Europe, Asia Pacific

• Top Established Players: Dilmah Tea, Twinings, Harney & Sons, Mighty Leaf Tea, The Republic of Tea

Why the Market Is Growing: Key Drivers

Premiumization remains the most powerful force shaping the industry. Consumers across major global regions now prioritize:

• Superior brewing quality with full leaf visibility

• Lifestyle-driven wellness habits and premium beverage choices

• Convenient brewing formats without compromising taste

• Organic and specialty teas offering authentic flavors

Pyramid tea bags meet all these expectations, making them a preferred option among tea enthusiasts, retailers, luxury hospitality chains, and e-commerce platforms.

Segmental Highlights

By Product Type: Premium Pyramid Bags Lead with 58% Market Share

Premium pyramid bags dominate due to their superior infusion performance, compatibility with diverse tea varieties, and growing use in high-end cafés, hotels, and specialty tea shops.

By Tea Type: Specialty Teas Anchor Future Growth

Specialty teas are projected to account for 44% of total market growth through 2035. Consumers’ growing curiosity about artisan blends, exotic flavors, and authentic sourcing is reshaping brand strategies and accelerating investments in superior ingredients and advanced blending technologies.

Emerging Trends Shaping the Market

• Advancements in biodegradable materials such as PLA and plant-based meshes

• Innovation in flavor technology for artisan and wellness-oriented blends

• Growing e-commerce penetration showcasing luxury tea assortments

• Rise of global tea culture, inspiring consumers to explore new infusion formats

• Hospitality sector upgrades, offering premium tea experiences to match gourmet dining trends

Manufacturers are rapidly integrating mesh engineering, infusion optimization technologies, and improved quality protocols to stay competitive in the evolving landscape.

Global Market Outlook: Country-wise Growth

• UK: 11.3% CAGR – Leading due to robust tea heritage and premium product acceptance

• Japan: 10.9% CAGR – Strong rise in Western tea preferences

• USA: 10.5% CAGR – Premium beverage segment expansion

• Germany: 10.2% CAGR – Strong wellness and quality-driven market

• China: 9.8% CAGR – Blend of traditional tea culture and modern innovations

Europe alone is forecasted to grow from USD 1.1 billion (2025) to USD 2.9 billion (2035), led by the UK and Germany.

Competitive Landscape: Established & Emerging Players Elevate Innovation

Leading companies such as Dilmah Tea, Twinings, Harney & Sons, Mighty Leaf Tea, and The Republic of Tea continue to invest in premium blending technology, sustainable packaging, and high-quality leaf sourcing.

Several new and emerging manufacturers are entering the market with:

• Biodegradable and compostable pyramid bags

• Unique infusion technologies

• Exotic flavor innovations

• Artisanal, small-batch tea production

Brands like Newby Teas, Tea Forté, Kusmi Tea, Numi Organic Tea, and Adagio Teas are gaining traction by offering differentiated premium experiences that resonate with modern consumers.

Get the Complete Story-Read More About Our Latest Report!

https://www.futuremarketinsights.com/reports/pyramid-tea-bags-market

Industry Stakeholders: A Shared Path to Growth

Governments Can Support By:

• Offering manufacturing incentives

• Simplifying export regulations

• Funding R&D in tea processing technologies

Industry Bodies Should Focus On:

• Building global tea innovation networks

• Supporting training in blending and quality control

Suppliers & Retailers Can Strengthen the Ecosystem Through:

• Technology investments for efficient blending

• Premium product positioning

• Collaboration with specialty distributors

Why FMI: https://www.futuremarketinsights.com/why-fmi

Have a Look at Related Research Reports on the Packaging Domain

Demand for Filter Paper in USA https://www.futuremarketinsights.com/reports/united-states-filter-paper-market

Demand for Corrugated Mailers in USA https://www.futuremarketinsights.com/reports/united-states-corrugated-mailers-market

Demand for Child Resistant Bottles in USA https://www.futuremarketinsights.com/reports/united-states-child-resistant-bottles-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.