MATIC Price Prediction: $0.45 Target by January 2025 as Polygon Tests Critical Resistance

Terrill Dicki

Dec 10, 2025 11:23

Our MATIC price prediction sees potential rally to $0.45 within 4-6 weeks if Polygon breaks above $0.43 SMA 20 resistance, though downside risk to $0.33 remains.

MATIC Price Prediction: Polygon Poised for Potential Breakout Above Key Technical Levels

Polygon (MATIC) finds itself at a critical juncture as the cryptocurrency trades near its 52-week low of $0.37, presenting both significant opportunity and notable risk for traders. With the current price at $0.38, our comprehensive MATIC price prediction analysis reveals a coin consolidating before a potential directional move that could determine its trajectory through early 2025.

MATIC Price Prediction Summary

• MATIC short-term target (1 week): $0.41 (+8%) if SMA 7 holds as support

• Polygon medium-term forecast (1 month): $0.45-$0.50 range upon breakout confirmation

• Key level to break for bullish continuation: $0.43 (SMA 20 resistance)

• Critical support if bearish: $0.33 (strong support zone)

Recent Polygon Price Predictions from Analysts

Recent analyst forecasts present a mixed but ultimately optimistic outlook for MATIC’s price trajectory. CoinCodex’s conservative MATIC price prediction of $0.1244 in the short term appears overly bearish given current technical positioning, while PricePredictions.com’s ambitious forecast of $0.763306 by December 2025 suggests significant upside potential.

The most balanced Polygon forecast comes from Benzinga, targeting $0.717 by 2030, which aligns with the token’s fundamental value proposition as Ethereum’s leading Layer-2 scaling solution. This range of predictions highlights the current uncertainty in the market, with our technical analysis suggesting the truth likely lies between the conservative and aggressive estimates.

Notably, the market consensus points toward cautious optimism, with medium to long-term MATIC price prediction scenarios favoring bulls despite near-term consolidation pressures.

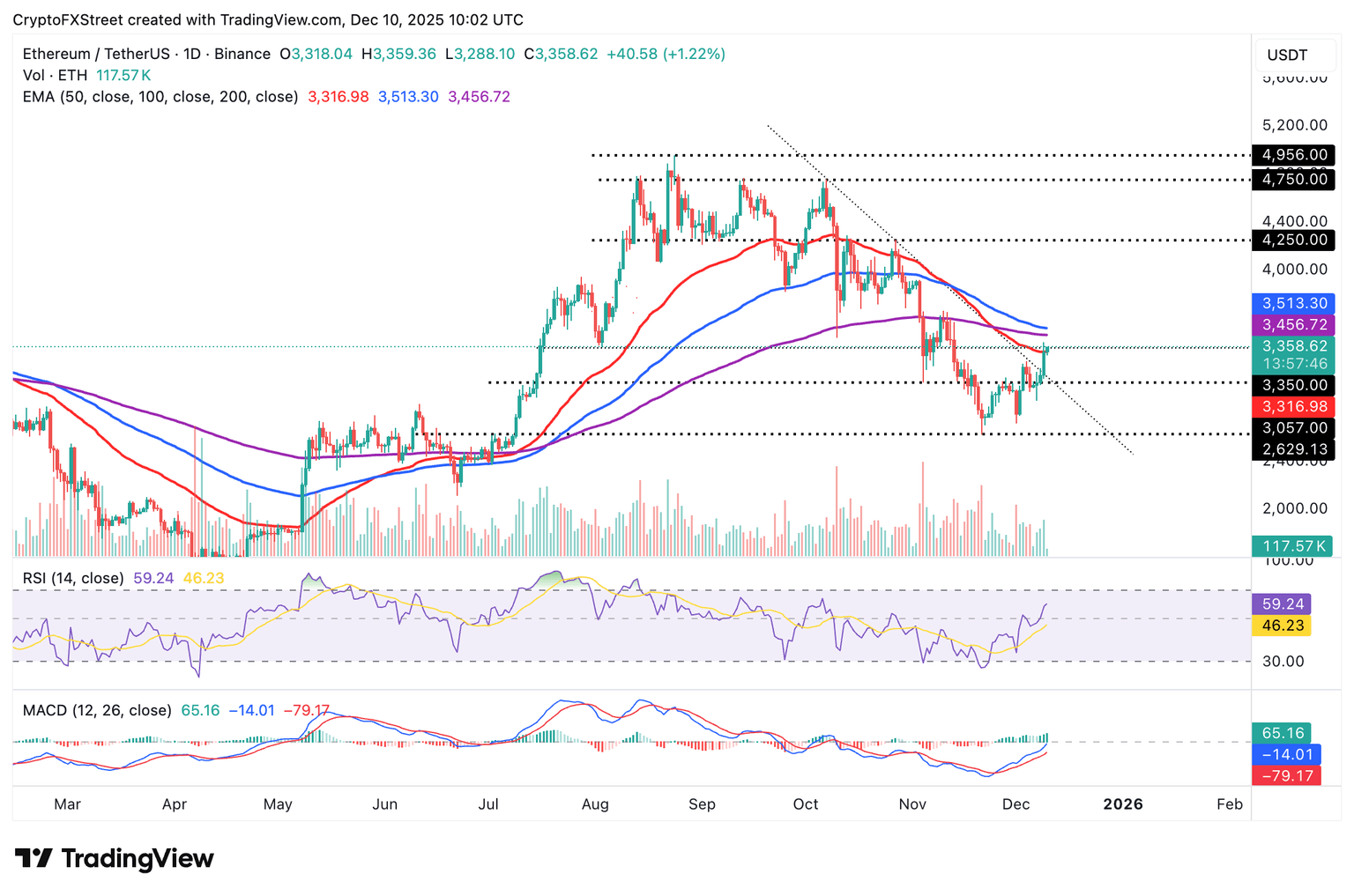

MATIC Technical Analysis: Setting Up for Consolidation Breakout

The Polygon technical analysis reveals a cryptocurrency testing crucial support levels while building momentum for a potential upward move. With MATIC trading at $0.38, the token sits precariously close to its lower Bollinger Band at $0.31, indicating oversold conditions that often precede reversals.

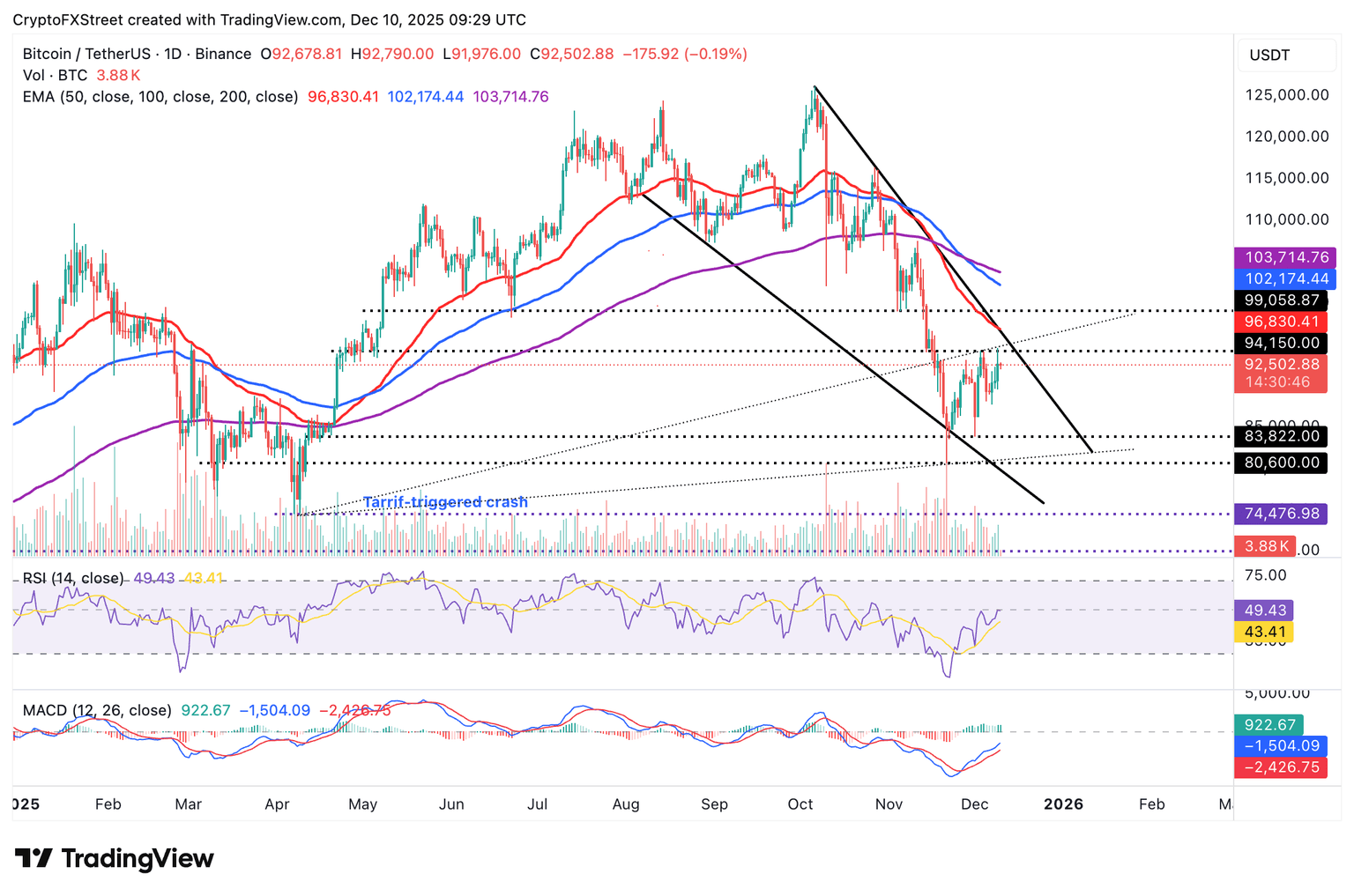

The RSI reading of 38.00 places MATIC in neutral territory, suggesting neither extreme oversold nor overbought conditions. This positioning provides room for upward movement without immediately triggering profit-taking pressure. However, the MACD histogram at -0.0045 indicates lingering bearish momentum that must be overcome for any sustained rally.

Volume analysis from Binance shows $1.07 million in 24-hour trading, which while modest, provides sufficient liquidity for institutional participation. The key technical pattern emerging is a potential double-bottom formation near the $0.37-$0.38 range, which historically signals trend reversals when confirmed by volume expansion.

The critical resistance cluster between $0.42-$0.43 represents both the EMA 26 and SMA 20 levels, making this zone the primary battleground for MATIC’s next directional move.

Polygon Price Targets: Bull and Bear Scenarios

Bullish Case for MATIC

Our optimistic MATIC price prediction scenario targets $0.45 as the initial objective, representing the SMA 50 level and a 18% gain from current levels. This MATIC price target becomes achievable if Polygon successfully breaks above the $0.43 resistance with expanding volume.

The secondary bullish target sits at $0.58, matching both the strong resistance level and upper Bollinger Band. Achieving this level would require sustained buying pressure and broader cryptocurrency market support, representing a 53% upside potential.

For this bullish Polygon forecast to materialize, MATIC needs to reclaim the $0.43 level decisively, ideally with daily closing prices above this threshold for at least three consecutive sessions. The RSI would need to break above 50, while the MACD histogram should turn positive to confirm momentum shift.

Bearish Risk for Polygon

The downside MATIC price prediction centers on a break below the $0.35 immediate support level, which could trigger algorithmic selling toward the $0.33 strong support zone. This represents a 13% decline from current levels and would likely coincide with broader market weakness.

A more severe bearish scenario sees MATIC testing the lower Bollinger Band at $0.31, particularly if Bitcoin experiences significant selling pressure or if Ethereum scaling narratives lose market favor. The 52-week low of $0.37 serves as a psychological support level that, if broken, could accelerate selling momentum.

Risk factors include potential regulatory concerns around Layer-2 solutions, competitive pressure from alternative scaling technologies, and general cryptocurrency market sentiment deterioration.

Should You Buy MATIC Now? Entry Strategy

Based on our Polygon technical analysis, the current risk-reward setup suggests a cautious buy approach for those willing to accept moderate volatility. The optimal entry point for our MATIC price prediction scenario lies between $0.37-$0.39, with a stop-loss positioned below $0.33 to limit downside exposure.

For conservative investors, waiting for a confirmed break above $0.43 with volume confirmation provides a higher probability setup, albeit with reduced upside potential. This approach aligns with the “buy or sell MATIC” decision framework that prioritizes capital preservation over maximum returns.

Position sizing should remain modest given the mixed technical signals, with recommendations not exceeding 2-3% of total portfolio allocation. Dollar-cost averaging into positions over 2-3 weeks can help mitigate timing risk while building exposure to potential upside.

The technical setup suggests setting take-profit orders at $0.45 (first target) and $0.50 (extended target), while maintaining trailing stops to capture momentum if the Polygon forecast exceeds expectations.

MATIC Price Prediction Conclusion

Our comprehensive analysis yields a medium confidence MATIC price prediction of $0.45 within the next 4-6 weeks, contingent on breaking above the critical $0.43 resistance level. The Polygon forecast remains cautiously optimistic despite current consolidation, with technical indicators suggesting oversold conditions may soon reverse.

Key indicators to monitor for prediction confirmation include RSI breaking above 50, MACD histogram turning positive, and sustained volume expansion above $2 million daily. Invalidation signals include a decisive break below $0.33 support or failure to reclaim $0.40 within the next two weeks.

The timeline for this MATIC price target assumes normal market conditions and no major external catalysts. Traders should remain flexible and adjust positions based on evolving technical patterns, particularly monitoring Bitcoin’s influence on overall cryptocurrency sentiment that directly impacts Polygon’s price action.

Image source: Shutterstock

Bloomsgiving is a hybrid tea shop and flower and plant store.(Courtesy of

Bloomsgiving is a hybrid tea shop and flower and plant store.(Courtesy of