Global Tea Market Size Outlook 2035

Global Tea Market Size Outlook 2035

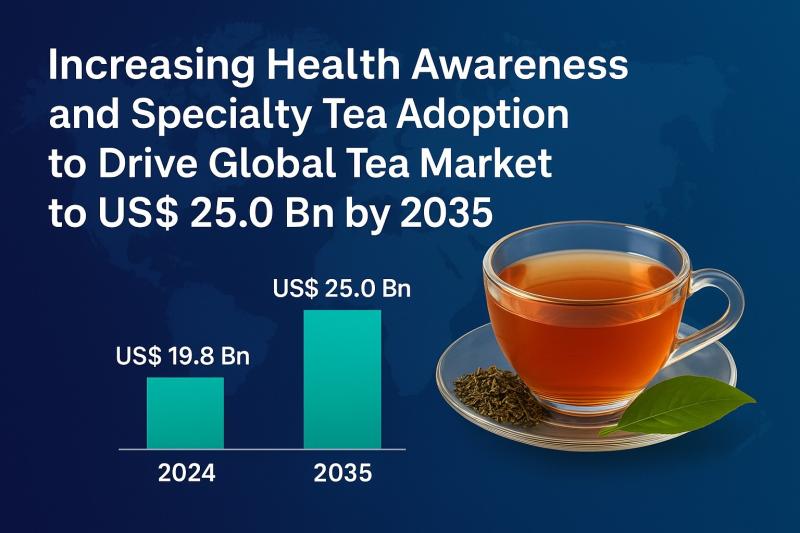

The global tea market was valued at US$ 19.8 Bn in 2024 and is projected to reach US$ 25.0 Bn by 2035, growing at a CAGR of 4.1% from 2025 to 2035. Leading companies in the industry include Associated British Foods (Twinings), Barry’s Tea, Bigelow Tea Company, BOH Plantations, and Celestial Seasonings, which continue to strengthen their presence through product innovation and global distribution.

In 2024, Asia Pacific dominated the market with a 34.7% revenue share, driven by high consumption and traditional tea culture in the region. Among tea types, the black leaf tea segment accounted for the largest share at 66.4%, reflecting its widespread popularity and demand across global markets.

👉 Get your sample market research report copy today@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4187

Market Overview

Tea, one of the world’s most consumed beverages, is derived from Camellia sinensis and categorized into green, black, oolong, white, and herbal teas.

The market is witnessing robust demand due to:

• Rising health and wellness awareness

• Increasing consumption of functional and herbal teas

• Growth in ready-to-drink (RTD) tea products

• Expansion of modern retail formats, e-commerce, and online sales channels

• Rising popularity of premium and organic tea varieties

Tea is gaining traction not only as a traditional beverage but also as a functional drink with antioxidant, anti-inflammatory, and immunity-boosting properties.

Key Market Growth Drivers

1. Health and Wellness Trends

Consumers increasingly choose tea over carbonated drinks due to its natural antioxidants, low-calorie content, and therapeutic benefits. Green tea, herbal tea, and specialty blends are particularly popular among health-conscious consumers.

2. Expansion of Ready-to-Drink (RTD) Tea

RTD tea products, including iced tea, flavored tea, and cold-brew variants, are driving market growth through convenience-focused consumption.

3. Premiumization and Specialty Tea Demand

Premium teas, such as single-origin, organic, and artisanal teas, are gaining popularity, especially in North America, Europe, and Asia-Pacific, where consumers are willing to pay a premium for quality and authenticity.

4. Rising E-commerce and Modern Retail Channels

The expansion of online grocery platforms, specialty tea stores, and supermarket chains is increasing accessibility and awareness of diverse tea products.

5. Growing Consumer Awareness and Education

Marketing campaigns, social media promotion, and wellness-focused initiatives educate consumers about tea’s health benefits, enhancing market adoption.

Analysis of Key Players – Key Strategies

Leading companies in the tea market focus on strategies such as product innovation, geographic expansion, mergers and acquisitions, and brand differentiation.

1. Product Innovation

• Introduction of flavored, functional, and organic tea variants

• Launch of herbal, wellness, and antioxidant-rich blends

• Expansion into ready-to-drink and cold-brew tea segments

2. Strategic Partnerships and Acquisitions

• Collaborating with retailers and e-commerce platforms to enhance distribution

• Acquiring regional tea brands to expand product portfolios and market reach

3. Geographic Expansion

• Expanding presence in emerging markets such as India, China, Southeast Asia, and Latin America

• Increasing penetration in urban and semi-urban areas

4. Sustainability and Ethical Sourcing

• Adoption of fair-trade practices, organic cultivation, and environmentally friendly packaging

• Emphasis on sustainable tea plantations and carbon footprint reduction

Analysis of Key Players in the Global Tea Market

The global tea market is dominated by leading manufacturers including

• Associated British Foods (Twinings)

• Barry’s Tea

• Bigelow Tea Company

• BOH Plantations

• Celestial Seasonings

• Clipper Tea

• Dilmah Ceylon Tea

• Harney & Sons

• ITO EN

• Nestlé

• Tata Consumer Products (Tetley)

• The Republic of Tea

• Unilever (Lipton)

• Wissotzky Tea

• Yamamotoyama

• Other Key Players.

These companies drive market growth through innovation, diverse product portfolios, and strategic expansions.

Each of these players has been profiled in the market report based on company overview, business strategies, financial performance, business segments, product portfolio, and recent developments.

Key Developments in the Tea Market

• October 2025 – Tata Tea Agni

Tata Tea Agni introduced a new variant, “Extra Josh”, India’s first tea fortified with natural caffeine for an energy boost. This launch targets on-the-go consumers in northern markets, aligning with the brand’s promise of delivering daily “Josh” with an enhanced offering.

• July 2025 – Lipton (Unilever)

Lipton launched its first-ever iced-tea concentrates along with a new fruit & herbal tea line-up, featuring flavors such as Golden Chamomile, Peach Paradise, Smooth Mint, and Lemon Ginger Refresh. The products were scheduled for national rollout in August.

• July 2025 – Dilmah Tea

Dilmah Tea unveiled the Genesis Tea and Cinnamon Experience at Genesis Colombo, designed to enrich the Sri Lankan travel experience for discerning consumers while raising awareness of its premium offerings.

👉 Discuss Implications for Your Industry Request Sample Research Report PDF@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4187

Market Challenges & Opportunities

Challenges

1. Price Volatility of Raw Tea Leaves

Fluctuating global tea leaf prices affect production costs and profitability.

2. Climate Change Impact

Unpredictable weather patterns can disrupt tea cultivation and supply.

3. High Competition from Coffee and Functional Beverages

Rising preference for other beverages can limit tea consumption growth.

4. Regulatory and Quality Compliance

Stringent food safety regulations and certifications are required for export and global distribution.

Opportunities

1. Growth of Specialty and Organic Tea Segments

Premium, herbal, and functional teas offer higher margins and differentiation opportunities.

2. Ready-to-Drink (RTD) and Cold-Brew Tea Expansion

Convenience-focused products are capturing young and urban consumer segments.

3. Emerging Markets Growth

Increasing disposable income and urbanization in Asia-Pacific, Africa, and Latin America provide strong growth potential.

4. Digital Marketing and E-commerce Penetration

Online sales platforms and subscription-based tea services allow companies to reach tech-savvy consumers globally.

5. Sustainable and Ethical Product Offerings

Eco-friendly packaging, fair-trade sourcing, and organic cultivation resonate with environmentally conscious consumers.

Investment Landscape and ROI Outlook

The global tea market offers stable investment opportunities due to consistent demand and evolving consumption patterns.

Investment Strengths

• Steady global consumption of tea as a staple and functional beverage

• Premium and RTD segments offer higher margins

• Emerging markets provide significant growth potential

• Increasing adoption of organic, herbal, and health-focused teas

ROI Outlook

With a CAGR of 4.1% through 2035, investments in product innovation, RTD formats, specialty teas, and e-commerce channels are expected to generate moderate-to-high returns, especially in emerging economies and urban markets.

Market Segmentations

By Type

• Green Tea

• Black Tea

• Oolong Tea

• White Tea

• Herbal Tea

• Others

By Form

• Loose Tea

• Tea Bags

• Ready-to-Drink (RTD) Tea

• Powdered Tea

By Distribution Channel

• Supermarkets/Hypermarkets

• Specialty Stores

• Online Retail/E-commerce

• Convenience Stores

• Others

By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East & Africa

Why Buy This Report?

✔ Forecast to 2035 with detailed market size and growth trends

✔ Insights on key drivers, challenges, and opportunities

✔ Competitive landscape and strategies of leading tea brands

✔ Segmentation by type, form, distribution channel, and region

✔ Strategic recommendations for investors, manufacturers, and retailers

✔ Covers trends such as RTD tea, herbal blends, organic sourcing, and digital marketing

👉 To buy this comprehensive market research report, click here to inquire@ https://www.transparencymarketresearch.com/checkout.php?rep_id=4187<ype=S

FAQs

1. What is the projected tea market size by 2035?

It is expected to reach US$ 25.0 billion by 2035.

2. What is the CAGR of the global tea market?

The market is projected to grow at a CAGR of 4.1% from 2025 to 2035.

3. Which type of tea dominates the market?

Black tea and green tea continue to hold the largest share, driven by traditional consumption and health benefits.

4. Which region is witnessing the fastest growth?

Asia-Pacific is expected to witness the fastest growth due to increasing disposable income, urbanization, and changing lifestyles.

5. What are the key market trends?

Growth of premium and organic teas, ready-to-drink products, herbal blends, and e-commerce distribution are shaping the market.

More Trending Research Reports-

• Skimmed Milk Market – https://www.transparencymarketresearch.com/skimmed-milk-market.html

• Low Fat Products Market – https://www.transparencymarketresearch.com/low-fat-products-market.html

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

Contact Us

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.