Solana Price Prediction: SOL Battles to Hold $130 as Liquidity Clusters, Wedge Patterns, and Market Structure Signal a Potential Move Towards $150–$165

Solana price is holding a crucial support zone near $133, creating a pivotal setup as liquidity clusters and wedge patterns hint at a potential move towards the $150–$165 range.

Solana price is back at a critical support region, with price reacting around the $130 zone as participants evaluate whether this level can stabilize the recent pullback. Momentum across the market remains mixed, but Solana continues to show pockets of strength on several high-timeframe structures, keeping the bullish case alive if demand holds.

Solana current price is $129.28, down 4.97% in the last 24 hours. Source: Brave New Coin

Current readings from BraveNewCoin list Solana’s price near $130, placing SOL slightly below mid-range levels but still above major weekly support. This area has repeatedly acted as a decision point for trend continuation, and the market’s next move from here will likely determine whether SOL begins rotating back towards $150 or revisits lower liquidity pockets first.

Liquidity Clusters Reveal Heavy Interest Around $130–$150

Liquidity data shared by TedPillows highlights a dense buildup of resting orders between $130 and $150, with a particularly notable cluster around the $130 handle. Historically, these liquidity shelves act as magnets, price often taps them before trending into the next region.

Solana’s liquidity map shows heavy interest stacked between $133 and $150, with a key cluster near $130 that often acts as a magnet for price before major rotations. Source: TedPillows via X

Ted noted that “the max pain remains to the upside,” implying that if Solana holds this area even briefly, market makers may drive price upward to hunt the thicker liquidity bands sitting above. The heatmap supports this idea, showing a well-defined vacuum from $145 to $165 where liquidity is lighter, making impulsive moves easier if momentum returns.

Solana Watching $133 as Key Support

Crypto Tony shows Solana price forming a potential basing pattern at support. The $132 zone has become the key battleground; reclaiming this area could trigger a push towards the major horizontal resistance around $145 to $150.

Solana is defending the crucial $133 support, with higher-low attempts hinting at a potential basing pattern that could drive price towards the $145–$150 resistance zone. Source: Crypto Tony via X

Tony’s chart highlights higher-low attempts forming beneath the range, suggesting buyers may be preparing a reaction if the current support stabilizes. The pattern resembles the early stages of an inverse structure, one that typically requires a strong breakout above neckline resistance before momentum truly shifts.

If $133 fails decisively, however, Tony warns that price may rotate back into untested areas closer to the late-November swing lows.

Sentiment Leans Bullish as Traders Flag Undervaluation Zones

Short-form commentary by CryptoCurb, who closely tracks valuation trends, called SOL “massively undervalued” while referencing historical relationship metrics. While sentiment alone isn’t a catalyst, it reinforces the idea that market watchers still expect SOL to outperform as long as the higher-timeframe trend remains intact.

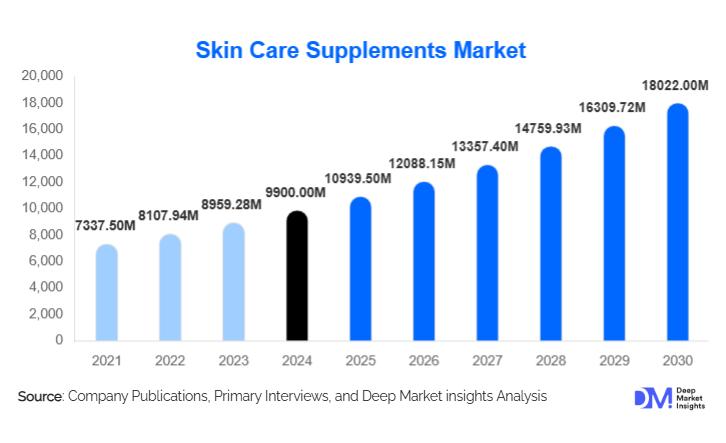

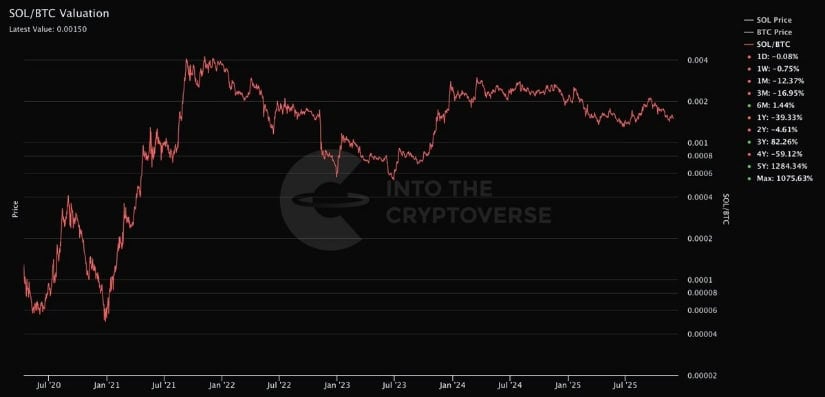

Similarly, IntoTheCryptoverse showcased Solana’s BTC pair, which still trades in a broad consolidation band. Historically, strong expansions in SOL/BTC valuation precede USD rallies, if this relationship firms up again, USD price targets between $150 and $165 become increasingly realistic.

Solana’s BTC pair continues to consolidate in a wide range, a structure that has historically preceded strong USD rallies when momentum returns. Source: IntoTheCryptoverse via X

Pattern-Based Targets Strengthen the Upside Case

A separate technical view from JamesEastonUK offered a structured roadmap for the coming days. He outlined a clean support-to-resistance rotation, where holding the current S/R flip would allow SOL to reclaim short-term levels and challenge $150 next.

SOL is primed to challenge $150 if buyers defend the current zone. Source: JamesEastonUK via X

James also noted that failure to defend this region could send price back towards recent swing lows, reinforcing the need for buyers to step in at the current zone to maintain bullish structure.

When combined with broader liquidity mapping and wedge compression, the confluence increases the likelihood of a recovery move if demand stabilizes.

Solana Price Outlook

If Solana holds the $130 region and momentum rotates upward, a move towards $145 to $150 appears increasingly achievable. A confirmed breakout above $150 would open the door towards $158 to $165, where major liquidity pockets thin out and price historically accelerates.

On a more aggressive trajectory, particularly if liquidity clusters behave as expected, SOL could even begin forming the early stages of a return to its 2021–2022 expansion zones.

Failure to hold $133, however, puts the focus back on $128 and $121, both of which have acted as important bounce regions. Losing these levels would indicate a deeper corrective swing.

Final Thoughts

Solana’s current setup reflects a market at a crossroads. Liquidity maps show heavy clusters below and pockets of opportunity above, creating conditions where volatility can rapidly expand once a direction is chosen.

If bulls can stabilize the $133 region, the path towards $150 to $165 becomes a clear technical target, supported by wedge structure, liquidity distribution, and improving sentiment. But if support falters, traders should prepare for another retest of deeper zones before any larger recovery takes shape.