ADA Recovery Incoming, Remittix Holders Positioned For December Announcement

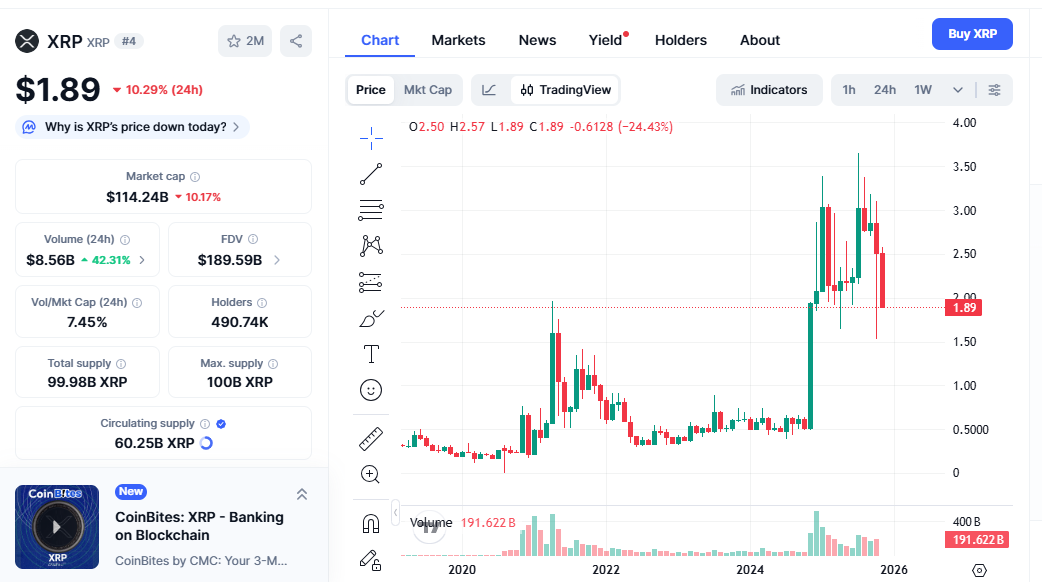

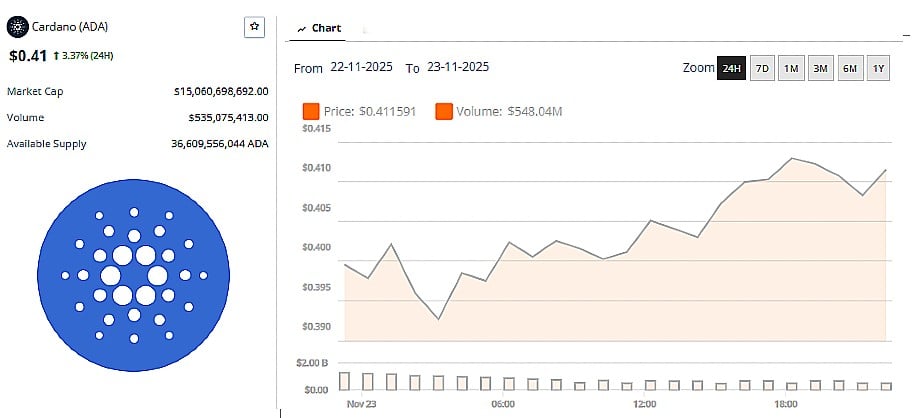

The Cardano price prediction story is getting interesting again, as ADA trades near $0.4032 after a sharp 30% drop over the past month.

The coin has slid into a key support zone around $0.40–$0.44, where past pullbacks have often slowed or reversed. At the same time, PayFi project Remittix (RTX) is quietly lining up a December announcement that many holders hope will be a fresh catalyst as money starts to rotate toward real-world payment tokens.

Cardano Price Prediction: Bulls Defend A Key Support Zone

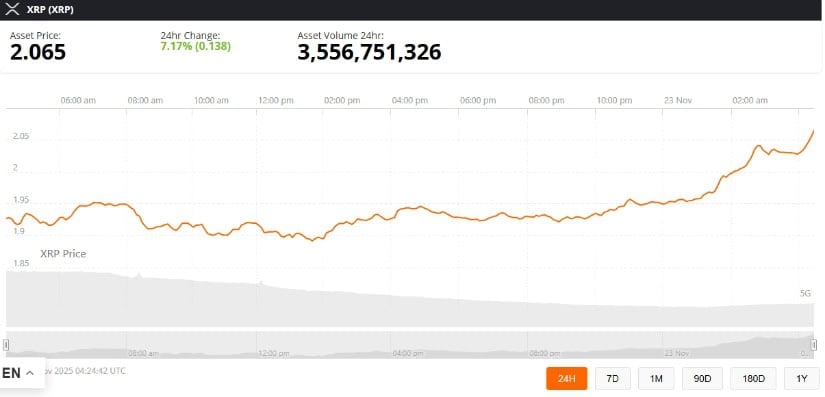

Right now, the primary focus of Cardano price predictions is the $0.45–$0.44 range. ADA is currently about $0.41 USD, with a market capitalization of around $14.8 billion USD, and it is up roughly 3.3% in the past 24 hours. Over the past week, the price has fallen by approximately 18%, dropping from about $0.50 USD a week ago to the current level.

Source: Brave New Coin ADA market data

On the charts, a clear bullish case starts if ADA can close back above $0.45 and then build toward $0.50–$0.52. Many short-term Cardano price prediction models say that a daily close above $0.60 would strongly confirm a trend change. From there, a push toward $0.69 would mean a gain of about 35 per cent from support. If price falls $0.44 on substantial volume, the following clear levels sit around $0.40, or even lower if the whole crypto market turns weaker.

Remittix: Payfi Holders Watch For A December Reveal

While ADA fights to turn support into a base, Remittix (RTX) is working on a different story. Remittix is a PayFi project that aims to move crypto directly into real bank accounts in more than 30 countries, with live FX conversion on the way.

The project has already raised over $28.1 million, sold more than 686 million RTX tokens, and is priced at $0.1166. It secured a BitMart listing after crossing $20 million in raised capital and added an LBank listing after surpassing $22 million, with a third centralized exchange said to be in the works.

Why Remittix Is Gaining Attention:

-

Remittix allows users to send crypto to bank accounts in over 30 countries, solving the $19T global payments problem.

-

The upcoming announcement in December might mark the beginning of a new phase for Remittix, adding fuel to its growing momentum.

-

Remittix is fully verified by CertiK, which guarantees that all smart contracts and the entire platform are secure, making it a trusted project in the space.

-

The project’s team has completed full KYC verification, adding a layer of transparency and trust for investors.

How ADA And RTX Can Fit In One Recovery Plan

The big question for Cardano is whether ADA is going to be able to move through $0.44 and jump back to $0.50, $0.60 or even $0.69, or whether it will drop below its $0.40 support. With no major announcements to provide an additional boost, upward price movement will lilley depend on on-chain data and the overall crypto market move.

Meanwhile, Remittix holders are waiting for the December announcement, which could drive the next phase of its PayFi story. Some traders are pairing ADA with Remittix, treating ADA as a safe recovery play while using Remittix as a riskier, actively updated payment token.

FAQs

1. What is the Cardano price prediction for December 2025?

It is based on ADA maintaining a support zone above $0.40. If ADA can remains above this, it may rise to $0.50-$0.52, and even to $0.60. A drop to below $0.40 will expose it to the lower support zones of $0.30 and $0.35.

2. In what way does Remittix differ from other crypto projects?

Remittix is different because it is one of the few crypto companies focused on actual, real-world applications, especially for cross-border crypto-to-bank payments in more than 30 countries. In the space, Remittix combines scalable, secure PayFi technology with a live wallet beta.

3. Why is Remittix considered one of the best altcoins to buy now?

Remittix is included on the list of the best altcoins to buy now because it focuses on real-world use cases, has sound security verified by CertiK, and already has a working product in beta. Its innovative PayFi network allows for cross-border crypto-to-bank payments, making it highly relevant in today’s market.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.