BNB Chain Welcomes Latest dApp Innovations in November

Darius Baruo

Nov 14, 2025 11:46

Discover the newest decentralized applications on the BNB Chain, spanning DeFi, AI, and more, as the ecosystem expands with innovative projects each week.

The BNB Chain continues to expand its ecosystem with a fresh wave of decentralized applications (dApps) introduced from November 6 to 12, 2025. This week’s additions highlight the dynamic growth of the BNB Chain, with projects spanning various sectors including decentralized finance (DeFi), artificial intelligence (AI), and real-world asset tokenization (RWA), according to the BNB Chain.

Innovative dApps Join BNB Chain

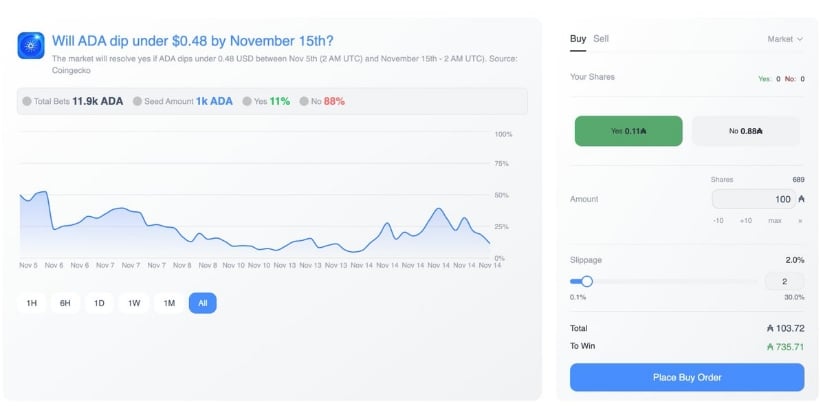

Among the notable entries is Ondo Finance, a tokenization platform that facilitates on-chain exposure to publicly traded securities, marking a significant step in bridging traditional finance with blockchain technology. Adding to the DeFi landscape, Yu Jie presents a unique anime-focused prediction market that merges fandom with financial foresight.

In the AI domain, Ask Brain offers an on-chain companion that provides real-time explanations of smart contracts, enhancing user understanding and transparency. Similarly, Haven introduces a decentralized platform for creating and simulating on-chain robots and AI agents, pushing the boundaries of AI integration in blockchain.

DeFi and RWA Developments

Additional DeFi innovations include Perpmate, an on-chain perpetual decentralized exchange offering 20x leverage, and Lotos, a multifunctional DeFi platform designed for decentralized trading. The RWA sector is further enriched by Midas, which aims to democratize access to institutional-grade financial products through blockchain technology.

Furthermore, piggycell provides RWA backed by a multitude of real transactions, showcasing the potential for blockchain to enhance transparency and security in asset management.

Growing Ecosystem

The BNB Chain’s commitment to fostering innovation is evident as it welcomes these new projects. With a focus on continuous growth and diversification, the chain aims to drive forward the adoption of Web3 technologies. As these dApps gain traction, they contribute to the broader vision of a decentralized and user-centric digital ecosystem.

The community is encouraged to explore these projects and stay updated on the latest developments through the BNB Chain’s official channels.

Image source: Shutterstock