Report Overview

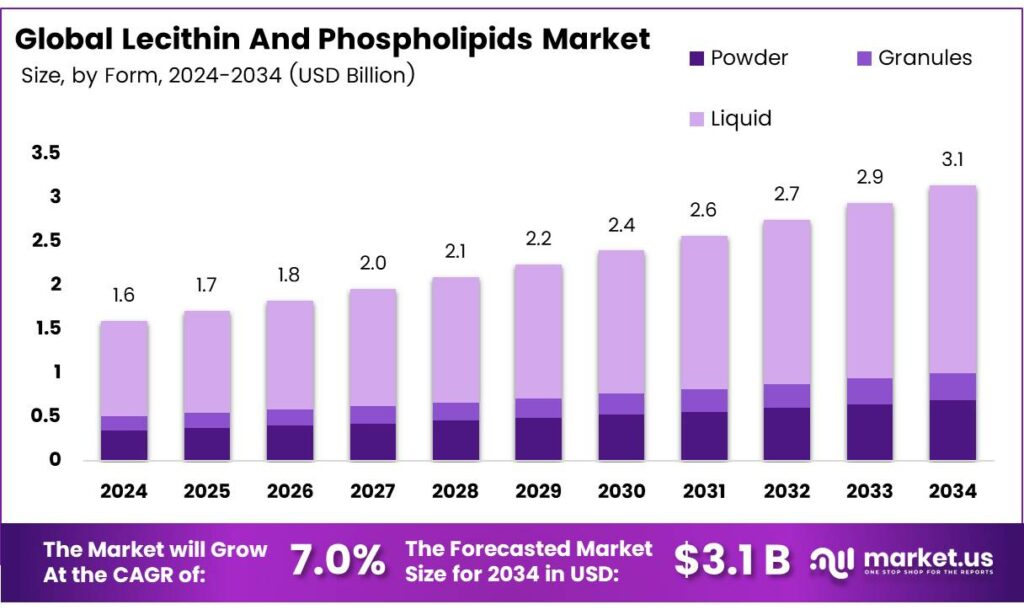

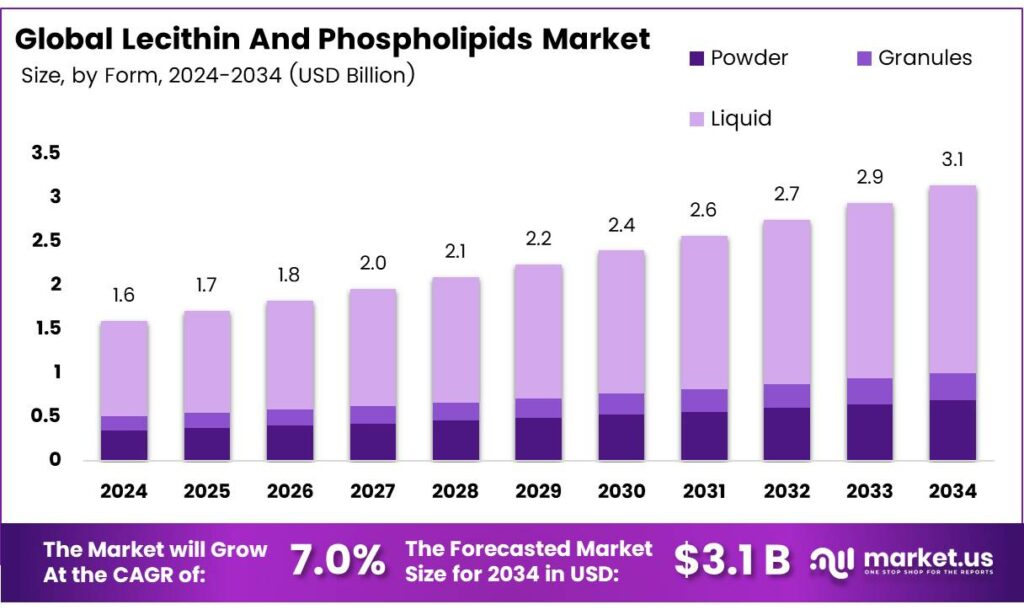

The Global Lecithin and Phospholipids Market size is expected to be worth around USD 3.1 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034.

Phospholipids and lecithin are closely related yet distinct substances that play essential roles in biology, nutrition, and industry. Phospholipids are a class of lipids featuring a glycerol backbone, two fatty acid tails, and a phosphate group, making them amphipathic molecules with both hydrophilic (water-loving) and hydrophobic (water-repelling) regions. In contrast, lecithin is a natural mixture rich in phospholipids but also containing neutral lipids such as triglycerides and glycolipids.

Typically extracted from soybeans, sunflower seeds, or egg yolks, lecithin is less pure than isolated phospholipids, with its phospholipid content varying from 60% to 90% depending on the grade. It is available in commercial forms including liquid lecithin, deoiled powder, and granules, and is widely used as a food emulsifier, dietary supplement, and pharmaceutical excipient. The term phospholipids refers to phosphorus-containing lipids first isolated from egg yolk and named lecithin from the Greek.

Egg yolk lecithin mainly contains 73% phosphatidylcholine (PC), along with phosphatidylethanolamine (PE) and lysophosphatidylcholine. It has three times more lecithin than soybeans, comprising about 10% of chicken and duck egg yolks. Phospholipids are vital cell membrane components. Lecithins act as emulsifiers due to surface-active properties, blending oil and water in products like margarine and paint. They reduce fat surface tension for better flow and mixability, used at 0.2–0.6% of total weight. Their amphipathic nature drives these functional benefits.

- Soybean lecithin includes PC (14–16%), PE (10–15%), PI (10–15%), and PA (5–12%). Fluid forms disperse in oil; powders work in water. Heating to 120°F (50°C) aids handling; salt above 1–2% impairs function. Oil-in-water needs 5–10%; water-in-oil needs 1–5%. Particle size affects wetting: large needs 0.25% lecithin, small needs up to 2%. Beyond soy, egg, and sunflower sources offer unique profiles. Companies like American Lecithin provide alternatives for nutrition, function, and labeling advantages.

Key Takeaways

- The Global Lecithin and Phospholipids Market is expected to grow from USD 1.6 billion in 2024 to USD 3.1 billion by 2034 at a 7.0% CAGR.

- Refined Lecithin dominates By Product Type with 48.7% share in 2024 due to high purity and versatility in food/pharma.

- Liquid form leads the By Form segment with a 63.9% share in 2024 for seamless manufacturing integration.

- Non-GMO holds 67.1% share in the By Nature segment in 2024, driven by clean-label demand and premium pricing.

- Emulsifier function dominates with 49.2% share in 2024, enhancing texture and shelf life.

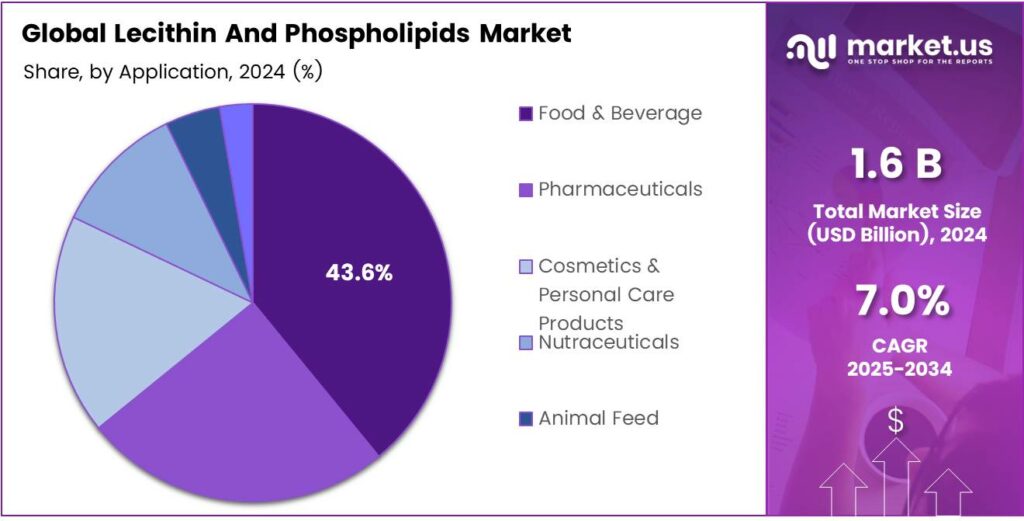

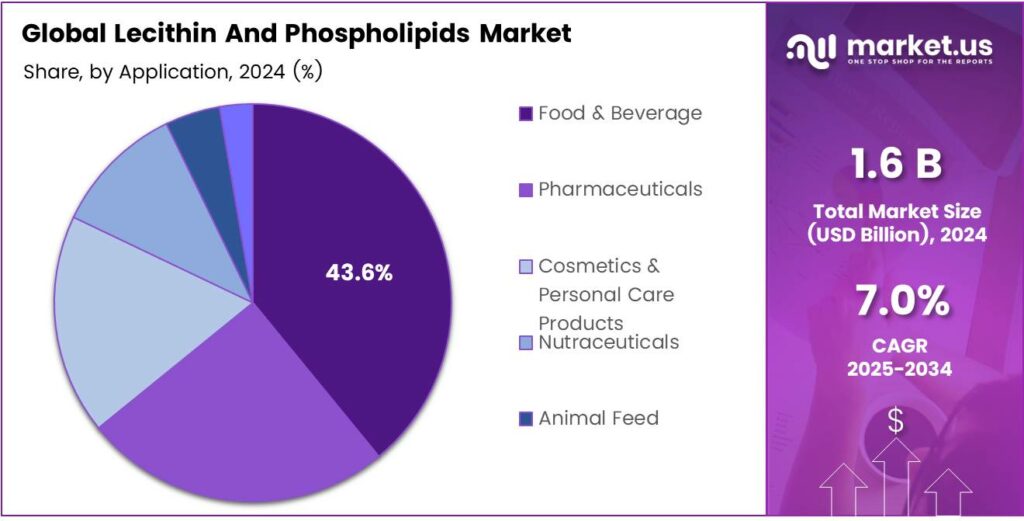

- Food & Beverage application leads with 43.6% share in 2024, fueled by emulsification in chocolates, margarines, and convenience foods.

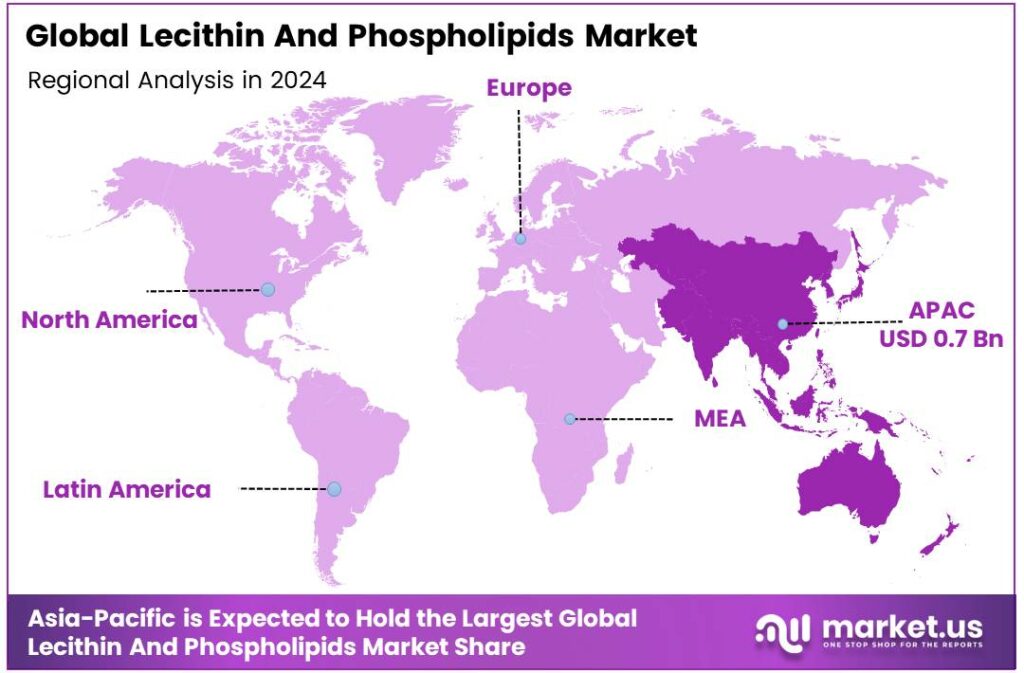

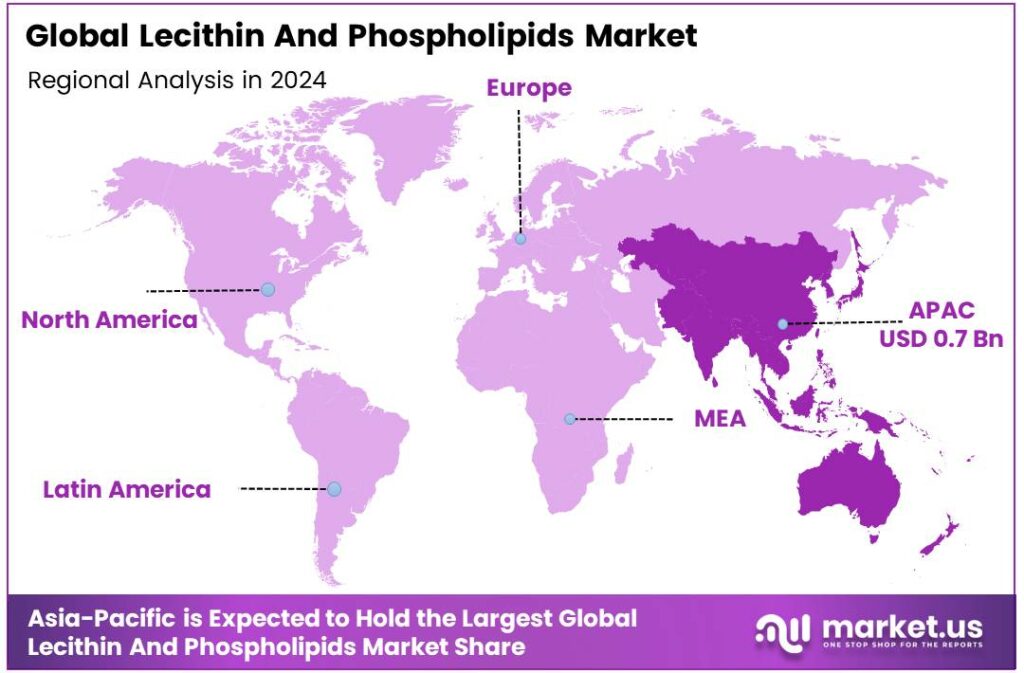

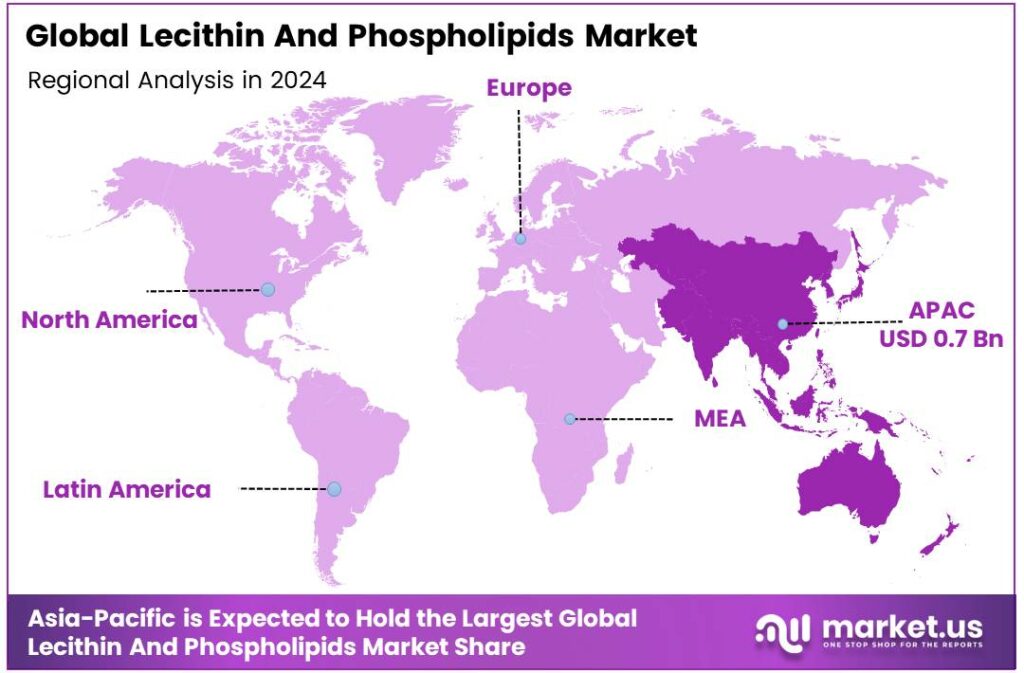

- Asia Pacific commands 45.9% market share, USD 0.7 billion in 2024, led by food processing, clean-label trends, and nutraceutical growth.

By Product Type Analysis

Refined Lecithin dominates with 48.7% due to its superior purity and versatility across industries.

In 2024, Refined Lecithin held a dominant market position in the By Product Type Analysis segment of the Lecithin and Phospholipids Market, with a 48.7% share. This segment leads because refined lecithin offers high purity and consistent quality. It suits diverse applications in food and pharmaceuticals. Additionally, advanced processing removes impurities effectively.

Unrefined Lecithin follows as a cost-effective alternative. It retains natural components and appeals to organic markets. However, its raw form limits precision uses. Still, it grows in niche health products. Consequently, producers target budget-conscious buyers. Rapeseed Lecithin gains traction from sustainable sourcing.

Europe drives its adoption. Yet, availability constraints hinder wider reach. Overall, it supports eco-friendly trends. Chemically Modified Lecithin enhances functionality through alterations. It improves stability in extreme conditions. Besides, specialty formulations benefit greatly.

By Form Analysis

Liquid dominates with 63.9% due to its ease of mixing and broad industrial compatibility.

In 2024, Liquid held a dominant market position in the By Form Analysis segment of the Lecithin and Phospholipids Market, with a 63.9% share. Liquid form excels in seamless integration. It blends quickly in manufacturing processes.

Additionally, the food and cosmetic sectors prefer it. Therefore, production efficiency boosts its leadership. Powder offers convenient storage and a longer shelf life. It suits dry mixes and tablets. Moreover, transportation costs decrease.

However, reconstitution challenges exist. Nonetheless, pharmaceutical applications expand steadily. Granules provide balanced handling and flowability. They reduce dust in processing. Animal feed incorporates them easily. Yet, market penetration remains limited. Overall, specialized needs drive growth.

By Nature Analysis

Non-GMO dominates with 67.1% due to rising consumer preference for natural and transparent sourcing.

In 2024, Non-GMO held a dominant market position in the By Nature Analysis segment of the Lecithin and Phospholipids Market, with a 67.1% share. Non-GMO variants align with clean-label demands. They assure safety and ethics. Besides, premium pricing supports profitability.

Hence, health-conscious buyers propel dominance. GMO remains viable for cost efficiency. It ensures abundant supply chains. Additionally, industrial scales favor it. Still, labeling concerns persist. Consequently, it serves traditional segments.

By Function Analysis

Emulsifier dominates with 49.2% due to its critical role in stabilizing mixtures across food and cosmetics.

In 2024, Emulsifier held a dominant market position in the By Function Analysis segment of the Lecithin and Phospholipids Market, with a 49.2% share. Emulsifiers prevent separation in products. They enhance texture and shelf life.

The bakery and dairy rely heavily. Dispersing Agent aids uniform particle distribution. It improves product consistency. Paints and inks utilize it. However, competition from alternatives grows. Nevertheless, reliability sustains demand.

Surfactants lower surface tension effectively. They enable foaming and cleaning. Besides, personal care boosts usage. Yet, specificity narrows the scope. In essence, targeted applications thrive. Others cover niche roles like viscosity modifiers. They support emerging innovations. Additionally, research expands possibilities. Still, fragmented adoption limits the share.

By Application Analysis

Food and Beverage dominate with 43.6% due to their extensive use in processing and product stabilization.

In 2024, Food and Beverage held a dominant market position in the By Application Analysis segment of the Lecithin and Phospholipids Market, with a 43.6% share. This sector consumes lecithin for emulsification. It ensures smooth chocolates and margarines. Additionally, convenience foods surge in demand. Therefore, daily essentials reinforce dominance.

Pharmaceuticals leverage lecithin in drug delivery. It enhances bioavailability. Moreover, capsules and creams incorporate it. However, stringent regulations apply. Nonetheless, health benefits accelerate growth. Cosmetics and Personal Care Products use it for moisturizing. It softens skin and hair. Furthermore, natural trends favor inclusion.

Nutraceuticals benefit from nutritional profiling. Lecithin supports brain health supplements. Besides, wellness booms drive uptake. Still, evidence-based claims matter. In summary, functional foods integrate well. Animal Feed improves nutrient absorption in livestock. It boosts feed efficiency. Additionally, poultry and aquaculture demand rise. Nevertheless, cost sensitivities influence.

Key Market Segments

By Product Type

- Refined Lecithin

- Unrefined Lecithin

- Rapeseed Lecithin

- Chemically Modified Lecithin

By Form

By Nature

By Function

- Emulsifier

- Dispersing Agent

- Surfactants

- Others

By Application

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care Products

- Nutraceuticals

- Animal Feed

- Others

Emerging Trends

Rising Shift Toward Clean-Label and Natural Emulsifiers

The clean-label movement has become one of the strongest forces reshaping how food companies think about ingredients like lecithin and phospholipids. People now want foods made with names they can recognize, ingredients they trust, and processes that feel closer to nature. Food manufacturers are moving away from synthetic emulsifiers and replacing them with plant-derived lecithin.

A major part of this trend is the growing awareness of how ingredients affect health, texture, and overall product quality. Clean-label lecithin fits perfectly into this shift because it delivers natural emulsification, moisture stability, and mouthfeel without chemical additives. In many baker’s, confectionery, beverage, and plant-based products, manufacturers now highlight sunflower lecithin directly on the label as a selling point.

- This movement is supported by large-scale crop production data. The Food and Agriculture Organization (FAO), global soybean production recently increased sharply, rising by 17.4 million tonnes, driven largely by Brazil’s strong output surge. This increasing supply ensures that food-grade soy lecithin remains widely available for natural formulation needs.

Drivers

Expanding Use of Lecithin in Large-Scale Food Processing

One major driver pushing the lecithin and phospholipids market forward is the rapid expansion of global food processing. As more countries improve their food manufacturing capacity, the need for reliable natural emulsifiers grows. Lecithin is essential in many everyday products—chocolates, instant mixes, baked goods, beverages, and even nutritional formulas—because it enhances texture and improves stability without synthetic additives.

- The FAO reports that global soybean harvests remain substantial, with world output reaching 176.6 million tons across 75.5 million hectares of cultivated land. This scale of production ensures the continuous availability of soy-based lecithin, the most widely used form in food manufacturing. Because lecithin is extracted during soybean processing, greater crop availability supports steady ingredient supply and helps manufacturers maintain consistent formulation standards.

Bakery and confectionery sectors in many regions are modernizing. As manufacturers automate processes and scale up production, they rely even more on lecithin to ensure dough handling improves, chocolate remains smooth, and ready-to-eat foods maintain the right texture. The rise of plant-based dairy, plant-based meat, and fortified beverages also contributes, since lecithin prevents separation and helps blend fats and water uniformly.

Restraints

Concerns Over Genetically Modified Soybean Sources

One major restraint affecting the lecithin and phospholipids industry is the ongoing concern around genetically modified (GM) soybean crops. Since a large portion of commercial lecithin comes from soybeans, any hesitation surrounding GM soy directly influences buyer decisions, particularly in regions where consumers prefer organic or non-GMO labeling.

- Biotech soybeans remain widely adopted, representing 48% of global biotech crop plantings. This number reflects how dominant GM soy remains in major producing countries. While GM technologies are approved and considered safe by regulators in many regions, consumer perception often moves more slowly than scientific consensus.

This concern puts pressure on suppliers to offer certified non-GMO lecithin or shift toward sunflower lecithin, which naturally avoids GMO controversies. However, sunflower production is still smaller in scale compared to soy, making pricing less stable. Manufacturers face higher costs or must develop alternative sourcing strategies if they want to maintain non-GMO claims on packaging.

Opportunity

Growing Demand for High-Quality Nutrition in Infant and Therapeutic Foods

A major growth opportunity for lecithin and phospholipids lies in infant nutrition, therapeutic foods, and specialized dietary products. Lecithin plays an important role in emulsification, fat absorption, and nutrient delivery—making it ideal for infant formula, medical nutrition powders, and therapeutic milk formulations used in malnutrition recovery programs.

- UNICEF highlights that the global infant formula market has been expanding steadily. UNICEF notes that infant formula products were valued at USD 24 billion and projected to reach USD 45 billion, reflecting strong consumption growth across Asia, Africa, and the Middle East. This rising need for nutritional products is directly tied to lecithin use.

Therapeutic milk programs used in malnutrition treatment also rely on phospholipid-rich ingredients to support energy density and absorption. Government-supported food security programs, emergency nutrition efforts, and international aid initiatives continue to strengthen demand for such formulations. As these programs scale, the requirement for safe, stable, and natural emulsifiers grows.

Regional Analysis

Asia Pacific Leads the Lecithin and Phospholipids Market with a 45.9% Share Valued at USD 0.7 Billion

Asia Pacific remains the most influential region in the global Lecithin and Phospholipids market, holding a dominant 45.9% share valued at USD 0.7 billion. This strong position comes from the region’s expanding food processing industry, rising demand for clean-label emulsifiers, and the rapid modernization of its nutraceutical and functional food sectors.

Countries such as China, India, Japan, and South Korea are witnessing steady growth in bakery, confectionery, dairy, and infant nutrition categories—sectors that heavily rely on lecithin for emulsification, stabilization, and texturization. Additionally, the region’s growing interest in plant-based formulations, especially soy, sunflower, and rapeseed lecithin, is creating new momentum for domestic producers and global suppliers.

Regulatory clarity across the Asia Pacific has further strengthened market confidence. India’s FSSAI standards for emulsifiers, China’s GB regulations for food additives, and Japan’s focus on high-purity phospholipids for pharmaceuticals have accelerated both product adoption and quality improvements. The pharmaceutical sector in the region, particularly in Japan and South Korea, has contributed to higher consumption.

Asia Pacific’s expanding soybean processing infrastructure and increasing investment in oilseed crushing facilities have created a reliable raw material base for lecithin extraction. Local manufacturers are also adopting advanced purification technologies to meet the rising demand for non-GMO and allergen-controlled lecithin. The region’s dynamic e-commerce distribution networks and expanding urban middle-class consumer base continue to support sustained market growth.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lecio GmbH is a German specialist renowned for its high-purity, customized phospholipid products. Focusing heavily on the pharmaceutical and nutraceutical sectors, the company provides critical lipid excipients for drug delivery systems and advanced parenteral nutrition. Its strategic emphasis on research-driven, application-specific solutions positions it as a key innovator and a preferred partner for high-value.

ADM is a dominant force in the lecithin market. Leveraging its massive, integrated supply chain for oilseeds like soy, it produces vast quantities of standardized, commodity lecithin. This scale ensures a consistent supply for the food and beverage industry, where lecithin is a primary emulsifier. ADM’s strength lies in its production capacity, global distribution network, and ability to serve the broad, volume-driven demands of the market.

VAV Life Science is a prominent Indian player specializing in high-purity phospholipids for sophisticated applications. With a strong focus on the pharmaceutical industry, it provides essential components for liposomal drug formulations and injectable emulsions. The company capitalizes on the growing demand for advanced drug delivery systems and nutraceuticals, positioning itself as a critical regional and global supplier of innovative.

Top Key Players in the Market

- Lecio Gmbh

- Archer Daniels Midland Company

- VAV Life Science Pvt. Ltd.

- Sonic Biochem

- American Chemie Inc.

- Americal Lecithin Company

- Fishmer Lecithin

- Lasenor Emul

- Sodrugestvo Group

- Kewpie Corporation

Recent Developments

- In 2025, Lecico GmbH, a leading producer of lecithins and phospholipids, will focus on product innovation to meet demands in functional foods and beverages. The company debuted instantized phospholipid powders designed for easy dissolution in functional beverages like smoothies, shakes, and dietary supplements.

- In 2025, ADM, a global leader in lecithin production, reported strong performance in its lecithin segment. Key developments include the expansion of non-GMO lecithin production capacity to address rising demand in Europe and North America, and increasing output through high-purity soy lecithin initiatives.

Report Scope