Why Gold Is Surging Today? Metal Rises With Bitcoin Price as U.S. Advances Shutdown Deal, Keeping Price Predictions Bullish

Bitcoin (BTC) price surged

above $106,000 and gold (XAU) jumped nearly 2% today (Monday), November 10,

2025, as the U.S. Senate voted 60-40 to advance legislation ending the longest

government shutdown in American history. The dual rally reflects dollar

weakness and improved risk sentiment as eight Democratic senators agreed to a

GOP funding deal, marking the 15th attempt by Senate Majority Leader John Thune

to secure bipartisan support.

I am looking in this article for an answer to why

Bitcoin and gold are surging today. I also provide a technical analysis of the

BTC/USDT and XAU/USD charts, based on more than ten years of experience as an

analyst and active retail investor.

Bitcoin

rocketed 4.38% to $106,274 in the 24 hours following the Senate breakthrough,

with the cryptocurrency trading at $106,403.31 as of Monday morning,

representing a 1.63% daily gain. The rally extended gains from weekend trading,

pushing Bitcoin decisively above the psychological $100,000 level after

multiple dips below that threshold during the prolonged shutdown.

The political

resolution triggered sharp improvements across crypto markets.

Ethereum surged over 7% to trade above $3,600, while XRP and Solana both

advanced approximately 6%. Total cryptocurrency market capitalization added

$156 billion in 24 hours, climbing to $3.57 trillion as long positions flooded

back into the market. Bitcoin open interest increased by nearly $700 million,

signaling aggressive position-building by traders anticipating further upside.

Markets

reacted swiftly to the temporal correlation between legislative advancement and

price movements. The Senate vote occurred Sunday, November 9, immediately

sparking the crypto rebound after weeks of suppressed sentiment due to

political gridlock and broader macroeconomic uncertainty. Bitcoin had tumbled

into bear market territory last week, falling over 20% from its October record

high of $126,080. The cryptocurrency remains more than 15% below that peak but

has recovered strongly from recent lows near $100,000.

Crypto prices are up today. Source: CoinMarketCapc.om

Joel

Kruger, crypto strategist at LMAX, noted: “The crypto market enters the

week on a solid footing, with Bitcoin closing last week above its 50-week

moving average and reaffirming the broader uptrend that has defined much of

this year. The mid-week dip we discussed proved to be another buying

opportunity rather than the start of any meaningful correction, with price

support at key technical levels attracting renewed demand across digital

assets.”

Why Gold Price Is Going Up

Today?

Gold prices

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085 as

the Senate shutdown vote pressured the U.S. dollar. According to my technical

analysis of the gold chart, XAU/USD is capitalizing on support just below the

$4,000 level, additionally reinforced by the 50-day exponential moving average,

and now has room to appreciate toward the historical highs tested in October

around $4,400 per ounce.

The only

scenario that would contradict this bullish outlook would be a breakdown of

current support, which would open the path to deeper correction toward the

$3,400 level where the 200 EMA also runs.

The dual

rally in both Bitcoin and gold represents a rare market phenomenon

where traditional safe havens and risk assets advance simultaneously. This

reflects the unique dynamics of the shutdown resolution, removing political

uncertainty (boosting risk assets) while simultaneously weakening the dollar

(supporting safe havens).

Why gold is going up today? Source: tradingview.com

In my previous gold price analysis, I

forecasted that the metal can jump to over $5,000 in the longer term.

Chris

Turner, ING analyst, observed: “Risk assets have been helped over the

weekend by news that a group of moderate Democrat senators are softening their

stance on the US government shutdown. There is still a long way to go here, but

we should know over the next couple of days whether the current compromise bill

has legs.”

Turner

noted that developments “hint at a path to ending the US government

shutdown,” explaining that “the prospect of massive flight delays

around Thanksgiving and the delay in food aid payments has prompted a group of

moderate Democrats to back a proposed compromise bill in the Senate.”

You may

also like: Bitcoin

Undervalued Compared to Gold, JPMorgan Flags $170K Fair Value

Dollar Weakness Drives

Precious Metals

FX markets

responded by pushing the risk-sensitive Australian dollar close to 0.5% higher,

while USD/JPY climbed over 154 as the yen served as funding currency for risk

trades. Turner explained: “While some might argue that the end of the

shutdown could be a risk-on, dollar-negative impulse for the FX markets, its

impact may be more mixed.”

The dollar

weakness stems from the shutdown resolution enabling federal spending

to resume, potentially increasing fiscal concerns that traditionally support

gold. Additionally, political stability allows the Federal Reserve to maintain

its dovish trajectory, with December rate cut probability still above 64%.

Lower rates reduce the opportunity cost of holding non-yielding gold while

typically weakening the dollar—a double benefit for precious metals.

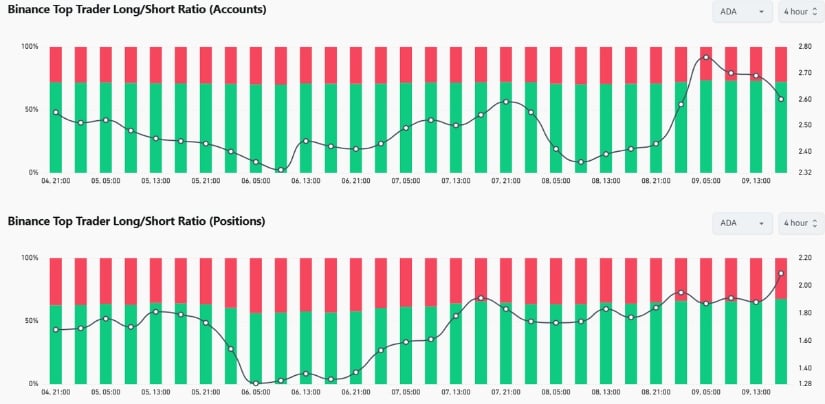

Bitcoin Technical

Analysis: Testing Critical Resistance

According

to my technical analysis, Bitcoin’s price is rising 1.7% on Monday and testing

session highs at $106,670 on Binance exchange, adding to Sunday’s gains and

producing a 4% advance over the past 24 hours. As visible on the chart, price

is bouncing from the lower boundary of the consolidation drawn continuously

since May, coinciding

with psychological support at $100,000 and the 50% Fibonacci retracement.

Currently,

price is stalling at the resistance zone around 106,000-108,000 dollars,

supported by the 38.2% Fibonacci retracement and 200 EMA. From my analysis,

this zone may determine the future direction within the current consolidation

pattern.

If Bitcoin

breaks above the grid of 50 and 200 EMAs and current resistance, it will open

the path to retesting the October all-time high around $126,000. If it fails to

overcome this resistance, risk increases for a move back below $100,000, falling

ultimately to $74,000. The cryptocurrency is currently trading at

$106,403.31, still below its 50-day moving average of $112,050 but showing

strong recovery momentum.

Bitcoin price technical analysis. Source: Tradingview.com

Joel Kruger

emphasized: “Momentum has since spilled over into Ethereum and the broader

altcoin complex, reinforcing the view that the market remains well-anchored

within a strong medium-term bullish structure. This resilience comes against a

macro backdrop that is once again turning supportive.”

What Happens Next?

The Senate

bill now moves to a full floor vote in coming days, followed by House

consideration. Market observers assign high probability to passage, with

prediction market Myriad showing over 90% chance the government closure ends

before November 15—up from 37% just 24 hours earlier.

For Bitcoin,

according to my technical analysis, breaking decisively above the

106,000-108,000 resistance zone would open the path toward retesting October’s

$126,000 all-time high. Failure to overcome this resistance increases the risk

of retreat below $100,000, though most analysts view the technical and

fundamental backdrop as supportive.

Gold faces resistance at historical

highs around $4,400 per ounce. According to my analysis, support is holding at

the critical $4,000 level reinforced by the 50 EMA. Dollar weakness from

resumed government spending and Fed dovishness should provide tailwinds for

further precious metals appreciation.

Turner

cautioned: “If last week’s 100.36 high in DXY is to prove significant, it

should not really be making it back above the 99.90/100.00 area now.” This

suggests dollar downside may be limited, potentially capping gold’s immediate

upside while still supporting the broader bullish trend.

The coming

48 hours in Congress will determine whether the shutdown compromise “has

legs,” with markets positioned for positive resolution but prepared for

continued volatility if the deal falters.

Before you leave, I encourage you to also check my earlier analyses and forecasts on gold and Bitcoin:

Bitcoin and Gold Price

Analysis FAQ

Why is Bitcoin going up

today?

Bitcoin is

surging 4.38% to $106,274 on Monday, November 10, 2025, primarily due to the

U.S. Senate’s 60-40 vote advancing legislation to end the historic 40-day

government shutdown. The cryptocurrency bounced from support at the

psychological $100,000 level after eight Democratic senators agreed to a GOP

funding deal, removing political uncertainty that had weighed on risk assets.

Why is gold rising today?

Gold

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085,

as the Senate shutdown vote pressured the U.S. dollar. The precious metal is

benefiting from dollar weakness stemming from expectations that resumed

government spending will increase fiscal concerns, while political stability

allows the Federal Reserve to maintain its dovish trajectory with December rate

cut probability above 64%.

What is Bitcoin price

prediction for November 2025?

Bitcoin

price forecasts for November 2025 vary significantly across analysts. Changelly

predicts Bitcoin could reach $129,042 by November 13, representing a 26% gain

from current levels. CoinCodex forecasts BTC will rise 4.48% to $127,142 by

November 17 if it reaches upper price targets, with technical indicators

currently showing bearish sentiment despite the recent rally.

What is gold price

prediction for 2025-2026?

Major

institutions forecast gold between $4,200-$5,000 per ounce by late 2026. UBS

projects gold reaching $4,200 as the next baseline target, with an upside

scenario of $4,700 by Q1 2026 if geopolitical risks intensify. Goldman Sachs

forecasts $5,055 by Q4 2026, while Bank of America targets $5,000 (averaging

$4,400 for the full year). ING expects more conservative near-term targets of

$4,000 for Q4 2025 and $4,100 for Q1 2026, with further upside through 2026.

How high can Bitcoin go?

Industry

experts project Bitcoin could reach $180,000-$200,000 during 2025, according to

forecasts compiled by CNBC. Youwei Yang, chief economist at Bit Mining,

predicts Bitcoin’s price will range between $180,000 and $190,000 in 2025,

though he warns of potential corrections to around $80,000 during market

shocks.

What are the risks to

Bitcoin and gold rallies?

For

Bitcoin, primary risks include failure to break above the $106,000-$108,000

resistance zone (which would increase probability of retreat below $100,000),

Federal Reserve speakers signaling slower pace of rate cuts (December cut

probability has dropped to 64%), and potential for corrections to $80,000

during major market shocks according to analyst warnings.

Bitcoin (BTC) price surged

above $106,000 and gold (XAU) jumped nearly 2% today (Monday), November 10,

2025, as the U.S. Senate voted 60-40 to advance legislation ending the longest

government shutdown in American history. The dual rally reflects dollar

weakness and improved risk sentiment as eight Democratic senators agreed to a

GOP funding deal, marking the 15th attempt by Senate Majority Leader John Thune

to secure bipartisan support.

I am looking in this article for an answer to why

Bitcoin and gold are surging today. I also provide a technical analysis of the

BTC/USDT and XAU/USD charts, based on more than ten years of experience as an

analyst and active retail investor.

Bitcoin

rocketed 4.38% to $106,274 in the 24 hours following the Senate breakthrough,

with the cryptocurrency trading at $106,403.31 as of Monday morning,

representing a 1.63% daily gain. The rally extended gains from weekend trading,

pushing Bitcoin decisively above the psychological $100,000 level after

multiple dips below that threshold during the prolonged shutdown.

The political

resolution triggered sharp improvements across crypto markets.

Ethereum surged over 7% to trade above $3,600, while XRP and Solana both

advanced approximately 6%. Total cryptocurrency market capitalization added

$156 billion in 24 hours, climbing to $3.57 trillion as long positions flooded

back into the market. Bitcoin open interest increased by nearly $700 million,

signaling aggressive position-building by traders anticipating further upside.

Markets

reacted swiftly to the temporal correlation between legislative advancement and

price movements. The Senate vote occurred Sunday, November 9, immediately

sparking the crypto rebound after weeks of suppressed sentiment due to

political gridlock and broader macroeconomic uncertainty. Bitcoin had tumbled

into bear market territory last week, falling over 20% from its October record

high of $126,080. The cryptocurrency remains more than 15% below that peak but

has recovered strongly from recent lows near $100,000.

Crypto prices are up today. Source: CoinMarketCapc.om

Joel

Kruger, crypto strategist at LMAX, noted: “The crypto market enters the

week on a solid footing, with Bitcoin closing last week above its 50-week

moving average and reaffirming the broader uptrend that has defined much of

this year. The mid-week dip we discussed proved to be another buying

opportunity rather than the start of any meaningful correction, with price

support at key technical levels attracting renewed demand across digital

assets.”

Why Gold Price Is Going Up

Today?

Gold prices

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085 as

the Senate shutdown vote pressured the U.S. dollar. According to my technical

analysis of the gold chart, XAU/USD is capitalizing on support just below the

$4,000 level, additionally reinforced by the 50-day exponential moving average,

and now has room to appreciate toward the historical highs tested in October

around $4,400 per ounce.

The only

scenario that would contradict this bullish outlook would be a breakdown of

current support, which would open the path to deeper correction toward the

$3,400 level where the 200 EMA also runs.

The dual

rally in both Bitcoin and gold represents a rare market phenomenon

where traditional safe havens and risk assets advance simultaneously. This

reflects the unique dynamics of the shutdown resolution, removing political

uncertainty (boosting risk assets) while simultaneously weakening the dollar

(supporting safe havens).

Why gold is going up today? Source: tradingview.com

In my previous gold price analysis, I

forecasted that the metal can jump to over $5,000 in the longer term.

Chris

Turner, ING analyst, observed: “Risk assets have been helped over the

weekend by news that a group of moderate Democrat senators are softening their

stance on the US government shutdown. There is still a long way to go here, but

we should know over the next couple of days whether the current compromise bill

has legs.”

Turner

noted that developments “hint at a path to ending the US government

shutdown,” explaining that “the prospect of massive flight delays

around Thanksgiving and the delay in food aid payments has prompted a group of

moderate Democrats to back a proposed compromise bill in the Senate.”

You may

also like: Bitcoin

Undervalued Compared to Gold, JPMorgan Flags $170K Fair Value

Dollar Weakness Drives

Precious Metals

FX markets

responded by pushing the risk-sensitive Australian dollar close to 0.5% higher,

while USD/JPY climbed over 154 as the yen served as funding currency for risk

trades. Turner explained: “While some might argue that the end of the

shutdown could be a risk-on, dollar-negative impulse for the FX markets, its

impact may be more mixed.”

The dollar

weakness stems from the shutdown resolution enabling federal spending

to resume, potentially increasing fiscal concerns that traditionally support

gold. Additionally, political stability allows the Federal Reserve to maintain

its dovish trajectory, with December rate cut probability still above 64%.

Lower rates reduce the opportunity cost of holding non-yielding gold while

typically weakening the dollar—a double benefit for precious metals.

Bitcoin Technical

Analysis: Testing Critical Resistance

According

to my technical analysis, Bitcoin’s price is rising 1.7% on Monday and testing

session highs at $106,670 on Binance exchange, adding to Sunday’s gains and

producing a 4% advance over the past 24 hours. As visible on the chart, price

is bouncing from the lower boundary of the consolidation drawn continuously

since May, coinciding

with psychological support at $100,000 and the 50% Fibonacci retracement.

Currently,

price is stalling at the resistance zone around 106,000-108,000 dollars,

supported by the 38.2% Fibonacci retracement and 200 EMA. From my analysis,

this zone may determine the future direction within the current consolidation

pattern.

If Bitcoin

breaks above the grid of 50 and 200 EMAs and current resistance, it will open

the path to retesting the October all-time high around $126,000. If it fails to

overcome this resistance, risk increases for a move back below $100,000, falling

ultimately to $74,000. The cryptocurrency is currently trading at

$106,403.31, still below its 50-day moving average of $112,050 but showing

strong recovery momentum.

Bitcoin price technical analysis. Source: Tradingview.com

Joel Kruger

emphasized: “Momentum has since spilled over into Ethereum and the broader

altcoin complex, reinforcing the view that the market remains well-anchored

within a strong medium-term bullish structure. This resilience comes against a

macro backdrop that is once again turning supportive.”

What Happens Next?

The Senate

bill now moves to a full floor vote in coming days, followed by House

consideration. Market observers assign high probability to passage, with

prediction market Myriad showing over 90% chance the government closure ends

before November 15—up from 37% just 24 hours earlier.

For Bitcoin,

according to my technical analysis, breaking decisively above the

106,000-108,000 resistance zone would open the path toward retesting October’s

$126,000 all-time high. Failure to overcome this resistance increases the risk

of retreat below $100,000, though most analysts view the technical and

fundamental backdrop as supportive.

Gold faces resistance at historical

highs around $4,400 per ounce. According to my analysis, support is holding at

the critical $4,000 level reinforced by the 50 EMA. Dollar weakness from

resumed government spending and Fed dovishness should provide tailwinds for

further precious metals appreciation.

Turner

cautioned: “If last week’s 100.36 high in DXY is to prove significant, it

should not really be making it back above the 99.90/100.00 area now.” This

suggests dollar downside may be limited, potentially capping gold’s immediate

upside while still supporting the broader bullish trend.

The coming

48 hours in Congress will determine whether the shutdown compromise “has

legs,” with markets positioned for positive resolution but prepared for

continued volatility if the deal falters.

Before you leave, I encourage you to also check my earlier analyses and forecasts on gold and Bitcoin:

Bitcoin and Gold Price

Analysis FAQ

Why is Bitcoin going up

today?

Bitcoin is

surging 4.38% to $106,274 on Monday, November 10, 2025, primarily due to the

U.S. Senate’s 60-40 vote advancing legislation to end the historic 40-day

government shutdown. The cryptocurrency bounced from support at the

psychological $100,000 level after eight Democratic senators agreed to a GOP

funding deal, removing political uncertainty that had weighed on risk assets.

Why is gold rising today?

Gold

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085,

as the Senate shutdown vote pressured the U.S. dollar. The precious metal is

benefiting from dollar weakness stemming from expectations that resumed

government spending will increase fiscal concerns, while political stability

allows the Federal Reserve to maintain its dovish trajectory with December rate

cut probability above 64%.

What is Bitcoin price

prediction for November 2025?

Bitcoin

price forecasts for November 2025 vary significantly across analysts. Changelly

predicts Bitcoin could reach $129,042 by November 13, representing a 26% gain

from current levels. CoinCodex forecasts BTC will rise 4.48% to $127,142 by

November 17 if it reaches upper price targets, with technical indicators

currently showing bearish sentiment despite the recent rally.

What is gold price

prediction for 2025-2026?

Major

institutions forecast gold between $4,200-$5,000 per ounce by late 2026. UBS

projects gold reaching $4,200 as the next baseline target, with an upside

scenario of $4,700 by Q1 2026 if geopolitical risks intensify. Goldman Sachs

forecasts $5,055 by Q4 2026, while Bank of America targets $5,000 (averaging

$4,400 for the full year). ING expects more conservative near-term targets of

$4,000 for Q4 2025 and $4,100 for Q1 2026, with further upside through 2026.

How high can Bitcoin go?

Industry

experts project Bitcoin could reach $180,000-$200,000 during 2025, according to

forecasts compiled by CNBC. Youwei Yang, chief economist at Bit Mining,

predicts Bitcoin’s price will range between $180,000 and $190,000 in 2025,

though he warns of potential corrections to around $80,000 during market

shocks.

What are the risks to

Bitcoin and gold rallies?

For

Bitcoin, primary risks include failure to break above the $106,000-$108,000

resistance zone (which would increase probability of retreat below $100,000),

Federal Reserve speakers signaling slower pace of rate cuts (December cut

probability has dropped to 64%), and potential for corrections to $80,000

during major market shocks according to analyst warnings.