Nutraceutical Ingredients Market Size Worth USD 191.04 Bn

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global nutraceutical ingredients market size is expected to be worth over USD 191.04 billion by 2034, increasing from USD 103.36 billion in 2026, growing at a strong CAGR of 7.98% between 2025 and 2034. The growing awareness about the benefits of functional foods and the trend of plant-based diets drive the market growth.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1162

Nutraceutical Ingredients Market Highlights:

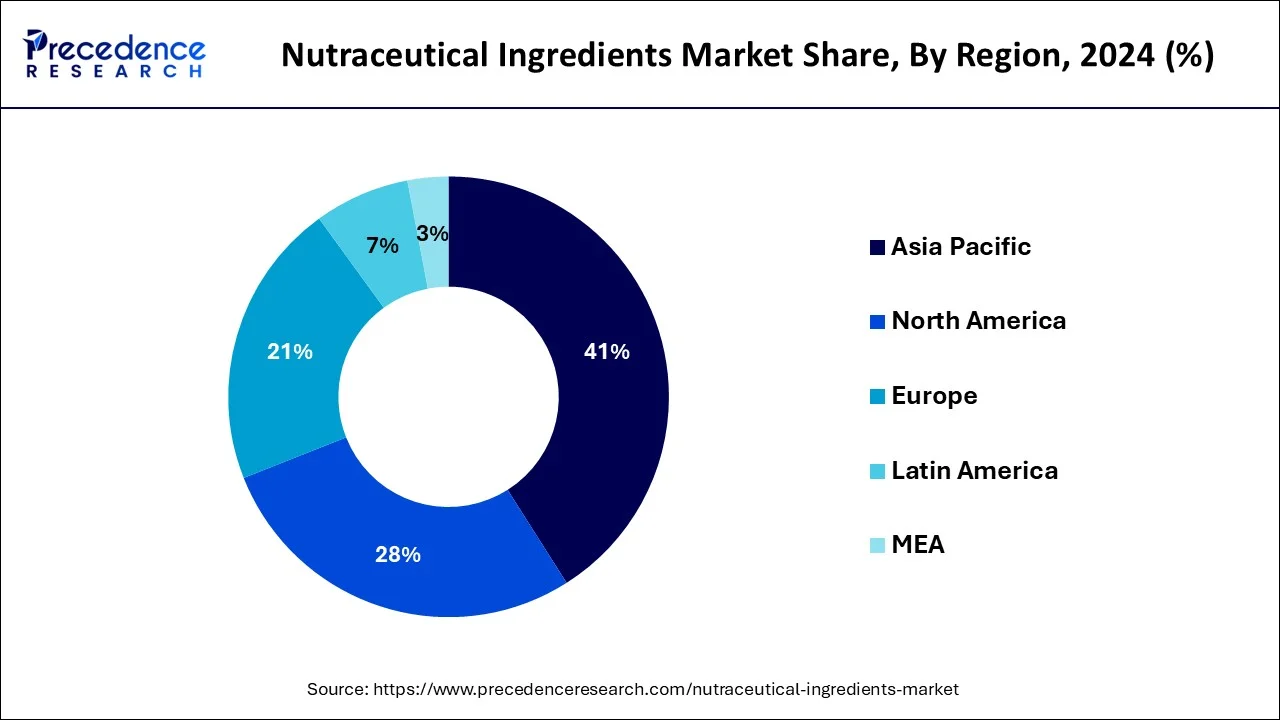

- Asia Pacific accounted for the largest market share of 41% in 2024.

- The North America is expected to expand at a strong CAGR from 2025 to 2034.

- By type, the proteins and amino acids segment held the major market share in 2024.

- By type, the probiotics segment is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the food segment contributed the biggest market share in 2024.

- By application, the dietary supplement segment is expected to grow rapidly from 2025 to 2034.

- By form, the dry form segment dominated the market with the largest share in 2024.

Nutraceutical Ingredients Market Report Coverage

| Report Highlights | Details |

| Market Size in 2025 | USD 95.73 Billion |

| Market Size in 2026 | USD 103.36 Billion |

| Market Size by 2034 | USD 191.04 Billion |

| Growth Rate (2025–2034) | CAGR of 7.98% |

| Leading Region | Asia Pacific (41% share in 2024) |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Health Benefits, Form, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Dominant Type Segment | Proteins & amino acids segment held the largest share in 2024 |

| Fastest-Growing Type Segment | Probiotics segment expected to grow rapidly over the forecast period |

| Dominant Application Segment | Food segment accounted for the largest share in 2024 |

| Fastest-Growing Application | Dietary supplements segment projected to expand significantly |

| Dominant Form Segment | Dry form dominated the market in 2024 |

| Key Market Drivers | Rising demand for personalized nutrition, preventive healthcare, and increasing R&D and government initiatives |

| Key Market Restraint | Availability of counterfeit and adulterated ingredients affecting quality and safety |

➤ Get the Full Report @ https://www.precedenceresearch.com/nutraceutical-ingredients-market

What are Nutraceutical Ingredients?

The nutraceutical market growth is driven by the growth in functional foods, the aging population, the increasing preference for a plant-based diet, and growing awareness about health. A nutraceutical ingredient is a naturally derived compound, such as minerals, prebiotics, fiber, herbal extracts, vitamins, probiotics, amino acids, and fatty acids. The examples of nutraceutical ingredients are omega-3 fatty acids, coenzyme Q10, glucosamine, echinacea, curcumin, green tea extract, and ginseng.

What are Popular Nutraceutical Ingredients?

| Ingredients | Food Sources | Health Benefits |

| Omega-3 Fatty Acids |

|

|

| Probiotics |

|

|

| Vitamin C |

|

|

| Curcumin |

|

|

| Resveratrol |

|

|

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Key Private Industry Investments for Nutraceutical Ingredients

- M2 Ingredients (Om Mushroom Superfood) – In January 2024, private equity firm Meaningful Partners led a funding round to accelerate the distribution and marketing of M2 Ingredients’ Om Mushroom Superfood brand, a vertically integrated supplier of certified organic mushroom powders. The investment aims to scale manufacturing at their new state-of-the-art growing facility in California.

- NutriScience Innovations – In 2017, Milwaukee-based private equity firm Lakeview Equity Partners invested in NutriScience Innovations, a global supplier of nutritional and functional ingredients. The investment involved the acquisition of assets from NutriScience’s sister company, FabriChem, to expand its reach in the health and wellness market.

- Nutris – Spanish private equity firm Nazca Capital became a majority shareholder of Nutris, a company specializing in functional gummies. The partnership aims to support Nutris’ ambitious growth plan, including expanding its international presence and developing new functional projects with scientific validation in the health field.

- MaryRuth Organics – In 2021, Butterfly Equity invested in MaryRuth Organics, a health and wellness brand operating in the premium vitamins, minerals, and supplements sector. The investment supports MaryRuth’s growth in the nutraceutical market.

- Nutriati – In December 2019, Nutriati, a plant-based ingredients company, received a $12.7 million investment led by Manna Tree and supplemented by Open Prairie. The funds are intended to accelerate growth, develop innovative ingredients, increase production, and reach new customers in the plant-based food sector.

Major Trends of the Nutraceutical Ingredients Market

- Rising Demand for Plant-Based and Natural Ingredients: Consumers are increasingly seeking clean-label, plant-derived, and natural nutraceutical ingredients, driving innovation in botanical extracts, algae-based compounds, and plant proteins.

- Focus on Immunity-Boosting Ingredients: The global emphasis on health and wellness, especially post-pandemic, has fueled demand for ingredients like vitamins C and D, zinc, probiotics, and herbal extracts that support immune system health.

- Growth in Personalized Nutrition: Advancements in technology and consumer awareness are pushing the market toward personalized nutraceuticals tailored to individual genetic profiles, lifestyle, and health needs.

- Expansion of Functional Foods and Beverages: Nutraceutical ingredients are increasingly incorporated into everyday foods and drinks, such as fortified snacks, cereals, and functional beverages, making health benefits more accessible.

- Sustainability and Ethical Sourcing: There is growing emphasis on sustainable sourcing, eco-friendly production, and transparency in ingredient origins, reflecting consumer demand for ethical and environmentally responsible products.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Nutraceutical Ingredients Market Opportunity

Rise in Health & Wellness Trends Unlocks Market Opportunity

The strong focus on preventive healthcare and the increasing prevalence of chronic diseases like cardiovascular disorders, obesity, & diabetes increase demand for nutraceutical ingredients. The focus on treating illness and the rise in consumption of plant-based diets increase demand for nutraceutical ingredients. The growth in personalised nutrition and increasing interest in an active lifestyle increases demand for nutraceutical ingredients.

The increasing awareness about health problems and the link between diet & gut health increases demand for nutraceutical ingredients. The strong focus on holistic wellness of emotional, physical, & mental, and increasing consciousness about health, increases demand for nutraceutical ingredients. The rise in health & wellness trends creates an opportunity for the growth of the market.

Limitations and Challenges

High Cost of Ingredients Limits Market Expansion

Despite several benefits of nutraceuticals in various health applications, the high cost of ingredients restricts the market growth. Factors like advanced processing technology, stricter regulatory compliance, specialized manufacturing, supply chain disruptions, sourcing of raw materials, and complex extraction increase the cost of ingredients.

The need for specialized equipment and sourcing of raw materials like herbs & plants increases the cost. The advanced processing technology, such as maintaining the bioactivity, purifying, & extracting bioactive compounds, increases the cost. The stricter quality standards and disruptions of supply chains increase the ingredient cost. The high cost of ingredients hampers the growth of the market.

Case Study: Aker BioMarine’s Strategic Expansion in Asia Pacific — Building Global Leadership in Sustainable Omega-3 Nutraceutical Ingredients

Company Overview:

Aker BioMarine, headquartered in Norway, is a biotechnology company specializing in krill-derived omega-3 ingredients used in dietary supplements and functional foods.

Sustainability-Driven Competitive Edge:

The company has established a global benchmark for sustainable sourcing, leveraging vertically integrated operations that include harvesting, processing, and ingredient formulation under strict environmental guidelines.

Patented Eco-Harvesting Technology:

Through its Eco-Harvesting technology, Aker BioMarine minimizes bycatch and environmental disruption while maintaining marine biodiversity, aligning with global trends favoring eco-conscious nutraceuticals.

Full Value Chain Control:

Aker BioMarine maintains end-to-end traceability — from Antarctic krill harvesting to final product delivery — ensuring transparency, safety, and quality assurance for B2B nutraceutical clients.

Digital Traceability and Transparency:

The company employs blockchain-enabled tracking systems to authenticate ingredient origin, boosting consumer trust and regulatory compliance.

Strategic Expansion in Asia Pacific:

- Established regional subsidiaries and partnerships across China, Japan, and South Korea.

- Focused on localized market strategies emphasizing preventive healthcare, brain function, and heart health benefits.

- Leveraged cross-border e-commerce and retail channels to penetrate rapidly growing wellness markets.

Product Portfolio and Market Positioning:

- Offers both branded ingredients (Superba Krill Oil) and white-label formulations for nutraceutical and food manufacturers.

- Combines clinical validation and sustainability metrics to appeal to health-conscious and regulatory-driven markets.

Financial Impact:

- Achieved higher profit margins through premium ingredient positioning and proprietary sustainability credentials.

- Strengthened long-term contracts with nutraceutical and functional food producers in Asia Pacific.

Strategic Outcome:

Aker BioMarine successfully turned environmental stewardship into a core business growth driver, capturing a leading share in the omega-3 segment while reinforcing its reputation for innovation and sustainability.

Key Takeaway:

The company’s integrated model — combining sustainability, transparency, innovation, and localization — demonstrates how nutraceutical firms can achieve scalable, ethical, and profitable expansion in emerging markets.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1162

Nutraceutical Ingredients Market Regional Outlook

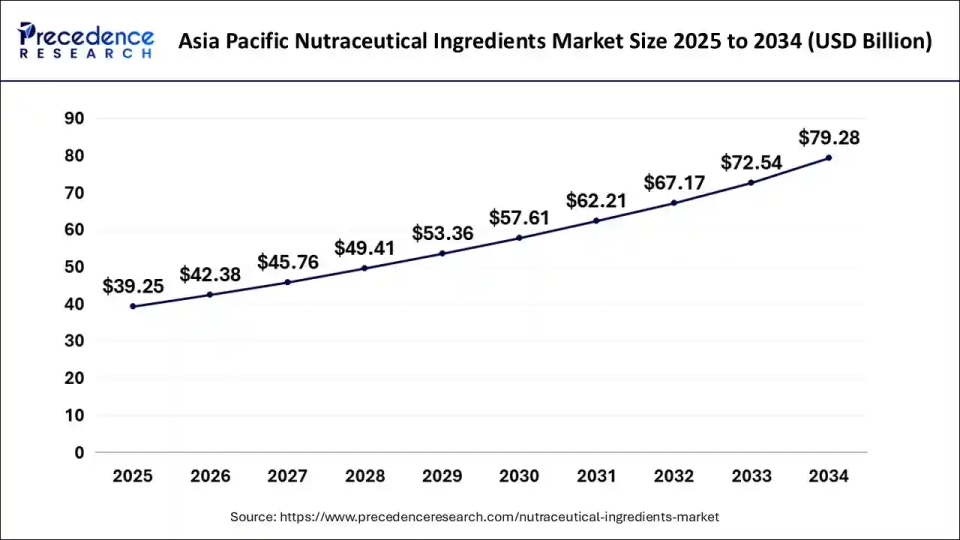

What is the Asia Pacific Nutraceutical Ingredients Market Size?

The Asia Pacific nutraceutical ingredients market size is valued at USD 39.25 billion in 2025 and is predicted to rise from USD 42.38 billion in 2026 to USD 79.28 billion by 2034, growing at a solid CAGR of 8.11% from 2025 to 2034.

Why is Asia Pacific Dominating the Nutraceutical Ingredients Market?

Asia Pacific dominated the global market with a 41% share in 2024. The growing awareness about the health benefits of functional foods and the increasing consumption of dietary supplements increase demand for nutraceutical ingredients. The focus on preventive healthcare and growth in e-commerce increases demand for nutraceutical ingredients. The changing lifestyle and growing utilization of herbal medicine increase the adoption of nutraceutical ingredients, supporting the overall growth of the market.

China dominates the regional market due to its large and growing consumer base, driven by rising health awareness and a booming middle class. Government support for traditional medicine and health supplements further fuels market expansion, while China’s strong, cost-effective manufacturing infrastructure enables it to be a leading producer and exporter of nutraceutical ingredients. Additionally, rapid urbanization and changing lifestyles increase demand for convenient, health-enhancing products, solidifying China’s position as the regional market leader.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1162

How North America is Experiencing the Fastest Growth in the Nutraceutical Ingredients Market?

North America is experiencing the fastest growth in the market during the forecast period. The increasing consciousness about health and focus on preventing illness increases demand for nutraceutical ingredients. The growing age-related conditions and increasing prevalence of chronic diseases increase the adoption of nutraceutical ingredients.

The high preference for plant-based products and increasing consumption of beverages & functional foods increase demand for nutraceutical ingredients, supporting the overall market growth.

Country-Level Investments and Funding for Nutraceutical Ingredients:

- United States: Significant private equity funding in companies like NutriScience Innovations and MaryRuth Organics, focusing on expanding functional ingredients and premium supplements.

- China: Large-scale government-backed initiatives and private investments to boost production of traditional herbal extracts and modern nutraceutical ingredient manufacturing.

- India: Growing venture capital investments in plant-based and ayurvedic nutraceutical ingredient startups, supported by government programs promoting indigenous health products.

- Spain: Private equity investment by Nazca Capital in Nutris, a leader in functional gummies, aimed at international growth and product innovation.

- Australia: Increasing funding into marine-based nutraceutical ingredients companies, leveraging rich natural resources for omega-3 and other bioactive compounds.

✚ Related Topics You May Find Useful:

➡️ Nutraceutical Excipients Market: Explore how formulation advancements and clean-label demands are shaping the next generation of nutraceutical excipients.

➡️ Herbal Nutraceuticals Market: Learn how ancient herbal remedies are being reimagined through modern nutraceutical innovation and science-backed formulations.

➡️ Vitamin Ingredients Market: Understand how personalized nutrition and fortified foods are driving global vitamin ingredient demand.

➡️ Bioactive Ingredients Market: Discover how functional bioactives are powering preventive health solutions across food, cosmetics, and supplements.

➡️ Europe Nutraceuticals Market: Examine Europe’s evolving regulatory landscape and growing consumer adoption of functional nutrition products.

➡️ Active Pharmaceutical Ingredient Market: See how innovation in synthesis and biologics is transforming global API manufacturing and supply.

➡️ Fermented Ingredients Market: Analyze how fermentation technology is driving clean-label production and gut health applications worldwide.

➡️ Prebiotic Ingredients Market: Explore how prebiotic innovation supports microbiome health and synergizes with probiotic formulations.

➡️ Nutraceutical Contract Manufacturing Services Market: Learn how outsourcing and turnkey manufacturing models are accelerating time-to-market for supplement brands.

➡️ Functional Food Ingredients Market: Track how rising health awareness and food fortification trends are reshaping the global functional ingredients sector.

Nutraceutical Ingredients Market Segmentation Insights:

Type Insights

Why the Proteins & Amino Acids Segment is Dominating the Nutraceutical Ingredients Market?

The proteins & amino acids segment dominated the market in 2024. The increasing consumption of protein-based dietary supplements and the focus on strengthening the immune system increase demand for proteins & amino acids. The rise in consumption of functional foods and the trend of a plant-based diet increase demand for proteins & amino acids. The growing demand for fortified foods, sports nutrition products, and infant formulas increases the adoption of proteins & amino acids, driving the overall market growth.

Application Insights

Which Application Held the Largest Share in the Nutraceutical Ingredients Market?

The food segment held the largest revenue share in the market in 2024. The growing consumer awareness about nutrition and the rise of functional foods increase demand for nutraceutical ingredients. The increasing consumption of beverages and the rise in the consumption of ready-to-eat food increase the adoption of nutraceutical ingredients. The strong focus on preventive healthcare and increasing consumption of plant-based diets drives the overall market growth.

Health Benefits Insights

Why the Nutrition Segment Dominates the Nutraceutical Ingredients Market?

The nutrition segment dominated the market in 2024. The growing awareness about healthy diets and increasing consumption of supplements increases demand for nutrition. The high prevalence of chronic disorders and the increasing popularity of personalised nutrition help the market growth. The growing demand for fortified foods and strong government support for wellness & health drive the overall growth of the market.

Form Insights

How does the Dry Form Segment hold the Largest Share in the Nutraceutical Ingredients Market?

The dry form segment held the largest revenue share in the market in 2024. The growing production of botanical extracts, vitamins, & minerals, and the focus on extending the shelf life of products, increases demand for dry form. The cost-effectiveness and ease of incorporation in diverse formulations increase the adoption of dry forms. The cost-effectiveness and availability of various product formats like powders, capsules, and tablets increase demand for dry forms, supporting the overall market growth.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Top Companies in the Nutraceutical Ingredients Market

- Kraft Heinz Company: Kraft Heinz leverages its expertise in food science to develop nutraceutical ingredients that enhance the nutritional value of everyday food products.

- GlaxoSmithKline: GlaxoSmithKline offers a broad range of scientifically backed nutraceutical ingredients focusing on immune support, vitamins, and minerals.

- Amway: Amway provides high-quality nutraceutical ingredients designed to promote wellness and support various health goals through its Nutrilite brand.

- Abbott: Abbott specializes in innovative nutraceutical ingredients that support clinical nutrition and overall health maintenance.

- Kellogg’s: Kellogg’s integrates functional ingredients into its cereals and snacks to deliver added health benefits such as fiber and probiotics.

- Danone: Danone focuses on probiotic and dairy-based nutraceutical ingredients that enhance digestive health and wellbeing.

- Cargill Inc.: Cargill offers a diverse portfolio of plant-based and bioactive nutraceutical ingredients aimed at improving health and nutrition.

- Nestle: Nestle develops cutting-edge nutraceutical ingredients that support healthy aging, immunity, and digestive health across various product lines.

- Archer Daniels Midland: ADM produces natural, plant-based nutraceutical ingredients that cater to dietary supplements and functional foods.

- DSM: DSM provides a wide array of vitamins, carotenoids, and other bioactive nutraceutical ingredients for health and wellness products.

- BASF: BASF supplies innovative nutraceutical ingredients including vitamins, antioxidants, and probiotics that enhance dietary supplements.

- PepsiCo: PepsiCo incorporates functional ingredients into its beverage and snack products to promote health and active lifestyles.

- General Mills: General Mills integrates whole grains, fibers, and other nutraceutical ingredients into its products to support balanced nutrition.

- Aker Biomarine: Aker Biomarine offers marine-based nutraceutical ingredients, rich in omega-3 fatty acids, for heart and brain health.

- Procter & Gamble: Procter & Gamble develops nutraceutical ingredients focused on skin health, immunity, and overall wellness in its supplement lines.

- Johnson & Johnson: Johnson & Johnson provides scientifically formulated nutraceutical ingredients that support bone health, immune function, and chronic disease management.

Recent Developments

Segments Covered in the Report

By Type

- Probiotic

- Proteins and amino acids

- Phytochemical & plant extracts

- Fibers & specialty carbohydrates

- Omega-3 fatty acids

- Vitamins

- Prebiotic

- Carotenoids

- Minerals

- Others

By Application

- Food

- Beverages

- Personal Care

- Animal Nutrition

- Dietary Supplements

By Health Benefits

- Cognitive Health

- Gut Health

- Heart Health

- Bone Health

- Immunity

- Nutrition

- Weigh Management

- Others

By Form

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1162

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter