Natural Gas Price Forecast: Sellers Test Trendline as Correction Nears Low

Fibonacci and ABCD Targets Define Downside Risk

Lower targets start with an 88.6% retracement of the advance at $2.95, that began from the low in August. A little lower is the 100% projection for a falling ABCD pattern at $2.89. That matches a higher monthly low from October and therefore takes on greater potential significance. Given the conviction of sellers during the correction, with sharp declines and a failure of the long-term average, it would not be surprising to see the lower level(s) hit before the correction completes. The speed to the rebound will then provide clues to whether bearish momentum is faltering.

Bounce Potential Remains Within Corrective Structure

Despite the potential for further downside, the area around the trendline could continue to show support, leading to a bounce. Since natural gas has been correcting with a larger bull trend, it is expected to complete the retracement and continue to progress the trend. An advance above Thursday’s lower daily high will provide the next sign of strength, but within a downtrend.

Key dynamic resistance is then at the 10-day average, currently at $3.36 and falling. Short-term downward pressure remains with trading below the 10-day line. That dynamic resistance zone is followed by a lower swing high at $3.50, the 200-day average at $4.54, and another lower swing high at $3.63. A daily close above the first lower swing high at $3.50, as that would confirm a bullish reversal based on structure.

Weekly Close and Momentum Hint at Correction Maturity

Watch how the week ends, as a daily close below last week’s low of $3.13 will confirm weakness on that larger timeframe. The Relative Strength Index (RSI) momentum oscillator is near a level where support was seen during prior bearish corrections and supports the idea that the correction is close to complete. Moreover, the two largest prior bearish measured moves since the 2024 bottom ended with a 46.5% decline and a 40.7% drop price. The current decline shows a 45.3% drop in price since the December peak at $5.50. This would suggest that the current correction has hit a low or is very close to doing so.

If you’d like to know more about what drives natural gas prices, please visit our educational area.

Slides from yearly highs, towards 212.00

The British Pound drops versus the Japanese Yen as the Friday’s Asian session begins, courtesy of Japanese authorities’ verbal intervention, which boosted the Asian currency. The GBP/JPY trades at 212.20 after falling from yearly highs near 214.30.

GBP/JPY Price Forecast: Technical outlook

The technical picture shows that the GBP/JPY uptrend is poised to continue, despite the ongoing pullback. It should be said that the pair dipped as a ‘bearish harami’ two candle pattern emerged near yearly highs, followed by a subsequent bearish candle that pushed the cross to new three-day lows of 212.00.

Momentum favors sellers as the Relative Strength Index (RSI) retreated from overbought territory, triggering a sell signal.

If GBP/JPY extends its losses decisively below 212.00, then it could challenge the 20-day SMA at 211.42. Once surpassed, traders will eye 210.00.

Conversely, if the cross-pair rises past the January 15 high of 213.31, the next key resistance would be the yearly peak at 214.29.

GBP/JPY Price Char — Daily

Japanese Yen Price This week

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this week. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.20% | 0.14% | 0.30% | -0.19% | -0.29% | -0.24% | 0.31% | |

| EUR | -0.20% | -0.07% | 0.18% | -0.39% | -0.48% | -0.43% | 0.10% | |

| GBP | -0.14% | 0.07% | 0.23% | -0.32% | -0.42% | -0.36% | 0.18% | |

| JPY | -0.30% | -0.18% | -0.23% | -0.52% | -0.63% | -0.56% | -0.02% | |

| CAD | 0.19% | 0.39% | 0.32% | 0.52% | -0.12% | -0.04% | 0.50% | |

| AUD | 0.29% | 0.48% | 0.42% | 0.63% | 0.12% | 0.06% | 0.60% | |

| NZD | 0.24% | 0.43% | 0.36% | 0.56% | 0.04% | -0.06% | 0.52% | |

| CHF | -0.31% | -0.10% | -0.18% | 0.02% | -0.50% | -0.60% | -0.52% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Copper price failed to settle– Forecast today – 15-1-2026

Copper price failed to settle for long time above $5.9700 barrier, affected by stochastic exit from the overbought level, to reach $5.8800 again, which increases the chances of activating temporary negative corrective trading, facing new bearish pressures that will force it to decline towards $5.6000 reaching extra support at $5.5100.

While the price success in surpassing the barrier and holding above it will reinforce it to record new historical gains by its rally towards $6.1200 and $6.2050.

The expected trading range for today is between $5.7500 and $6.000

Trend forecast: Fluctuated within the bullish trend

Drops in a Safety Bid (Chart)

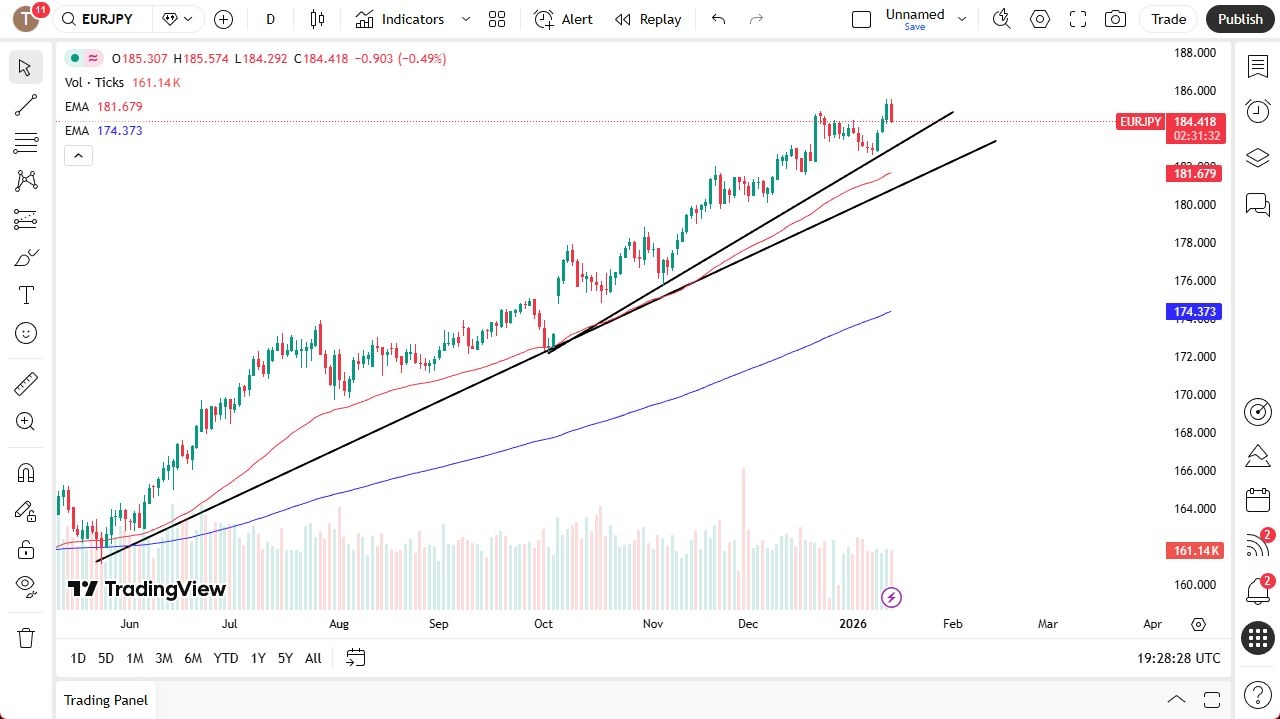

The euro weakened temporarily against the yen due to yen-driven risk flows, but the broader uptrend remains intact. Structural policy differences favor buying dips, with expectations for a rebound and continued positive momentum.

The euro has struggled a bit against the Japanese yen during the trading session on Wednesday, but this has been a Japanese yen-related move and not really anything to do with the euro. There are a lot of geopolitical concerns out there, and the handful of traders who believe in doomsday are buying the yen for the session. The reality is that the trend is very strong and is light years away from changing.

At this point in time, to assume that sooner or later the buyers come back is the camp being taken. Somewhere near the 183 level, there should be traders willing to get involved, assuming the market gets anywhere near there. The 50-day EMA is at the 181.67 yen level, and there are also a couple of trend lines in the same mix.

Monetary Policy and Carry Trade Support

The Japanese yen is backed by a Bank of Japan that simply cannot do anything to tighten monetary policy significantly, and that is the part that most traders need to be paying attention to. The focus is on a drop and a bounce. So far, the drop has occurred, but the bounce has not. Once the market starts to take off to the upside, there is a willingness to buy the right-hand side of the V pattern.

This could send the market towards the 186 level, possibly even higher than that. Ultimately, traders get paid at the end of every day to collect the carry trade. With that being said, this is a market with no interest in shorting. The overall momentum and bulk of the market’s attitude remain positive, and this dip should offer a buying opportunity for those patient enough.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.

Natural gas price approaches the initial target– Forecast today – 15-1-2026

The EURJPY pair failed to breach the barrier near 185.55, forcing it to delay the bullish rally and activating the attempts of gathering gains by reaching below 184.85, to approach from %78.2 Fibonacci correction level at 184.10.

The contradiction between the main indicators confirms the dominance of the sideways bias, to keep providing mixed trading until gathering bullish momentum, to ease the mission of stepping above 184.85, then wait for targeting 185.50, we should note that the price decline below 184.10 and providing negative close will increase the efficiency of the bearish corrective track, to expect targeting the next support near 183.40.

The expected trading range for today is between 184.05 and 184.85

Trend forecast: Fluctuated within the bullish track

EUR/USD, GBP/USD and EUR/GBP Forecasts – Currency Markets Show US Dollar Strength

GBP/USD Technical Analysis

The British Pound is breaking below the 50-day EMA, and I think it is finally starting to roll over. I did previously suggest that maybe this was a topping pattern. I think on Thursday, we’re starting to get that answer.

With that being the case, the 200-day EMA is the next target, and then after that, we could be looking at the 1.30 level. I have no interest in buying anymore, at least not until we break above 1.36, something that I just don’t see happening in the short term.

EUR/GBP Technical Analysis

The Euro has bounced slightly against the British Pound during trading on Thursday as the 200-day EMA continues to offer support. That being said, I still think this is a pair that probably falls, but short-term rallies are likely in the meantime.

I’m willing to fade those short-term rallies at the first signs of exhaustion. The 0.86 level underneath, I think, is your initial target. Anything below there really opens up the downside here, and we could go looking to the 0.85 level, followed by the 0.84 level. Above, the 50-day EMA offers a bit of a ceiling.

For a look at all of today’s economic events, check out our economic calendar.

XAU/USD awaits next catalyst around $4,600

XAU/USD Current price: $4,604

- United States encouraging macroeconomic data fail to support the US Dollar.

- Financial markets are all about sentiment, tech sector lifts Wall Street.

- XAU/USD consolidates around the $4,600 level, with buyers surging on dips.

Spot Gold consolidates recent gains, trading comfortably around $4,610 a troy ounce. The XAU/USD pair keeps finding buyers on dips towards the $4,580 price zone, as the US Dollar (USD) remains unattractive.

Sentiment improved after Wall Street’s opening, and the United States (US) indexes seem to have left behind their poor performance of the last few days, with the tech sector rebounding and leading gains. The better mood caps the bright metal, which, anyway, holds near fresh record highs.

Other than that, the latest round of US macroeconomic data was encouraging, although not enough to bring speculative interest back to life. The country reported that Initial Jobless Claims eased to198K in the week ended January 10, improving from the 207K previous. Additionally, the Philadelphia Fed Manufacturing Survey printed at 12.6 in January following a revised -8.8 in December.

Friday will bring little of interest in terms of macroeconomic releases, with the focus on US political noise and President Donald Trump’s inside and outside battles.

XAU/USD short-term technical outlook

The 4-hour chart shows XAU/USD trades around the 20-period Simple Moving Average (SMA) at $4,610, which partially lost its bullish strength. At the same time, the 100 and 200 SMAs maintain a bullish bias as price holds above the gauges. Initial support emerges at the 100 SMA at $4,476.27. Meanwhile, the Momentum indicator aims lower around its midline, while the Relative Strength Index (RSI) indicator eases at around 55, reflecting the lack of buying interest rather than supporting a downward extension.

In the daily chart, XAU/USD paused, but did not give up. Technical indicators are correcting overbought conditions, but lack downward strength. At the same time, the pair develops far above all its moving averages, with the 20-day Simple Moving Average (SMA) rising above the 100- and 200-day measures, and all three slope higher, underscoring a firm bullish bias. Critical dynamic support aligns at the 20-day SMA at $4,452.69, with additional layers at the 100-day at $4,069.11 and the 200-day at $3,698.49.

(The technical analysis of this story was written with the help of an AI tool.)

GBP/USD Forecast: Pound Sterling Loses Momentum as BoE Outlook Unchanged

– Written by

Tim Boyer

STORY LINK GBP/USD Forecast: Pound Sterling Loses Momentum as BoE Outlook Unchanged

The Pound to US Dollar exchange rate (GBP/USD) slipped back on Thursday after an initial lift from stronger-than-expected UK growth data faded, leaving investors unconvinced that the rebound marked a turning point for the British economy.

At the time of writing, GBP/USD was trading around $1.3415, drifting lower after an early uptick following the UK’s GDP release.

The Pound briefly found support after data from the Office for National Statistics showed the UK economy expanded by 0.3% month-on-month in November, reversing October’s 0.1% contraction and beating expectations for a modest 0.1% rise.

However, the upbeat headline failed to generate lasting momentum. November’s expansion marked the first month of growth since June and was widely viewed by markets as a technical rebound rather than evidence of renewed economic strength.

Confidence was further tempered by concerns over the composition of the growth. A sizeable portion of the increase was driven by a sharp 25.5% surge in car manufacturing, as Jaguar Land Rover ramped up output following disruption caused by a cyber-attack earlier in the year.

As these caveats sank in, Sterling gave back its initial gains and slipped back into a softer trading range.

The US Dollar, meanwhile, traded without strong direction as improving global risk appetite reduced demand for traditional safe havens. A brighter market mood followed signs of easing tensions in the Middle East after Iran paused planned executions linked to recent protests, prompting the US to dial back the prospect of military action.

Save on Your GBP/USD Transfer

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

Despite the shift towards a more positive risk backdrop, the Dollar managed to hold its ground. A mild uptick in US Treasury yields helped underpin the currency, limiting losses even as investors tentatively rotated into higher-risk assets.

GBP/USD Forecast: Fed Speakers and US Output in Focus

Looking ahead to Friday, the Pound to Dollar exchange rate may be influenced by the release of US industrial production data. Output is forecast to have risen by just 0.1% in December, a slowdown that could place modest pressure on the Dollar if confirmed.

Later in the session, comments from Federal Reserve policymakers Michelle Bowman and Philip Jefferson will be closely watched. Both are viewed as leaning dovish, and any remarks reinforcing expectations of looser monetary policy could weigh on the US currency.

With no major UK economic releases scheduled, Sterling may continue to take its cues from broader market sentiment. A sustained improvement in risk appetite could support the increasingly risk-sensitive Pound, while renewed caution would be more likely to favour the US Dollar.

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Dollar Forecasts

Forecast update for EURUSD -15-01-2026.

The EURJPY pair failed to breach the barrier near 185.55, forcing it to delay the bullish rally and activating the attempts of gathering gains by reaching below 184.85, to approach from %78.2 Fibonacci correction level at 184.10.

The contradiction between the main indicators confirms the dominance of the sideways bias, to keep providing mixed trading until gathering bullish momentum, to ease the mission of stepping above 184.85, then wait for targeting 185.50, we should note that the price decline below 184.10 and providing negative close will increase the efficiency of the bearish corrective track, to expect targeting the next support near 183.40.

The expected trading range for today is between 184.05 and 184.85

Trend forecast: Fluctuated within the bullish track