PRESS RELEASE

Published October 24, 2025

What if the next 100x crypto is already roaring and the market hasn’t caught the echo yet? Every cycle has its breakout moment, and the hunt for the best cryptos to buy in 2025 has begun. The new year’s altcoin season is shifting focus from speculation to structured mechanics where smart tokenomics, hype, and community collide.

In this new wave, Solana, Bitcoin Cash, and BullZilla lead the pack. Solana’s ETF approval in Hong Kong pulls institutions into the altcoin arena, Bitcoin Cash is reclaiming its payment-coin crown, and BullZilla is redefining what a meme-fueled ecosystem can achieve through design, not luck.

Final Countdown: Grab BullZilla at $0.00018573 Before Stage 8A Ignites

Solana ($SOL): ETF Approval Sparks Institutional Demand

Solana crypto is back in the headlines after Hong Kong approved its first spot Solana ETF, managed by ChinaAMC. The Solana price climbed 1.41% to $187.40 as excitement built ahead of its October 27 trading debut. For the first time, institutional investors can gain Solana crypto price exposure through a regulated fund without private keys or custodial friction.

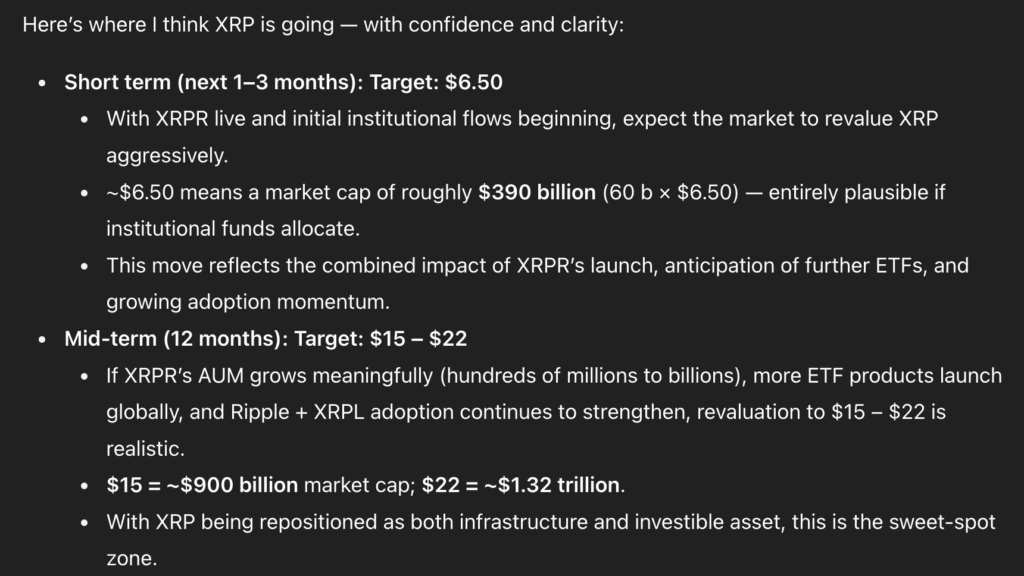

Solana news like this changes everything. JP Morgan forecasts up to $1-1.5 billion in inflows across Hong Kong’s new altcoin ETFs within a year, a massive vote of confidence for Solana’s liquidity and adoption. Analysts now peg the Solana 2025 price prediction near $280-$300 if inflows sustain. The Solana price today reflects quiet accumulation, but the ETF’s long-term impact could push SOL into the same institutional bracket as Bitcoin and Ethereum.

Frequently Asked Questions About Solana

What does the approval of a Solana ETF in Hong Kong mean for investors?

The approval of the first spot Solana ETF by Hong Kong’s regulator allows institutional and retail investors to gain exposure to Solana without directly managing wallets or private keys. This move legitimizes Solana as an investable asset under regulated frameworks, potentially driving major inflows and boosting long-term adoption.

How could the Solana ETF affect the SOL price in 2025?

Analysts expect the ETF launch to attract between $1-$1.5 billion in inflows within its first year, enhancing Solana’s liquidity and demand. If sustained, this could push the Solana price prediction for 2025 into the $280-$300 range, positioning SOL alongside Bitcoin and Ethereum as a key institutional asset.

BullZilla Powers the Best Cryptos to Buy in 2025

BullZilla is the storm forming under Ethereum’s sky, a meme with math behind the madness. As conversations intensify around the best cryptos to buy in 2025, BullZilla’s presale is stealing attention for all the right reasons. It blends emotion, precision, and storytelling into a system engineered for relentless growth.

Its identity is its weapon. Each holder becomes part of a 24-chapter cinematic lore that unfolds with every milestone, turning simple participation into legend-building. Behind this lore lies BullZilla’s engine, a progressive price model that climbs automatically every $100K raised or every 48 hours. Add in live Roar Burns, a 70% APY HODL Furnace, and a referral vault paying 10% in bonus tokens, and you have a living organism of momentum. BullZilla doesn’t wait for the market to believe in it; it forces the market to catch up.

Investment Scenario: $1,500 in BullZilla Could Forge Over 8 Million Tokens

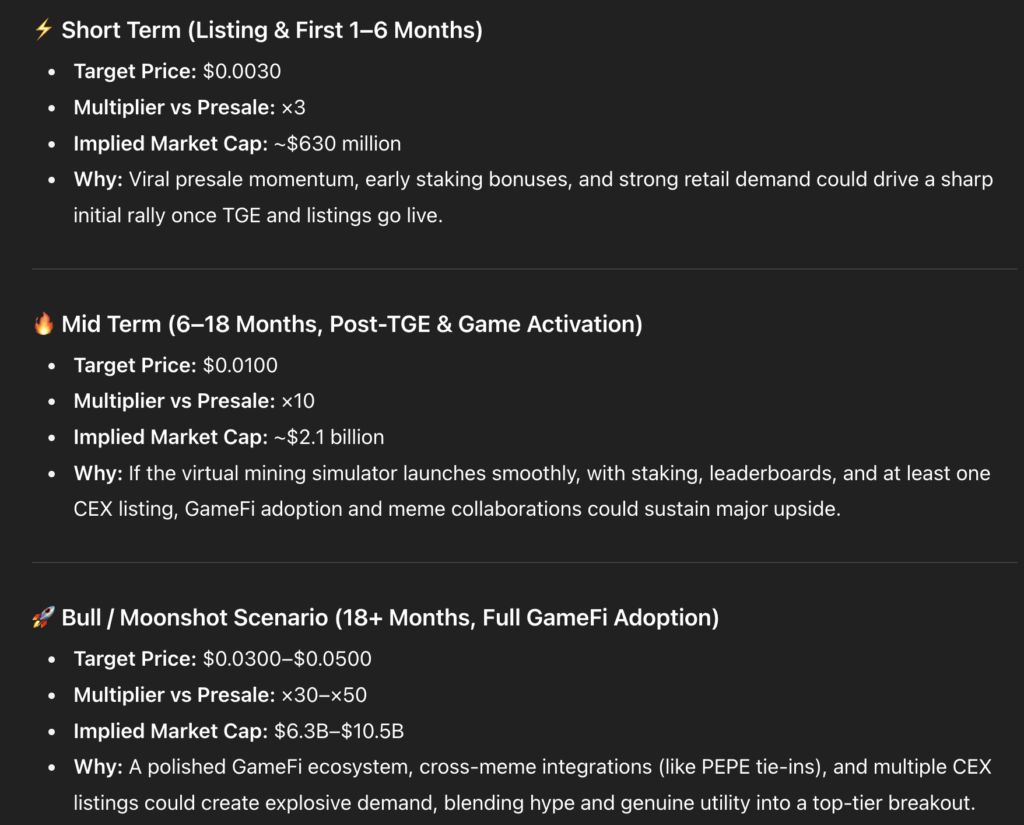

BullZilla’s Stage 7 (Bag Signal Activated) is burning bright. The current presale price is $0.00018573, with over $960K raised, 31 billion tokens sold, and 3,200 holders onboard. Early entrants have already seen potential ROIs near 3,130%, while the projection from this stage to listing ($0.00527) stands at 2,738%.

A $1,500 buy-in today yields roughly 8.07 million $BZIL tokens. The next stage (8A) lifts prices another 3.59%, and every $100K raised or 48-hour cycle guarantees the climb continues. Using a referral on a $50+ purchase secures 10% extra tokens, while sharing your code earns 10% from your network’s buys, vesting two weeks post-presale.

It’s like catching lightning before it knows it’s thunder, an entry point most will only recognize in hindsight.

How to Join the BullZilla Presale

To participate in the BullZilla presale, head to the official How to Buy page on the project’s website. Select your preferred payment option –ETH, USDT, BNB, or another supported token –and complete your purchase to secure $BZIL tokens at the current stage price. The presale price automatically rises after every $100K raised or every 48 hours, whichever comes first. All tokens remain locked until the official launch to maintain fair distribution and minimize early listing risks. Always double-check that you’re on the official BullZilla domain and avoid clicking on unverified links or Telegram promotions.

Frequently Asked Questions About BullZilla Presale

What makes BullZilla different from other crypto presales?

BullZilla isn’t just another meme coin, it’s a story-driven ecosystem built for growth. Each milestone unlocks a new chapter in its 24-part lore, while features like live Roar Burns, a 70% APY HODL Furnace, and a 10% referral vault fuel constant engagement. Add an automated price climb every $100K raised or 48 hours, and BullZilla becomes a self-sustaining engine of momentum rather than a short-term hype play.

How much growth potential does BullZilla have before launch?

With over $960K raised, 31 billion tokens sold, and 3,200+ holders, BullZilla’s current stage projects an ROI of 2,738% from presale to listing. A $1,500 contribution today equals roughly 8.07 million $BZIL tokens, and every new stage pushes prices higher, proof that the earlier you enter, the stronger your upside potential.

Is it safe to join the BullZilla presale?

Yes, as long as you purchase directly from BullZilla’s official website. The presale uses a structured, time-based price model, and all tokens remain locked until launch to prevent early dumping or manipulation. Always double-check you’re on the correct domain and ignore fake Telegram or X links pretending to offer purchase shortcuts.

Why Presale Tokens Don’t Appear in Your Wallet Immediately

Presale tokens often don’t show up in your wallet right after purchase because they’re locked until the project’s official launch or token generation event (TGE). This system ensures fair distribution, prevents premature selling, and protects investors from early price volatility. Your transaction is still securely recorded on the blockchain, and the tokens will automatically appear in your wallet once they’re released. In some cases, you may need to manually add the token’s contract address to your wallet to view them after unlocking.

Only a Few Hours Left: Lock in BullZilla at $0.00018573 for 2,738% ROI.

Bitcoin Cash ($BCH): Old Name, New Momentum

Bitcoin Cash crypto is quietly rewriting its comeback story. The Bitcoin Cash price jumped 1.38% to $484.87, signaling revived demand as traders revisit payment-based assets. Network updates now deliver faster confirmations and lower fees, while renewed merchant adoption strengthens real-world usage.

Recent Bitcoin Cash news highlights partnerships with global payment gateways that could accelerate retail adoption. Long-term traders eye Bitcoin Cash 2025 price prediction targets between $750 and $800, supported by liquidity growth and consistent on-chain metrics. The Bitcoin Cash crypto price today shows slow but steady accumulation, proof that old champions can still punch above their weight when innovation meets persistence.

Frequently Asked Questions About Bitcoin Cash

Why is Bitcoin Cash gaining momentum again in 2025?

Bitcoin Cash is experiencing renewed interest due to its faster transaction confirmations, lower network fees, and growing merchant adoption. Recent partnerships with global payment gateways are also expanding its real-world use, positioning BCH as a strong contender in the payments-focused crypto space.

What is the Bitcoin Cash price prediction for 2025?

Analysts expect the Bitcoin Cash price to reach between $750 and $800 in 2025, driven by rising liquidity, steady on-chain growth, and the broader market’s shift toward practical, payment-oriented digital assets.

Conclusion: Solana and Bitcoin Cash Join the Roar

Solana and Bitcoin Cash have earned their place among the best cryptos to buy in 2025. Solana’s ETF debut merges regulation with innovation, while Bitcoin Cash proves that utility never goes out of style. Both are mature, battle-tested networks ready for institutional money.

Yet BullZilla roars louder. Its presale’s progressive price engine, token-burning rituals, and 70% staking APY transform meme energy into measurable economics. With nearly $1 million raised and counting, BullZilla isn’t just another hype token; it’s the heartbeat of the next retail revolution.

Secure Your Bag: BullZilla’s $0.00018573 Entry Is About to Vanish.

For More Information:

BZIL Official Website

Join BZIL Telegram Channel

Follow BZIL on X (Formerly Twitter)

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com

COMTEX_469766411/2909/2025-10-24T06:39:10