Breast Cancer and AI – HealthyWomen

Brittany Barreto, Ph.D., is a podcaster, an entrepreneur, and a molecular and human geneticist. (In other words, she’s really smart.) Read her column to learn about what’s happening in the world of technology and innovation in women’s health.

October is Breast Cancer Awareness Month.

Artificial intelligence (AI) isn’t just for nerds anymore. It’s changing the way we approach breast cancer, from predicting who’s at risk to detecting disease earlier to personalizing treatment. By reviewing images with incredible precision and processing vast amounts of patient data, AI can aid in estimating disease risk, guide diagnoses and suggest which treatments might work best. For breast cancer, that means the right test or therapy at the right time, leading to better outcomes and less unnecessary treatment.

Predicting who’s at risk: Gabbi

(Photo/Courtesy Gabbi)

There are free breast cancer risk assessment tools available online, which many women find helpful, and that clinicians also use. The Brem Foundation’s CheckMate calculator and the Gail model offered through the Susan G. Komen website are both widely respected and easy to access online.

These questionnaires use personal and family history, along with other risk factors, to estimate a woman’s chances of developing breast cancer. These tools rely on traditional statistics. Their equations are based on established formulas that don’t change the more that you use the tool. That’s where AI-based models come in. Since they get smarter every time someone uses them, they can offer a more advanced way to assess risk by analyzing larger and more diverse data sets.

One company using AI to improve prevention is Gabbi, which offers an online survey that estimates a woman’s breast cancer risk in just a few minutes. The Gabbi Risk Assessment Model (GRAM) was found to be an accurate prediction tool, using a dataset containing more than 3.6 million people.

Unlike older models, GRAM includes women as young as 18 and more women of color, making it more inclusive. This is how Gabbi works:

- Take a two-minute online assessment to receive your GRAM score

- Schedule a virtual visit with a breast health expert to design a care plan, if needed

- Gabbi’s breast health experts will schedule any needed imaging or testing right away

- Receive ongoing support through a care concierge

“I know firsthand how devastating late-stage breast cancer can be. My mom’s cancer went undetected until it was too late, and I was diagnosed myself at just 24,” said Kaitlin Christine, the founder and CEO of Gabbi. “I created Gabbi to change that — to give women the tools for prevention and early detection so fewer families have to experience this loss.”

While Gabbi doesn’t have peer-reviewed data published and has not been cleared by the FDA, so far more than 50,000 women have used the tool. For every 1,000 patients seen, four women have been diagnosed with breast cancer, often earlier than they would have otherwise.

Costs for Gabbi can vary. Gabbi’s in network with several insurance plans, and the assessment is sometimes covered in an office visit with a referring provider.

If you’re paying out of pocket with no coverage, the self-assessment costs $49.99. Virtual visits, if they’re not covered by your insurance, cost $170 for the first visit and $130 thereafter. You can use your HSA and FSA funds to pay for all Gabbi services.

Predicting risk from a mammogram: Clairity Breast

iStock.com/mik38

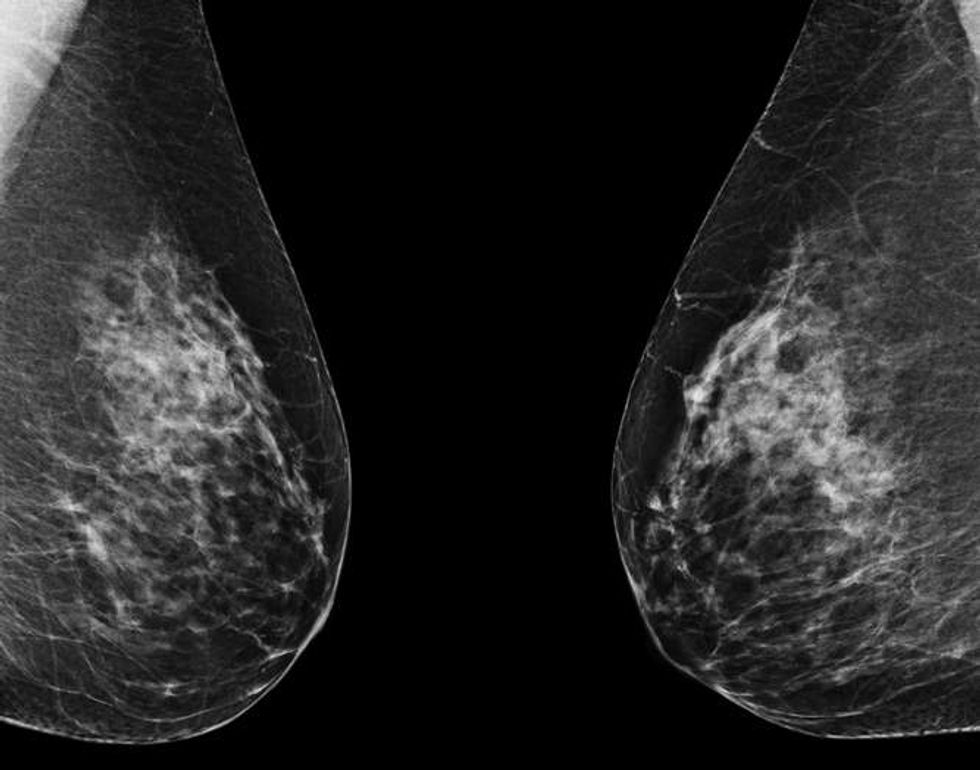

In June 2025, the FDA granted De Novo authorization (meaning the first of its kind) to Clairity Breast, the first AI tool cleared to predict a woman’s risk of developing breast cancer within five years using only a standard mammogram. Unlike traditional risk models that rely on age, family history or self-reported questionnaires, Clairity Breast analyzes the mammogram itself.

Clairity’s AI scans the images for subtle features in breast tissue that are invisible to the human eye or not yet recognized by medicine as warning signs. These patterns can reveal a woman’s likelihood of developing breast cancer even when her mammogram appears normal. The result is a validated five-year risk score that can help healthcare providers (HCPs) offer personalized follow-up care, such as earlier screening, preventive medications or genetic counseling, before any sign of disease is visible.

Clairity is still working with insurance providers to secure coverage, so stay tuned to find out more about insurance coverage and what this tool will cost. The technology is scheduled to be available to HCPs in fourth quarter 2025.

Using AI to keep mammogram schedules on track

AI can also help solve a practical challenge, making sure women don’t miss their mammograms. By analyzing electronic health records, AI can flag patients who are overdue for screening and even prioritize outreach to women at higher risk.

But AI tools can do more than just identify women who are overdue for a mammogram. They can also predict barriers such as transportation or scheduling conflicts; send personalized reminders through text, email or phone; provide information in multiple languages; and flag high-risk patients so they can receive faster follow-up after screening.

A recent study showed that AI-based patient navigators could successfully re-engage patients who had missed other screenings like colonoscopies by identifying and addressing barriers such as transportation or medical mistrust. At least one AI model used for colon cancer screening is going to be tested for breast cancer as well. This approach saves time for clinics, helps women stay on top of their care and may catch cancers that may have been missed otherwise.

AI in breast cancer treatment planning

Beyond risk and screening, AI is also transforming the way breast cancer is treated. For example, it can predict how a tumor will respond to different therapies, helping HCPs choose the most effective option from the start. A recent Nature paper showed that combining clinical and biological data with AI can improve predictions of how well patients will respond to therapy.

AI also designs more precise radiation therapy plans that protect healthy tissue by improving accuracy and identify when women with early cancers can safely avoid unnecessary treatments. Researchers report that using this type of AI-assisted radiotherapy planning also can save experts time.

In addition, AI is enhancing accuracy in the lab and operating room. It can analyze pathology slides to detect cancer markers, such as HER-2, with greater precision. AI is also helping surgeons by predicting whether cancer has spread to lymph nodes and defining tumor margins more clearly with deep-learning models that are able to predict lymph node metastasis from mammograms before surgery.

By combining real-world data from medical records, lab results and patient-reported outcomes, AI continues to refine and personalize care when it’s used by an experienced HCP.

The future of breast cancer care

AI is still new, but its impact is already being felt. From Gabbi’s early risk assessments to Clairity Breast’s breakthrough FDA approval, AI is shifting breast cancer care from reactive to proactive. The goal is simple: get the right care to the right woman at the right time.

As these tools continue to expand, women everywhere may benefit from earlier diagnoses, more personalized treatment and better outcomes. AI won’t replace HCPs — and their clinical judgment — but it may help them save more lives.

From Your Site Articles

Related Articles Around the Web