Green Tea Market Poised for Robust Growth, Expected to Hit USD

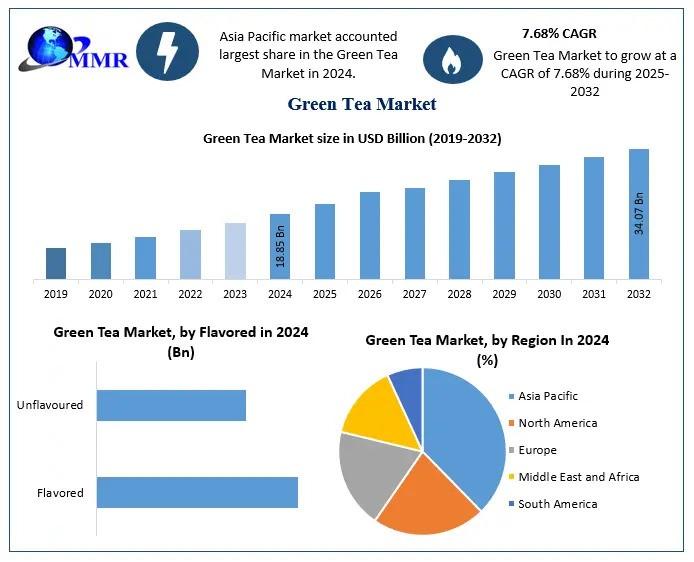

Green Tea Market size was valued at USD 18.85 Billion in 2024 and the total Green Tea revenue is expected to grow at a CAGR of 7.68% from 2025 to 2032, reaching nearly USD 34.07 Billion.

Green Tea Market Overview:

The Green Tea Market has witnessed substantial growth in recent years due to rising health awareness and increasing consumer preference for natural and functional beverages. Green tea, rich in antioxidants and bioactive compounds, is recognized for its potential health benefits, including weight management, improved metabolism, and reduced risk of chronic diseases. The market includes various product types such as loose-leaf, bagged, flavored, and ready-to-drink green tea, catering to diverse consumer needs. Expanding urban populations, changing lifestyles, and the rise of health-conscious millennials are driving consumption. Additionally, the growth of organized retail and e-commerce channels has enhanced product accessibility and convenience. North America, Europe, and Asia-Pacific are major contributors to market expansion, with Asia-Pacific holding the largest share due to traditional consumption and cultural integration. As awareness of wellness and natural beverages grows globally, the green tea market continues to demonstrate robust growth potential.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/221435/

Green Tea Market Outlook and Future Trends:

The outlook for the Green Tea Market remains highly promising, supported by increasing health-conscious behavior, innovation in flavors, and diversification of product formats. Future trends indicate a growing demand for organic, flavored, and functional green teas fortified with vitamins, minerals, or herbal blends. Ready-to-drink green tea products and bottled beverages are gaining popularity due to convenience and lifestyle changes. The rising influence of social media and health-focused marketing campaigns is further driving consumer engagement. Additionally, there is a growing trend toward sustainable packaging and eco-friendly production methods, appealing to environmentally conscious consumers. Asia-Pacific is expected to maintain dominance due to high consumption and cultural preference, while North America and Europe are witnessing growing adoption driven by wellness trends. Overall, the market is expected to expand steadily as manufacturers continue to innovate and cater to evolving consumer preferences.

Green Tea Market Dynamics:

The Green Tea Market is shaped by a combination of health trends, consumer preferences, and economic factors. Increasing awareness of preventive healthcare and lifestyle diseases is boosting demand for green tea as a functional beverage. Rapid urbanization, higher disposable incomes, and the proliferation of cafes, restaurants, and specialty tea shops contribute to market growth. However, fluctuations in raw material availability, particularly high-quality tea leaves, and price volatility pose challenges for manufacturers. Competition from alternative beverages like coffee, herbal teas, and energy drinks also influences market dynamics. Opportunities lie in product innovation, such as blending green tea with natural flavors, functional additives, and convenient ready-to-drink options. E-commerce and direct-to-consumer sales channels are further enhancing reach and accessibility. Overall, a combination of health awareness, convenience, and product innovation continues to drive the growth trajectory of the global green tea market.

Green Tea Market Key Recent Developments:

Recent developments in the Green Tea Market underscore innovation, expansion, and sustainability initiatives. Leading manufacturers are launching flavored and organic green tea varieties to cater to evolving consumer preferences. Companies are increasingly introducing ready-to-drink and bottled green tea products to tap into the growing demand for convenience-oriented beverages. Strategic partnerships with cafes, restaurants, and health-focused retailers are expanding market reach. The adoption of sustainable cultivation practices, eco-friendly packaging, and fair-trade sourcing reflects the industry’s commitment to environmental responsibility. Additionally, advancements in processing techniques and cold-brewing methods have improved taste, aroma, and nutritional quality. Digital marketing, influencer collaborations, and social media campaigns have enhanced brand visibility and consumer engagement. These developments collectively position the green tea market for sustained growth, emphasizing innovation, health benefits, and environmentally responsible practices as key drivers for future expansion.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/221435/

Green Tea Market Segmentation:

by Flavored

Flavored

Unflavoured

by Form

Green Tea Bags

Instant Green Tea Mixes

Loose Green Tea Leaves

Iced Green Tea

by End User

Supermarket/Hypermarket

Convenience Stores

Specialty Stores

Online

Some of the current players in the Green Tea Market are:

1. AMORE Pacific Corp

2. Arizona Beverage Company

3. Associated British Foods plc

4. Bigelow Tea Company

5. Cape Natural Tea Products

6. Celestial Seasonings

7. Coca-Cola Company

8. Dilmah Ceylon Tea Company PLC

9. Finlays Beverages Ltd.

10. Frontier Natural Products Co-Op.

11. Hambleden Herbs

12. Hankook Tea

13. Honest Tea, Inc.

14. Hybrid Green Tea

15. ITO EN

16. Metropolitan Tea Company

17. Nestlé

18. Northern Tea Merchants Ltd

19. Numi Organic Tea

20. Oishi Group Plc.

21. Organic India

22. Republic of Tea, Inc.

23. Shangri La Tea Company

24. Tata Consumer Products Limited

25. Tazo Tea Company

26. Typhoo Tea,

27. Unilever plc

28. Yogi Tea

For additional reports on related topics, visit our website:

♦ Halal Food Market https://www.maximizemarketresearch.com/market-report/global-halal-food-market/28343/

♦ Chocolate Market https://www.maximizemarketresearch.com/market-report/global-chocolate-market/13157/

♦ Coconut Market https://www.maximizemarketresearch.com/market-report/global-coconut-market/29399/

♦ India Edible Oils Market https://www.maximizemarketresearch.com/market-report/india-edible-oils-market/125654/

♦ Global Fast Food Market https://www.maximizemarketresearch.com/market-report/global-fast-food-market/28718/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading market intelligence and consulting company recognized for providing in-depth analysis and practical business solutions across a wide range of industries, including healthcare, automotive, technology, and pharmaceuticals. The firm focuses on delivering precise data, forward-looking insights, and strategic recommendations that enable organizations to identify emerging opportunities, minimize risks, and achieve long-term growth. By combining advanced research methodologies with industry expertise, Maximize Market Research supports clients in making well-informed decisions, enhancing operational efficiency, and strengthening their competitive advantage in global markets.

This release was published on openPR.