DeepSnitch AI Eclipses SOL with 100x Potential

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

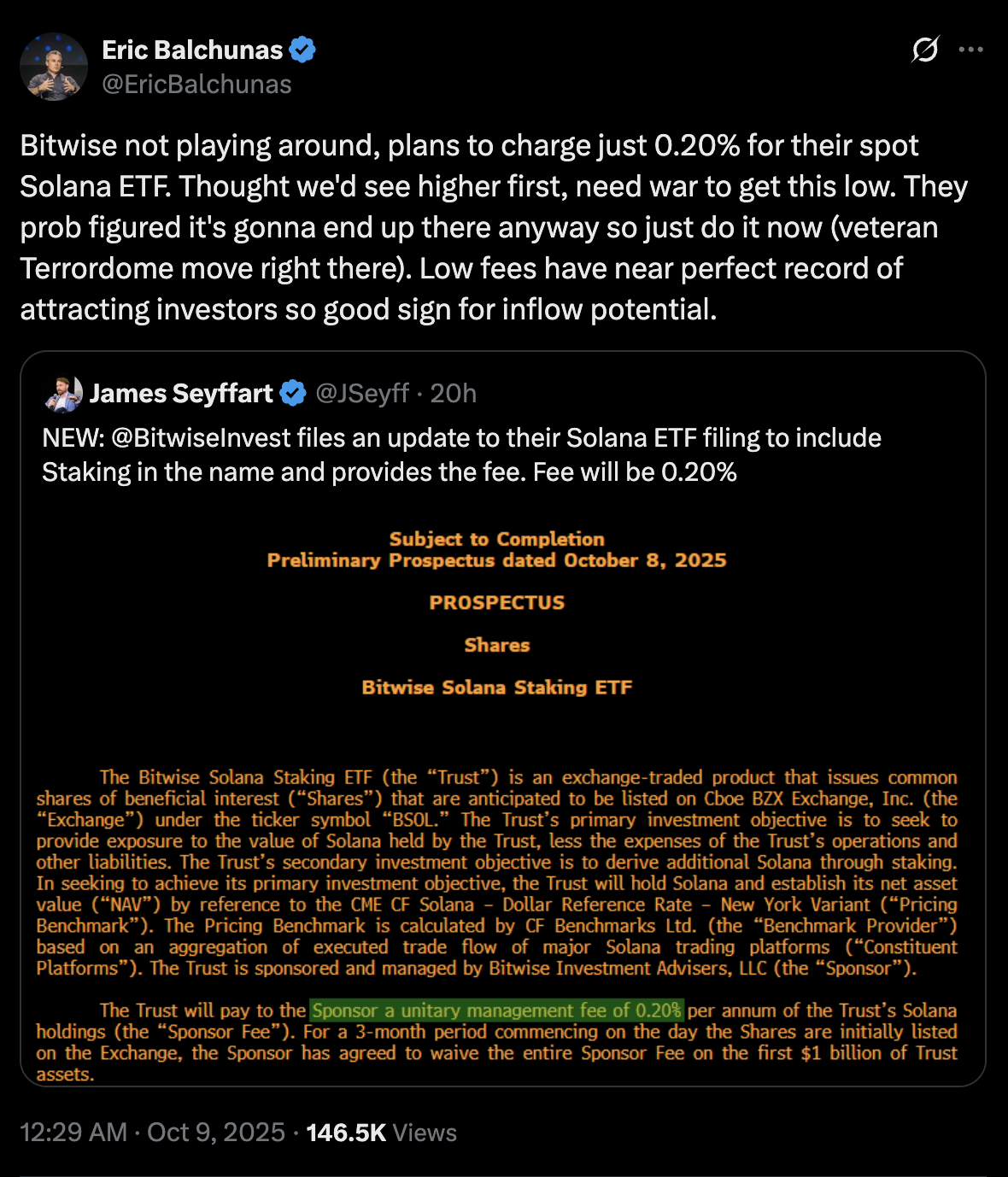

Bitwise just kicked off a new ETF fee war, slashing its proposed Solana ETF fee to 0.20%. The company is racing to attract early institutional inflows, and history suggests it could work.

Analysts compare this to the fee-cutting frenzy that fueled Bitcoin’s 2024 ETF boom, which triggered billions in inflows and sent BTC soaring. If history repeats, Solana could be next in line for a breakout.

But while the Solana price prediction tops at 2x, DeepSnitch AI offers asymmetric upside, with $342K already raised and tools that help traders catch trends before they break.

Bitwise goes aggressive on Solana ETF fees

Bitwise has submitted an amended application to the U.S. SEC to slash its fees on the upcoming Solana ETF to 0.2%, a proposal that could drive significant investor interest if approved.

ETF analyst Eric Balchunas called the move a “veteran Terrordome” play, highlighting that low fees consistently attract the most inflows. Compared to REX-Osprey’s 0.75%, Bitwise’s offering is leaner and includes staking. This positions the ETF as a more efficient option for institutional exposure.

Balchunas also pointed out that SSK has experienced tracking issues, trailing spot SOL performance by as much as 12%, while Bitwise’s product is designed for more accurate price exposure.

This pricing war echoes what happened before the launch of U.S. Bitcoin ETFs in January 2024, when issuers slashed fees to capture early capital. The launch of those ETFs led to billions in inflows and helped drive BTC’s price significantly higher.

If history repeats itself, Solana could benefit from a similar influx of capital. ETF analyst Nate Geraci has already predicted that several staking-enabled Solana ETF applications could be approved by mid-October.

Still, while Solana price predictions show a maximum 2x–3x upside on ETF-driven momentum, DeepSnitch AI has the potential to outperform those gains by a much wider margin.

The next altcoin to boom: DeepSnitch AI outperforms SOL and ETH

DeepSnitch AI outperforms most top altcoins with massive AI potential

DeepSnitch AI is building for one purpose: to give retail traders the kind of alpha whales pay millions for. It could deliver real-time tools that help users react earlier, avoid scams, and trade with confidence.

One of the biggest challenges retail traders face is emotional trading. While whales use advanced tools and data to act calmly, small traders often sell too soon or chase pumps until there’s nothing left to sell. DeepSnitch cuts through the noise, reduces FOMO, and helps users make decisions that lead to profits.

This edge is delivered through one of DeepSnitch’s five powerful AI agents: SnitchFeed. It monitors Telegram alpha groups and threads around the clock, detecting changes in sentiment or coordinated FUD attacks.

Everything runs directly inside Telegram, home to over 1B crypto-savvy users, so the intel hits where traders actually are. With DeepSnitch plugging directly into that massive ecosystem, whales are already eyeing the presale as the next 100x opportunity.

And if they’re right, a $1,000 investment at today’s $0.01805 price could grow into $100,000 after launch, a return early SOL buyers made before it hit $200+. This is why over $342k worth of DSTN has been sold already.

Solana price prediction: can SOL push past $250 in Q4?

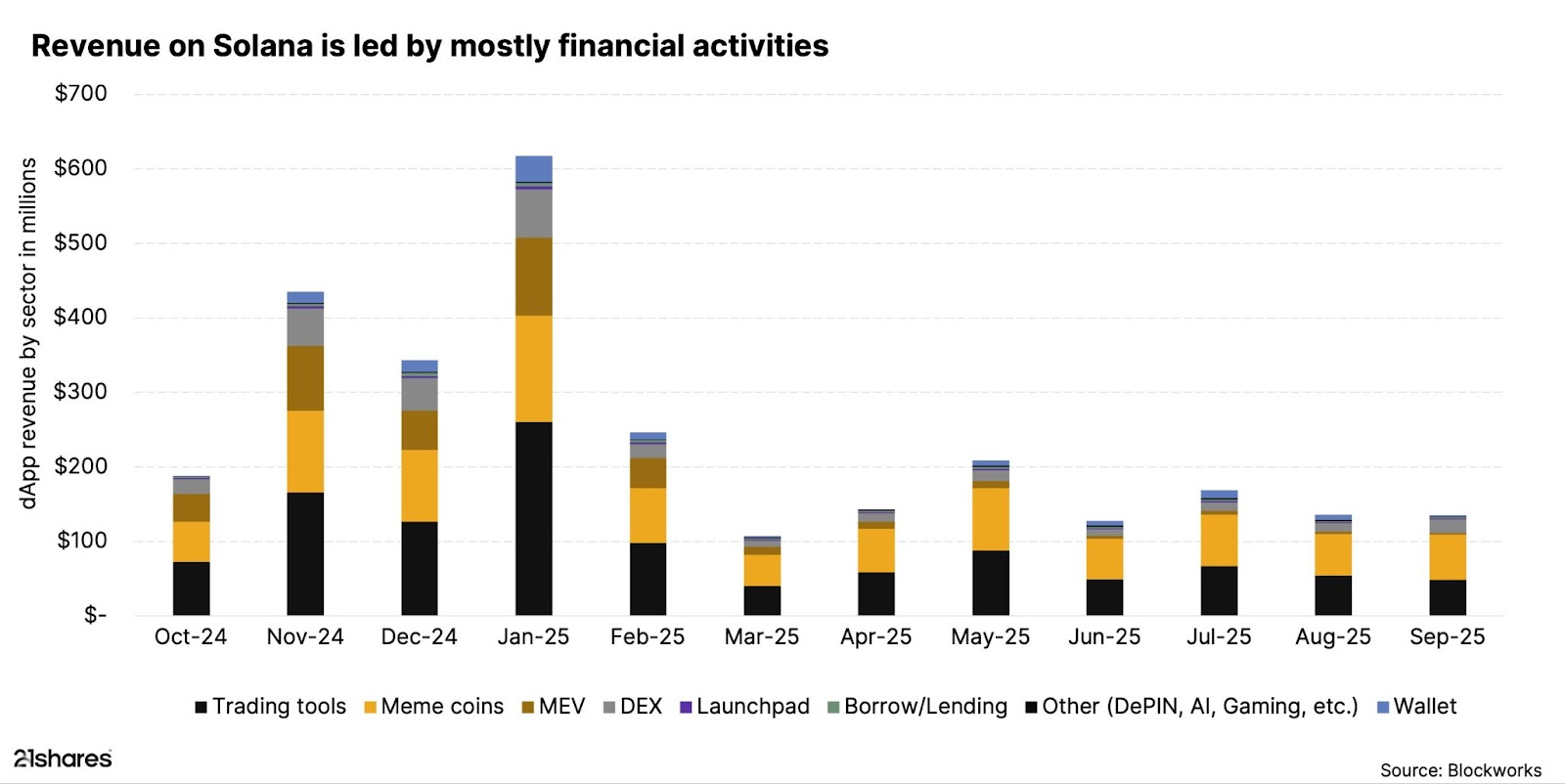

Solana is showing fresh strength as DeFi revenue and user activity pick up fast. A new report from 21Shares puts Solana’s annualized revenue at $2.85 billion, with $616 million earned in January alone. Trading tools lead the charge, making up 39% of total revenue, while meme coins continue to fuel volume.

The fundamentals are now feeding into the Solana price prediction. A key shift came mid-August when SOL broke above $187. Price now holds firm at $190.8, with resistance looming at $253.5. The RSI sits at 58, showing healthy momentum. OBV remains strong, hinting at light profit-taking but no heavy selling.

Short-term movement remains uncertain. The weekly chart supports upside, but the daily shows some weakness. Bulls are eyeing $214-$218 and $199-$205 as support zones if the price dips.

Ethereum targets the $5,000 level on increased momentum

Ethereum is moving sideways near $4,430, up just 1.3% this week. But under the surface, big players are loading up. Whale wallets added 870,000 ETH in a single day. It’s one of the biggest inflows in months, hinting at a potential breakout.

Short-term holders are rising too. The 24-hour group jumped from 0.34% to 0.87%, while 1–3 month holders moved from 11.57% to 12.36%. These movements often signal early accumulation before sharp price moves.

On the chart, ETH is forming an ascending triangle between $4,400 and $4,620. Rising lows are building pressure. A hidden bullish RSI divergence from late August to early October adds strength to the pattern, showing sellers are running out of steam.

If ETH breaks above $4,620, targets stretch to $4,870 and even $5,130. But if support fails at $4,400, the price could pull back to $4,240 or $4,070.

Final thoughts

DeepSnitch is playing a bigger game, tapping into a trillion-dollar AI boom that dwarfs even the most bullish Solana price prediction.

With over $342K raised and whales already circling, DSNT is being priced like a meme but built like a blue chip.

At just $0.01805, this could be the cycle’s breakout token.

Check the website for more info.

FAQs

FAQs

How much has DeepSnitch AI raised so far?

DeepSnitch AI has already raised over $342,000 in its presale, with tokens currently priced at just $0.01805. Early buyers have already seen a +19% return since launch.

Is DeepSnitch AI already live or still in presale?

It is still in presale, making this the ideal time to buy before listings and price increases. The current price is $0.01805.

Where can I buy DeepSnitch AI tokens?

You can participate in the presale by visiting the official DeepSnitch AI website. Quantities are limited, and prices increase with each new stage.

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

:max_bytes(150000):strip_icc()/What-Happens-to-Your-Body-When-You-Take-Vitamin-C-Every-Day-3567a770b2a74d1dbbef96cd6f147d80.jpg)