Solana Price Prediction Is Uplifted by Its Upcoming Upgrade, but DeepSnitch AI Technology Could 100x

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

There’s constant discussion in crypto news about the next trending coin. The latest hype usually grabs most headlines. But seasoned investors know well that crypto is, after all, about good technology.

Solana’s price prediction has been uplifted by recent news about Alpenglow, its upcoming tech upgrade. Nonetheless, the coin that is grabbing increasing attention for its sophisticated tech is DeepSnitch AI.

The project is developing what might be the very first AI use case with extensive adoption in the crypto space. And its tech stack is nothing short of astonishing.

Solana’s Alpenglow promises to be a breakthrough upgrade

On October 3, the global asset manager VanEck published a report that highlights Solana’s Alpenglow as a technical breakthrough. According to the firm, the upgrade should be considered as the biggest change to the network’s software core, since it was launched 5 years ago.

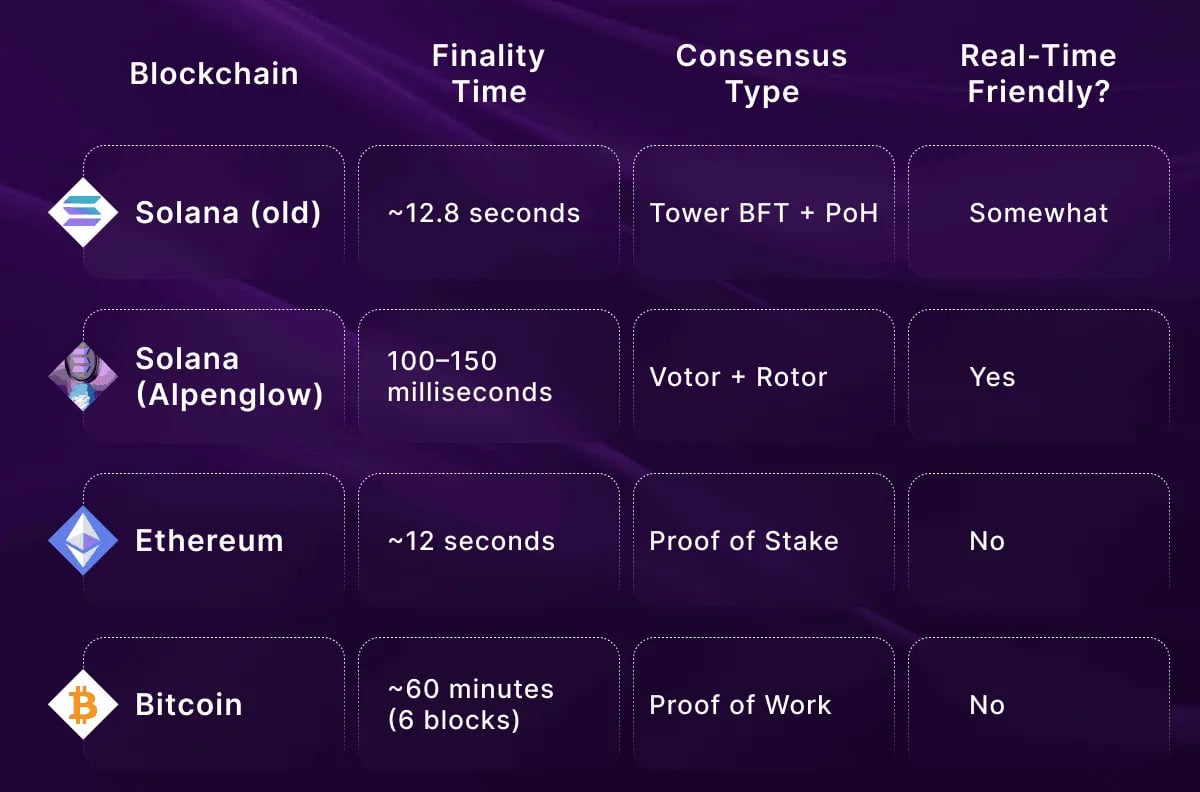

Among the improvements, one that stands out is the substantial shortening of the time it takes to confirm a transaction. From the 12 seconds required by the current Solana’s stack, the time is reduced to about 150 milliseconds. This makes Solana the fastest blockchain network among the big ones; by a lot.

Such an improvement is expected to give Solana an edge over competing networks. As a result, many are becoming bullish about Solana’s price prediction. This kind of news makes some analysts give increased focus to the technology stacks behind coins. That is one of the dimensions where DeepSnitch AI is shining, as shall be explained.

Another crypto that is being talked about is Polygon. The Layer-2 platform, created to address Ethereum’s shortcomings in speed and costs, has been upgraded. A new token, POL, was launched to replace its original MATIC token, and medium to long-term prospects are positive.

Cryptos with impressive technology

1. DeepSnitch AI (DSNT): Deep tech stack

DeepSnitch AI offers one of the most sophisticated technology stacks in the crypto space. At its core, it is a platform with a suite of AI agents that transform raw data into business intelligence.

The project’s mission is to level the playing field in the crypto market, by making available to everyone the kind of actionable insights that only whales enjoy.

To accomplish that, the AI agents scan a proprietary data pipeline that includes raw transaction data, mempool activity, and smart contract events. The data is then aggregated with off-chain data coming from social media channels like X or Telegram.

Finally, the AI agents analyse this data using Machine Learning models and create business intelligence. This includes detection of scams or shifts in market sentiment, hidden gems, latest hour trends, etc.

This sophisticated stack powers an AI use case that is beneficial to virtually all crypto investors out there. For a market that already surpasses half a billion people, DeepSnitch AI is a product with an immense adoption potential.

That is why many people are already seeing DeepSnitch AI as the next 100x story in crypto. The success of its presale attests to that. In just the very first stage, more than $330,000 has been raised.

But benefiting from that growth potential requires investing early in the presale. The entry price is still only $0.01805, meaning that the upside is virtually unlimited.

2. Solana (SOL): Price prediction

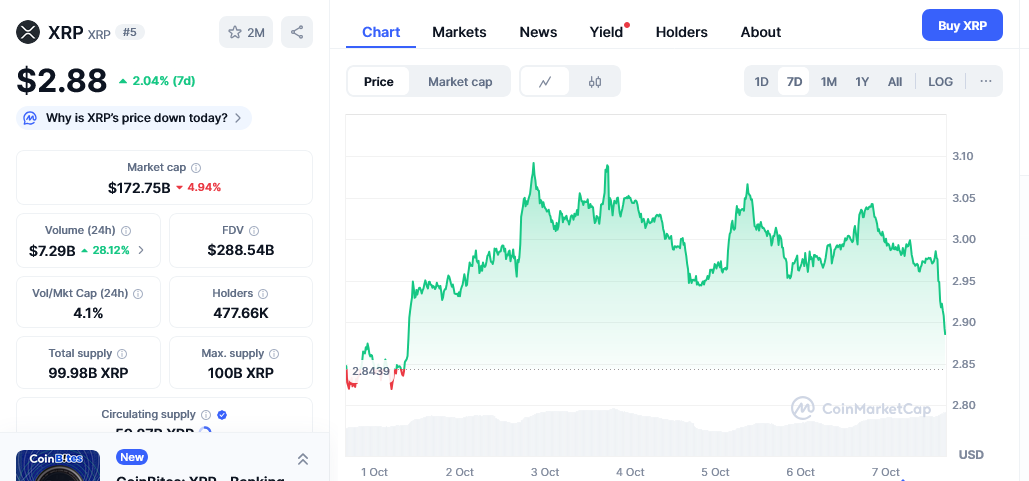

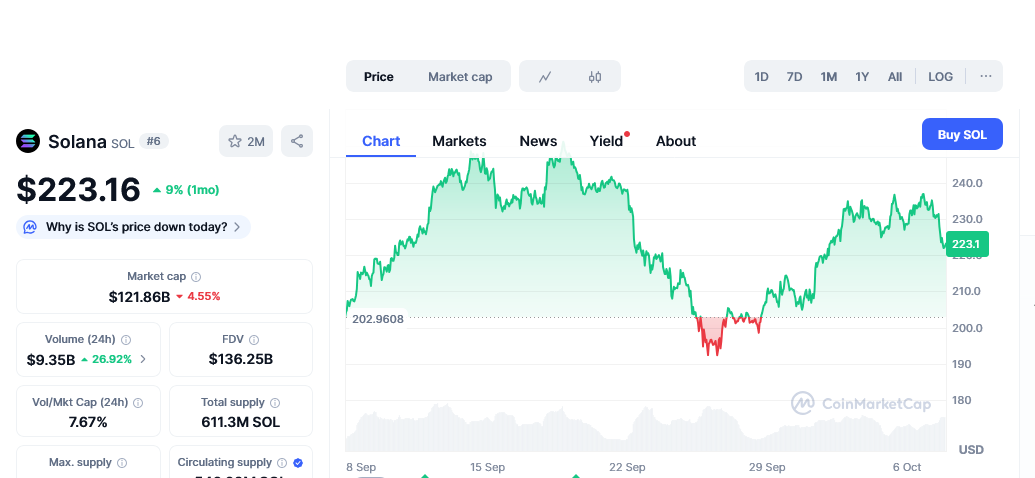

The Alpenglow upgrade is expected to be a positive catalyst in Solana’s price prediction. So far, in the first week of October, SOL’s price increased 10%, slightly outperforming BTC.

Since the whole market fell into a trough after Trump’s “Liberation Day” back in April, Solana has more than doubled its price. That’s a remarkable feat for a coin whose market cap exceeds $100 billion.

The risk with the Alpenglow upgrade is the big expectations that it creates. If execution is then hampered by technical issues (e.g., transaction time is well above 150 milliseconds), that could affect SOL’s price.

3. Polygon (POL): Polymarket’s stack

Polygon became the quintessential Layer-2 Ethereum solution when it was launched. Throughout the years, the platform has grabbed headlines by making deals with Starbucks or Mastercard. But today it is mostly known for being the technology layer behind Polymarket, the prediction platform.

Recent news about a $2 billion investment in Polymarket by the owner of the NYSE has sparked attention. This, in turn, benefits POL, which has so far regained its $0.25 mark. While Solana price prediction seems more optimistic than that of Polygon, this could be a good opportunity to buy when POL’s price is still low.

Conclusion

Contrary to what some may think, lasting success in the crypto space comes down to solid technology and a use case that makes sense, not to hype. Tech upgrades like Alpenglow are catalysts for momentum, and that is why Solana price prediction is looking more bullish.

DeepSnitch AI is a project whose sophisticated technology is impressing many. Its AI/ML powered process of transforming raw data into market insights addresses a need felt by hundreds of millions. That’s a combination for an explosive potential that could exceed 100x returns in a short period.

That moonshot, however, will be reserved for those who act fast by taking part in its presale.

Visit the official website to buy into the DeepSnitch AI presale now.

FAQs

FAQs

How is Solana’s price prediction impacted by the Alpenglow upgrade?

Technology upgrades tend to drive up a coin’s price. But they are a double-edged sword. If the upgrade does not perform as expected, the effects can be quite negative.

How does DeepSnitch AI generate business intelligence?

The platform deploys a suite of AI agents. They scan and aggregate on-chain and off-chain data, analyse it through ML models, and transform it into actionable insights about the market.

What makes DeepSnitch AI a potential 100x moonshot?

Among other things, its combination of a sophisticated and solid technology stack with a relevant and timely use case. That combination has been behind crypto’s greatest success stories, including Solana and Polygon.

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>