Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

The global vitamin B12 ingredient market is projected at USD 0.3 million in 2025 and is anticipated to reach USD 0.5 million by 2035, expanding at a CAGR of 5.8% over the forecast period. A breakpoint analysis highlights key inflection points where market growth experiences noticeable shifts, reflecting both demand surges and periods of relative stabilization. In the initial phase, from USD 0.2 million to USD 0.3 million, the market shows steady gains driven by early adoption in dietary supplements, fortified foods, and nutraceutical applications. This stage represents the first breakpoint, marking the transition from niche utilization to broader incorporation in health-oriented formulations.

As the market progresses from USD 0.3 million to USD 0.4 million, incremental growth reflects rising consumer awareness about vitamin B12’s role in energy metabolism, neurological health, and vegetarian or vegan dietary needs, establishing the second breakpoint where adoption accelerates slightly. In the later phase, from USD 0.4 million to USD 0.5 million, the market reaches maturity, with adoption stabilized across supplements, functional beverages, and specialized health products, reflecting consistent demand but limited scope for sudden spikes. Overall, the breakpoint analysis demonstrates that the vitamin B12 ingredient market experiences measured growth punctuated by identifiable adoption points, emphasizing the gradual shift from early-stage acceptance to steady integration into mainstream nutritional products.

Quick Stats for Vitamin B12 Ingredient Market

- Vitamin B12 Ingredient Market Value (2025): USD 0.3 million

- Vitamin B12 Ingredient Market Forecast Value (2035): USD 0.5 million

- Vitamin B12 Ingredient Market Forecast CAGR: 5.8%

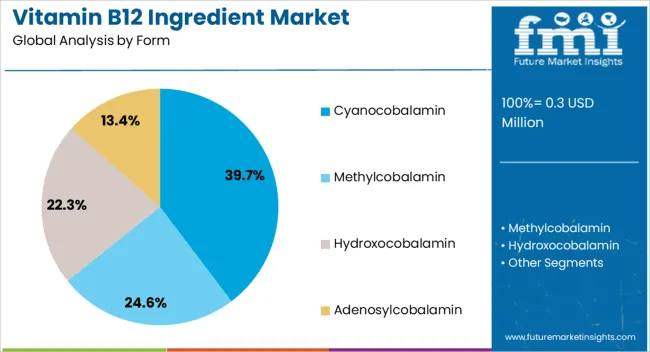

- Leading Segment in Vitamin B12 Ingredient Market in 2025: Cyanocobalamin (39.7%)

- Key Growth Regions in Vitamin B12 Ingredient Market: North America, Asia-Pacific, Europe

- Top Key Players in Vitamin B12 Ingredient Market: Adisseo, BASF SE, DSM Nutritional Products, Gnosis by Lesaffre, Jubilant Life Sciences, Lonza, Merck KGaA, NOW Foods, NutraGenesis, Nutrilo, Pharmavit, Rousselot, Spectrum Chemical Manufacturing, Thermo Fisher Scientific, Zhejiang Shengda Bio-Pharm

Vitamin B12 Ingredient Market Key Takeaways

| Metric |

Value |

| Vitamin B12 Ingredient Market Estimated Value in (2025 E) |

USD 0.3 million |

| Vitamin B12 Ingredient Market Forecast Value in (2035 F) |

USD 0.5 million |

| Forecast CAGR (2025 to 2035) |

5.8% |

The vitamin B12 ingredient market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the dietary supplements and nutraceuticals market, which accounts for about 40% share, as vitamin B12 is widely used in capsules, tablets, powders, and liquid formulations targeting energy support, cognitive health, and anemia prevention. The functional food and beverage sector contributes around 25%, driven by the fortification of products such as energy drinks, breakfast cereals, dairy alternatives, and meal replacements to meet increasing consumer demand for health-promoting ingredients. The pharmaceutical and clinical nutrition market holds close to 15% influence, supported by prescription and over-the-counter formulations that utilize vitamin B12 for treating deficiency-related conditions and supporting metabolic functions.

The animal feed and pet nutrition industry adds nearly 12%, as vitamin B12 is incorporated into livestock and companion animal feed to ensure proper growth, reproduction, and overall health. The biotechnology and fermentation technology sector contributes close to 8%, as advanced microbial fermentation processes are employed to produce high-purity, bioavailable vitamin B12 ingredients efficiently. The distribution of market influence shows that dietary supplements and functional foods form the backbone of this market, while pharmaceutical, animal nutrition, and biotech innovations continue to expand its commercial relevance.

Why is the Vitamin B12 Ingredient Market Growing?

The vitamin B12 ingredient market is witnessing steady expansion, driven by rising consumer awareness regarding micronutrient deficiencies and their impact on metabolic and neurological health. The current landscape reflects a growing incorporation of vitamin B12 in fortified foods, dietary supplements, and clinical nutrition, spurred by an aging population and the increasing prevalence of vegan and vegetarian diets that typically lack sufficient cobalamin intake.

Regulatory frameworks and nutritional guidelines recommending regular B12 intake have further supported market penetration, particularly in pharmaceutical and nutraceutical formulations. Moreover, the scalability of vitamin B12 production through both biosynthetic and chemical synthesis methods has contributed to improved availability and cost efficiency across regions.

Future market growth is expected to be underpinned by enhanced clinical research, continued product innovation, and strategic investments by ingredient manufacturers in high-purity and bioavailable B12 variants. As global health initiatives continue emphasizing preventative nutrition, the vitamin B12 ingredient market is projected to evolve as a vital component of the broader health and wellness ecosystem.

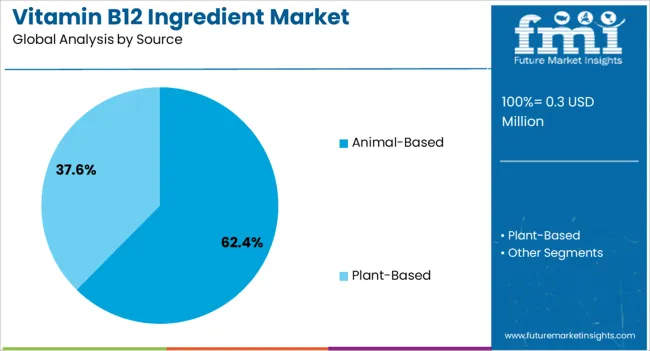

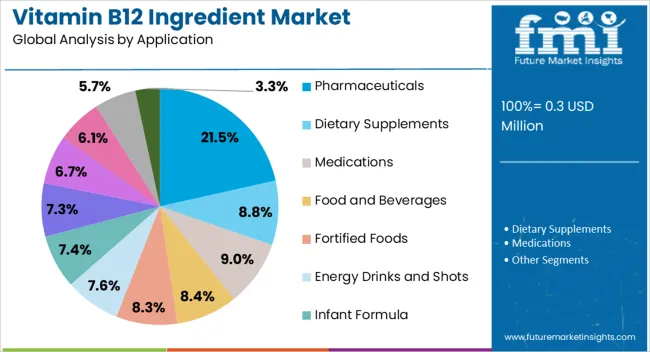

Segmental Analysis

The vitamin b12 ingredient market is segmented by form, source, application, end use, and geographic regions. By form, vitamin b12 ingredient market is divided into Cyanocobalamin, Methylcobalamin, Hydroxocobalamin, and Adenosylcobalamin. In terms of source, vitamin b12 ingredient market is classified into Animal-Based and Plant-Based. Based on application, vitamin b12 ingredient market is segmented into Pharmaceuticals, Dietary Supplements, Medications, Food and Beverages, Fortified Foods, Energy Drinks and Shots, Infant Formula, Cosmetics and Personal Care, Skin Care Products, Hair Care Products, Oral Care Products, and Animal Feed and Nutrition. By end use, vitamin b12 ingredient market is segmented into Human Nutrition and Animal Nutrition. Regionally, the vitamin b12 ingredient industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Cyanocobalamin Segment

The cyanocobalamin segment leads the form category within the vitamin B12 ingredient market, contributing approximately 39.7% to the overall share. Its dominance is attributed to widespread industrial preference due to its chemical stability, long shelf life, and compatibility with multiple delivery formats such as tablets, capsules, and injectables.

Cyanocobalamin is the most commonly used synthetic form of vitamin B12 in fortified foods and supplements, favored for its cost-effectiveness and ease of mass production. Despite emerging interest in alternative bioactive forms like methylcobalamin, cyanocobalamin continues to outperform in terms of commercial scalability and regulatory acceptance across key markets.

Its reliable absorption and proven efficacy in treating B12 deficiency further reinforce its position in both therapeutic and preventive health segments. As innovation in formulation and delivery systems advances, the segment is expected to sustain its leadership, driven by persistent demand from manufacturers prioritizing formulation stability and affordability.

Insights into the Animal-Based Segment

The animal-based segment dominates the source category, accounting for approximately 62.4% of the total vitamin B12 ingredient market. This leadership is primarily supported by the historically established extraction processes from animal tissues and the high bioavailability associated with naturally derived B12 compounds.

The segment benefits from regulatory trust and consumer confidence in the efficacy of animal-origin ingredients, particularly within clinical and pharmaceutical applications. Moreover, established supply chains and processing infrastructure contribute to the cost-effectiveness and consistent quality of animal-based B12 production.

Despite the rise of fermentation-derived and plant-based alternatives targeting vegan demographics, animal-derived sources continue to lead due to their compatibility with high-potency formulations and extensive clinical validation. Given their established usage and superior efficacy in critical deficiency treatments, animal-based vitamin B12 ingredients are anticipated to maintain a dominant share, particularly in applications where therapeutic precision and proven absorption rates are essential.

Insights into the Pharmaceuticals Segment

The pharmaceuticals segment leads the application category in the vitamin B12 ingredient market, holding a share of approximately 21.5%. This prominence stems from the essential role of vitamin B12 in treating conditions such as pernicious anemia, neuropathy, and other B12-deficiency-related disorders.

Pharmaceutical-grade B12 is utilized in various delivery forms including injectables, oral tablets, and sublingual formulations, driven by strong clinical demand and reimbursement support in several countries. The segment also benefits from a steady increase in chronic disease incidence, aging populations, and heightened awareness among healthcare professionals about the neurological implications of prolonged B12 deficiency.

Rigorous regulatory standards and high product purity requirements further reinforce the segment’s reliance on well-established, bioavailable B12 compounds. As global healthcare systems continue prioritizing early diagnosis and micronutrient supplementation, the pharmaceutical segment is expected to retain its leading market share, supported by continuous clinical research and therapeutic innovation.

What are the Drivers, Restraints, and Key Trends of the Vitamin B12 Ingredient Market?

The Vitamin B12 ingredient market is shaped by rising demand from dietary supplements, expansion in functional foods and fortified beverages, advances in production and formulation technologies, and regional market growth supported by consumer awareness. Increasing prevalence of B12 deficiency, interest in preventive healthcare, and adoption of plant-based diets are driving ingredient adoption. Enhanced delivery systems and stable formulations are improving product effectiveness and versatility. Retail, e-commerce, and regional partnerships are ensuring accessibility and market penetration. Together, these dynamics are fostering steady growth, expanding applications across nutraceutical, food, and beverage sectors, and strengthening the role of Vitamin B12 as a critical nutritional ingredient globally.

Growing Demand from Nutraceutical and Dietary Supplements

The market is witnessing growth due to rising consumer interest in dietary supplements and nutraceutical products. Vitamin B12 is essential for nerve function, red blood cell formation, and energy metabolism, making it a key ingredient in multivitamins, fortified foods, and beverages. Increasing awareness of deficiency-related health issues, particularly among vegetarians, vegans, and aging populations, is driving adoption. Manufacturers of dietary supplements are incorporating B12 in tablets, capsules, gummies, and liquid formulations to meet diverse consumer needs. The growth of preventive healthcare and wellness-oriented products is creating consistent demand, supporting market expansion globally.

Expansion in Functional Foods and Fortified Beverages

Vitamin B12 is being increasingly added to functional foods, fortified beverages, and plant-based alternatives to enhance nutritional value. Breakfast cereals, energy drinks, protein powders, and dairy substitutes are commonly enriched with B12 to meet daily dietary requirements. Food and beverage manufacturers are leveraging consumer demand for convenient nutrition solutions that support energy, immunity, and overall wellness. Regulatory guidelines for fortification and labeling are being followed to ensure quality and consumer trust. The incorporation of B12 in diverse product categories is broadening its application base and driving ingredient adoption across health-focused food and beverage segments worldwide.

Advances in Production and Formulation Technologies

Market players are investing in advanced production and formulation techniques to improve stability, bioavailability, and compatibility of Vitamin B12 ingredients. Microencapsulation, powder formulations, and liquid delivery systems are enhancing shelf life and absorption efficiency. Fermentation-based and synthetic production methods are being optimized to meet large-scale demand while maintaining cost-effectiveness. Ingredient manufacturers are focusing on consistency, purity, and regulatory compliance to appeal to nutraceutical, food, and beverage sectors. Technological improvements in formulation and delivery mechanisms are expanding the versatility of B12 applications and supporting wider adoption in both mainstream and specialty product segments.

Regional Market Expansion and Consumer Awareness

The Vitamin B12 ingredient market is growing across North America, Europe, and Asia-Pacific due to increasing health awareness and nutritional supplementation trends. Rising incidence of B12 deficiency and adoption of plant-based diets in urban populations are encouraging fortification and supplementation. Regional manufacturers and distributors are partnering with global ingredient suppliers to improve availability and reduce lead times. Retail expansion, online sales, and e-commerce platforms are enhancing consumer access to B12-enriched products. Educational campaigns and promotional activities are increasing awareness of the health benefits of B12, driving adoption and reinforcing the market’s growth trajectory across multiple regions.

Analysis of Vitamin B12 Ingredient Market By Key Countries

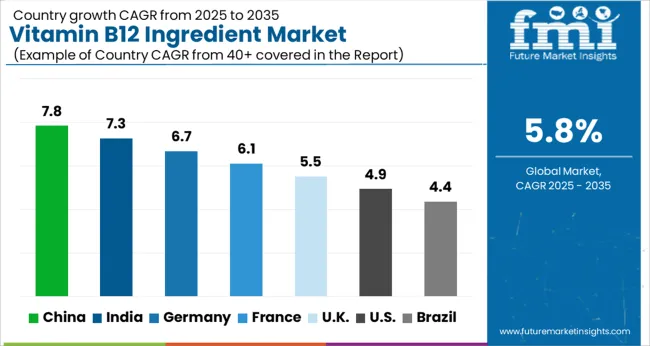

| Country |

CAGR |

| China |

7.8% |

| India |

7.3% |

| Germany |

6.7% |

| France |

6.1% |

| UK |

5.5% |

| USA |

4.9% |

| Brazil |

4.4% |

The global vitamin B12 ingredient market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads with 7.8%, followed by India at 7.3%, Germany at 6.7%, the UK at 5.5%, and the USA at 4.9%. Growth is driven by increasing demand for dietary supplements, fortified foods, and functional beverages, alongside rising consumer awareness of vitamin deficiencies. BRICS countries, particularly China and India, are scaling fermentation production, ingredient standardization, and distribution networks to meet domestic and export demand. OECD nations such as Germany, the UK, and the USA emphasize quality control, regulatory compliance, and formulation innovations to enhance efficacy and market penetration. The analysis spans over 40+ countries, with the leading markets detailed below.

Growth Analysis of Vitamin B12 Ingredient Market in China

The vitamin B12 ingredient market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by increasing demand for fortified foods, dietary supplements, and functional beverages. Rising awareness about vitamin deficiencies, particularly among aging populations and urban consumers, supports the adoption of B12-enriched products. Nutraceutical and pharmaceutical companies are incorporating vitamin B12 in formulations targeting energy metabolism, cognitive health, and overall wellness. Growth in e-commerce and modern retail channels enhances accessibility for consumers. Government regulations on nutrient fortification and food safety further strengthen market adoption and drive product innovation.

- Fortified foods and dietary supplements boosting demand

- Consumer awareness about vitamin deficiencies driving adoption

- Regulatory support encouraging product innovation and fortification

Sales Outlook of Vitamin B12 Ingredient Market in India

The vitamin B12 ingredient market in India is expected to grow at a CAGR of 7.3% from 2025 to 2035, supported by rising health consciousness and increased consumption of fortified foods and dietary supplements. The vegetarian population in India creates higher demand for B12-fortified products, as natural sources are limited. Pharmaceutical and nutraceutical manufacturers are incorporating vitamin B12 in energy boosters, cognitive health supplements, and functional beverages. Growth in e-commerce platforms and modern retail stores enhances product availability across urban and semi-urban regions. Government initiatives promoting nutritional awareness and food fortification further support market growth.

- High vegetarian population increasing B12-fortified product demand

- Fortified foods and supplements supporting health-conscious consumers

- E-commerce and retail expansion enhancing market accessibility

Growth Analysis of Vitamin B12 Ingredient Market in Germany

The vitamin B12 ingredient market in Germany is projected to grow at a CAGR of 6.7% from 2025 to 2035, driven by strong demand for dietary supplements, functional foods, and nutraceutical products. Aging population and growing awareness of vitamin deficiencies encourage consumption of B12-enriched formulations. The pharmaceutical and food industries are actively incorporating vitamin B12 in capsules, beverages, and fortified snacks. Regulatory compliance with EU food fortification standards ensures product safety and quality, fostering consumer confidence. Trends toward vegan and vegetarian diets further increase reliance on fortified products, strengthening market adoption.

- Dietary supplements and functional foods driving growth

- Aging population increasing vitamin B12 consumption

- Vegan and vegetarian trends boosting fortified product demand

Demand Prospects of Vitamin B12 Ingredient Market in the United Kingdom

The vitamin B12 ingredient market in the UK is expected to grow at a CAGR of 5.5% from 2025 to 2035, supported by increasing interest in dietary supplements, fortified foods, and functional beverages. Consumer awareness about energy metabolism, cognitive health, and nutritional deficiencies drives adoption. Pharmaceutical and nutraceutical companies are incorporating vitamin B12 in energy boosters, wellness products, and specialized formulations for targeted health benefits. Retail expansion, e-commerce growth, and health-focused marketing campaigns enhance product accessibility. Government regulations on food fortification, labeling, and supplement quality further encourage safe and effective usage.

- Dietary supplements and fortified foods boosting adoption

- Consumer awareness about cognitive and energy health

- Retail and e-commerce growth improving product availability

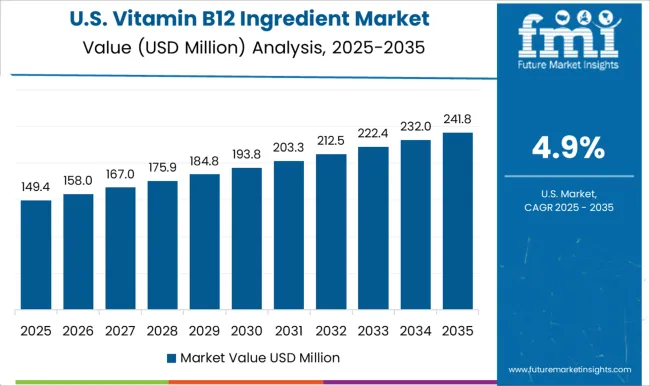

Future Insights into Vitamin B12 Ingredient Market in the United States

The vitamin B12 ingredient market in the USA is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by high demand for dietary supplements, functional beverages, and fortified foods. Consumers increasingly focus on energy support, cognitive function, and overall wellness, creating strong adoption of B12-enriched products. Nutraceutical and pharmaceutical companies are innovating with capsule, powder, and beverage formulations to cater to diverse consumer needs. Expansion of online retail and health-focused stores enhances accessibility nationwide. Regulatory standards ensuring safety, quality, and accurate labeling strengthen consumer trust and drive market expansion.

- High consumer demand for supplements and functional foods

- Focus on energy and cognitive health driving B12 adoption

- Retail and online channels expanding accessibility nationwide

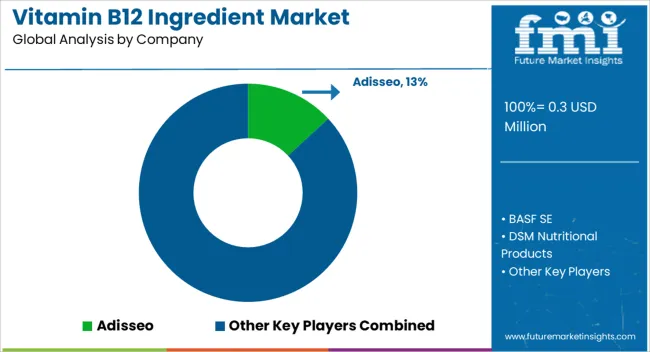

Competitive Landscape of Vitamin B12 Ingredient Market

Competition in the vitamin B12 ingredient market is shaped by production technology, purity standards, and application versatility. Adisseo, BASF SE, DSM Nutritional Products, Gnosis by Lesaffre, Jubilant Life Sciences, Lonza, Merck KGaA, NOW Foods, NutraGenesis, Nutrilo, Pharmavit, Rousselot, Spectrum Chemical Manufacturing, Thermo Fisher Scientific, and Zhejiang Shengda Bio-Pharm lead by offering high-purity cyanocobalamin, methylcobalamin, and adenosylcobalamin for use in dietary supplements, fortified foods, beverages, and pharmaceutical applications. Product differentiation is achieved through fermentation-based or chemical synthesis methods, advanced encapsulation technologies, stability enhancement, and compliance with global quality standards such as USP, FCC, and ISO. Mid-tier and regional players focus on customized formulations, small-batch production, and rapid delivery services for nutraceutical and functional food manufacturers, catering to demand for personalized nutrition solutions.

Strategies across leading companies emphasize research-driven product innovation, regulatory compliance, and diversified application portfolios. Microencapsulation, slow-release technologies, and co-formulation with other vitamins and minerals are leveraged as critical differentiators to enhance bioavailability, stability, and consumer appeal. Differentiation is further strengthened through proprietary production methods, supply chain transparency, and tailored ingredient solutions for food, beverage, and supplement manufacturers. Companies strive to strike a balance between cost efficiency and high-quality standards, ensuring consistent potency, safety, and stability while meeting regulatory requirements across multiple regions. The market reflects strong competition based on purity, bioavailability, and versatility, where global and regional players maintain leadership by delivering high-quality vitamin B12 ingredients with reliable supply chains and application support. Continuous innovation in fermentation, synthesis, and delivery systems drives growth, while customer-centric strategies, customized solutions, and regulatory expertise reinforce competitive positioning. The vitamin B12 ingredient market exhibits a dynamic landscape characterized by technological advancements, product differentiation, and growing demand for nutraceuticals and fortified foods.

Key Players in the Vitamin B12 Ingredient Market

- Adisseo

- BASF SE

- DSM Nutritional Products

- Gnosis by Lesaffre

- Jubilant Life Sciences

- Lonza

- Merck KGaA

- NOW Foods

- NutraGenesis

- Nutrilo

- Pharmavit

- Rousselot

- Spectrum Chemical Manufacturing

- Thermo Fisher Scientific

- Zhejiang Shengda Bio-Pharm

Scope of the Report

| Item |

Value |

| Quantitative Units |

USD 0.3 Million |

| Form |

Cyanocobalamin, Methylcobalamin, Hydroxocobalamin, and Adenosylcobalamin |

| Source |

Animal-Based and Plant-Based |

| Application |

Pharmaceuticals, Dietary Supplements, Medications, Food and Beverages, Fortified Foods, Energy Drinks and Shots, Infant Formula, Cosmetics and Personal Care, Skin Care Products, Hair Care Products, Oral Care Products, and Animal Feed and Nutrition |

| End Use |

Human Nutrition and Animal Nutrition |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered |

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Adisseo, BASF SE, DSM Nutritional Products, Gnosis by Lesaffre, Jubilant Life Sciences, Lonza, Merck KGaA, NOW Foods, NutraGenesis, Nutrilo, Pharmavit, Rousselot, Spectrum Chemical Manufacturing, Thermo Fisher Scientific, and Zhejiang Shengda Bio-Pharm |

| Additional Attributes |

Dollar sales, share, form demand (capsule, powder, liquid), regional adoption, end-use segments, competitor landscape, pricing trends, fortification and supplementation trends, bioavailability focus, regulatory compliance, functional food applications, nutraceutical growth. |

:max_bytes(150000):strip_icc()/ar-pepsico-recall-ar-pepsico-2x1-1e4038c22f214334afc62102779e44a9.jpg)