ADA Price Predictions For October, November & December

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Cardano News Today looks at future ADA Price Forecasts for October, November, and December 2025, as investors consider how sentiment and network activity would affect ADA’s performance to the end of the year.

Blockchain’s steady growth via staking pools, DeFi integrations and ecosystem upgrades maintains its fundamentals intact. At the same time, investor appetite is fueling fresh payment-focused projects like Remittix (RTX) priced at $0.1130, indicative of demand for utility-focused crypto assets that have real-world applications, a trend characterizing late-2025 market potential.

Cardano, ADA Price Outlook For The Final Quarter

Cardano (ADA) Price stands at $0.7892, having clocked a 0.59% fall in the day as its market cap also hovers around $28.23 billion. Its volume rose 30.45% to $1.11 billion, indicating that there is renewed interest from traders and long-term investors.

October could see ADA range-bound between $0.75 and $0.85, and with potential room to move in November if general crypto sentiment turns around. December can see some estimating ADA at $0.90 with expected network developments and Layer 2 rollout.

However, Cardano’s cautious development pace might also mean slow and not explosive growth, especially as investors diversify into other DeFi networks and cross-chain payment tokens.

As the year winds down, ADA’s fundamentals, facility ambitions, low gas costs and strong community backing will remain in the valuation spotlight. That said, newer low cap crypto gems can influence near-term price behavior.

Remitix Beta Wallet Launch And Ecosystem Development

Aside from ADA, Remittix (RTX) is making waves as a crypto with real-world application, bridging digital assets to traditional banking. The Beta Wallet is live and allows users to send cryptocurrency straight to bank accounts in 30+ nations. Supporting over 40+ cryptocurrencies and 30+ fiat currencies, it simplifies cross-border payments with instant FX conversions and low gas fee crypto transactions.

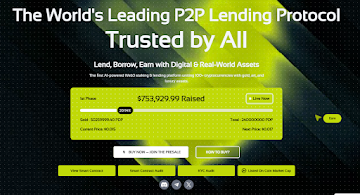

Remittix is valued at $0.1130 per token with over $26.8 million raised and 673 million+ tokens sold, one of the best crypto presale 2025 campaigns so far. Milestone accomplishments from the team are CertiK verification and Ranked #1 for Pre-Launch Tokens, lending credibility and transparency to the project’s roadmap.

What’s Fueling Remittix’s Adoption Surge:

- Beta Wallet live with 40+ cryptos & 30+ fiats

- Over $26.8 million raised & 673 million+ tokens sold

- CertiK Verified & Ranked #1 for Pre-Launch Tokens

- BitMart & LBank listings confirmed

- $250,000 Giveaway+ 15% USDT referral rewards

These statements position RTX as a future 100x crypto contender in 2025, combining real-world payments with DeFi innovation.

Exchange Listings Coming Up & Referral Rewards

As part of its growth strategy, Remittix is pleased to announce two high-profile centralized exchange (CEX) listings: BitMart and LBank. These listings, timed with presale benchmarks of $20 million and $22 million respectively, will enhance liquidity and availability upon going live.

Holders are also incentivized through a 15% USDT referral program, allowing for immediate claimable rewards every 24 hours. This initiative encourages organic community growth while driving project visibility across active crypto presales.

In addition to this, Remittix is enabling a $250,000 community giveaway to promote engagement as it nears full mainnet deployment.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

:max_bytes(150000):strip_icc()/FE3F9AD2-9085-40B8-8E8E-AF95656B0B37-048bcc651b0f4063b40038d3df45e712.jpeg)