Policosanol Market Shows Outstanding Growth at

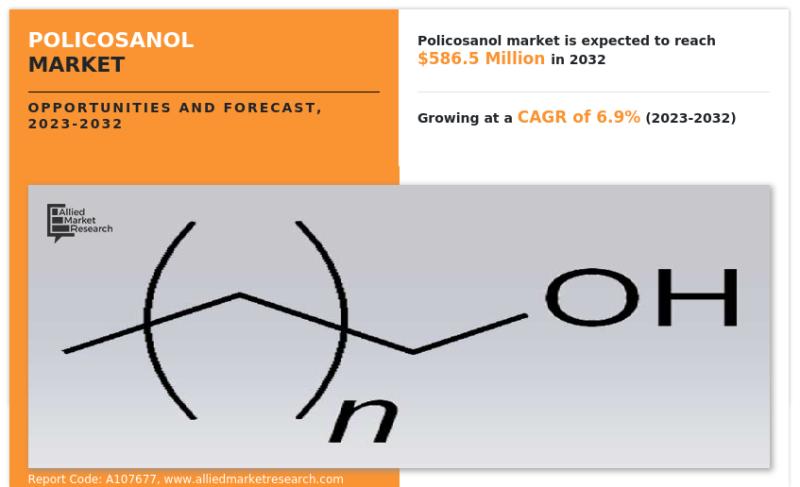

Allied Market Research has recently published a comprehensive report titled “Policosanol Market by Source (Sugarcane, Wheat Germ, Beeswax, and Others), by Application (Dietary Supplements, Pharmaceutical Drugs, Personal Care and Cosmetics, and Animal Feed): Global Opportunity Analysis and Industry Forecast, 2023-2032”. The report indicates that the policosanol market was valued at $301.0 million in 2022 and is estimated to reach $586.5 million by 2032, exhibiting a CAGR of 6.9% from 2023 to 2032.

Download Sample PDF : https://www.alliedmarketresearch.com/request-sample/A107677

Prime Growth Determinants:

The increasing emphasis on cardiovascular health among the aging population, coupled with a growing focus on preventive healthcare, drives the demand for policosanol. Known for its potential cholesterol-lowering and antiplatelet effects, policosanol is positioned as a preventive measure against heart disease and related conditions. Moreover, heightened awareness of policosanol through consumer education initiatives or marketing campaigns further contributes to market growth. However, the high costs associated with policosanol may pose a challenge to market expansion.

Key Highlights from the Report:

The report provides insights into current trends and the future scenario of the policosanol market from 2023 to 2032, identifying prevailing opportunities and potential investment pockets.

Market analysis is conducted in terms of both value ($Million) and volume (Kilotons), considering factors such as source, application, major regions, and over 15 countries.

The policosanol market is characterized by consolidation, with a few major players such as Manus Aktteva Biopharma LLP, Zxchem Group, Ambe Phytoextracts Pvt. Ltd., BOC Sciences, Huzhou Shengtao Biotech LLC, Botanic Healthcare, Bioriginal Food & Science Corp, Sabinsa, Sunpure Extracts Pvt Ltd., and Shreeji Pharma International holding significant market shares.

Purchase Enquiry Report @ https://www.alliedmarketresearch.com/purchase-enquiry/A107677

The report offers strategic planning and industry dynamics to aid decision-making for existing market players and new entrants in the policosanol industry.

Sugarcane Segment Leads the Way:

In terms of source, the sugarcane segment dominated the market in 2022, contributing to over two-fifths of the global policosanol market revenue. It is projected to maintain this lead with the highest CAGR of 7.2% during the forecast period. The demand for sugarcane is fueled by factors such as population growth, changes in consumer preferences, industrial uses, economic development, and the ongoing need for sugar as a food ingredient. Moreover, policosanol derived from sugarcane is recognized for its potential health benefits, particularly in supporting cardiovascular health by modulating cholesterol levels. This factor is expected to drive the demand for sugarcane-derived policosanol, particularly in medicinal applications.

Interested in Procuring this Report? Visit Here: https://www.alliedmarketresearch.com/policosanol-market/purchase-options

Pharmaceutical Drugs Segment Maintains Dominance:

Among applications, the pharmaceutical drugs segment held the largest share in 2022, contributing to nearly two-fifths of the global policosanol market revenue. The rising demand for pharmaceutical products and treatments, driven by factors such as aging populations, chronic diseases prevalence, and medical technology advancements, boosts the market for policosanol. Widely used to reduce LDL cholesterol and increase HDL cholesterol, policosanol finds extensive application in heart health. The dietary supplements segment is anticipated to register the highest CAGR of 7.3% during the forecast period.

Asia-Pacific Continues Dominance:

Regionally, Asia-Pacific led the market in 2022, accounting for nearly half of the global policosanol market revenue and is projected to register the highest CAGR of 7.5% during the forecast period. The Asia-Pacific policosanol market is anticipated to expand significantly, driven by countries like India, China, and Japan. The region’s growing pharmaceutical sector, where policosanol is predominantly used as an antioxidant and anticoagulant agent in drug formulations, contributes to its market growth.

Access Full Summary Report: https://www.alliedmarketresearch.com/policosanol-market-A107677

Leading Market Players:

Key market players such as Zxchem Group, Sabinsa, Sunpure Extracts Pvt Ltd., Bioriginal Food and Science Corp, Ambe Phytoextracts Pvt. Ltd., Manus Aktteva Biopharma LLP, BOC Sciences, Huzhou Shengtao Biotech LLC, Botanic Healthcare, and Shreeji Pharma International have been analyzed in detail in the report. The report provides valuable insights into their business performance, operating segments, product portfolio, and strategic moves, thereby showcasing the competitive landscape.

Contact Us:

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.