Gold silver prices surge copper and platinum fall: Gold and silver prices surge today while copper and platinum crash — 5 key reasons behind the sharp move in gold, silver, copper, and platinum markets

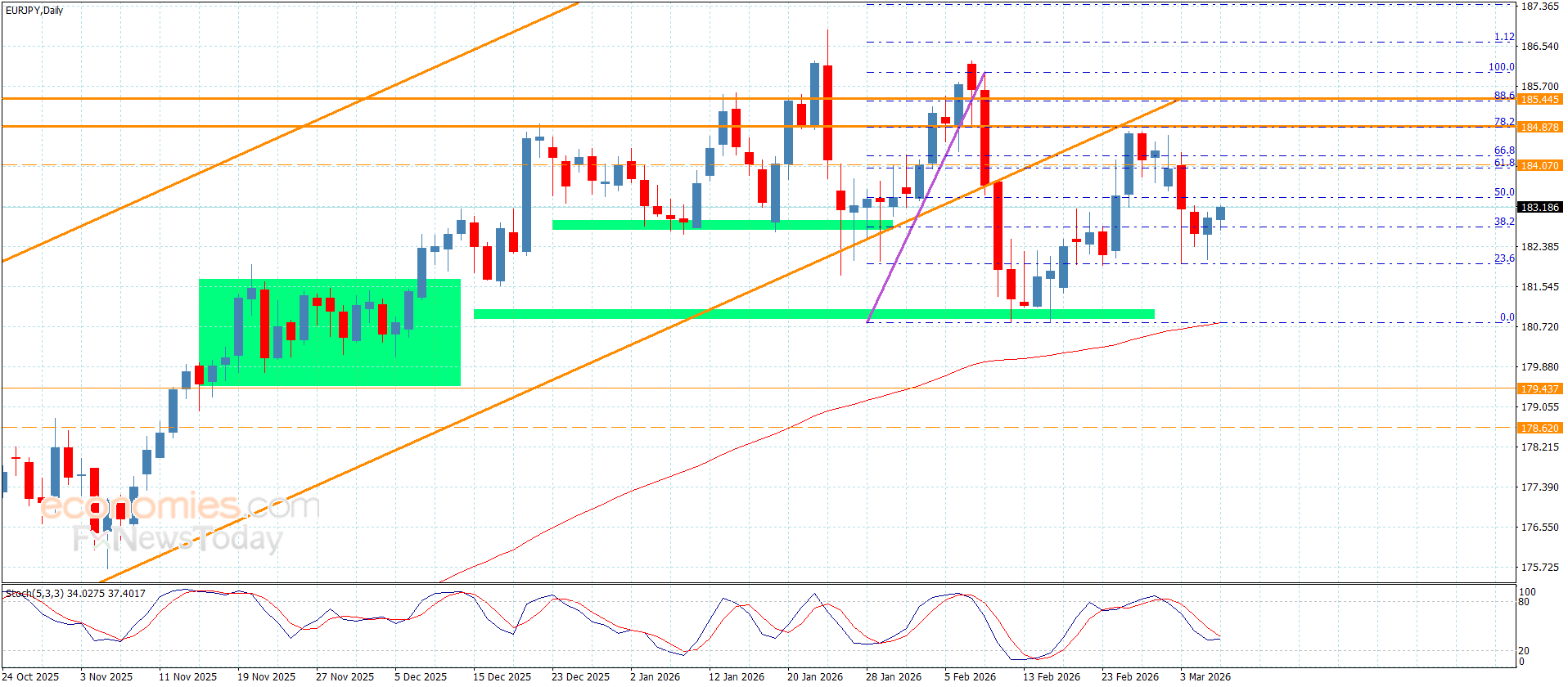

The commodity market in March 2026 is not telling one story. It is telling two. Gold at $5,090 and silver at $82.52 are running on geopolitical fear, central bank accumulation, dollar debasement risk, and a structural loss of confidence in U.S. sovereign debt as a safe-haven instrument. These forces are not going away. They are deepening. Gold’s path to $6,300 and silver’s path to sustained $80-plus pricing are both credible if the macro environment holds its current trajectory.

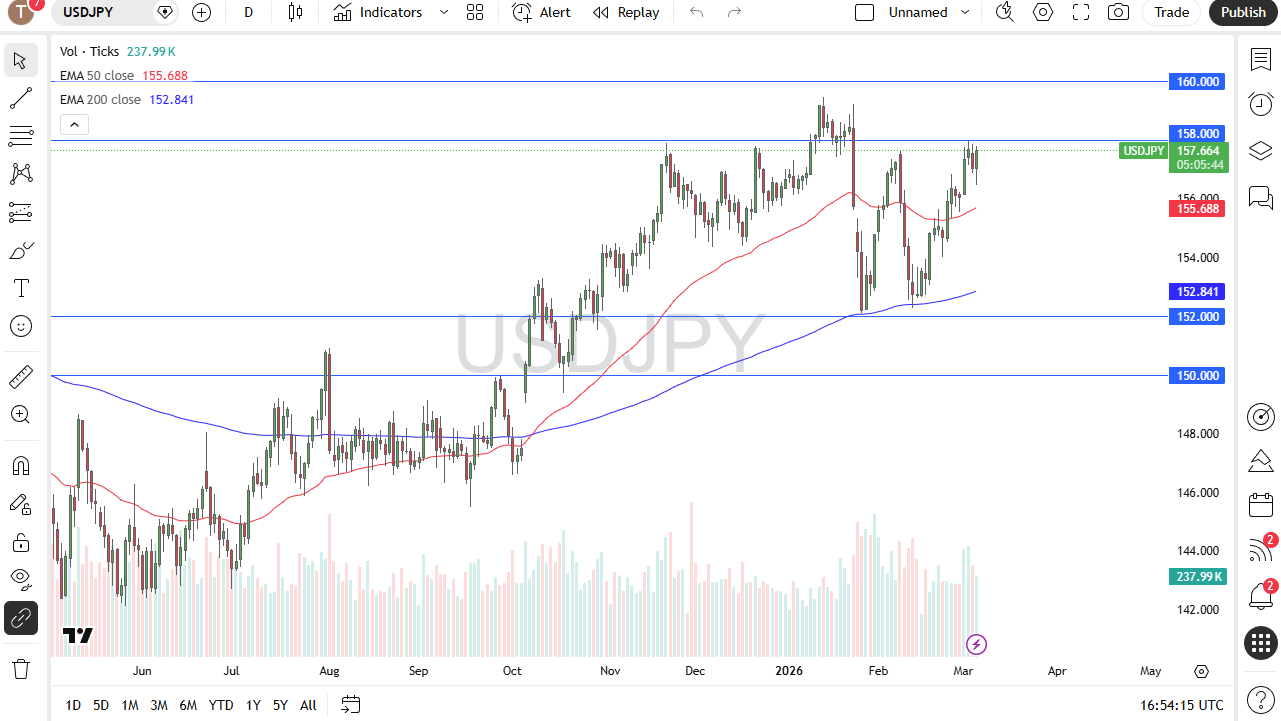

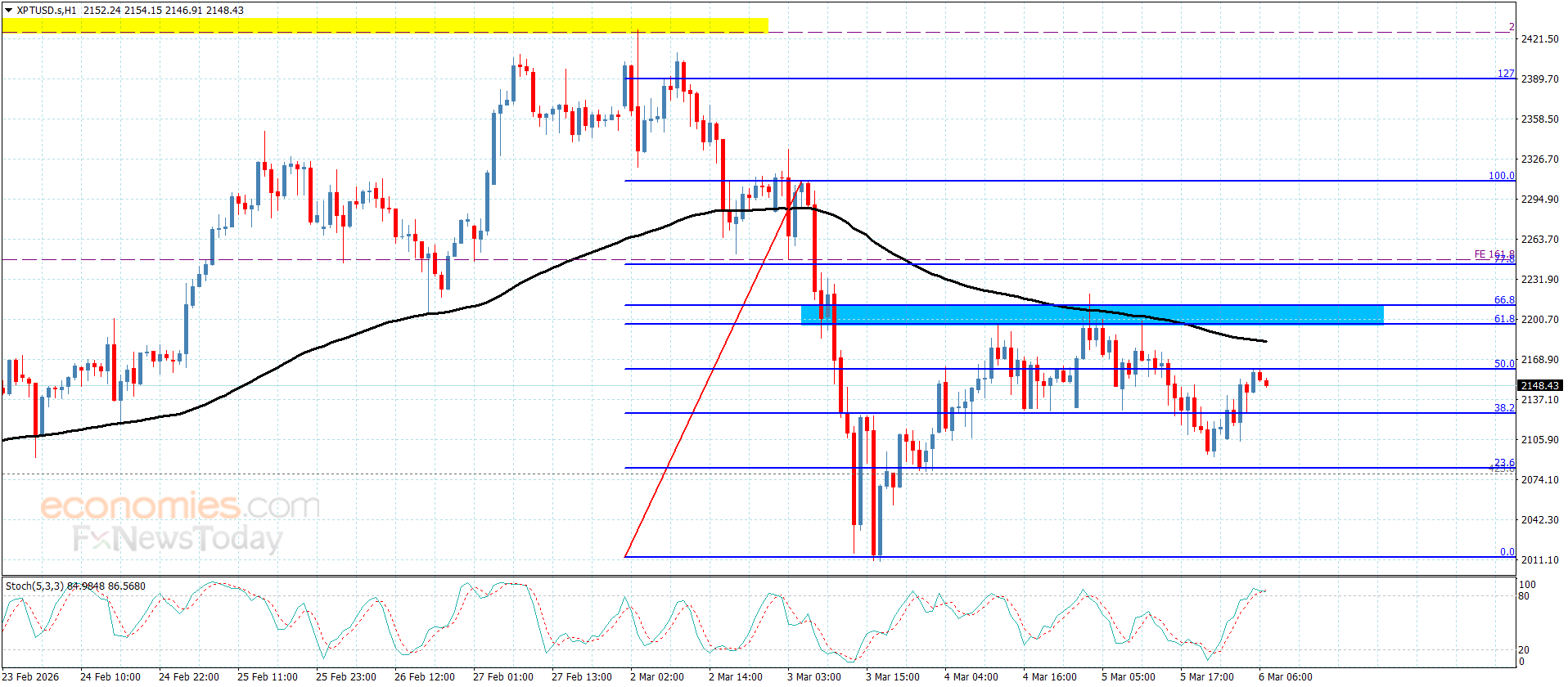

Copper at $5.80 and platinum at $2,125 are telling the opposite story. Both metals face real headwinds — a 300,000-tonne copper surplus, collapsing Chinese refined copper demand, falling platinum automotive consumption, and a wave of ETF profit-taking in platinum after its extraordinary January run. Neither metal is broken structurally. Copper’s decade-long bull case from 2029 to 2035 remains intact. Platinum’s supply deficit is real and persistent. But the next six months will test conviction before the long-term stories can reassert themselves.

Gold and Silver Prices Surge Today While Copper and Platinum Crash

Gold has gained over 100% in just 12 months. A year ago, the metal traded near $2,624 per ounce. By January 2026, it crossed $5,000 for the first time in history. It then hit an all-time intraday high of $5,589 before consolidating to today’s level of $5,090. That kind of sustained, directional move does not happen by accident. Multiple forces are converging simultaneously — and each one is reinforcing the others.

The most important driver is the collapse of trust in traditional safe-haven assets. The U.S. 10-year Treasury yield climbed to 4.10% — and yet gold surged past $5,400 at the same time. That used to be impossible. For decades, rising yields made non-yielding gold less attractive to investors. That relationship has broken down. Investors are no longer treating U.S. Treasuries as the ultimate store of value. Gold has taken that crown — and the shift appears structural, not cyclical.

Central banks are accelerating this trend. Global central bank gold purchases are running at levels not seen since 1967. J.P. Morgan forecasts central bank and investor demand to average 585 tonnes per quarter in 2026, with approximately 755 tonnes of purchases expected across the full year — still dramatically elevated compared to pre-2022 averages of 400 to 500 tonnes annually. Sovereign buyers across Asia, the Middle East, and Eastern Europe are actively rotating out of dollar-denominated reserve assets and into gold. The reason is clear: the risk of U.S. sanctions, SWIFT exclusions, and asset seizures has made gold the only truly neutral reserve asset left.

Geopolitics is providing the immediate catalyst. Military strikes involving U.S. and Israeli forces hit Iranian infrastructure on February 28, 2026. Fears over the Strait of Hormuz — the chokepoint for 20% of the world’s daily oil supply — triggered a massive safe-haven bid overnight. Gold surged. Silver followed. And neither metal has given back those gains in a meaningful way. J.P. Morgan’s analysts describe gold’s current move as a “rebasing higher” — not a speculative bubble, but a genuine revaluation of what gold is worth in a world where dollar hegemony is being actively questioned. Their year-end price target for gold in 2026 is $6,300 per ounce. If just 0.5% of all foreign-held U.S. assets rotated into gold, that single flow alone would push prices to $6,000 per ounce. BofA Securities carries a $6,000 target. Goldman Sachs sits at $5,400. The direction across Wall Street is unanimous — only the pace is debated.

Silver Price Hits $82.52 and Triples From Its 12-Month Low — Why Silver Is the Best-Performing Asset of 2026

Silver is the headline story that most mainstream financial media are underreporting. The metal traded at just $27.52 at its 12-month low. It touched $120 per ounce just weeks ago before a sharp pullback. Today it holds at $82.52 — meaning silver has effectively tripled from its floor in under a year. It rose 146% in 2025, making it the single best-performing major asset class globally — beating equities, bonds, crypto, and every other commodity. And its structural story for 2026 remains firmly intact.

Silver operates with a dual identity that no other metal shares. It is simultaneously a safe-haven precious metal and a critical industrial raw material — and both of those demand engines are firing right now. On the safe-haven side, silver tracks gold closely, amplifying its moves in both directions. When gold rallies 1%, silver tends to rally 2% to 3%. When gold sells off, silver falls harder. That leverage is exactly what sophisticated investors seek when they want high-beta precious metals exposure.

On the industrial side, silver’s demand fundamentals are secular, not cyclical. Every solar panel manufactured today contains approximately 20 grams of silver. The global solar industry alone consumes nearly 30% of total annual silver supply. Each electric vehicle uses between 25 and 50 grams of silver for wiring, sensors, and semiconductors. AI data centres require silver for advanced chip manufacturing. None of these demand streams are slowing. All of them are growing.

The supply picture makes this more urgent. The silver market has run a structural supply deficit for five consecutive years. Above-ground stockpiles are actively being drained to meet demand. Holders of physical silver are demanding higher prices to release inventory into the market — and that dynamic alone creates a structural floor under prices regardless of short-term speculative flows.

J.P. Morgan forecasts silver to average $81 per ounce across full-year 2026 — more than double its 2025 average. The bank acknowledges that the pace of the recent surge will likely trigger some substitution and thrifting in industrial applications, which could cap the absolute ceiling. But the structural deficit, the safe-haven bid, and the clean-energy demand story together create a powerful, multi-year case for silver that most retail investors are still underestimating.

Copper Price Falls to $5.80 Today — China Demand Slowdown and a 300,000-Tonne Surplus Are Crushing the Red Metal

Copper’s long-term story is one of the most compelling in all of commodities. AI data centres use up to 10 times the electrical load of traditional buildings. Green energy grids, electric vehicle charging infrastructure, and 5G networks all consume enormous quantities of copper. Goldman Sachs forecasts copper demand to overtake global supply from 2029 onwards, with the LME price potentially reaching $15,000 per metric tonne by 2035. The structural bull case is real.

But none of that matters today. Copper is falling today — and the reasons are specific, data-driven, and worth understanding clearly.

China is the single most important factor. China consumes nearly 60% of the world’s refined copper annually. When Chinese buyers slow down, the entire global copper market slows with them. China’s refined copper consumption fell approximately 8% year-on-year in Q4 2025 as the boost from government stimulus policies wore off and the country’s property sector remained structurally weak. Downstream demand in transport, construction, home appliances, and power equipment is not recovering at the pace that speculative copper longs had priced in.

Goldman Sachs has revised its 2026 copper market surplus estimate upward to 300,000 tonnes — nearly double its earlier forecast of 160,000 tonnes. High prices are simultaneously damping demand growth and incentivising greater scrap copper supply. Goldman’s analysts state plainly that the copper price has overshot its fundamental fair value, which they estimate at approximately $11,500 per metric tonne. The price needs a correction — and the catalyst is likely coming.

That catalyst is the U.S. tariff decision on refined copper, expected by mid-2026. American companies and traders have been stockpiling copper ahead of anticipated tariffs, with global tracked inventory above 970,000 tonnes as of February 2026 — the highest level since 2003. Once Washington announces its decision, the rationale for stockpiling disappears, inventory floods back into the market, and prices face acute downward pressure. Goldman Sachs’ year-end 2026 copper price target is $11,000 per metric tonne. J.P. Morgan sits at $12,075. Citi has a bull-case target of $15,000. The 40% spread between top Wall Street estimates on copper is itself a warning — this is not a market with clear near-term direction.

Platinum Price Crashes 27% From Its All-Time High — Why Automotive Demand and Investment Outflows Are Killing the Rally

Platinum hit $2,920 per ounce on January 26, 2026 — its highest price in nearly 15 years. Investors piled into the metal on a compelling story: three consecutive years of supply deficit, mine output at a five-year low of 5.51 million ounces, and strong momentum from safe-haven precious metals demand. The rally looked unstoppable. Six weeks later, platinum was trading at $2,000. Today it sits at $2,125. That is a 27% collapse from the peak — and understanding why it happened is critical for any investor holding or considering the metal.

The World Platinum Investment Council published its latest Platinum Quarterly on March 4, 2026 — just two days ago. Its key finding: a fourth consecutive year of platinum market deficit is expected in 2026, with the shortfall running at 240,000 ounces following a massive 1.1 million ounce deficit in 2025. That is structurally bullish. And in the long run, it will support prices. But the short-term demand picture tells a sharply different story.

Total platinum demand is forecast to contract 6% in 2026. The primary driver of that contraction is a 540,000-ounce swing in non-bar-and-coin investment demand as tariff-related uncertainty eases and ETF investors take profits. Warehouse stocks that had been drawn down aggressively in 2025 are now rebuilding — removing the physical supply urgency that justified last year’s premium pricing.

Automotive demand — platinum’s single largest end-use market — is forecast to fall another 3% to 2.915 million ounces in 2026. The reason is structural: battery-electric vehicles do not require catalytic converters, which are the primary industrial application for platinum in internal combustion engine cars. As EV adoption accelerates globally, platinum’s automotive demand base shrinks year after year. Over 70% of global platinum mine supply comes from South Africa, making the metal vulnerable to rand strength, labour disputes, and energy cost inflation — all of which compress margins and occasionally disrupt supply, but not enough to offset weakening demand.

Platinum is fundamentally not a monetary metal. It does not carry gold’s 5,000-year history as a store of value. It does not benefit from silver’s dual industrial-precious identity. When geopolitical fear spikes, investors choose gold first, silver second, and platinum only if specific conditions align. Right now, those conditions — a simultaneous safe-haven bid and robust automotive demand — are not both present. Until they are, platinum will struggle to reclaim its January highs.

Gold Forecast $6,300, Silver at $81, Copper at $11,000 — What Goldman Sachs, J.P. Morgan, and BofA Are Predicting

The divergence in Wall Street forecasts for gold, silver, copper, and platinum is as instructive as the current price action itself.

On gold, the consensus is unusually unified in direction, differing only in magnitude. J.P. Morgan carries the most bullish target at $6,300 per ounce by year-end 2026, driven by central bank accumulation, Federal Reserve rate cuts, and de-dollarisation flows. Goldman Sachs sits at $5,400, acknowledging that gold’s break above historic yield-correlation limits represents a genuine regime change. BofA Securities has a $6,000 target but flags growing volatility as a risk to the upside timeline. Across all three major institutions, the directional call is identical: gold moves higher from here.

On silver, J.P. Morgan forecasts a full-year 2026 average of $81 per ounce — more than double its 2025 average. The bank identifies the five-year structural deficit and clean-energy industrial demand as the primary pillars of the bull case. It cautions that extremely high prices will eventually trigger substitution effects in industrial applications, which will act as a natural ceiling — but does not see that ceiling being tested until prices sustain significantly above current levels.

On copper, Goldman Sachs forecasts an LME average of $10,710 per metric tonne in H1 2026, drifting toward $11,000 by year-end before the long-term structural bull market reasserts from 2029 onwards. J.P. Morgan is more constructive at $12,075 for the full year. Both banks agree on the long-term thesis — copper scarcity is coming — but disagree sharply on the path between now and then. The U.S. tariff announcement on refined copper is the single most important near-term catalyst to watch.

On platinum, the World Platinum Investment Council’s CEO Trevor Raymond states that the key drivers of platinum’s 2025 rally — supply-demand tightness, depletion of above-ground stocks, and macropolitical safe-haven demand — are expected to persist through 2026. That is a cautiously optimistic read from the industry’s own research body. But it also signals that platinum needs very specific conditions — sustained trade tension, continued central bank precious metals buying, and stabilising automotive demand — to retest its January 2026 highs. LiteFinance forecasts a wide range of $1,833 to $3,171 for platinum in 2026 — an unusually large band that honestly reflects how binary and conditional the outlook remains.