Brazil Nutraceuticals Market Size | Industry Report, 2033

Brazil Nutraceuticals Market Summary

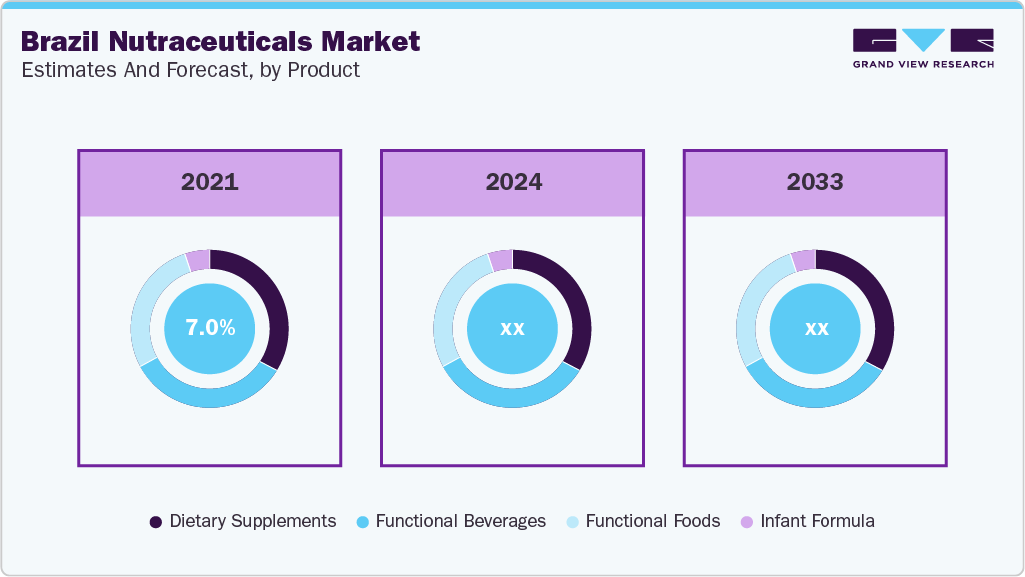

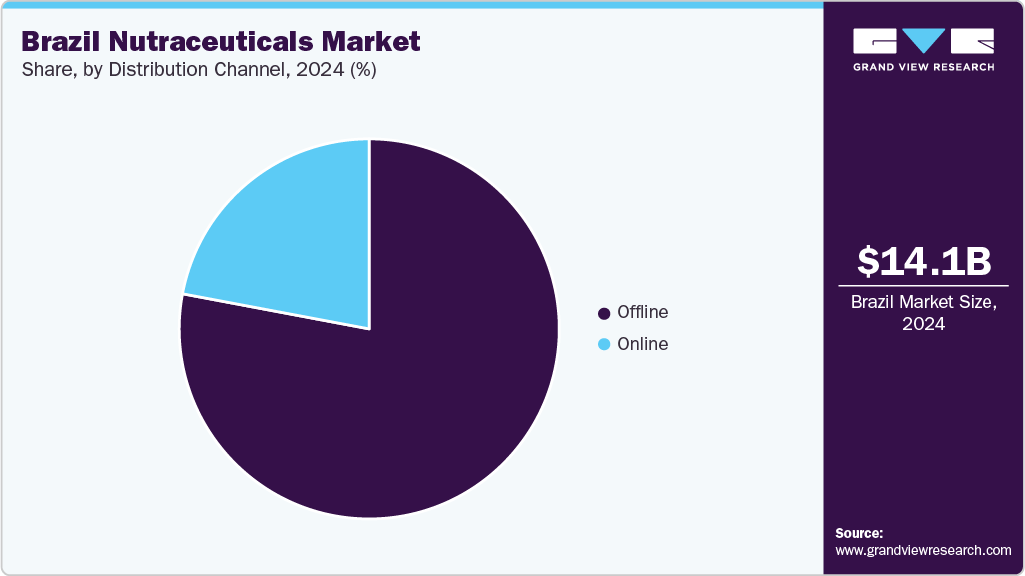

The Brazil nutraceuticals market size was estimated at USD 14.08 billion in 2024 and is projected to reach USD 29.82 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The market is experiencing steady growth, driven by an aging population, rising health awareness, and a growing middle class with increased disposable income.

Key Market Trends & Insights

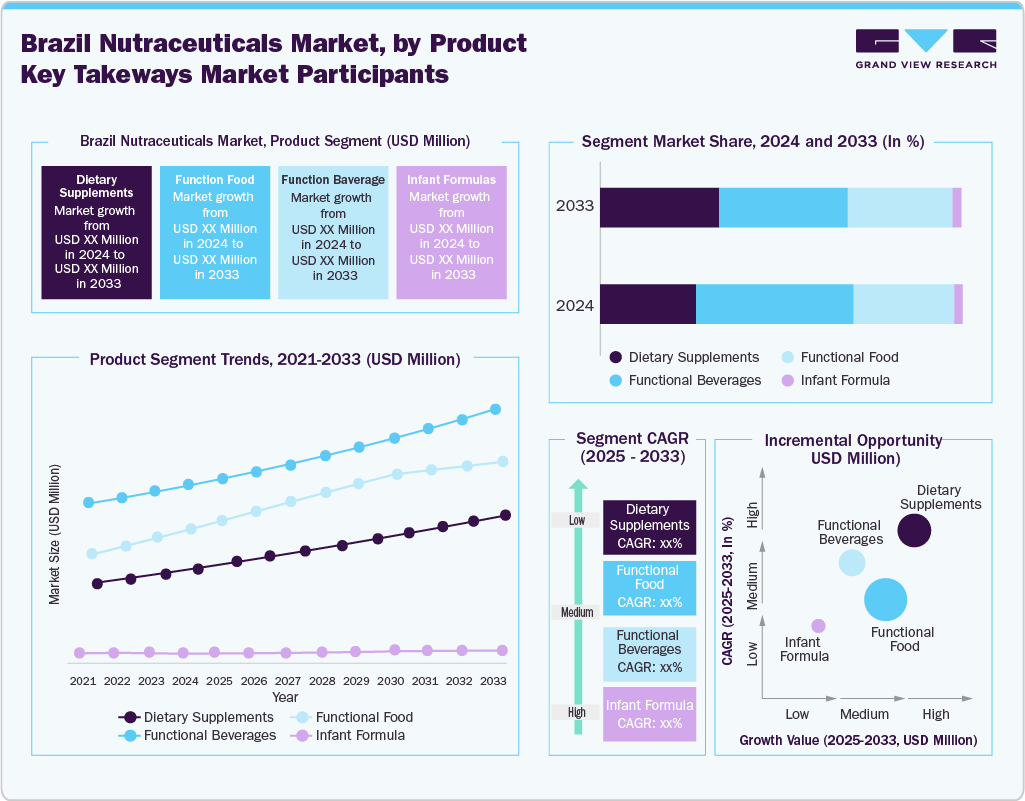

- By product, the functional food segment held the highest market share of 32.8% in 2024.

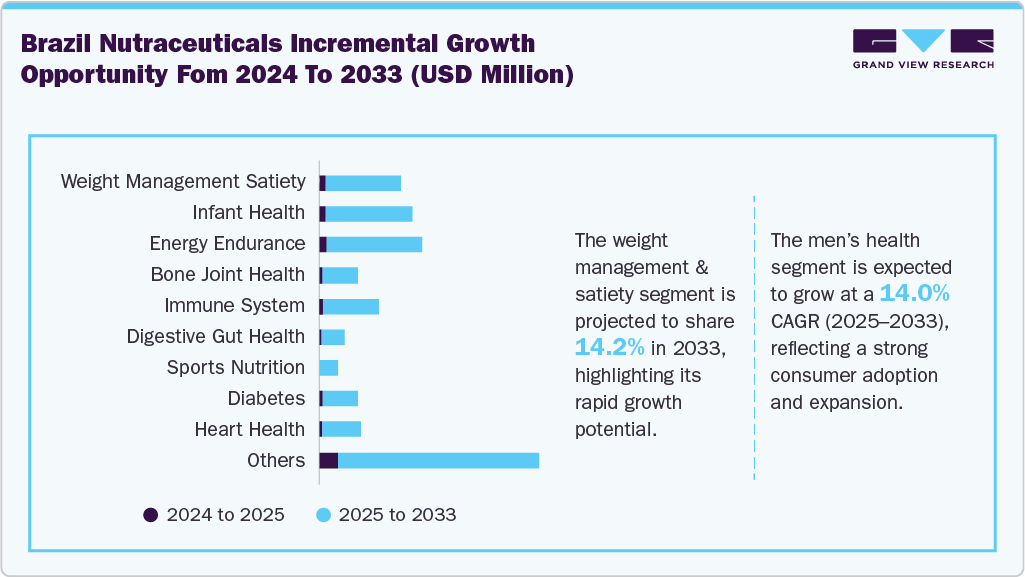

- Based on application, the weight management & satiety segment held the highest market share of 17.2% in 2024.

- By distribution channel, the offline segment held the highest market share of 79.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.08 Billion

- 2033 Projected Market Size: USD 29.82 Billion

- CAGR (2025-2033): 8.7%

Consumers are increasingly turning to supplements for preventive healthcare, particularly to manage chronic conditions such as obesity and diabetes. Post-pandemic, there is heightened demand for immunity-boosting and natural products, including those featuring native superfoods such as acai and guarana. E-commerce and influencer marketing are further accelerating market expansion, especially among younger demographics. Moreover, regulatory clarity from ANVISA has boosted industry confidence and encouraged innovation.

In addition to demographic and health-driven factors, Brazil’s abundant biodiversity plays a crucial role in supporting the nutraceuticals market. The country’s vast natural resources enable the development of unique, plant-based products that appeal to both local consumers and international buyers seeking clean-label, functional products.

Consumer Insights

In Brazil, people’s choices around supplements vary a lot depending on their age and income. Older adults usually look for products that help with immunity, joint issues, and heart health, and they tend to trust recommendations from pharmacists. People in their 30s and 40s are more focused on staying energized, aging well, and managing stress, and many of them prefer easy-to-use formats such as powders or drinks. Younger adults, especially those in their 20s, are big on fitness, skin health, and convenience, often choosing gummies or energy shots they see promoted on social media. While wealthier consumers are willing to pay more for personalized or organic products, budget-conscious shoppers usually go for bundle deals or local brands that offer good value.

Probiotics are becoming more popular, especially with women in cities, thanks to growing awareness around gut health and immunity. Collagen, especially when combined with vitamin C or hyaluronic acid, is trending among women focused on beauty, with drinkable formats in high demand.

Product Insights

The dietary supplements segment dominated the Brazil nutraceuticals market and accounted for a revenue share of 32.8% in 2024. Growth of this segment is primarily driven by growing public interest in wellness and preventive health. With lifestyle-related conditions such as obesity, diabetes, and stress becoming more common, many Brazilians are turning to vitamins, minerals, and herbal supplements to stay ahead of chronic illnesses. This shift is especially noticeable among urban, health-conscious consumers who view supplements as part of a daily routine rather than a temporary fix.

The functional beverages segment is anticipated to experience the fastest CAGR of 10.0% during the forecast period. This segment is experiencing rapid growth as more consumers look for convenient ways to stay healthy on the go. Urban lifestyles, increased gym culture, and growing concern over chronic conditions such as diabetes and obesity are pushing demand for drinks that support immunity, digestion, hydration, or energy. Products such as kombucha, protein waters, and vitamin-fortified juices are gaining traction, especially among younger demographics in major cities.

Application Insights

The weight management & satiety segment dominated the Brazilian dietary supplements market in 2024. Rising obesity rates and growing public interest in preventive health drive growth. Consumers are increasingly drawn to natural ingredients such as glucomannan, guar gum, green tea extract, and Garcinia cambogia, which help suppress appetite and promote fullness. Functional foods and supplements that support satiety, such as fiber-rich powders, high-protein shakes, and metabolism-boosting capsules, are gaining ground across pharmacies and online platforms. Urban professionals and fitness-focused consumers especially favor these products for managing weight without relying on drastic diets. In April 2025, specialty‐ingredient distributor Barentz Brazil presented solutions focused on weight-control and satiety at the NIS 2025. Presentation highlighted Soluble Fiber Nutriose and Nutralys Pea Protein supporting weight control and satiety.

Based on application, the men’s health segment is expected to grow at the fastest CAGR from 2025 to 2033. This segment is expanding steadily, driven by increased awareness of male-specific health concerns such as testosterone support, prostate function, and metabolic health. Younger men are turning to supplements for muscle gain and energy, while older demographics seek support for vitality and chronic condition management. Popular products include protein powders, amino acids, omega-3s, and plant-based testosterone boosters. The country’s strong fitness culture and widespread use of digital wellness platforms have also amplified demand.

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. Major pharmacy chains such as Raia Drogasil, Pague Menos, and DPSP are instrumental in providing consumer trust through face-to-face guidance and convenient access. Many Brazilians still prefer purchasing supplements in person, valuing pharmacist recommendations and product visibility. Supermarkets such as Carrefour and DIA also contribute significantly, offering functional foods and supplements alongside routine groceries. This physical retail presence is especially important for older consumers and those less active online, reinforcing brand credibility and boosting impulse purchases.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2033. In Brazil, the digital channel is becoming a key driver for the nutraceutical market as consumers increasingly prefer the convenience, breadth of choice, and home-delivery option offered by online platforms. These channels are especially attractive for urban, tech-savvy shoppers who seek functional foods and dietary supplements for weight management, men’s health, and other wellness purposes.

Key Companies & Market Share Insights

Some of the key companies operating in Brazil dietary supplements industry include Amway, Haleon plc, GSK plc., Yakult S/A Indústria e Comércio, and others.

- Amway is a leading player through its Nutrilite brand, supported by a certified-organic acerola farm in Ubajara, Ceará, which serves as a key global supply source. The farm cultivates vitamin C-rich botanicals using sustainable, traceable farming methods.

Key Brazil Nutraceuticals Companies:

- Amway

- Haleon plc

- GSK plc.

- Yakult S/A Indústria e Comércio

- The Kraft Heinz Company

Recent Developments

- In April 2024, MuscleTech entered a manufacturing and marketing agreement with Brazil-based Trust Group to produce Brazil-specific SKUs, including male-performance oriented products (e.g., NitroTech, Creatine Chews) in-country. This expansion underlines men-oriented supplement demand in Brazil.

Brazil Dietary Supplements Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 15.30 billion

|

|

Revenue forecast in 2033

|

USD 29.82 billion

|

|

Growth rate

|

CAGR of 8.7% from 2025 to 2033

|

|

Actuals

|

2021 – 2024

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, application, distribution channel

|

|

Key companies profiled

|

Amway; Haleon plc; GSK plc.; Yakult S/A Indústria e Comércio; The Kraft Heinz Company

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Brazil Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Brazil nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Dietary Supplements

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Functional Food

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

Infant Formula

-

-

-

Application Outlook (Revenue, USD Million, 2021 – 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

Source link

Share this article: