Category: Forex News, News

Crude Oil News Today: Fed Concerns Weigh Despite Robust US Fuel Demand

Benchmark Price Performance

Brent crude futures settled at their lowest level since February, while U.S. crude futures hit a three-month low on Thursday. Brent futures are heading for a weekly decline of over 3%, and WTI futures are poised for nearly a 4% drop from last week. The anticipation of ‘higher-for-longer rates’ has put significant pressure on oil prices this week.

Federal Reserve’s Influence

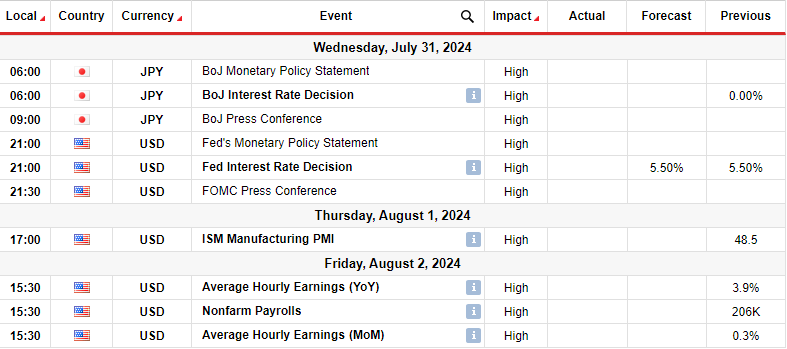

Minutes from the Fed’s latest policy meeting, released on Wednesday, showed policymakers debating whether current interest rates are sufficient to control inflation. Some officials expressed willingness to increase borrowing costs if inflation rises further. However, Fed Chair Jerome Powell and others have indicated that further rate hikes are unlikely. Higher rates could slow economic growth and reduce fuel demand.

U.S. Fuel Demand

Strengthening U.S. gasoline demand ahead of the Memorial Day holiday weekend has helped stabilize prices. The Energy Information Administration (EIA) reported that gasoline demand reached its highest level since November. This seasonal uptick is significant as U.S. drivers represent about a tenth of global oil demand, making the summer driving season a crucial factor for global demand recovery, according to ANZ analysts.

OPEC+ Meeting

Attention is now on OPEC+ and their upcoming meeting to decide on extending voluntary oil output cuts of 2.2 million barrels per day (bpd). The meeting, initially scheduled for June 1 in Vienna, has been moved online to June 2. OPEC+ has implemented cuts totaling 5.86 million bpd since late 2022, equivalent to about 5.7% of daily global demand. Sources suggest an extension of these cuts is likely, despite rising output from the U.S. and other non-member producers.

Market Forecast

Considering the economic backdrop and supply decisions, the market outlook is bearish. While the firm U.S. gasoline demand offers some support, the persistent concerns over interest rates and potential further Fed actions are likely to weigh on prices. Traders should prepare for further declines in the short term, influenced by macroeconomic constraints and OPEC+ decisions.

Technical Analysis

Source link

Discover more from BIPNs

Subscribe to get the latest posts sent to your email.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article:

Discover more from BIPNs

Subscribe to get the latest posts sent to your email.