The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

XRP has spent the past few weeks trading in a tight zone as investors wait for the SEC’s ETF ruling. Many traders are asking if the latest XRP price prediction calling for a $5 breakout can hold. At the same time, a new presale project called Layer Brett has stolen the spotlight. Analysts now say the 50x return potential from Layer Brett could make it a better bet than XRP in the near term. Read on to see why.

Market watchers are pointing to Layer Brett as the next big token on Ethereum. It is a Layer 2 meme project built with speed, low fees, and real staking rewards. Unlike the first Brett coin on Base, this version is backed by actual scaling power. Analysts call it “the meme with real utility.”

The presale has already broken early records. Thousands of wallets joined within days, and funds raised have surged past expectations. This activity has prompted traders to draw comparisons with early-stage runs of coins like PEPE.

Only this time, Layer Brett introduces token rewards and community staking at rates as high as 850% APY, a significant reduction from the 20,000% APY enjoyed by early stakers.

Analysts expect a 50x ROI once the presale ends and exchange listings go live. He pointed to Ethereum gas fees being cut to pennies as the game-changer that could make Layer Brett stand out. It’s currently available for $0.0055 in presale.

XRP has a loyal base, and the current XRP price prediction from many analysts calls for a run to $5 if the bull flag plays out. The token trades around $2.90, holding above the $2.70 zone that has acted as strong support.

Analysts like Eric Balchunas from Bloomberg say an XRP ETF approval is almost inevitable by November, with odds near 95%. If the ETF is approved, XRP could see inflows from significant funds, pushing the price toward $10–$20 in the medium term. Some traders even talk about $50 if BlackRock enters.

Still, risks remain. XRP has seen a decline in on-chain activity, with active addresses dropping from 50,000 to around 19,000. Futures open interest also fell from $11 billion to $7.5 billion, indicating reduced speculative activity. Technical charts highlight a descending triangle that could break down if $2.70 fails. If that happens, XRP could test $2 or lower before any rebound.

While XRP depends on the SEC’s decision and long-term institutional flows, Layer Brett is already rewarding early participants. It offers simple entry through MetaMask or Trust Wallet with ETH, USDT, or BNB.

Buyers can instantly stake tokens for outsized rewards, and the low presale price creates substantial upside. Ethereum Layer 2 solutions are forecast to handle over $10 trillion annually by 2027.

Layer Brett fits into this trend while also drawing power from meme culture. That mix of utility and community hype gives it an edge that XRP does not currently have. Analyst Nate Geraci of ETF Store says ETF approvals will open doors for XRP, but he also admits the growth may take years.

XRP has a path to $5 or even higher, but it is tied to heavy regulatory and market decisions outside of investor control. The latest XRP price prediction highlights the upside, yet risks remain if support levels fail. Layer Brett, however, is offering early access to a new Layer 2 token with speed, low fees, and staking rewards that XRP cannot match.

Layer Brett is still in its presale stages—but not for long. Don’t miss the opportunity to get in early on the most scalable meme project to ever launch on Ethereum.

Presale: LayerBrett | Fast & Rewarding Layer 2 Blockchain

Telegram: View @layerbrett

X: Layer Brett (@LayerBrett) / X

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

The race for the best crypto to buy now has intensified this September as Solana continues a steady climb and new altcoins enter the spotlight.

Solana price predictions point to bullish momentum, yet it is Remittix that is stealing headlines as the PayFi challenger tipped for a faster breakout.

The urgency is clear. Investors are watching closely and those who hesitate risk missing one of the most explosive opportunities of 2025.

Solana is trading around $207 and is strong enough to indicate that it will push to an upside of $213.62 by the month end. This is viewed by market analysts as a sign of strength in a fluctuating market and they believe that it will be able to stand its ground even should short-term shocks occur.

Solana price predictions suggest that the token will remain between $205 and $213 in the coming weeks, underpinned by developer expansion and rising transaction volume. It is well positioned for steady gains, but investors searching for truly life-changing returns are already looking beyond Solana toward disruptive PayFi players promising rapid acceleration.

Remittix is not a speculative token. It is a utility-driven project that is already redefining how global payments work. Designed to let users send crypto and deliver fiat instantly into bank accounts across more than 30 countries, it tackles one of the biggest bottlenecks in finance.

This is not hype without substance. Remittix has sold over 645 million tokens at $0.103 and raised more than $24 million. The first centralized exchange listing on BitMart was secured after surpassing $20 million, while the second on LBank followed after the $22 million milestone.

A third listing is being prepared and the wallet beta launch arrives in Q3 2025. Every catalyst is locked in, and early investors are running out of time.

Why Remittix is building momentum now:

Solana price predictions highlight a path of gradual strength, but the breakout narrative belongs to Remittix. It is rare to find a crypto project that delivers both real-world adoption and clear profit catalysts in one package. With listings secured, a wallet launch imminent and investor demand surging, Remittix looks set to outpace traditional altcoins.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Dogecoin continues to dominate headlines with fresh accumulation signals, while Hedera (HBAR) struggles to break out of its sideways trading zone. Both tokens remain in focus as traders look for catalysts heading into the final stretch of the year.

Yet, growing buzz around Remittix, a new altcoin with real-world payment utility, has many calling it the best crypto to buy now for a potential 10x multiplier.

Dogecoin is gaining momentum as capital flows shift in its favor, with traders eyeing the DOGE Price today as it consolidates under resistance. A steady rise in short-term holder supply shows retail investors are accumulating, a signal that has historically triggered explosive Dogecoin rallies. The DOGE News cycle has also been buzzing with anticipation of a Dogecoin ETF, with approval odds climbing across prediction markets.

Analysts now point to an expanding wedge pattern that could drive the Dogecoin Price Prediction as high as $1.40 before year-end. With speculation heating up, the Dogecoin Price could benefit from both accumulation trends and institutional products, making it one of the most-watched tokens in the market right now.

Hedera Hashgraph is stuck in a tight range, with the HBAR Price today hovering near $0.2202 after weeks of sideways trading. Resistance at $0.2237 has capped upside attempts, while $0.2109 remains the key floor. Market signals point to indecision, as the RSI sits near neutral and volatility measures keep shrinking. This lack of conviction leaves traders waiting for a breakout.

If buying demand accelerates, the HBAR Price Prediction points toward $0.2368 in the short term. A drop below support, however, could send the Hedera Price toward $0.1945. The current setup highlights how the market is in balance, with neither bulls nor bears taking control. For now, HBAR News centers on whether catalysts can push the Hedera Price Prediction higher.

Remittix is winning attention as traders look beyond hype-driven tokens like PEPE and Pi Network. Priced at just $0.1050, RTX has raised more than $24.6 million while selling over 652 million tokens, showing strong investor conviction.

Remittix offers a PayFi solution that lets users convert crypto into fiat instantly, making it one of the best cryptos to buy now for utility and growth. Its upcoming CEX listings and wallet beta launch add momentum that Dogecoin and Hedera holders are closely watching.

With real adoption at its core, Remittix is emerging as a 10x contender for investors seeking value and long-term potential.

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article is not intended as financial advice. Educational purposes only.

Cardano hovers near $0.83, pressing against a key breakout level at $0.84 as participants anticipate its next decisive move.

Cardano is currently trading at $0.83, up 1.20% in the last 24 hours, as momentum slowly starts to build around the altcoin. After weeks of consolidation, ADA is showing signs of strength, with participants watching closely for a breakout setup that could set the tone for its next major move.

Cardano price is trading around $0.83, up 1.94% in the last 24 hours. Source: Brave New Coin

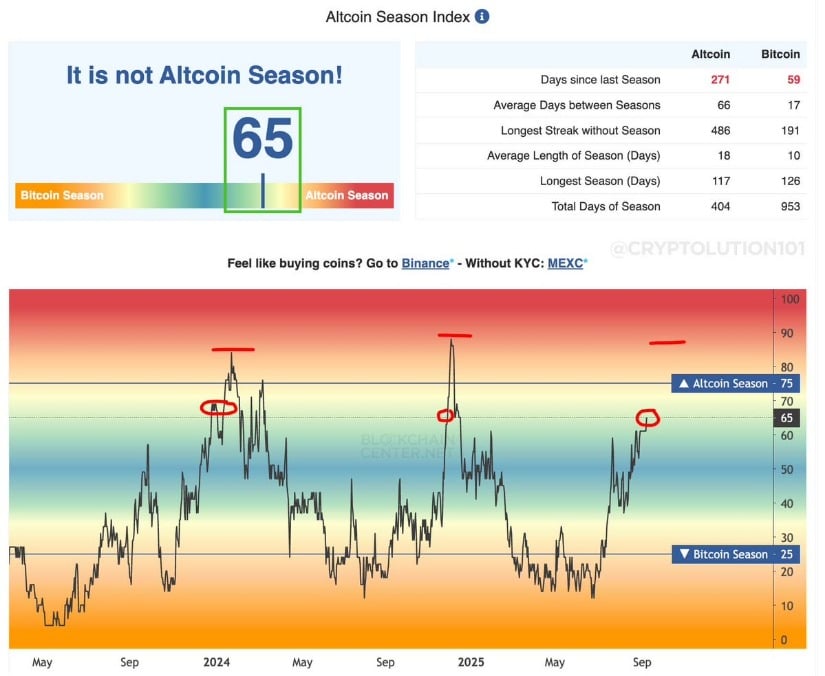

The Altcoin Season Index is climbing toward the critical threshold, currently sitting at 65, suggesting the market may soon move into a true altseason phase. Historically, this level has acted as a precursor for capital rotation out of Bitcoin and into alternative assets. Cardano, with its consistent developer activity and long-term community support, stands out as one of the coins that could capture significant inflows once this rotation gains pace.

Cardano eyes altseason momentum as the index nears a critical threshold, positioning it among top Layer 1 contenders. Source: Raphael Turcios via X

For ADA, the timing is particularly important. After months of consolidation and steady upgrades to its ecosystem, the coin is well-positioned to benefit from a wave of renewed interest in altcoins. If the index continues pushing towards the upper zone above 75, it could set the stage for broader momentum across major Layer 1 assets, with Cardano likely to be one of the prime beneficiaries.

Cardano is trading around $0.83, holding firm above the 50-week SMA near $0.74 and building a base for a potential breakout. The chart structure shows that ADA has a serious chance of targeting the $1.25 and $1.50 resistance levels if momentum continues to build. Both levels have acted as key rejection points in the past, and reclaiming them would mark a shift in sentiment after months of consolidation.

ADA holds steady above key support, with analysts eyeing $1.25 and $1.50 targets as September’s macro decisions approach. Source: Ssebi via X

Analyst Ssebi notes that factors such as possible rate cuts and ETF developments could provide the push ADA needs to move higher. With the RSI sitting around 53, there’s still room for upside before conditions become overheated, leaving space for a sustained rally.

Cardano has now managed to push above the 7, 25, and 99-week moving averages, a technical alignment that hasn’t been seen since its last major cycle run. This kind of structure often signals that momentum is shifting in favor of the bulls.

ADA flips above the 7, 25, and 99-week moving averages, signaling bullish momentum not seen since its last major cycle run. Source: TapTools via X

Trading above all three layers suggests that ADA is beginning to establish a stronger floor, reducing the downside risk that has dominated in past months.

TapTools highlights how this flip across multiple moving averages could serve as an early indication of broader trend continuation. Historically, ADA’s most explosive moves have come after clearing the 99-week MA, as it tends to act as the line between extended bearish phases and fresh bullish legs.

Despite all the bullish developments, $0.84 remains the key level to confirm a true breakout for Cardano. Price is compressing inside a falling wedge, and the upper wedge boundary currently intersects near $0.84. A clean move and close above that line would flip the pattern and signal a shift from corrective action to trend continuation.

Cardano ADA faces a decisive test at $0.84, with a breakout above the falling wedge seen as the trigger for a move towards $0.90–$0.95. Source: Ali Martinez via X

As Ali Martinez highlights, a decisive break of the wedge top around $0.84 would open room towards $0.90 to $0.95 area. If bulls can reclaim and hold above the breakout level, it would neatly align with ADA’s recent moving-average flips and the broader altseason backdrop, turning $0.84 from ceiling into support.

Cardano is at an important turning point, where technicals and market sentiment are starting to align in its favor. The break above long-term moving averages, combined with the broader setup of a falling wedge, shows that momentum is quietly building under the surface.

If buyers manage to flip $0.84 into support, it would not only confirm the breakout but also strengthen the case for ADA pushing towards $0.90 and beyond. In a market leaning towards altseason, this type of confirmation could act as the spark that shifts Cardano back into the spotlight.

XRP price climbed 4.15% to $3.02 today

(Tuesday), September 9, 2025, marking its third consecutive session of gains

and pushing the cryptocurrency back above the psychologically important $3.00 level.

The surge comes as Federal Reserve (Fed) rate cut expectations hit 99%

probability and Ripple announced an expanded custody partnership with

Spanish banking giant BBVA.

In this

article, I address the question of why the XRP price is surging and provide a

technical analysis of the XRP/USDT chart, which suggests that current XRP price

predictions are pointing to a potential increase of more than 50 percent.

During

Tuesday’s session, XRP extended its upward correction and broke through the

psychological level of $3. XRP’s 4.15% daily gain significantly outpaced other

major cryptocurrencies, with only Cardano posting stronger performance at 5.4%.

The cryptocurrency has recovered 7.5% from Sunday’s lows, adding over 21 cents

to its value during the three-day rally.

Current

market capitalization stands at approximately $178 billion, with 24-hour

trading volume reaching $6.78 billion across major exchanges. The token

maintains its position as the fourth-largest cryptocurrency by market cap, with

59.6 billion XRP in circulation from a maximum supply of 100 billion tokens.

XRP price today. Source: CoinMarketCap

The primary

catalyst behind XRP’s surge stems from overwhelming market expectations that

the Federal Reserve will cut interest rates at its September 16-17

meeting. Fed futures now indicate a 99% probability of at least a 25-basis

point rate cut, with some analysts predicting a more aggressive 50-basis point

reduction following weak August employment data.

This

monetary policy shift benefits cryptocurrencies like XRP as lower interest

rates typically weaken the U.S. dollar and drive investors toward riskier

assets. The prospect of cheaper money has sparked institutional interest across

the crypto sector, with XRP outperforming major competitors including Bitcoin,

Ethereum, and Dogecoin during Tuesday’s trading session.

Cassie Craddock, Ripple’s managing director for Europe

Adding to

the bullish momentum, Ripple announced it will provide digital asset custody

technology to BBVA for Spanish retail clients, extending their existing

partnerships in Switzerland and Turkey. The expanded collaboration allows BBVA

to offer end-to-end custody services for Bitcoin and Ethereum trading

under the European Union’s Markets in Crypto Assets (MiCA) regulation

framework.

“Now

that MiCA is established, the region’s banks are emboldened to launch the

digital asset offerings that their customers are asking for,” said Cassie

Craddock, Ripple’s managing director for Europe.

This

institutional adoption represents a significant validation of Ripple ‘s

technology infrastructure and could signal broader banking sector acceptance of

cryptocurrency services.

From my

technical analysis perspective, XRP has successfully reclaimed the 50-day

exponential moving average (50 EMA) and broken above the $2.96-$3.00

resistance zone, which was reinforced by the 38.2% Fibonacci retracement level

measured from June lows to July highs near $3.65. This breakthrough opens the

path for testing local August highs around $3.30 and potentially the

year’s peak levels starting from $3.60.

Trading

volume spiked to 159.63 million, nearly three times daily averages,

confirming institutional participation in the breakout. The RSI remains in

neutral-to-bullish territory in the mid-50s, while the MACD histogram

is converging toward a bullish crossover, indicating accumulation patterns.

Current upside

potential exceeds 21% to the $3.30 level.

XRP/USDT technical analysis. Source: Tradingview.com

Moreover, the

breakout above the July downtrend line potentially triggers a measured move from

the three-month flag formation that could target $4.70 –

representing additional gains of over 55%.

The flag

pattern had been forming since the June lows, and within the current triangle,

XRP had less and less room to move. Ultimately, it broke to the upside, which

in my view opens the way for bulls to drive a significant rally from the local

lows we are now observing.

Market

analysts are also increasingly optimistic about XRP’s trajectory. Paul

Howard from Wincent noted that “XRP is now just 18% off its all time

high. The team has built an impressive crypto cohort the last 9 months with

acquisitions, corporate adoption and regulatory movements that add credibility

to the token.”

How high can XRP price go? Source: Tradingview.com

Paul Howard, Wincent

Howard

emphasized that while the short-term outlook shows range-bound trading,

“XRP likely to outperform and break the $3.00 technical line given its

volatility over BTC.” The analyst highlighted XRP’s superior performance

relative to Bitcoin’s more constrained trading range.

Others

also read: XRP Price Could

Reach $8 in 2025, According to Latest XRP/USDT Technical Prediction

The

cryptocurrency market is experiencing significant institutional momentum that

extends beyond XRP. Bitcoin ETFs recorded $246 million in net inflows during

early September 2025, driven by BlackRock’s iShares Bitcoin Trust

absorbing $434.3 million and Fidelity’s FBTC adding $25.1

million.

Bitcoin’s

illiquid supply has climbed to a record 14.3 million BTC, with Ryan Lee,

Chief Analyst at Bitget, noting that “more than 70 percent of coins now in

wallets with little spending history, confidence in Bitcoin’s long-term value

remains evident.” This supply tightening “not only reinforces the

asset’s role as a store of value but also heightens the potential for sharp

moves as demand persists”.

Lee expects

Bitcoin to stabilize and regain upward momentum, with a target range of

$105,000 to $118,000 supported by sustained institutional inflows and

bullish technical signals. This broader crypto market strength provides a

supportive backdrop for XRP’s rally.

Despite

increased exchange reserves reaching 12-month peaks, sophisticated investors

continue accumulating XRP. Whale wallets reportedly accumulated 10 million

XRP in just 15 minutes during Tuesday’s breakout, while broader whale

holdings increased by 340 million tokens over recent weeks.

This

divergence between short-term selling pressure from exchange inflows and

long-term accumulation by large holders suggests different time horizons among

market participants. The whale buying activity totaling $700 million in

recent transfers has sparked speculation about institutional positioning ahead

of potential XRP ETF approvals in October.

Looking

ahead, traders are monitoring several critical factors that could influence

XRP’s trajectory. The $2.99-$3.00 resistance zone that was repeatedly

rejected in recent sessions has now become potential support, while the next

major resistance lies at $3.30-$3.50.

Six XRP ETF

applications currently under SEC review for October decisions represent a

structural catalyst that could transform institutional access and demand

dynamics. Combined with the Federal Reserve’s anticipated rate cut and

continued banking partnerships, these fundamentals support the technical

breakout scenario.

However,

risks remain if the cryptocurrency fails to maintain momentum above $3.00, with

key support levels at $2.88-$2.89 where buying interest has

consistently emerged during recent corrections.

XRP is

surging due to 99% probability Federal Reserve rate cut expectations and

Ripple’s expanded digital asset custody partnership with BBVA in Spain.

The combination of dovish monetary policy and institutional banking adoption is

driving demand across cryptocurrency markets.

Technical

analysis suggests XRP could reach $4.70 if it completes the

three-month flag formation breakout, representing 55% upside potential.

Conservative predictions target $3.30-$3.60 resistance levels, while

bullish forecasts from analysts like Standard Chartered project $5.50-$15.00 by

year-end depending on ETF approvals and institutional adoption.

Key drivers

include institutional partnerships with banks like BBVA, potential XRP

ETF approvals in October 2025, Federal Reserve rate cuts, and whale

accumulation patterns. Technical breakouts above $3.00 combined with regulatory

clarity are supporting higher price targets.

XRP’s

primary advantage lies in cross-border payment utility and institutional

banking adoption. With 3-5 second settlement times and minimal

transaction fees, XRP serves as a bridge currency for financial institutions.

Recent partnerships with major banks and potential Amazon and Uber

adoption distinguish it from speculative altcoins.

XRP price climbed 4.15% to $3.02 today

(Tuesday), September 9, 2025, marking its third consecutive session of gains

and pushing the cryptocurrency back above the psychologically important $3.00 level.

The surge comes as Federal Reserve (Fed) rate cut expectations hit 99%

probability and Ripple announced an expanded custody partnership with

Spanish banking giant BBVA.

In this

article, I address the question of why the XRP price is surging and provide a

technical analysis of the XRP/USDT chart, which suggests that current XRP price

predictions are pointing to a potential increase of more than 50 percent.

During

Tuesday’s session, XRP extended its upward correction and broke through the

psychological level of $3. XRP’s 4.15% daily gain significantly outpaced other

major cryptocurrencies, with only Cardano posting stronger performance at 5.4%.

The cryptocurrency has recovered 7.5% from Sunday’s lows, adding over 21 cents

to its value during the three-day rally.

Current

market capitalization stands at approximately $178 billion, with 24-hour

trading volume reaching $6.78 billion across major exchanges. The token

maintains its position as the fourth-largest cryptocurrency by market cap, with

59.6 billion XRP in circulation from a maximum supply of 100 billion tokens.

XRP price today. Source: CoinMarketCap

The primary

catalyst behind XRP’s surge stems from overwhelming market expectations that

the Federal Reserve will cut interest rates at its September 16-17

meeting. Fed futures now indicate a 99% probability of at least a 25-basis

point rate cut, with some analysts predicting a more aggressive 50-basis point

reduction following weak August employment data.

This

monetary policy shift benefits cryptocurrencies like XRP as lower interest

rates typically weaken the U.S. dollar and drive investors toward riskier

assets. The prospect of cheaper money has sparked institutional interest across

the crypto sector, with XRP outperforming major competitors including Bitcoin,

Ethereum, and Dogecoin during Tuesday’s trading session.

Cassie Craddock, Ripple’s managing director for Europe

Adding to

the bullish momentum, Ripple announced it will provide digital asset custody

technology to BBVA for Spanish retail clients, extending their existing

partnerships in Switzerland and Turkey. The expanded collaboration allows BBVA

to offer end-to-end custody services for Bitcoin and Ethereum trading

under the European Union’s Markets in Crypto Assets (MiCA) regulation

framework.

“Now

that MiCA is established, the region’s banks are emboldened to launch the

digital asset offerings that their customers are asking for,” said Cassie

Craddock, Ripple’s managing director for Europe.

This

institutional adoption represents a significant validation of Ripple ‘s

technology infrastructure and could signal broader banking sector acceptance of

cryptocurrency services.

From my

technical analysis perspective, XRP has successfully reclaimed the 50-day

exponential moving average (50 EMA) and broken above the $2.96-$3.00

resistance zone, which was reinforced by the 38.2% Fibonacci retracement level

measured from June lows to July highs near $3.65. This breakthrough opens the

path for testing local August highs around $3.30 and potentially the

year’s peak levels starting from $3.60.

Trading

volume spiked to 159.63 million, nearly three times daily averages,

confirming institutional participation in the breakout. The RSI remains in

neutral-to-bullish territory in the mid-50s, while the MACD histogram

is converging toward a bullish crossover, indicating accumulation patterns.

Current upside

potential exceeds 21% to the $3.30 level.

XRP/USDT technical analysis. Source: Tradingview.com

Moreover, the

breakout above the July downtrend line potentially triggers a measured move from

the three-month flag formation that could target $4.70 –

representing additional gains of over 55%.

The flag

pattern had been forming since the June lows, and within the current triangle,

XRP had less and less room to move. Ultimately, it broke to the upside, which

in my view opens the way for bulls to drive a significant rally from the local

lows we are now observing.

Market

analysts are also increasingly optimistic about XRP’s trajectory. Paul

Howard from Wincent noted that “XRP is now just 18% off its all time

high. The team has built an impressive crypto cohort the last 9 months with

acquisitions, corporate adoption and regulatory movements that add credibility

to the token.”

How high can XRP price go? Source: Tradingview.com

Paul Howard, Wincent

Howard

emphasized that while the short-term outlook shows range-bound trading,

“XRP likely to outperform and break the $3.00 technical line given its

volatility over BTC.” The analyst highlighted XRP’s superior performance

relative to Bitcoin’s more constrained trading range.

Others

also read: XRP Price Could

Reach $8 in 2025, According to Latest XRP/USDT Technical Prediction

The

cryptocurrency market is experiencing significant institutional momentum that

extends beyond XRP. Bitcoin ETFs recorded $246 million in net inflows during

early September 2025, driven by BlackRock’s iShares Bitcoin Trust

absorbing $434.3 million and Fidelity’s FBTC adding $25.1

million.

Bitcoin’s

illiquid supply has climbed to a record 14.3 million BTC, with Ryan Lee,

Chief Analyst at Bitget, noting that “more than 70 percent of coins now in

wallets with little spending history, confidence in Bitcoin’s long-term value

remains evident.” This supply tightening “not only reinforces the

asset’s role as a store of value but also heightens the potential for sharp

moves as demand persists”.

Lee expects

Bitcoin to stabilize and regain upward momentum, with a target range of

$105,000 to $118,000 supported by sustained institutional inflows and

bullish technical signals. This broader crypto market strength provides a

supportive backdrop for XRP’s rally.

Despite

increased exchange reserves reaching 12-month peaks, sophisticated investors

continue accumulating XRP. Whale wallets reportedly accumulated 10 million

XRP in just 15 minutes during Tuesday’s breakout, while broader whale

holdings increased by 340 million tokens over recent weeks.

This

divergence between short-term selling pressure from exchange inflows and

long-term accumulation by large holders suggests different time horizons among

market participants. The whale buying activity totaling $700 million in

recent transfers has sparked speculation about institutional positioning ahead

of potential XRP ETF approvals in October.

Looking

ahead, traders are monitoring several critical factors that could influence

XRP’s trajectory. The $2.99-$3.00 resistance zone that was repeatedly

rejected in recent sessions has now become potential support, while the next

major resistance lies at $3.30-$3.50.

Six XRP ETF

applications currently under SEC review for October decisions represent a

structural catalyst that could transform institutional access and demand

dynamics. Combined with the Federal Reserve’s anticipated rate cut and

continued banking partnerships, these fundamentals support the technical

breakout scenario.

However,

risks remain if the cryptocurrency fails to maintain momentum above $3.00, with

key support levels at $2.88-$2.89 where buying interest has

consistently emerged during recent corrections.

XRP is

surging due to 99% probability Federal Reserve rate cut expectations and

Ripple’s expanded digital asset custody partnership with BBVA in Spain.

The combination of dovish monetary policy and institutional banking adoption is

driving demand across cryptocurrency markets.

Technical

analysis suggests XRP could reach $4.70 if it completes the

three-month flag formation breakout, representing 55% upside potential.

Conservative predictions target $3.30-$3.60 resistance levels, while

bullish forecasts from analysts like Standard Chartered project $5.50-$15.00 by

year-end depending on ETF approvals and institutional adoption.

Key drivers

include institutional partnerships with banks like BBVA, potential XRP

ETF approvals in October 2025, Federal Reserve rate cuts, and whale

accumulation patterns. Technical breakouts above $3.00 combined with regulatory

clarity are supporting higher price targets.

XRP’s

primary advantage lies in cross-border payment utility and institutional

banking adoption. With 3-5 second settlement times and minimal

transaction fees, XRP serves as a bridge currency for financial institutions.

Recent partnerships with major banks and potential Amazon and Uber

adoption distinguish it from speculative altcoins.

The Solana price prediction continues to dominate conversations among top crypto analysts, with ambitious targets of $400 and even $500 on the horizon. This bullish outlook is pinned on powerful network upgrades and the massive potential of a spot SOL ETF. But the key question is one of timing: could the ETF approval really happen in 2026? As investors weigh this uncertainty, many are turning to Layer Brett ($LBRETT), an altcoin whose growth catalysts are active today.

While Solana‘s future hinges on an external decision, Layer Brett’s growth is driven by powerful, internal catalysts that are active right now. Its value is being created by its own self-contained ecosystem. The presale itself is a live event that has already raised over $3million, proving strong organic demand without needing anyone’s approval.

The project’s high-yield staking crypto feature, with an APY around 865%, acts as an internal economic engine, creating its own reward loop and incentivizing holders. This is all built on a functioning Ethereum Layer 2 foundation, giving it a technical backbone that isn’t waiting for a future upgrade. This ecosystem is designed for long-term engagement, with a roadmap featuring gamified staking and NFT integrations that give the token real utility.

Furthermore, its tokenomics are built for sustainable value, with a fixed supply of 10 billion tokens and a $1 million giveaway to bootstrap its community. It’s a complete package for investors who want to be a part of the growth engine itself, making it one of the best crypto to buy now.

The long-term Solana price prediction is incredibly strong. Analysts point to the “Alpenglow” network upgrade, which will boost speed and DeFi performance, as a major driver. The network is already a leader in DEX volume and is seeing its Total Value Locked grow, reinforcing SOL demand. Short-term technicals are also positive, with the price consolidating above $200 and analysts targeting a breakout toward $218.

However, the biggest catalyst that could push Solana toward $400—a spot ETF approval in the US—remains a waiting game. Reporting suggests the SEC’s review is “cautious,” with a potential timeline stretching into 2026. This leaves investors in a position where they must wait for an external regulator to unlock the token’s full potential.

The choice between Solana and Layer Brett is a classic investment dilemma. Solana represents a bet on the steady, incremental growth of a blue-chip asset, where gains are measured in percentages. Layer Brett, however, offers an asymmetric opportunity: a high-reward play where a small presale investment could deliver the exponential returns that established giants no longer can.

The Solana price prediction is undeniably bullish, but its most significant catalyst, the ETF, is a promise for tomorrow with an uncertain timeline. Layer Brett offers a different proposition: a bet on catalysts that are delivering value today.

For investors looking for the best crypto to buy now, the choice is between waiting for a regulator to approve Solana‘s future, or participating in Layer Brett’s self-contained growth engine that is already firing on all cylinders. It represents a more proactive approach to capturing the explosive gains of the 2025 bull run.

The Layer Brett presale is still live, but the window for early access is closing fast. Don’t miss out on the most scalable meme project to ever launch on Ethereum.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

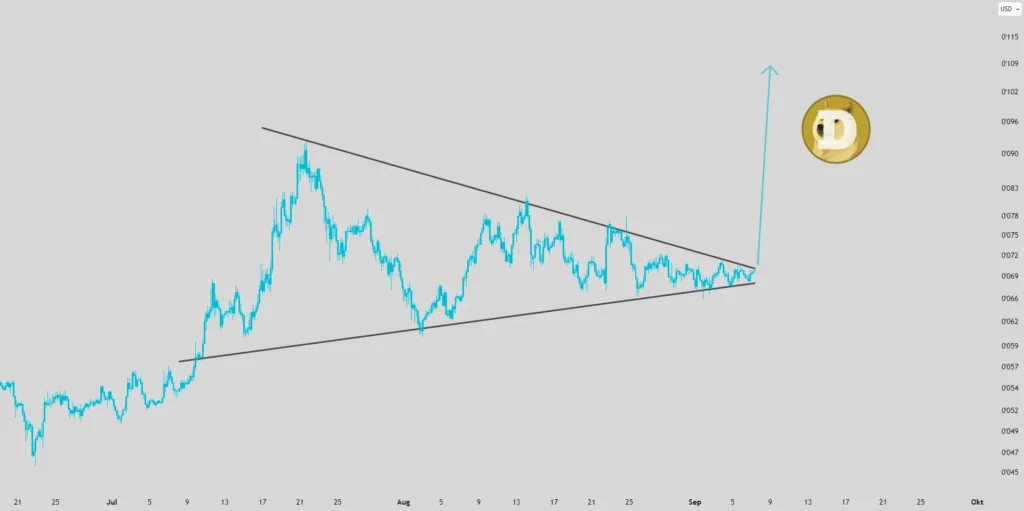

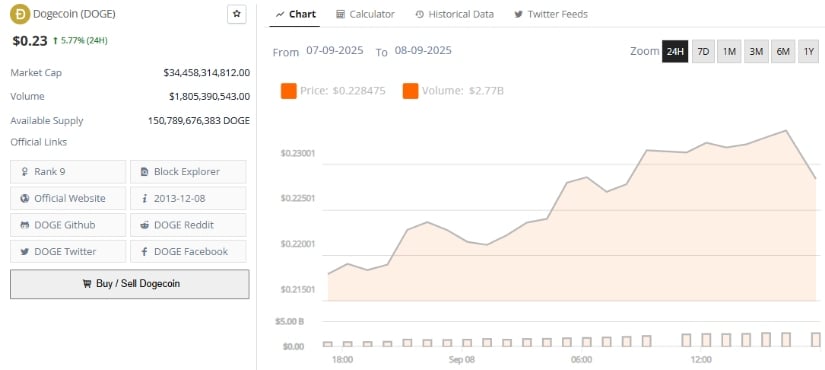

Dogecoin (DOGE) is making waves again after a sudden 6% price surge, reigniting discussions about its next big move and whether a breakout is on the horizon.

This unexpected rally has brought Dogecoin back into the spotlight as traders watch key resistance levels closely. With rising futures open interest, growing spot inflows, and bullish technical setups, the market is speculating on how far this Dogecoin price prediction could go.

On-chain data confirms that dip-buying is actively supporting the market. Glassnode’s HODL waves show that the 1–2 year holding cohort increased from 21.65% to 23.24% in the past month, suggesting long-term conviction among holders.

Dogecoin remains bullish but may pull back before breaking $0.235, with $0.222 as key support. Source: davoody.majid on TradingView

Short-term investors are also accumulating. The 1–3 month holding group grew from 5.43% to 6.58%, indicating that both retail traders and patient investors perceive value at current levels.

The combination of patient long-term holders and active short-term buyers has provided Dogecoin with a solid foundation for further gains, reinforcing market confidence in the ongoing rally.

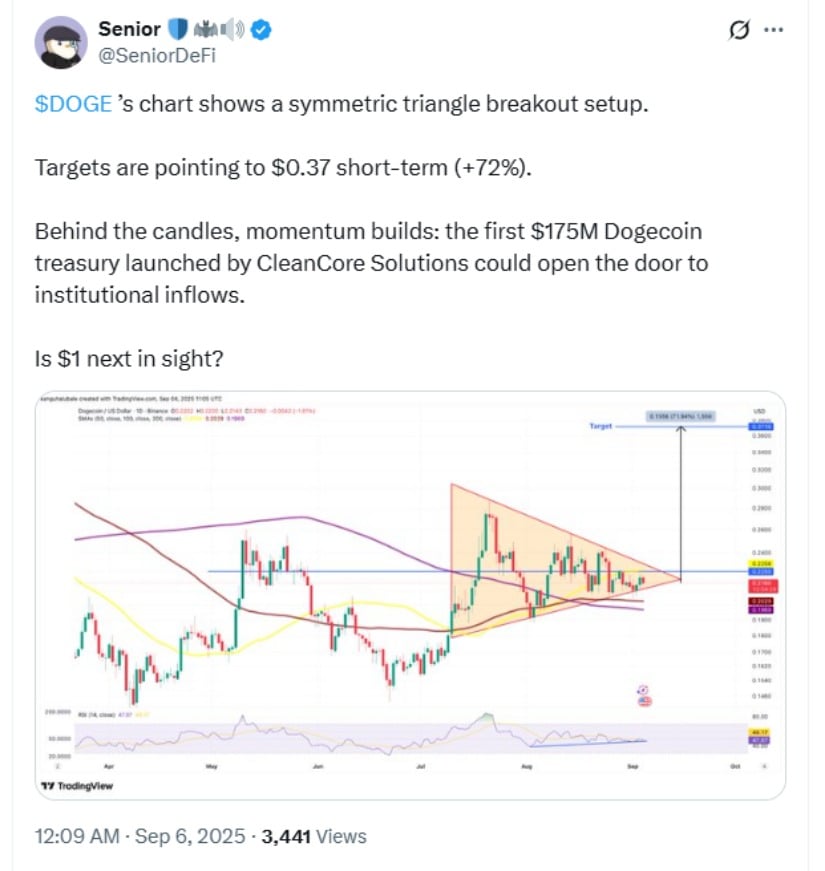

Chart patterns and indicators add weight to this bullish narrative. The 4-hour chart recently broke out of an inverse head-and-shoulders pattern, a setup that often signals the end of a bearish phase.

Dogecoin shows a symmetric triangle breakout, targeting $0.37 short-term, with institutional interest from a $175M DOGE treasury potentially supporting further gains. Source: Senior via X

This pattern gives a near-term Dogecoin price prediction of $0.248, about 7.4% above current levels. Adding to the optimism, the 20-period EMA crossed above the 200-period EMA, a golden crossover, with two more EMA crossovers nearing confirmation, potentially fueling a larger rally.

Derivatives data show that traders are positioning for upside. Futures open interest has jumped 16.7% to $3.89 billion, while options open interest has spiked over 300%. Long/short ratios on major exchanges remain heavily tilted toward the long side, suggesting confidence in a breakout.

Still, analysts warn that spot inflows must rise to confirm this futures-driven optimism. Without strong spot demand, heavy leverage could trigger sharp liquidations if the price fails to hold above $0.235.

The immediate resistance sits at $0.235, with a breakout likely to target the $0.260–$0.280 range. On the downside, $0.212 is the first key support. A break below $0.204 would completely invalidate the bullish structure and could bring Dogecoin price back toward $0.190 or even the $0.150 demand zone.

Dogecoin’s $0.209 support is critical, with a hold likely pushing prices toward $0.225–$0.241, while a breakdown could risk a drop to $0.200. Source: 𝙎𝙐𝘿𝙀𝙇𝙔𝙏𝙄𝘾 via X

For traders watching the market, this makes the next few sessions critical for Dogecoin price prediction today and the overall future of Dogecoin.

Adding to the bullish sentiment, multiple asset managers—including Grayscale, Bitwise, and REX-Osprey—have filed for a spot Dogecoin ETF. The latest filing suggests that at least 80% of the fund would hold Dogecoin directly or through futures and swaps.

Dogecoin teases a breakout as large-cap meme coins rise, with a DOGE ETF expected this week, potentially acting as a major market catalyst. Source: Fabix via X

Analysts estimate a 90% probability of ETF approval before the end of 2025. If approved, this would make Dogecoin one of the few meme coins with a regulated investment vehicle, potentially driving new institutional demand.

While $1 remains a psychological milestone, analysts caution that such a move would require significant spot demand, regulatory clarity, and sustained network growth. Still, the combination of bullish technicals, rising open interest, and ETF optimism keeps sentiment positive.

Dogecoin was trading at around $0.23, up 5.77% in the last 24 hours at press time. Source: Brave New Coin

For now, Dogecoin price predictions suggest a test of $0.248 is likely if bulls hold above $0.235. Traders should watch spot inflows and key support zones closely as the market approaches a decisive breakout point.

With a 31% surge year-to-date, TRX has officially overtaken Cardano in market cap and is now setting its sights on Dogecoin.

DOGE has lagged behind during the latest market push, opening the door for Tron to claim the 8th spot on crypto’s leaderboard – a scenario that supports a bullish Tron price prediction for the weeks ahead.

TRX is already up 1.5% in the past 24 hours, and trading volumes are climbing fast, with a breakout above $1 billion likely if momentum continues.

Altcoin season is well underway – Ethereum (ETH) is holding strong above $4,000 and Solana (SOL) just ripped past $210, setting the tone for what could be TRX’s next major rally.

The Altcoin Season Index tracked by CoinMarketCap has been above 50 for a few days, indicating that this category has been gaining strength while Bitcoin’s dominance continues to retreat.

This favors a bullish Tron price prediction at a point when the market is expecting an interest rate cut from the U.S. Federal Reserve during the next FOMC meeting.

The most relevant catalyst to watch this week that could push TRX above DOGE would be positive inflation data.

The daily chart shows that TRX has hit a key trend line support $0.30 from which it could bounce strongly.

Trading volumes surged as the token entered that price zone, indicating its relevance to market participants. We could expect a move above $0.38 first to confirm a bullish Tron price prediction.

If that happens, the price could soon make it to much higher ground, possibly to $0.45 first and then to $0.80, offering an upside potential of 141% if the rally gains traction. In that scenario, Tron’s market cap could rise to $75 billion – effectively flipping DOGE and even USDC.

Overtaking XRP’s 4th spot in the leaderboard would take a move near the $2 level for TRX, meaning a 500% gain in the near term.

Such a move seems unlikely at the moment, since it would require XRP to post no gains over this period.

But while that kind of growth may be out of reach for Tron, top crypto presales like Pepenode ($PEPENODE) could deliver 10X or even 100X returns, with its mine-to-earn (M2E) model that takes all the hard work out of mining meme coins.

Pepenode ($PEPENODE) lets you build your own virtual meme coin mining rig – no hardware, no hassle.

This mine-to-earn (M2E) game gives players a way to deploy digital servers, stack mining rigs, and earn $PEPENODE tokens in return.

The more rigs you own, the more you earn – and if you dominate the leaderboard, you’ll get surprise airdrops of trending meme coins like $PEPE and $FARTCOIN from the rewards pool.

No cables, no GPUs, no fans – just load up on $PEPENODE, fire up your rigs, and start mining instantly.

Funds from the presale will go toward building out the Pepenode game. Once it launches, demand for the token could skyrocket, since it powers the entire ecosystem.

To grab $PEPENODE before launch, head to the official Pepenode website, connect your wallet (Best Wallet is a great option)

You can swap crypto or use a bank card to complete the transaction in seconds.

Visit the Official Website Here

The post TRON Price Prediction: TRX Just Overtook Cardano – Is Dogecoin and XRP Next? appeared first on Cryptonews.

In the latest “The Weekly Insight,” analyst @CryptoinsightUK places XRP at the center of the next market advance—mapping a five-wave structure that targets Wave 3 ≈ $6.50, Wave 4 holding > $5, and Wave 5 ≈ $9.69. The call is anchored in XRP’s relative strength and a broader macro setup that he describes bluntly: “I’m bullish. I’m bullish. I’m bullish.”

Near term, he concedes Bitcoin can still “dip in the short term and reclaim some of the liquidity sitting below us,” but he argues that any shakeout precedes an aggressive upswing that should favor leaders like XRP.

The author’s relative-strength case is explicit: “XRP has been leading the way this cycle,” adding it “is about to begin its next major leg higher.” He contrasts structures: “If you overlay the Ethereum chart on top of XRP’s, the difference is striking… XRP… held strong around all-time highs… has pushed above both its previous all-time high and the $2.70 swing high, and is now consolidating above them.

Meanwhile, Ethereum is still struggling to reclaim and hold its all-time high.” He continues: “This relative strength is important… it could continue to outperform the largest altcoin in the market,” with spot ETF speculation for XRP “possibly coming in September or October” and potential policy tailwinds adding fuel.

Zooming out, the newsletter situates XRP within a risk-on macro backdrop that could lift Bitcoin and TOTAL/Total2 and, by extension, turbo-charge altcoin leadership. Equities breadth is the opening bid: the S&P 500, Nasdaq, Dow Jones, and Russell 2000 are, he writes, “on the edge of or already in expansion,” with monthly RSI in overbought historically preceding “at least a few months, and often a prolonged period, of strong bull market activity.” He calls it a “clear signal, a green light for risk on.”

On cross-asset signals, @CryptoinsightUK underscores the directional tie between Bitcoin and gold, despite gold’s “risk-off” label. Chinese gold demand and Western currency debasement, in his view, strengthen Bitcoin’s long-term case. Historically, gold bottoms have led Bitcoin bottoms by an average ~126 days across four instances; applied to the latest sequence, he sketches a probabilistic Bitcoin bottom window around September 15, 2025.

The liquidity map remains pivotal. On higher timeframes, he sees “extremely dense” liquidity above Bitcoin, arguing that once the current range resolves, “the move will likely be sharp and aggressive,” with a roadmap that “quickly” carries BTC toward $144,000 and beyond.

For alt breadth, he points to Total2. By his analog, today’s structure rhymes with an “orange circle” precursor from last cycle; from that point to the peak, alts rallied about 350% (technically ~366%). A repeat implies ~$7.73 trillion for Total2—an environment in which “XRP will be one of the clear leaders in the next leg of this market cycle,” provided Bitcoin prints new highs and Total2 breaks out.

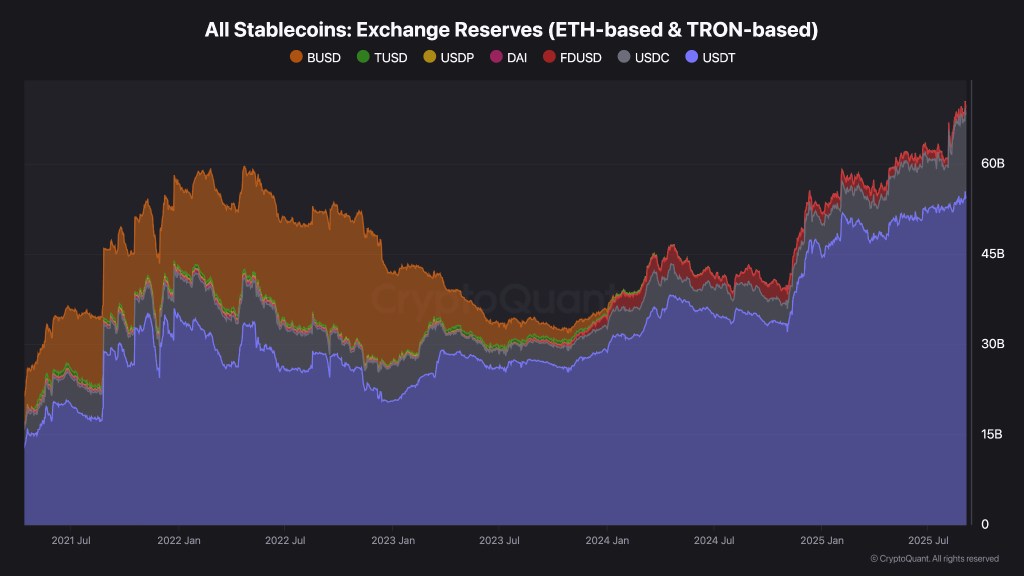

The companion “Charts of the Week” (by @thecryptomann1) sharpen the market’s near-term complexion and how it may channel into XRP. Stablecoin exchange reserves (ETH- and Tron-based) sit at all-time highs—~$66 billion (≈ $53B USDT, $13B USDC), a cache of “dry powder” that could chase upside on a breakout or cushion a final dip toward ~$105,000 on BTC before reversing.

A caution flag: the 30-day change in aggregate whale holdings has “dropped off a cliff” recently—“alarming,” he notes, and not to be ignored even if it doesn’t spell disaster. Meanwhile, NUPL (Net Unrealized Profit/Loss) has been sliding as the market “takes back” profits from the past ten months; a revisit of the “yellow zone” (<~0.5) could catalyze the next parabolic phase. Structurally, the realized price bands are yet to tag their upper bound, supporting a cycle view that BTC surpasses $200,000 before the run is done.

Within that mosaic, XRP’s wave count and leadership profile are the through-line. The projected path—Wave 3 to ~$6.5, Wave 4 holding above $5, Wave 5 extending to ~$9.69—is presented as the high-conviction roadmap if Bitcoin’s final shakeout resolves higher, Total2 breaks to new cycle highs, and ETF/policy catalysts keep skewing flows toward XRP. To the author, those pieces add up to a market where “any pullback is a buying opportunity,” and where the path of least resistance—once the range resolves—is higher, with XRP positioned to lead.

At press time XRP traded at $2.975.

The waiting game is over for Solana holders. After weeks of sideways movement that had traders questioning whether SOL could break free from its range, the breakout finally arrived with authority. What we’re seeing now isn’t just another false breakout – the technical setup, market conditions, and fundamental backdrop are all pointing in the same direction. This could be the move that separates Solana from the pack of struggling altcoins.

Solana has officially escaped its weeks-long consolidation pattern, and the charts are looking pretty sweet right now. The breakout that @ali_charts called is playing out exactly as expected, with Fibonacci extensions backing up the bullish case. We’re looking at a classic setup that could push SOL toward multi-month highs if the momentum holds.

The 4-hour chart tells the whole story. Solana broke out of its symmetrical triangle right around $210, and the move had serious conviction behind it. Price shot up to $214 before pulling back slightly, but that’s normal after a breakout like this.

Here’s what matters right now:

As long as Solana holds above that breakout zone, this setup has legs to run higher.

The breakout isn’t happening in a vacuum. Solana’s ecosystem keeps expanding with new DeFi projects, NFT platforms, and gaming applications choosing to build on the network. Its speed advantage over Ethereum is becoming impossible to ignore, especially when transaction costs are a fraction of what users pay elsewhere. The broader crypto market recovery is also helping, with money flowing into high-beta altcoins like SOL now that Bitcoin has found some stability. Plus, retail interest in Solana remains strong, which tends to fuel these kinds of momentum moves.

While Ethereum dominates the institutional narrative, Solana owns the speed game and retail adoption story. What sets it apart from other altcoins is how well it’s held up during recent market chop. SOL has been defending higher lows, creating a much stronger technical foundation than most of its peers.