The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

We’re just 32 days away from the SEC’s final call on more than 92 Spot ETFs, and that includes the Grayscale Dogecoin ETF, the first memecoin ETF ever. Bloomberg experts still have the approval odds sitting above 90%. This decision will have a huge effect on Dogecoin price prediction.

Dogecoin also stands out with its massive open interest levels. Futures positions are steady at nearly 17 billion DOGE, worth about $4.01B.

CoinGlass data shows barely any pullback, and the numbers are actually up over 15% in the last 24 hours. That means roughly 16.82 billion DOGE, still around $3.99B, are locked into the derivatives market even while the wider market slows down.

Gate.io is leading the pack in Dogecoin futures, holding over $1.02B in open contracts. Binance follows with about 20.65% of total open interest, roughly $824.56M, making it another major hub for DOGE exposure.

Price-wise, DOGE has been chopping in the same zone without picking a clear direction, but the steady futures positioning shows investors aren’t losing confidence in the coin just yet.

Currently, the DOGE price is breaking out against that white descending trendline, which has been the main resistance wall for weeks. If the price breaks and holds above it, the next real test will be in the $0.26–0.30 zone.

The RSI is already sitting at 80, so a small dip could hit before the breakout, especially with the SEC meeting around the corner and rate-cut talk adding extra volatility.

The MACD just flipped positive, suggesting fresh bullish energy. The overall setup shows DOGE is on the edge of turning bullish, with a clean pump toward $0.32–0.35 if it clears resistance, but short-term cooling-off shouldn’t surprise anyone.

Smart money this cycle isn’t chasing meme hype the same way; it’s flowing into projects with real utility. Best Wallet (BEST) is one of those fresh presales grabbing attention, already raising over $1M in less than two weeks.

The project’s building a decentralized wallet that fixes a lot of the old 2021-era flaws, while adding perks like staking and token swaps. BEST token itself comes with low fees, exclusive features, and staking rewards sitting at a crazy 89% right now.

Buying in is simple; you can grab BEST straight in the app with a card or swap ETH/USDT. This one feels less like a short-term meme play and more like a utility bet with serious traction.

Visit the Official Website Here

The post Dogecoin Price Prediction: $3.36B Positions Stay Open – Are Degens Betting Big on the Next Explosive Rally? appeared first on Cryptonews.

Cardano is currently sitting at $0.84, eying a new price momentum that is currently brewing for the token to bask in. Cardano (ADA) is basking in new anticipations, with the ADA approval deadlines coming closer by the day. September and October are two significant months for Cardano to take note of. While September is accelerating in the interest rate cut anticipation, October, on the other hand, could bring in notable ETF development news, which again could transform Cardano, pushing the token to hit new highs. How high can ADA truly surge if both these scenarios come true in the next two months? Let’s find out.

Also Read: Ethereum Recovery Eyes $4,811 Pivot Before $8,500 Target: Here’s How

According to Sebastien, a leading cryptocurrency expert, September could bring in lucrative benefits for ADA in general. The Federal Reserve may announce the highly anticipated rate cuts this season, which could pivot the investor sentiment towards the cryptocurrency sector, primarily the altcoin sector. If this happens, chances are that leading altcoins like Cardano may end up gaining significant attention, which can help the token secure new price highs in the process.

Sebastien was quick to note another leading development related to Cardano. ADA ETFs are also a trending development due for approval from the US SEC. The deadline for the aforementioned development is in October, which is another reason that is helping ADA spike high in anticipation.

Sebastien later predicts how ADA can surge as high as $3 and beyond amid the rising rate cut hype and ADA ETF approval.

“If rate cuts are announced on the 17th of September, I think $ADA has a real chance to break the resistance at $1.25 and close September above $1.5. With rate cuts and ETF approval, $ADA can easily hit $3 in the next 3 months.”

If rate cuts are announced on the 17th of September, I think $ADA has a real chance to break the resistance at $1.25 and close September above $1.5.

With rate cuts and ETF approval, $ADA can easily hit $3 in the next 3 months. https://t.co/vQOziACFTF pic.twitter.com/D1G77pobHB

— Sssebi

(@Av_Sebastian) September 7, 2025

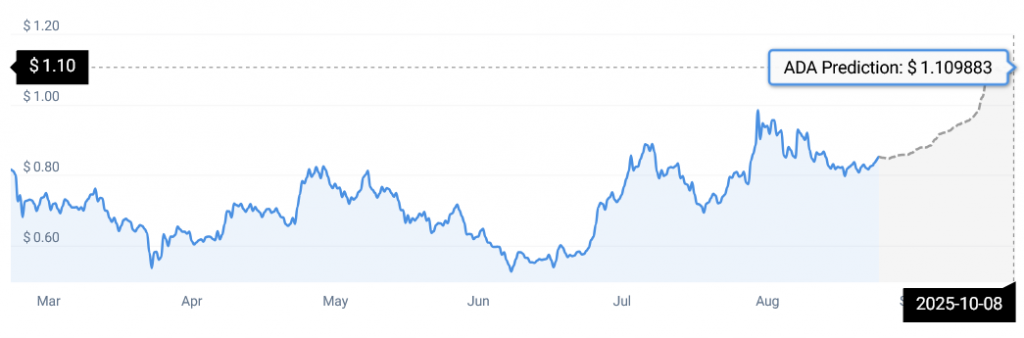

According to CoinCodex ADA data, Cardano may surge as high as $1 by the end of September or the first week of October 2025.

“According to our current Cardano price prediction, the price of Cardano is predicted to rise by 29.79% and reach $1.090822 by October 8, 2025. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 51 (neutral). Cardano recorded 14/30 (47%) green days with 5.42% price volatility over the last 30 days. Based on the Cardano forecast, it’s now a good time to buy Cardano.”

Also Read: Cardano Price Prediction: Can ADA Hit $1 Post Rate Cut?

Cardano (ADA) and Ripple (XRP) are two of the largest, most-discussed cryptocurrencies across the globe. They also have a large community and are backed by massive market caps. Yet for ambitious investors hoping to turn $5,000 into $100,000, the most compelling bet right now is LayerBrett (LBRETT). With a roaring presale and an explosive potential, LayerBrett looks like the best way to rake in maximum returns in 2025. This article explains why.

Crypto experts back LayerBrett as the breakout crypto star for the second half of 2025. This is because LBRETT, whilst being a meme coin, delivers real utility as well.

It is a layer 2 Ethereum solution, providing lightning-fast transactions at ultra-low fees whilst seamlessly integrating NFTs and DeFi functionalities into its operations. Its staking program is drawing huge interest, offering up to 864% APY for early adopters, which is almost unheard of in meme circles.

Momentum is at a peak: LBRETT’s presale has raised nearly $3 million, which is quite remarkable. Its entry price of $0.0055 is extremely attractive and analysts believe its current surge will propel LBRETT well past $1 in the next bullish phase. This gives $5,000 buyers a legitimate shot at six-figure returns. Little wonder everyone wants in before exchange listings begin.

The outlook for XRP is getting cloudy. Since summer began, Coinbase has slashed its XRP reserves by 83%, alarming retail and whale holders alike. Recent on-chain movements—like a $250 million whale transfer—suggest major holders may be losing confidence in Ripple.

While XRP’s efficient network and institutional partnerships remain strong, XRP sell signals are going stronger as there’s little room for handsome upsides in the near future. This increases the case for diversification out of XRP. Many see prudence in cashing out and rotating into higher-growth opportunities, with LayerBrett top of mind.

Retail sentiment for ADA has flipped bearish, with a commentary ratio of bullish to bearish at 1.5:1. This is the lowest this ratio has been in 5 months, and it means that Cardano price predictions are about to become more bearish, even though ADA has one of the strongest foundations in crypto.

At the moment, ADA remains range-bound, trading below $1 for most of the last few months. Analysts believe a breakout above $1.18 could unleash a powerful rally, and send ADA up to $3 or even $5.

This would restore ADA’s dominance in the crypto market. But without sustained momentum this scenario remains speculative. And a cautious approach is warranted for anyone thinking about putting money in ADA.

Right now, LayerBrett stands out as the superior investment versus Cardano and XRP. That’s because it is fresher, and has loads of room for price appreciation. If meme coins like DOGE and SHIB produced 10,000% returns in prior bull cycles, LBRETT—with advanced tech, energetic community, and viral meme power—may do even better.

LBRETT’s presale offers ground-floor access to what analysts predict will be a 100x meme token. For anyone seeking to turn $5,000 into $100,000 in today’s market, joining LayerBrett before it lists on exchanges is the way to go.

Layer Brett is in presale now, but it’s moving fast. Get in early, stake while rewards are high, and don’t miss your shot at the next 100x crypto!

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

XRP price today is trading at $2.88, holding a fragile base above $2.84 support while pressing into short-term resistance at the 100-EMA. The setup has gotten a lot of attention again as traders weigh the October ETF decision window against technical compression. This could change the outlook for XRP.

On the 4-hour chart, XRP has been grinding higher off the $2.77–$2.84 accumulation range. Buyers have defended this zone repeatedly, with the 200-EMA at $2.82 acting as a backbone for bullish sentiment. Overhead, immediate resistance aligns at $2.92–$2.93, where the 100-EMA and trendline converge.

Momentum indicators show that things are getting stronger. RSI has gone above 59, which means that bullish momentum is getting stronger. At the same time, MACD is flattening, which means that the market may be moving from a neutral bias to a positive momentum. A decisive break above $2.93 would expose the broader downtrend line near $3.10, setting the stage for a retest of $3.20.

Exchange flow data recor…

The post XRP (XRP) Price Prediction for September 9 appeared first on Coin Edition.

Unlike Dogecoin, which relies heavily on nostalgia and Musk’s endorsements, Layer Brett is building buzz across social platforms, trading forums, and presale communities. Its record-breaking presale has already pulled in thousands of investors, including crypto whales looking for asymmetric gains.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

The crypto market never stops evolving, and new contenders are starting to challenge established giants. Right now, many investors are rethinking their Cardano price prediction, as ADA shows signs of slipping in momentum while newer meme-fueled projects like Layer Brett attract massive interest.

Built on Ethereum layer 2 technology, Layer Brett combines meme culture with real blockchain utility. With its crypto presale already raising over $2.9 million and the $LBRETT price still just $0.0055, analysts are asking whether ADA can maintain its top-10 position in 2025.

For years, ADA has stood out for its ambitious roadmap and scientific approach. Its Hydra scaling upgrade introduced layer 2 capabilities of its own, pushing transaction speeds higher. Still, despite strong fundamentals, many investors feel left waiting.

A conservative Cardano price prediction sees ADA climbing back to its all-time high of $3.10, but big percentage gains look less likely given its $30 billion market cap.

In contrast, Layer Brett starts at a tiny valuation and is designed to solve many of the issues that still slow Cardano. Its Ethereum layer 2 design allows for 10,000 transactions per second with gas fees down to pennies.

Layer Brett was built to be more than just another meme token. It fuses viral culture with utility, offering:

At the $LBRETT price of $0.0055, the entry point is accessible while the upside remains enormous. For those looking at the best crypto presale options, Layer Brett is increasingly being called a top gainer crypto candidate.

When comparing ADA to Layer Brett, the difference is clear. The Cardano price prediction has become more cautious, with many analysts expecting slower, steadier growth rather than explosive moves. Even if ADA reclaims the $3 level, its massive market cap makes a 100x return nearly impossible.

Layer Brett, however, is positioned as a low-cap crypto gem. Ethereum layer 2 networks are projected to process more than $10 trillion annually by 2027, and Layer Brett is designed to ride that wave. Add in staking crypto rewards above 895% and plans for gamified staking and NFT integrations, and you have a project that offers meme appeal with genuine scalability.

Many ADA holders are loyal, but frustrations with slow growth and delayed upgrades have some looking elsewhere. The Cardano price prediction may keep ADA in the top 10 for now, but there’s no denying the buzz around Layer Brett. It combines community-driven energy with utility in a way that older projects rarely do anymore.

With its crypto presale still live and over $2.9 million already raised, Layer Brett is quickly becoming one of the most talked-about new crypto coins. The blend of memecoin culture, strong tokenomics, and layer 2 speed makes it a real competitor in the race for top altcoin status.

The gap between ADA and Layer Brett highlights the contrast between established giants and fast-moving newcomers. While a Cardano price prediction may still be bullish in the long term, it’s unlikely to deliver life-changing gains. Layer Brett, on the other hand, is just getting started.

With the $LBRETT price at $0.0055 and staking rewards above 895% APY for early adopters, the window to buy in at presale prices is closing.

Presale: LayerBrett | Fast & Rewarding Layer 2 Blockchain

Telegram: View @layerbrett

X: Layer Brett (@LayerBrett) / X

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

XRP (Ripple) is approaching a critical juncture as it compresses within a falling wedge formation on the daily chart. This classic bullish pattern suggests the cryptocurrency could be gearing up for a significant breakout, with momentum building near the $2.80 zone. Traders are watching closely as price action tightens, setting the stage for volatility expansion.

The daily chart shows a well-defined falling wedge with descending highs and converging support near $2.60–$2.70. This consolidation follows a sharp summer rally, making the pattern particularly notable. Falling wedges typically resolve bullishly once buyers reclaim the descending trendline.

The pattern structure confirms reliability after multiple touches of both boundaries.

A decisive close above $2.90–$3.00 would mark a breakout, potentially attracting strong momentum. First resistance sits around $3.20, followed by $3.60, with a measured move projecting as high as $4.00–$4.10 if sustained.

Holding above $2.70 remains crucial, with stronger support near $2.50–$2.60. A breakdown below this invalidates the bullish setup. The prolonged compression often results in sharp breakouts, while current altcoin rotation may favor large-cap tokens like XRP.

In the bullish scenario, breaking $3.00 opens paths toward $3.20–$3.60, with $4.00 as extended target. The neutral case involves sideways trading between $2.70–$2.95 until decisive movement. The bearish scenario sees closes below $2.60–$2.70 risking drops toward $2.50 or lower.

XRP’s structure favors bullish breakout if wedge resistance breaks. Traders should watch for closes above $2.90–$3.00 as confirmation. If the bullish scenario unfolds, XRP could move significantly toward $3.60 and beyond.

Lawrence Jengar

Sep 08, 2025 02:04

MATIC price prediction suggests potential 18-32% upside to $0.45-$0.50 range if current $0.35 support holds, with bearish scenario targeting $0.31 lower Bollinger Band.

Polygon (MATIC) is currently trading at a critical juncture near its 52-week low of $0.37, presenting both significant risk and opportunity for traders. Our comprehensive MATIC price prediction analysis suggests the token could be setting up for a potential recovery, though several key technical hurdles must be overcome first.

• MATIC short-term target (1 week): $0.40-$0.42 (+5-11% from current levels)

• Polygon medium-term forecast (1 month): $0.45-$0.50 range (+18-32% upside potential)

• Key level to break for bullish continuation: $0.43 (SMA 20 resistance)

• Critical support if bearish: $0.35 immediate support, $0.31 lower Bollinger Band

While our analysis found no significant MATIC price prediction updates from major analysts in the past three days, this absence of fresh commentary often occurs during consolidation phases. The lack of analyst attention at current price levels near the 52-week low historically presents contrarian opportunities, as retail sentiment typically reaches extreme pessimism at market bottoms.

The current technical setup suggests that Polygon forecast models are likely being recalibrated given the token’s 70% decline from its 52-week high of $1.27, creating potential for oversold bounce scenarios that many analysts may be overlooking.

The Polygon technical analysis reveals a mixed picture with several key indicators suggesting MATIC may be approaching a inflection point. The RSI reading of 38.00 places the token in neutral territory, notably above the oversold threshold of 30, which suggests selling pressure may be moderating.

However, the MACD histogram at -0.0045 indicates bearish momentum remains intact, with the MACD line (-0.0246) still below its signal line (-0.0202). This divergence between RSI stabilization and continued MACD weakness often precedes trend reversals, particularly when combined with MATIC’s current position within the Bollinger Bands.

The token’s %B position of 0.2879 places it in the lower portion of the Bollinger Band range, with price action compressed between the middle band at $0.43 and lower band at $0.31. This compression typically precedes volatility expansion, and with daily ATR at $0.03, MATIC appears coiled for a significant move in either direction.

Our bullish MATIC price target scenario envisions a recovery toward the $0.45-$0.50 range over the next 30 days. This projection is based on several technical factors converging favorably. First, a successful defense of the $0.35 immediate support level would likely trigger short covering, as this level represents a crucial floor above the 52-week low.

The primary resistance cluster sits at the SMA 20 level of $0.43, which aligns closely with the Bollinger Band middle line. A decisive break above this level would open the path toward the SMA 50 at $0.45, representing our initial MATIC price target. Extended bullish momentum could potentially drive prices toward the upper Bollinger Band at $0.56, though this scenario carries lower probability given current market dynamics.

Volume confirmation will be critical for this bullish case, as the current 24-hour volume of $1,074,371 on Binance remains relatively subdued. A volume surge above 2-3x current levels would significantly increase confidence in upside breakout scenarios.

The bearish scenario for our Polygon forecast centers on a breakdown below the $0.35 immediate support level. Such a breach would likely trigger algorithmic selling and stop-loss orders, potentially driving MATIC toward the $0.33 strong support level initially, followed by the lower Bollinger Band at $0.31.

A sustained break below $0.31 would represent a significant technical failure, potentially opening the door for further downside toward the $0.25-$0.28 range. This scenario becomes more likely if broader cryptocurrency markets experience renewed selling pressure or if Polygon-specific fundamental concerns emerge.

The Stochastic indicators (%K at 25.19, %D at 19.74) suggest oversold conditions are developing, but these can persist longer than expected in strong downtrends. Traders should monitor for positive divergence between price and momentum indicators as an early warning of potential reversal.

Based on our analysis, the current risk-reward profile presents a compelling but cautious buy or sell MATIC decision matrix. Conservative investors might consider dollar-cost averaging into positions with initial entries around current levels ($0.38), while more aggressive traders could wait for a confirmed break above $0.40 before establishing positions.

Recommended entry strategy includes scaling into positions with 25% allocation at current prices, 25% on any dip toward $0.35 support, and reserving 50% for confirmed breakout above $0.43. This approach allows participation in potential upside while managing downside risk.

Stop-loss levels should be placed below $0.33 for swing trades, representing approximately 13% risk from current entry points. Position sizing should not exceed 2-3% of total portfolio allocation given the elevated volatility and technical uncertainty.

Our comprehensive MATIC price prediction suggests a medium confidence scenario for recovery toward $0.45-$0.50 over the next 30 days, contingent on successful defense of current support levels. The technical setup favors patient accumulation near current prices, with the understanding that near-term volatility will likely remain elevated.

Key indicators to monitor for prediction confirmation include RSI movement above 45, MACD histogram turning positive, and sustained trading volume above $2 million daily. Conversely, a break below $0.35 with increasing volume would invalidate the bullish thesis and suggest targeting lower support levels.

The timeline for this Polygon forecast to materialize extends through early October 2025, with initial signals expected within the next 7-10 trading days. Given MATIC’s proximity to significant technical levels, position management and risk control remain paramount for successful navigation of this setup.

Image source: Shutterstock

The crypto market has declined over the past 24 hours following weak labor market data in the US. Bitcoin has dropped 1.4%, Ethereum is down 2.9%, and XRP has fallen 1.5%. However, the labor market data has increased expectations of an interest rate cut – the FedWatch tool shows a 100% chance of a September rate cut and even an 11% chance of a 50-basis point cut.

A 50-basis-point cut also occurred in September 2024, and it caused Bitcoin to rally from under $60,000 to $100,000 for the first time ever. This also caused altcoins to surge, with XRP, Cardano, and BNB among those seeing the biggest gains.

So with a similar macroeconomic situation developing again, traders are watching these top altcoins closely and expecting substantial gains ahead. To gauge how far they might go, we asked ChatGPT for price predictions.

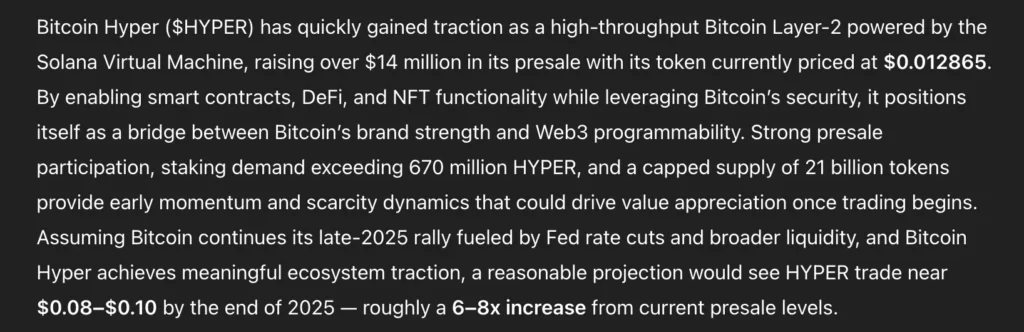

The chatbot indicates that all three projects are on track for growth by the end of 2025, but says a new Bitcoin layer 2 called Bitcoin Hyper is set for the biggest gains. Currently in presale, HYPER has already raised an impressive $14.2 million, reflecting strong community support and potential for profits once it becomes available on exchanges.

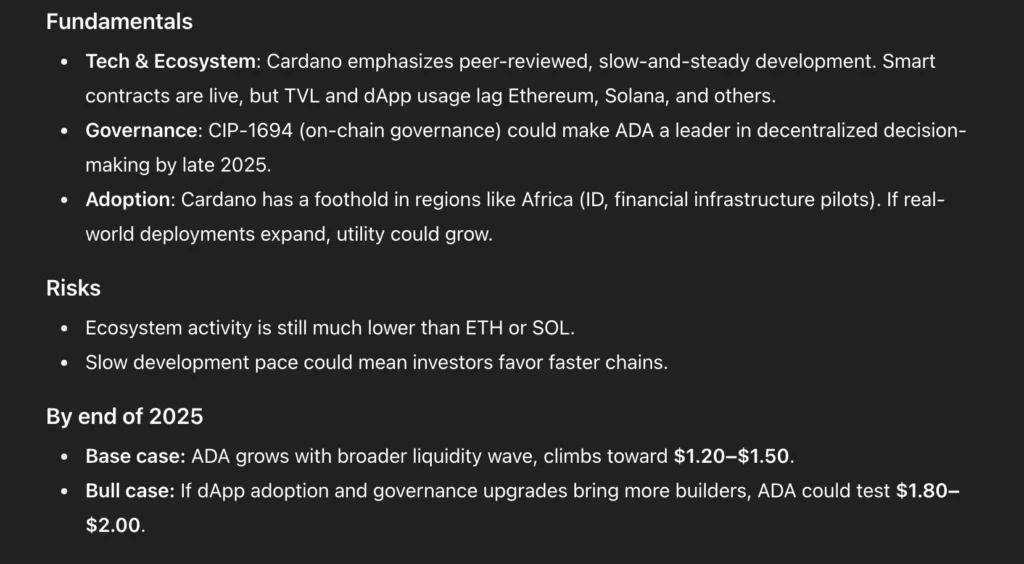

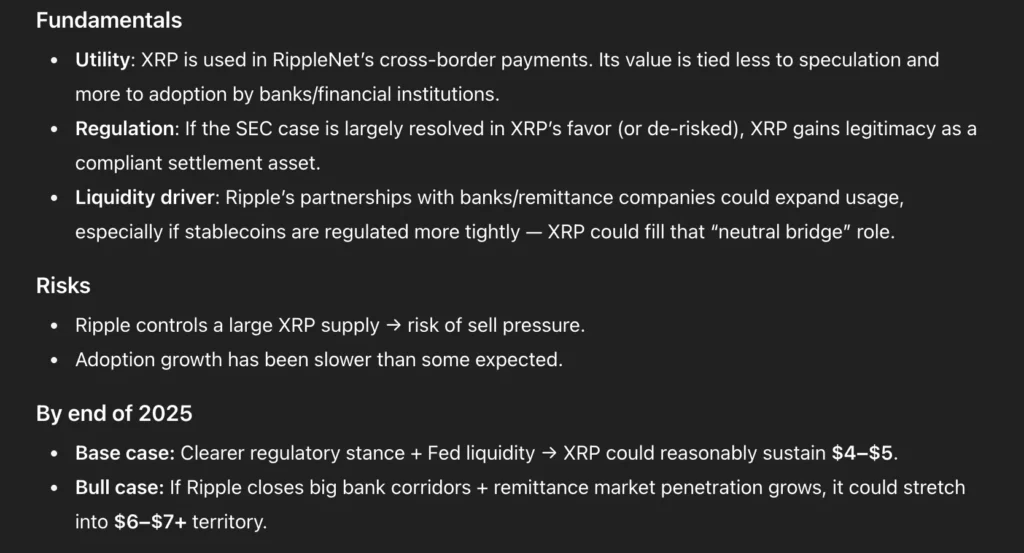

ChatGPT began by explaining that “Rate cuts in late-2025 could coincide with a Q4 liquidity push, amplifying demand across risk assets,” which contributed to its analysis for XRP, Cardano, and BNB.

It then moved on to project-specific drivers. Regarding XRP, it notes that its increasing utility, along with an improved regulatory environment and potential Ripple Labs partnerships, could boost its price.

The chatbot states that XRP could reach between $4 and $5 in a base case or highs of $7 in a bullish scenario this year. This leaves room for just over a 2x gain from its current price of $2.8.

ChatGPT pointed to Solana’s strong ecosystem as the main reason its price could rise toward the end of this year, noting the network “emphasizes peer-reviewed, slow-and-steady development.”

It also states that Cardano’s decentralized governance structure and growth of real-world initiatives could help boost its price in the final months of 2025.

Based on these factors, the chatbot suggests that Cardano could reach a base case target between $1.2 and $1.5 this year, or a bullish target between $1.8 and $2. From its current price, this offers room for almost a 2.5x gain.

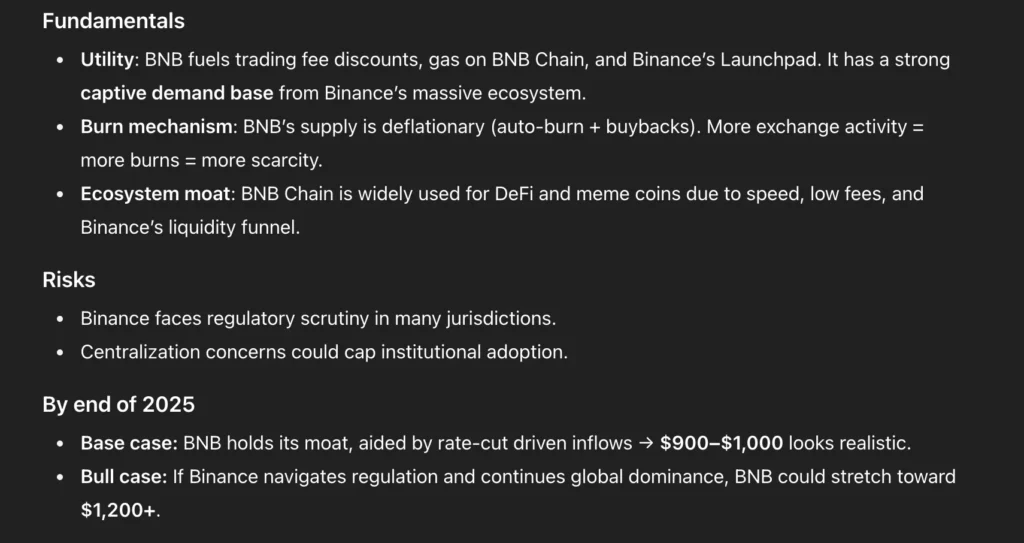

BNB is the most active blockchain by users in the past 24 hours, with 4.4 million active addresses. ChatGPT states that the network’s strong community is a key reason it could perform well in the coming months.

It also mentions that the project has a burn mechanism that destroys BNB, meaning the more ecosystem activity there is, the scarcer BNB becomes. And so given its leading on-chain usage, it becomes clear that BNB is firmly positioned for gains.

As a result, the chatbot predicts BNB to reach between $900 and $1000 in a base case and $1200 in a bull case, resulting in up to a 39% gain.

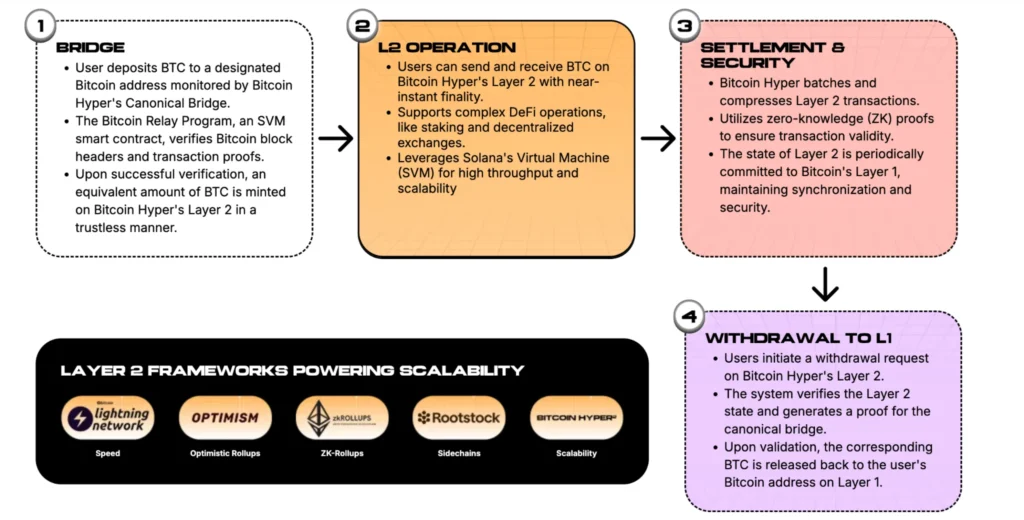

Bitcoin Hyper is developing the world’s first ZK-rollup-powered Bitcoin layer 2 blockchain, aimed at solving Bitcoin’s issues of slow speeds, high fees, and limited functionality.

By integrating ZK-rollups, Bitcoin Hyper can inherit Bitcoin’s security benefits, making transactions on the L2 as secure as on the L1, a feat that earlier L2s like Stacks and Rootstocks didn’t acheive.

The project is also built using the Solana Virtual Machine, which enables blistering transaction speeds, smart contract support, and interoperability with the Solana blockchain. Solana developers can port their apps and tokens to Bitcoin Hyper without needing wrappers or learning a new programming language, laying the foundations for a vibrant ecosystem.

As a result, ChatGPT predicts significant gains for HYPER this year, estimating it could reach between $0.08 and $0.1 by the end of 2025, representing a 6x to 8x increase.

The reason Bitcoin Hyper is expected to outperform XRP, Cardano, and BNB is primarily because its presale allows investors to purchase at the very beginning. That’s comparable to buying XRP in 2013 or Cardano and BNB in 2017.

However, the HYPER presale is selling out fast, raising around $200,000 daily. This means that investors interested in purchasing should act quickly to avoid missing out.

This article is not intended as financial advice. Educational purposes only.

Ripple (XRP) rose 3% on Sunday, September 7, emerging as the second-best intraday performer among the top 10 cryptocurrencies behind Dogecoin (DOGE), which bounced 4%. Community discussions over the past 24 hours suggest both assets benefited from increased speculation around pending Cryptocurrency ETF reviews as the SEC approaches a critical October 18 decision window.

🚨 XRP SPOT ETF COUNTDOWN 🚨

Starting Oct 18, 2025, Grayscale, 21Shares, Bitwise & more await the SEC’s decision. ⚡️

👉 One approval could change XRP forever. 🚀#XRP #CryptoETF #BullRun pic.twitter.com/oq7qLD65XR

— GC (@AlphaTradesFX) September 7, 2025

Echoing many other active influencers within the Ripple army online community, analyst AlphaTrades posted an image showing key deadline dates on the XRP ETF filings by seven asset managers, all anticipated in seven days between October 18 and October 25.

Ripple (XRP) Price Rises 3% on Sunday, September 7, 2025, with trading volume down 10% | Source: CoinMarketCap

XRP trading metrics on Sunday reflects the 3% price uptick was mainly driven by active high-leverage speculative demand. As seen on the CoinMarketCap chart above, XRP price 3% rally on Sunday was accompanied by a 10.3% decline in 24 hour trading volume. Such a significant price increase during a decline in spot market activity signals that the main catalyst lies among traders speculating on future events.

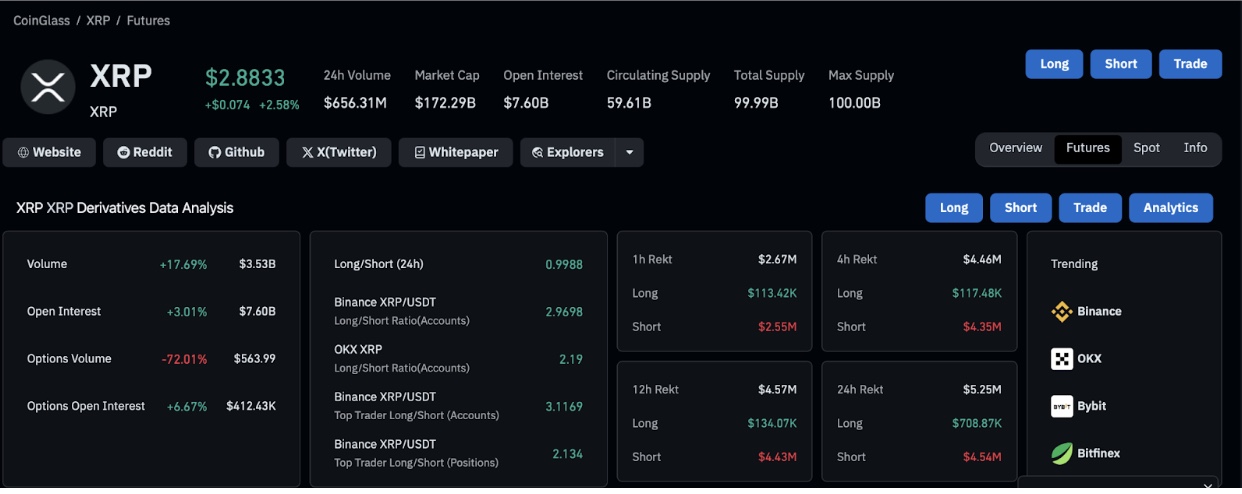

Ripple (XRP) Derivatives Market Analysis | Source: Coinglass, September 7, 2025

Confirming this narrative, Coinglass’ derivatives data shows XRP futures trading volume rose 17% with open interest, which tracks the value of new XRP futures positions created over the last 24 hours increased by 3%, aligning with the daily timeframe XRP price increase.

If the rising speculative demand persists as the critical ETF deadlines approach, top altcoins like XRP, with seven active filings in review, could continue to outperform spot market headwinds as seen in Sunday trading.

XRP’s technical outlook shows price consolidating near $2.88 after the 3% intraday rally. The Bollinger Bands narrow around $2.70 support and $3.07 resistance, suggesting volatility compression ahead of a breakout.

A bullish scenario would see XRP break above $3.07 resistance, supported by improving RSI momentum, now at 48.3 after bouncing from oversold levels. If bulls push through, the next upside target sits at $3.20, with a longer-term target at $3.45 should ETF speculation intensify.

Ripple (XRP) Technical Analysis | XRPUSDT 24H Chart | TradingView, September 7, 2025

The bearish case points to weakening spot trading activity as a risk factor. With leveraged bull traders overexposed, negative macro catalysts could spark massive liquidation, potentially dragging the XRP price towards the recent local low at $2.70 support. A breakdown below this level risks a sharper retracement toward $2.50, undoing recent gains.

With RSI showing mid-level positioning and a lack of spot demand backing the rally, XRP is likely to trade range-bound below $3, until fresh catalysts emerge. However, high leverage positioning over the weekend confirms expectations of potential sharp moves in either direction this week.

Ripple’s (XRP) rally has coincided with renewed attention on new token launches, with SUBBD ($SUBBD) drawing significant market interest. The newly-launched AI-powered platform for content creators, has attracted traction with innovative features combining creator-fan engagement with real utility.

SUBBD Presale

Currently priced at $0.05625, the SUBBD presale has raised $1.05 million of its $1.26 million target, with limited discounted tiers remaining. Prospective investors can still secure SUBBD tokens directly through the official website before the presale cap is reached.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.