The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Crypto News.

You can use the search box below to find what you need.

[wd_asp id=1]

Ripple (XRP) rose 3% on Sunday, September 7, emerging as the second-best intraday performer among the top 10 cryptocurrencies behind Dogecoin (DOGE), which bounced 4%. Community discussions over the past 24 hours suggest both assets benefited from increased speculation around pending Cryptocurrency ETF reviews as the SEC approaches a critical October 18 decision window.

🚨 XRP SPOT ETF COUNTDOWN 🚨

Starting Oct 18, 2025, Grayscale, 21Shares, Bitwise & more await the SEC’s decision. ⚡️

👉 One approval could change XRP forever. 🚀#XRP #CryptoETF #BullRun pic.twitter.com/oq7qLD65XR

— GC (@AlphaTradesFX) September 7, 2025

Echoing many other active influencers within the Ripple army online community, analyst AlphaTrades posted an image showing key deadline dates on the XRP ETF filings by seven asset managers, all anticipated in seven days between October 18 and October 25.

Ripple (XRP) Price Rises 3% on Sunday, September 7, 2025, with trading volume down 10% | Source: CoinMarketCap

XRP trading metrics on Sunday reflects the 3% price uptick was mainly driven by active high-leverage speculative demand. As seen on the CoinMarketCap chart above, XRP price 3% rally on Sunday was accompanied by a 10.3% decline in 24 hour trading volume. Such a significant price increase during a decline in spot market activity signals that the main catalyst lies among traders speculating on future events.

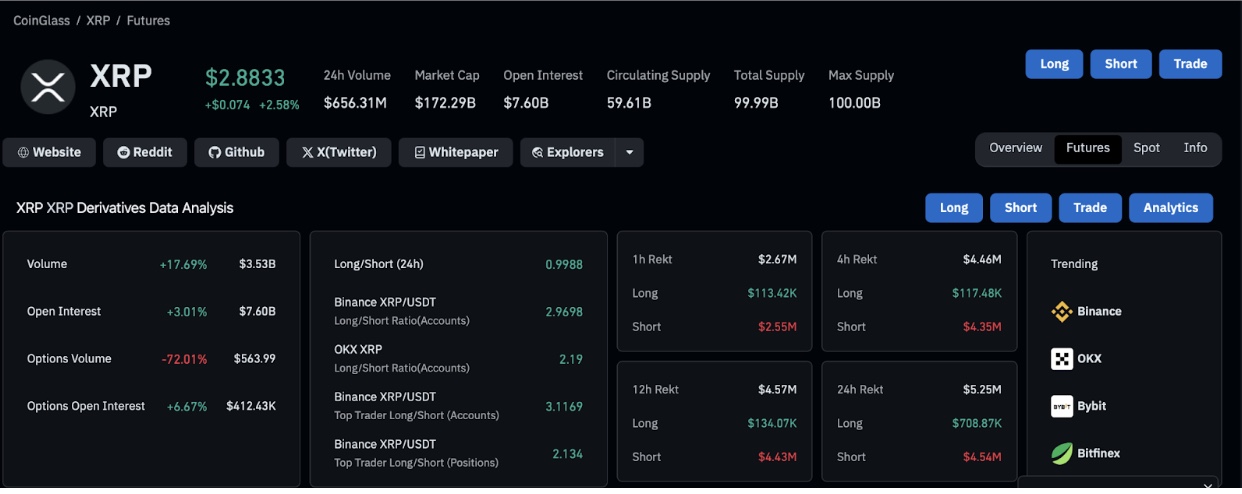

Ripple (XRP) Derivatives Market Analysis | Source: Coinglass, September 7, 2025

Confirming this narrative, Coinglass’ derivatives data shows XRP futures trading volume rose 17% with open interest, which tracks the value of new XRP futures positions created over the last 24 hours increased by 3%, aligning with the daily timeframe XRP price increase.

If the rising speculative demand persists as the critical ETF deadlines approach, top altcoins like XRP, with seven active filings in review, could continue to outperform spot market headwinds as seen in Sunday trading.

XRP’s technical outlook shows price consolidating near $2.88 after the 3% intraday rally. The Bollinger Bands narrow around $2.70 support and $3.07 resistance, suggesting volatility compression ahead of a breakout.

A bullish scenario would see XRP break above $3.07 resistance, supported by improving RSI momentum, now at 48.3 after bouncing from oversold levels. If bulls push through, the next upside target sits at $3.20, with a longer-term target at $3.45 should ETF speculation intensify.

Ripple (XRP) Technical Analysis | XRPUSDT 24H Chart | TradingView, September 7, 2025

The bearish case points to weakening spot trading activity as a risk factor. With leveraged bull traders overexposed, negative macro catalysts could spark massive liquidation, potentially dragging the XRP price towards the recent local low at $2.70 support. A breakdown below this level risks a sharper retracement toward $2.50, undoing recent gains.

With RSI showing mid-level positioning and a lack of spot demand backing the rally, XRP is likely to trade range-bound below $3, until fresh catalysts emerge. However, high leverage positioning over the weekend confirms expectations of potential sharp moves in either direction this week.

Ripple’s (XRP) rally has coincided with renewed attention on new token launches, with SUBBD ($SUBBD) drawing significant market interest. The newly-launched AI-powered platform for content creators, has attracted traction with innovative features combining creator-fan engagement with real utility.

SUBBD Presale

Currently priced at $0.05625, the SUBBD presale has raised $1.05 million of its $1.26 million target, with limited discounted tiers remaining. Prospective investors can still secure SUBBD tokens directly through the official website before the presale cap is reached.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Solana is testing key resistance after strong whale and institutional accumulation, with participants eyeing a potential breakout toward higher levels.

Market watchers suggest SOL Solana price could be gearing up for a decisive breakout, with the price action repeatedly pressing against the $213 resistance. If this level gives way, participants believe Solana may be poised for a sharp rally.

Whale activity is once again drawing attention to Solana, with CryptoJack noting that large holders have resumed aggressive accumulation. Historically, whale inflows have often preceded stronger directional moves for SOL.

Solana whales resume aggressive accumulation, hinting at renewed strength as September trading momentum builds. Source: CryptoJack via X

The timing is especially notable with September kicking off, raising the question of whether Solana could become the standout altcoin story of the month.

Accumulation patterns tend to signal medium-term conviction, and with Solana already holding steady near key support zones, this renewed interest could act as a trigger for the next leg higher.

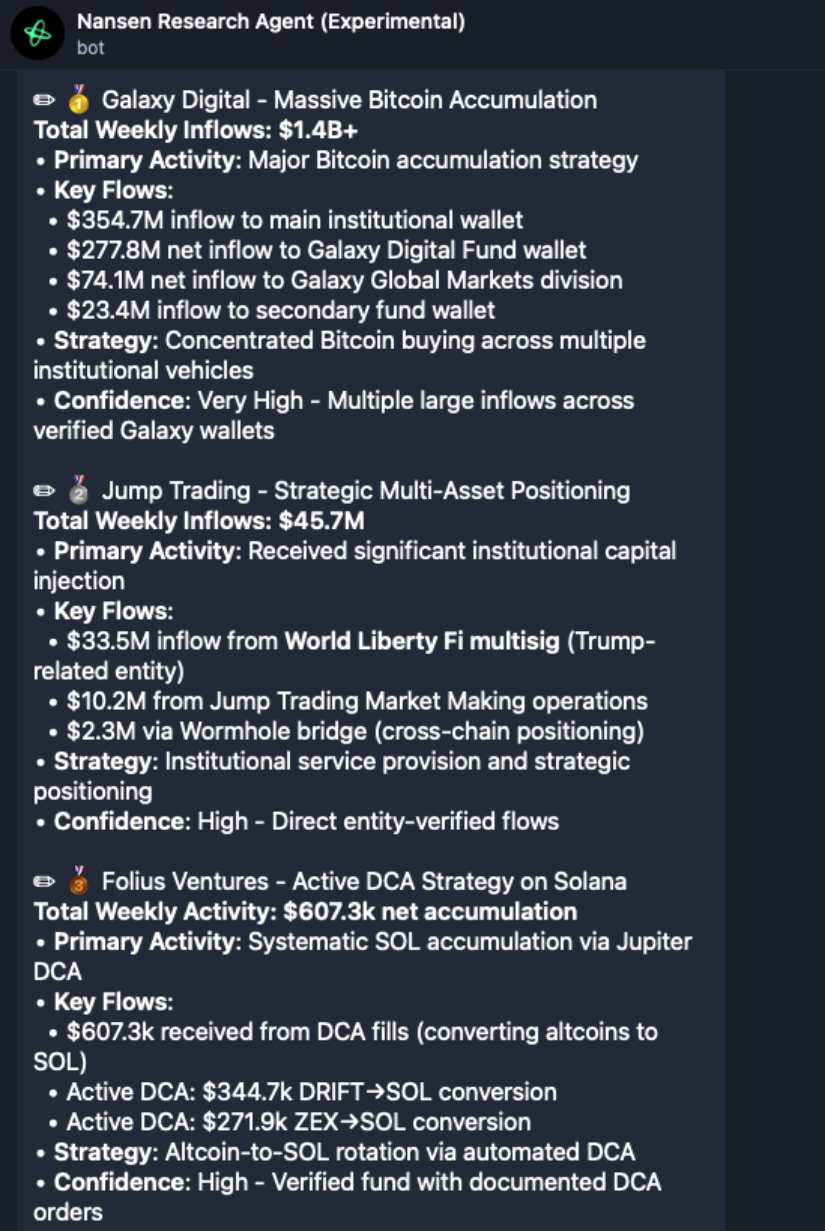

The latest data from Nansen shows that institutions are also leaning into Solana, with Folius Ventures allocating over $600K into SOL through DCA strategies this week. While smaller in scale compared to Bitcoin inflows from Galaxy Digital, the steady addition of Solana exposure highlights how funds are diversifying beyond BTC and ETH.

Institutional investors like Folius Ventures are steadily adding Solana, reinforcing whale accumulation. Source: Nansen via X

The alignment between whales and institutional wallets adds weight to the broader September narrative. With Solana already showing resilience near key supports, continued inflows from both big holders and structured fund strategies could serve as the foundation for a breakout month.

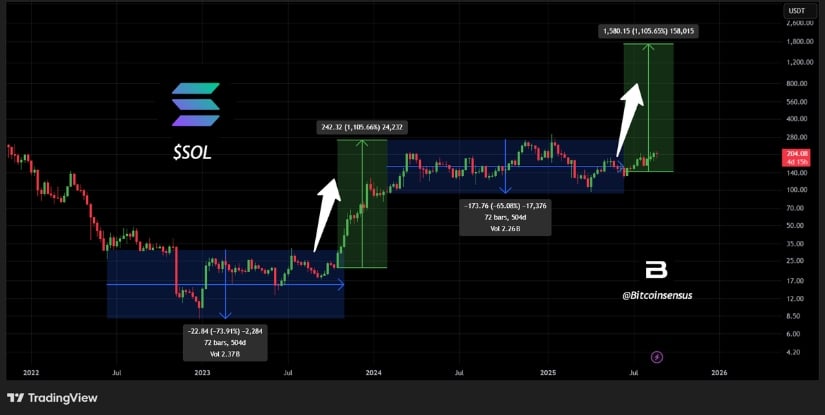

Bitcoinsensus highlights that Solana’s price action is once again reflecting a familiar fractal structure, where extended consolidation phases have historically preceded impulsive rallies. On the current chart, SOL has already logged 504 days inside an accumulation range, closely resembling the previous cycle before its breakout. This prolonged base-building adds weight to the argument that the market is coiling for a larger move as September unfolds.

Solana’s 504-day accumulation mirrors past fractals, signaling a potential breakout with $500 as the broader cycle target. Source: Bitcoinsensus via X

The fractal comparison also shows how prior accumulation ranges were followed by explosive expansions once trends transitioned. With SOL steadily respecting its range structure and repeating a similar time-based pattern, the current setup suggests the market is preparing for another leg higher. As long as Solana continues to hold its accumulation floor and press against the upper boundary, the fractal outlook supports a constructive Solana price prediction, with $500 standing as the broader cycle target.

The $213 mark has emerged as a crucial resistance level for Solana, with the weekly chart showing price repeatedly testing this zone. Structurally, SOL has managed to hold its base around $197, keeping the broader trend constructive. A decisive reclaim of $213 would likely confirm momentum shifting firmly back to the buyers, potentially setting the stage for a stronger breakout into the next range.

Solana holds firm above $197 support as price watch for a decisive breakout past $213 to target the $240–$250 range. Source: Crypto Tony via X

As noted by Crypto Tony, clearing $213 could allow Solana to consolidate briefly before targeting the $240 to $250 region. The key will be maintaining support at current levels, and if these conditions hold, Solana’s technical setup suggests it is positioning for the next leg upward.

Solana’s daily chart is showing strength as price continues to respect the exponential moving averages, using them as dynamic trend driving support. The alignment of shorter EMAs with the longer ones highlights that momentum remains intact, with buyers stepping in each time SOL tests these levels. Holding above these averages signals the ongoing bullish trend.

Solana continues to ride its key EMAs with RSI near neutral, signaling steady momentum and room for further upside. Source: Shardi B via X

As Shardi B points out, the price is also tracking along the main trend line, suggesting that Solana is comfortably riding its structure while preparing for the next push higher. Indicators such as RSI are hovering near neutral, giving SOL room to expand further without signs of immediate exhaustion.

SOL Solana’s current setup paints a picture of steady confidence from both whales and institutions, which historically has been the fuel behind its strongest rallies. The mix of accumulation, strong support defense, and alignment with fractal patterns gives SOL a solid foundation heading into September.

If momentum carries through the $213 mark, the stage looks set for a larger leg higher, with $240 to $250 acting as the first checkpoint before bigger cycle targets come into play.

Dogecoin has been around long enough to outlive the joke it started as back in 2013. What was once just internet humor is now a heavyweight in the cryptocurrency space, ranking among the largest coins by market capitalization.

Over the years, it’s become a regular guest in every bull run.

Whenever meme coins start catching fire, Dogecoin price predictions are what people bring up, from small retail traders on Reddit to influencers pushing hype on X, and of course, Elon Musk, who has turned a single tweet into billion-dollar swings more than once.

With 2025 underway, investors are once again asking whether Dogecoin can mount another major rally or if the “meme season” that powered earlier surges is finally losing momentum.

Right now, Dogecoin is holding in the mid-$0.20 range after what’s been a rollercoaster year.

In 2024, it managed to double at one point, only to give back much of those gains as sellers stepped in. The community behind DOGE remains one of the strongest in crypto, but the absence of fresh upgrades or real utility has left many analysts hesitant to call for big breakouts.

Without substantial buying volume or fresh headlines, the coin risks being left behind while other sectors of the market, such as PayFi, draw more serious attention.

For now, many believe, according to Dogecoin price predictions, that the coin may trade within a range of $0.18 to $0.32 through the rest of the year, unless a broader crypto rally lifts all boats.

Meme coins like Dogecoin and Shiba Inu have often been considered gateways for new investors entering the crypto space. They are inexpensive in dollar terms, easy to understand, and widely discussed online.

However, there is growing recognition among traders that sustainable returns often come from projects with real utility, not just internet buzz.

This shift in sentiment is one reason why the PayFi sector, financial services built on blockchain rails, has gained popularity.

Remittix (RTX), a rising star in this category, has been attracting attention from both retail buyers and crypto analysts:

Unlike Dogecoin and its counterparts, which rely almost entirely on community hype, the Remittix PayFi project aims to address real-world problems by focusing on cross-border payments, remittances, and affordable transactions across emerging markets.

Some experts believe Remittix could follow in the footsteps of successful altcoins that once started small before multiplying in value.

Unlike Dogecoin price predictions, which are wavering, predictions of 20x to 40x returns are circulating, though naturally, such forecasts should be treated with caution.

What makes it stand out is the timing: with global interest in decentralized finance and payment solutions increasing, Remittix has managed to position itself right in the middle of the conversation.

Discover the future of PayFi with Remittix by checking out the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Investors looking at crypto projects like Cardano and the GambleFi upstart Rollblock are asking the same question: where will the biggest gains be made in 2025? While the most recent Cardano price prediction has made headlines thanks to massive institutional moves, experts are suggesting Rollblock could deliver up to 50x returns this year.

For investors with conviction, that kind of multiple could be life changing…

Rollblock (RBLK) has emerged as one of the top crypto projects because it brings tangible use cases to an industry where promises often outweigh delivery.

It’s not a concept on a whitepaper but a fully live Web3 platform with over 12,000 AI-powered games, immersive poker rooms, live dealer blackjack, and a sports prediction league spanning thousands of fixtures.

Rollblock is licensed and fully audited, giving players and investors confidence that this is more than hype. The platform’s deflationary tokenomics make it one of the best crypto to invest in right now:

Weekly buybacks use up to 30% of revenue to purchase tokens from the open market, with 60% burned to reduce the supply permanently. The rest funds staking rewards of up to 30% APY, rewarding loyal holders.

Key points that set Rollblock apart:

The presale is moving astonishingly quickly, with over 83% of tokens already sold at $0.068 and early buyers sitting on more than 500% gains. With $11.5 million raised so far and just 23 days until the presale ending date is announced, demand is heating up as crypto exchange listings draw closer. A 20% bonus is still available for now, but that window is closing fast.

Professor Crypto breaks it down here, showing how seamless onboarding can be:

As Rollblock stated in a recent update, it is rewriting the rules of online play, a sentiment echoed by its growing community.

Cardano is trading at $0.8221 today, slightly down by 0.9% this week. Analyst Trader Rai summed up the short-term outlook with, “If bulls hold $0.83, ADA could break $0.85 next!”

That reflects the cautious optimism that Cardano bulls are holding onto, with many confident that ADA could soon reach new highs above $3.10.

The real driver behind this Cardano price prediction is institutional. Grayscale recently filed for a Cardano ETF under the ticker GADA, pairing it with Polkadot in a submission to the SEC. This move signals growing interest in top altcoins beyond Bitcoin and Ethereum, following the success of spot ETFs for those assets in early 2024.

Cardano’s long-term fundamentals, combined with these institutional products, position it as one of the best altcoins of 2025.

| Project | Price | Market Cap | Total Supply | Revenue Share | Growth Potential |

| Rollblock | $0.068 | $11.5M (presale) | 1B RBLK | Up to 30% weekly buybacks | High, tipped for 50x |

| Cardano | $0.8221 | $29.38B | 45B ADA | None | Moderate, ETF-driven |

Rollblock is bringing real crypto payment solutions and transparency to an industry that desperately needs it. With proven adoption, audited security, and a deflationary design, RBLK is more than just a token, it’s a full ecosystem that rewards both players and holders.

Cardano’s ETF news is exciting, but Rollblock’s momentum in GambleFi positions it as the best crypto to buy right now. For those looking for life-changing multiples, Rollblock is the project most likely to deliver.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

XRP experienced a dramatic price surge on Sunday morning that caught the crypto market off guard. The digital asset jumped above $2.90 following an intense 15-minute buying wave where traders purchased over 10 million tokens.

The weekend rally occurred during thin trading conditions when smaller orders typically have larger price impacts. This created perfect conditions for the explosive move that shifted market sentiment around the third-largest cryptocurrency.

$XRP just decided to send on this Sunday morning

Any news?

+10M $XRP net buy pressure in 15 minutes pic.twitter.com/4etRddPZUs

— Dom (@traderview2) September 7, 2025

According to exchange data, Kraken led the buying pressure with cumulative volume delta spiking past 5 million units. Coinbase and Binance also recorded notable inflows during the same period, though at smaller volumes than Kraken’s surge.

The coordinated buying across multiple major exchanges explains why the price movement was both sharp and sustained. XRP shot up from $2.85 to $2.93 within minutes before settling back slightly to current levels around $2.83.

The Sunday rally comes as XRP accumulation has reached its highest point in over two years. Exchange net position change data shows investors have accumulated approximately 1.7 million XRP tokens over the past month.

This renewed buying interest suggests market participants remain confident in the asset’s potential recovery. The accumulation trend reflects optimism despite broader market uncertainty affecting the cryptocurrency sector.

Long-term holders appear to be taking advantage of current price levels to build positions. The scale of recent accumulation indicates belief that XRP has room for upward movement.

XRP now trades just below the critical $2.85 resistance level that previously capped price movements. Breaking above this level could open the path toward $2.95 and potentially $3.07 if momentum continues.

The $2.85 level has become the key support to watch following Sunday’s action. Holding above this price point would validate the bullish breakout attempt and potentially attract additional momentum traders.

The psychological $3.00 level represents the next major target if bulls can maintain control. This round number often acts as a magnet for price action in cryptocurrency markets.

The Network Value to Transactions ratio has spiked to its highest point in two months following recent price action. This surge suggests XRP’s network valuation may be exceeding its current transaction activity levels.

Historically, elevated NVT ratios can indicate that accumulation momentum may be cooling in the short term. While overall sentiment remains positive, the high ratio could create temporary headwinds for further price advances.

The metric serves as a warning that despite strong buying pressure, the network fundamentals may not fully support current valuation levels. This creates potential for short-term volatility.

The timing of Sunday’s rally played a crucial role in its magnitude. Weekend cryptocurrency trading typically features reduced liquidity and fewer active participants compared to weekday sessions.

These conditions mean that large orders can move prices more dramatically than during regular trading hours. The combination of thin liquidity and concentrated buying created an ideal environment for the sharp price spike.

Professional traders and institutions often use weekend conditions to execute large positions with minimal market impact. The scale of Sunday’s buying suggests involvement from sophisticated market participants rather than retail traders alone.

XRP closed Sunday’s session at $2.83 with the market watching whether bulls can maintain control above the $2.85 support level established during the weekend rally.

Solana’s strong momentum in 2025 has investors eyeing bold targets, with many analysts placing the Solana price prediction near $400 if current growth holds. At the same time, Ethereum holders are turning toward Rollblock, a project that has already raised $11.5 million in presale and processed over $15 million in wagers.

With projections of a 500% surge for its RBLK token, Rollblock is positioning itself as a serious contender, drawing attention from those seeking the next high-upside opportunity in crypto.

Ethereum investors seeking projects with genuine traction are finding Rollblock hard to ignore. The presale has already pulled in more than $11.5 million, while its live iGaming platform has processed over $15 million in wagers. That kind of adoption, paired with a growing user base of over 55,000 and a catalog of 12,000 games, shows that Rollblock is building substance rather than relying on hype.

Unlike many early-stage tokens, Rollblock is already licensed, independently audited, and fully operational. The RBLK token is tied directly to platform revenue, creating an ecosystem where value flows back to holders.

Each week, 30% of the platform’s revenue funds token buybacks, with most tokens burned to reduce the supply and the rest staked to generate an APY of up to 30%. This structure blends transparency, scarcity, and utility in a way that appeals to seasoned crypto investors.

Key drivers behind Rollblock’s rise include:

Analysts now expect RBLK to approach $1 in 2025, giving Ethereum holders plenty of reason to view Rollblock as their next high-potential play.

Solana is trading around $202 after a slight dip of 0.78% on the day, cooling off from a recent push toward $218. The token has delivered a substantial 60% gain over the past year, supported by growing adoption and a consistent inflow of trading activity. The chart shows solid support near $190, with buyers defending that zone after August’s rally from $155.

Analysts point to $250 as the next hurdle, while long-term Solana Price Prediction models suggest SOL could double toward $400 in 2025 if momentum holds. For now, consolidation at these levels reflects strength rather than weakness, keeping Solana firmly on investor watchlists.

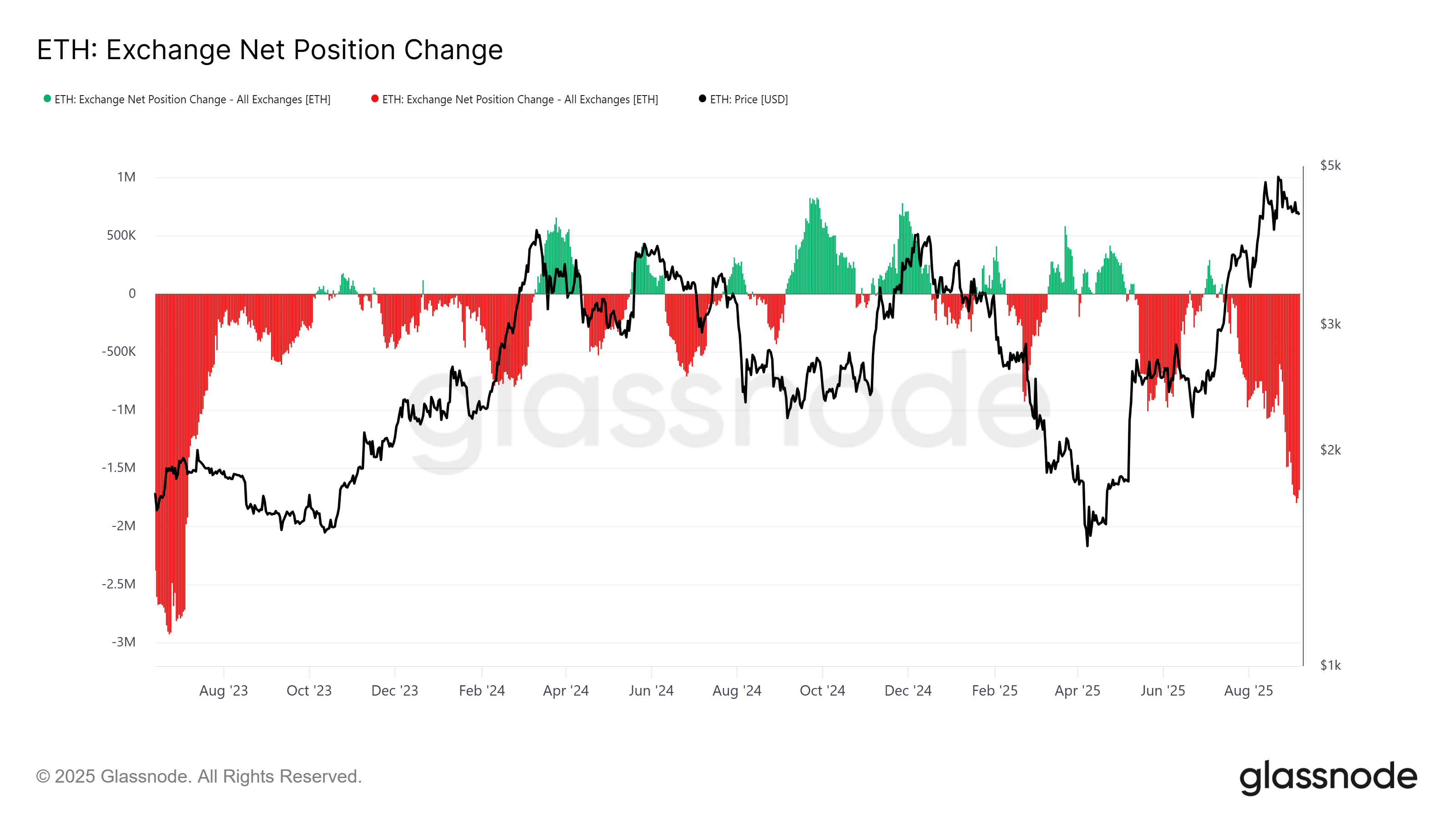

Ethereum is trading at $4,275, holding steady after a brief dip from the recent high of $4,956. Over the past month, ETH has gained 9.35%, with a yearly return of 92.15%, demonstrating its strong performance.

On the chart, ETH has struggled to break past the $4,900 zone, facing resistance each time buyers push higher. Nevertheless, ETH is holding around the price level of $4,200, leaving traders on alert.

Analysts believe that breaking out above $5,000 cleanly will open up the upper end to $5,500, and a weaker bottom to $4,000 can lead to further decline. At this time, ETH looks range-bound, awaiting the momentum to determine the next giant leap.

With over $11.5 million raised in presale and a fully functional platform already processing millions in wagers, Rollblock is building momentum that many believe could surpass both Solana and Ethereum in the coming cycle. While analysts keep a close eye on the Solana price prediction heading toward $400, RBLK’s revenue-driven model and weekly buybacks give it a different edge. For investors, Rollblock’s trajectory is shaping up as one of crypto’s standout stories for 2025.

Discover the Opportunities of the RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

The week is ending bullish for most of the coins, according to CoinMarketCap.

The rate of Binance Coin (BNB) has risen by 1.51% since yesterday. Over the last week, the price has risen by 1.16%.

On the hourly chart, the price of BNB is near the local resistance of $873.80. If bulls can hold the gained initiative and the daily bar closes around $873 or above, the growth is likely to continue to the $880 mark.

On the bigger time frame, the rate of the native exchange coin is rising. However, the price is far from the support and resistance levels.

As neither side is dominating, sideways trading in the range of $860-$880 is the more likely scenario.

From the midterm point of view, the picture is more positive for buyers. If the weekly bar closes near the $900 mark, traders may witness a resistance breakout, followed by an ongoing upward move.

BNB is trading at $871.40 at press time.

Zach Anderson

Sep 07, 2025 06:53

MATIC price prediction suggests potential 18-53% upside to $0.45-0.58 range by October 2025, though immediate downside risk to $0.33 support remains amid bearish momentum signals.

Polygon (MATIC) is currently trading at $0.38, presenting a complex technical picture that demands careful analysis for accurate price forecasting. Our comprehensive MATIC price prediction suggests the token is positioned at a critical juncture, with potential for significant moves in either direction over the coming weeks.

• MATIC short-term target (1 week): $0.35-0.42 range (-8% to +11%)

• Polygon medium-term forecast (1 month): $0.45-0.58 range (+18% to +53%)

• Key level to break for bullish continuation: $0.43 (SMA 20)

• Critical support if bearish: $0.33 (strong support level)

The absence of significant analyst predictions in recent days suggests market participants are taking a wait-and-see approach to MATIC. This silence often indicates uncertainty around key technical levels, which aligns with our observation that Polygon is trading near critical support zones. The lack of fresh institutional forecasts creates an opportunity for technical analysis to guide our Polygon forecast.

Without recent analyst consensus to contradict, our technical-based approach carries additional weight in forming realistic price expectations for the token.

The current Polygon technical analysis reveals a token under pressure but showing early signs of potential stabilization. With MATIC trading at $0.38, exactly at the calculated pivot point, the token sits at a critical decision zone.

The RSI reading of 38.00 indicates MATIC is approaching oversold territory without being deeply oversold, suggesting limited downside momentum remaining. However, the MACD histogram at -0.0045 confirms bearish momentum is still present, though the relatively small negative value indicates this momentum may be weakening.

The Bollinger Bands positioning at 0.29 shows MATIC is trading in the lower portion of its recent range, typically a zone where reversals can occur. The significant gap between the current price ($0.38) and the upper Bollinger Band ($0.56) illustrates the substantial upside potential if bullish momentum returns.

Volume analysis from Binance shows $1.07 million in 24-hour trading, which represents moderate but not exceptional interest. For a sustained move higher, we would expect to see volume expansion above $2 million daily.

Our primary MATIC price target for the bullish scenario centers on the $0.45-0.58 range, representing the SMA 50 and immediate resistance levels respectively. This target is based on several technical factors:

The first significant resistance at $0.43 (SMA 20) would need to be reclaimed to confirm any bullish reversal. Once cleared, MATIC could quickly advance to test the SMA 50 at $0.45, representing an 18% gain from current levels.

If momentum builds beyond $0.45, the next logical target becomes the immediate resistance at $0.58, marking a 53% potential upside. This level aligns with the upper Bollinger Band, making it a natural profit-taking zone.

For this bullish scenario to unfold, MATIC would need to see RSI break above 45, MACD histogram turn positive, and daily volume consistently exceed $1.5 million.

The downside scenario for our MATIC price prediction focuses on the critical support at $0.33. This level represents strong technical support and sits near the 52-week low of $0.37, making it psychologically significant.

A break below $0.35 (immediate support) would likely trigger algorithmic selling and push MATIC toward the $0.33 level, representing a 13% decline from current prices. Below $0.33, there is limited technical support until the $0.30 psychological level.

Key risk factors include broader crypto market weakness, continued MACD bearish momentum, and failure to hold above the current pivot point of $0.38.

Based on our Polygon technical analysis, the current environment suggests a cautious approach rather than aggressive accumulation.

Entry Strategy:

– Conservative entry: Wait for a break above $0.43 with increased volume

– Aggressive entry: Scale into positions between $0.35-0.38 if support holds

– Dollar-cost averaging: Small positions at $0.38, $0.36, and $0.34

Risk Management:

– Stop-loss: $0.32 (below strong support)

– Take-profit levels: 50% at $0.45, 50% at $0.55

– Position size: No more than 2-3% of portfolio due to current uncertainty

The answer to “buy or sell MATIC” depends on risk tolerance, but current levels favor patient buyers willing to accept short-term volatility for medium-term potential gains.

Our MATIC price prediction carries medium confidence for the bullish scenario and high confidence for identifying key risk levels. The technical setup suggests MATIC is more likely to find support near current levels and attempt a recovery toward $0.45-0.58 over the next 4-6 weeks.

Key indicators to monitor:

– RSI breaking above 45 for bullish confirmation

– MACD histogram turning positive

– Daily volume exceeding $1.5 million consistently

– Hold above $0.35 support level

Timeline: We expect this Polygon forecast to play out over the next 30-45 days, with initial direction likely confirmed within the next 7-10 trading days. A break above $0.43 would accelerate the bullish timeline, while a break below $0.35 would shift focus to testing the $0.33 support zone.

The current setup favors patient investors willing to accept near-term volatility for potential medium-term gains, with clear risk management levels defined by the technical structure.

Image source: Shutterstock

Dogecoin is back in the spotlight, trading near $0.21 as a $50M Trump-backed mining plan fuels $1 dreams—but whales may drag prices down 15%.

The meme coin is caught between bullish news and bearish pressure. Massive investments, ETF buzz, and treasury formation are driving optimism, but heavy whale sell-offs and weak money flow indicators threaten to break support and trigger a deeper correction.

Thumzup’s $50 million shareholder capital raise will fund the purchase of 2,500 Dogecoin mining units, with potential expansion to 3,500 rigs. The company also plans to acquire DogeHash Technologies to establish itself as a leading publicly traded Dogecoin miner in North America.

Trump-backed Thumzup invests $50M in 3,500 Dogecoin mining rigs, projecting $100M revenue if DOGE reaches $1. Source: Tesla Model Ðoge via X

At current dogecoin price levels, the operation could generate between $22 million and $103 million annually, according to company projections.

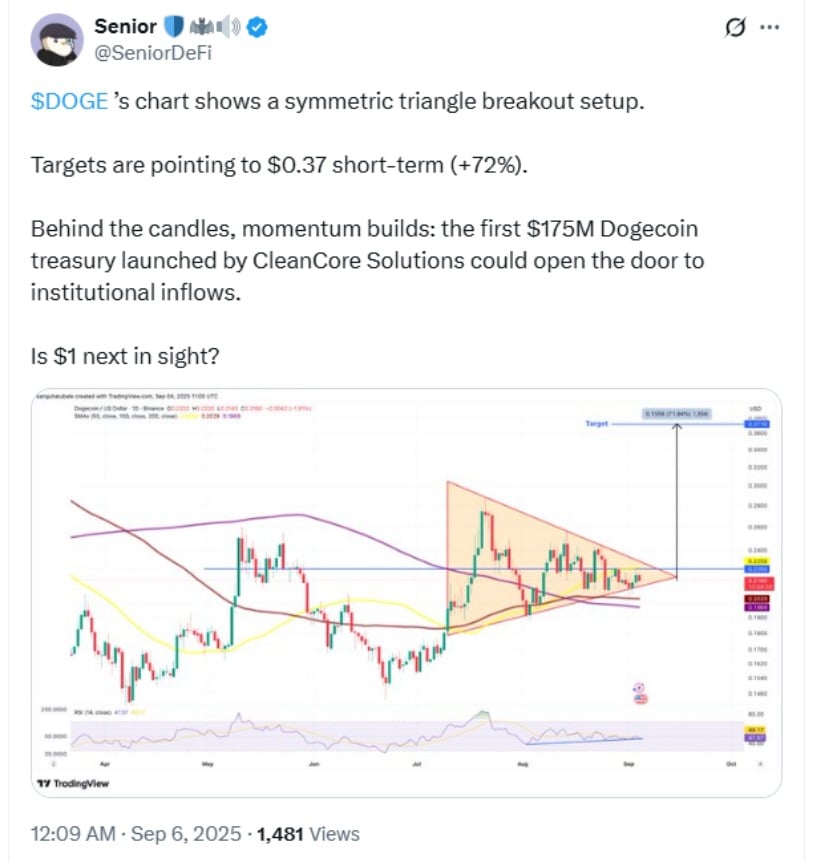

“Large-scale mining is a critical step toward Dogecoin’s long-term sustainability,” noted crypto analyst SeniorDeFi, who identified a breakout pattern that could lift DOGE 72% toward $0.37 in the near term.

Optimism around a potential Dogecoin ETF is also supporting bullish sentiment. Asset manager REX-Osprey has filed to launch DOJE, the first Dogecoin ETF, with similar applications submitted by 21Shares, Bitwise, and Grayscale. If approved, these ETFs could open DOGE exposure to a wider pool of institutional investors.

Rex-Osprey’s Dogecoin ETF may launch as early as next week, potentially becoming the first $DOGE ETF, Bloomberg’s Eric Balchunas reports. Source: 𝓣 𝓞 𝓟 𝓓 𝓞 𝓖 𝓔 via X

Meanwhile, the House of Doge and CleanCore Solutions have announced the formation of a $175 million Dogecoin treasury, chaired by Elon Musk’s personal attorney Alex Spiro—a move seen as a major step toward formalizing DOGE as a mainstream digital asset.

These developments have sparked speculation among traders asking, “Will Dogecoin reach $1?” Analysts believe DOGE requires approximately $90 billion in additional market capitalization to reach that milestone, which would represent a 400% increase from current levels.

Despite bullish long-term projections, technical indicators show near-term weakness. The Money Flow Index (MFI) has dropped below 40, indicating a decline in buying pressure.

Dogecoin shows a symmetric triangle breakout targeting $0.37 short-term, with a $175M treasury potentially paving the way for institutional inflows and a $1 milestone. Source: Senior via X

If buyers step back while whales continue offloading, corrections could deepen, potentially pushing Dogecoin toward $0.178 without sufficient dip-buying support.

Futures data confirms this cautious outlook, with open interest in DOGE derivatives dropping over 35% since July—indicating weaker speculative demand.

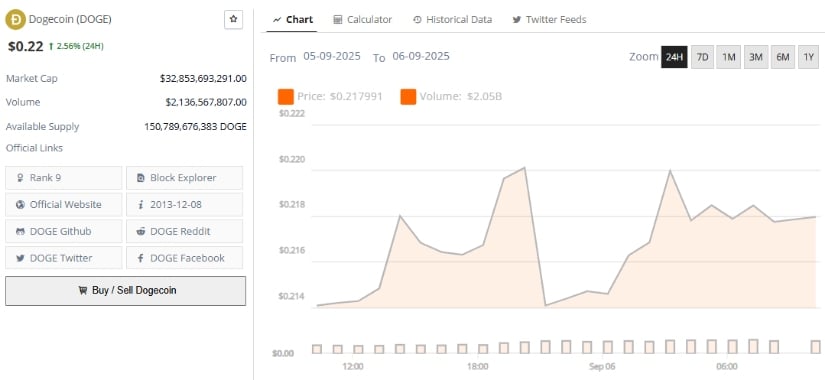

Dogecoin’s price is currently navigating a critical pivot at $0.21, a level that traders are closely monitoring for short-term direction.

Dogecoin was trading at around $0.22, up 2.56% in the last 24 hours at press time. Source: Brave New Coin

Holding above this threshold could allow DOGE to retest resistance levels between $0.23 and $0.25, with a successful breakout potentially opening the door to $0.27 or even $0.30. Conversely, if the price falls below the $0.20 support zone, stop-loss triggers and selling pressure could intensify, pushing DOGE toward $0.178.

Should bearish momentum continue, the cryptocurrency could even revisit stronger support levels in the $0.15–$0.16 range, highlighting the high volatility and risk-reward dynamics currently shaping the market.

Looking further ahead, several Dogecoin predictions suggest a gradual climb toward $0.50–$0.56 by late 2025, with the potential to break $1 by early 2026 if market sentiment and adoption trends remain strong.

It’s surprising, but the idea of a memecoin reaching a $1 trillion market cap is undeniably thrilling. Source: haysicayim on TradingView

Long-term forecasts project DOGE trading in the $1.05–$1.10 range by December 2025, with subsequent price targets of $2.40 by 2026 and $6.50 by 2030, assuming continued network growth, Layer-2 development, and increased use in payments.

XRP (Ripple) finds itself at a crucial juncture as technical patterns align with fundamental developments. The cryptocurrency’s recent price action suggests a potential breakout may be on the horizon, particularly as institutional players begin showing more interest in Ripple’s ecosystem.

XRP trades near $2.803, down 0.42%, while maintaining support in the $2.70–$2.80 range. Market analyst @_CryptoMetric notes that the chart reveals a developing cup-and-handle pattern – a formation traders often associate with strong upward moves.

All eyes are on whether XRP can push past the $3.38 resistance level, which could spark the next major rally.

The technical setup becomes more compelling when viewed alongside recent developments. BlackRock’s participation in Ripple Swell 2025 represents a significant shift in institutional sentiment. When the world’s largest asset manager engages with Ripple’s ecosystem, it suggests XRP is being evaluated not just as a trading asset but as potential payment infrastructure.

This combination of technical readiness and institutional validation creates an interesting dynamic for XRP‘s near-term prospects.

The bullish case rests on several pillars: