The main category of Dietary Supplements News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Dietary Supplements News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Many people take a probiotic supplement to improve their digestive health or stomach issues, yet the benefits can go far beyond that. Research suggests that probiotics, the beneficial bacteria that live in your gut and make up your microbiome, can help strengthen the immune system, improve blood sugar levels and insulin sensitivity, speed up metabolism, assist in weight maintenance, and even alleviate anxiety and depression. If those are benefits you’re looking for (and really, who wouldn’t be), you likely want to know the best time to take probiotics to get the most perks.

Meet the Experts: Mia Syn, M.S., R.D.N., owner of Nutrition by Mia; Janelle Connell, R.D.N., nutrition expert at Viome; Hilary McAllister, senior formulation chemist at Metagenics; Mastaneh Sharafi Ph.D., R.D., SVP of Science and Innovation at Ritual; Stephanie Saletta, M.S., R.D., MyFitnessPal nutrition scientist; Shelley Balls, R.D.N., a registered dietitian nutritionist at Intermountain Health.

Here, nutrition experts share the best time to take probiotics, plus the best foods to take them with, how to add probiotic-rich foods to your diet, and more.

“Some studies suggest that the best time to consume probiotics is with or after meals,” said Mia Syn, M.S., R.D.N., owner of Nutrition by Mia. “However, the best time of day to take probiotics is not definitively established.” What’s more important than when you take them is that you take them at all.

“The best time to take probiotics is when it’s most convenient for you and when you will remember to take them,” added Janelle Connell, R.D.N., nutrition expert at Viome. “Consistency is key to support probiotic effectiveness and meaningful changes within your microbiome.”

Hilary McAllister, senior formulation chemist at Metagenics, added: “Most clinical studies on probiotics do not control for the time of day and still show good benefits.” The more important thing is making sure to take them every day.

Given that they’re digestion-centric, to consider meal time when taking probiotics is natural. But not all brands are created equal, explained Mastaneh Sharafi Ph.D., R.D., SVP of Science and Innovation at Ritual. “It’s always best to follow the directions on the product label,” she said. “Some brands recommend taking their probiotic on an empty stomach, while others suggest taking it with food.”

The experts we spoke to agreed that there’s nothing wrong with taking probiotics with food, and because it’s often recommended, it can’t hurt—unless the packaging instructions advise otherwise. “Taking them before breakfast may be the preferred option, because your digestive system has been at rest for an extended period of time and the probiotic has less resistance reaching the intestines,” said Stephanie Saletta, M.S., R.D., MyFitnessPal nutrition scientist.

On the other hand, taking probiotics with food may also help them survive their digestive travels. Connell explained that the food can act as a protective barrier, “helping probiotics survive stomach acid and harsh bile salts to reach the lower intestines, where they can be most effective.”

Saletta recommended talking with a doctor for guidance on picking the right strain and the right time of day to take it, and also reaching for probiotic- and fiber-rich foods to get similar benefits. “Research has shown that a wide variety of fruits, vegetables, whole grains, and legumes will improve your gut probiotic makeup,” she added.

Prebiotic foods, which promote the growth of beneficial microorganisms and are known as food for probiotics, are good to eat alongside the supplement, said Shelley Balls, R.D.N., a registered dietitian nutritionist at Intermountain Health. Prebiotics include onions, bananas, Jerusalem artichokes, oats, lentils, almonds, asparagus, barley, wheat bran, greens, yams, apples, garlic, leeks, soybeans, flaxseeds, seaweed, and cacao.

Connell and Syn said that to get the most out of probiotic supplements, you should avoid ultra-processed and sugary foods that feed harmful bacteria, as well as artificial sweeteners, alcohol, and fatty, greasy foods that disrupt gut balance. They also recommended avoiding excess alcohol.

Keiser said it’s best not to take probiotics if you’re also on antibiotics, which can kill off probiotics and reduce their efficacy. “If you’re taking antibiotics, be sure to take probiotics a few hours before or after your antibiotics,” she added.

It’s also important to make sure you are taking a reputable brand that is upfront about their quality and research. Research helps identify and verify the specific health benefits of different probiotic strains and formulations to help ensure that consumers receive safe and effective products. Read the label thoroughly to see what strands of bacteria are present and if the product has been third-party certified.

You should take probiotics consistently, whenever is convenient for you, and a few hours before or after taking antibiotics, if you are on them. Even so: “Probiotics from supplements alone aren’t enough to promote optimal gut health,” Balls said. “Eating a balanced diet that includes prebiotics, probiotics, and a healthy lifestyle can all play an important part.”

Probiotic foods to prioritize include:

Dietary supplements are products intended to supplement the diet. They are not medicines and are not intended to treat, diagnose, mitigate, prevent, or cure diseases. Be cautious about taking dietary supplements if you are pregnant or nursing. Also, be careful about giving supplements to a child, unless recommended by their healthcare provider.

Harney & Sons has been around since 1983, and its teas have garnered a lot of attention over the years. Specialty blends of the company’s tea have been commissioned by the Royal Family and the Met’s British Galleries. That speaks volumes! The Brits love their tea, consuming around 100 million cups per day! But they don’t know iced tea.

Southerners, on the other hand, take iced tea very seriously. So, when this Southern girl found out that Harney & Sons had a selection of iced tea among its 300 varieties, I knew I had to see what they were all about. Because I know good iced tea.

Good iced tea is something that delivers a robust, natural taste, color, and aroma of the actual tea leaf, not a thin, dirty-looking version of water. And if it’s going to be flavored tea, it shouldn’t be elusive or highly artificial. The taste of what is being promised on the package needs to be forthright and refreshing. And the herbs and flora should shine through with their own organic visuals and scent. But most of all, that tea better be good enough to drain a pitcher because we don’t waste time or tea where I’m from.

So, I gave Harney & Sons iced teas a chance, pulled out my jug and kettle, and went looking for those exact attributes in nine different flavors. And this is how they ranked.

While all the teas on this list offer their own undeniable aromas, the Blueberry Green tea is haughty in aromatic nature, refusing to let any passersby miss its sweet, perfumed fragrance. Made with green tea, vanilla and blueberry flavor, lemongrass, cornflowers, and blueberry pieces, this tea brews to the mild amber color one expects from green tea. Although once water is added, the color changes to a strange, almost neon, yellow. Now I’ve seen tea made of many different herbs and plants. A big favorite back home is dandelion tea. But I’ve never seen anything that would naturally make this color, and that is a red flag for me.

As far as flavor, there is a definitive blueberry to this tea that carries no sweetness or tartness. There is no flavor of actual tea that comes through on the palate — although between the blueberry flavor and fragrance, I feel that it is almost an impossible quest. While there is no doubt about the flavor of this tea, the color is too strange, the scent too pointed, and the blueberry flavor artificial. Together, they create something off-putting and highly manufactured, not something you feel you’ve brewed. Within just a few sips, it becomes hard to enjoy the beverage due to the attention-grabbing sight and smell, which places this tea at the bottom of this list.

This flavor is labeled as an herbal infusion and actually contains no tea at all, which isn’t something that throws me. I’ve seen many “herbal teas” that actually didn’t have tea in them and instead carried an ingredient list much like this one: safflowers, apple pieces, blood orange flavor, orange peel, grapefruit flavor, rose hips, raspberry flavor, hibiscus, beetroot, and orange flavor. And while it gives a vibrant red showing once steeped, that fades quickly when adding water.

The aroma is also not as fruity as I imagined, as this brew gives off a powdery scent that offers hints of citrus but falls toward a perfumed side, which isn’t as refreshingly teasing as other options on this list. And when it comes to taste, it isn’t the fruit that makes an appearance; it’s mainly the rose hips, which I personally don’t care for. There is a slight blush of apple that seems to try to round out the profile, but the floral aspects are just too powerful. This has a heavy tartness that clings to the palate that doesn’t originate from any citric flavor and seems misplaced.

As far as an iced tea goes, this one just doesn’t deliver. It tastes more like something one would rather smell than actually taste. Although the natural aesthetics of it all do allow it to rank higher than the one before.

The steep of this brew is a muted red with an aroma of something tropical and highly pungent. With the ingredients simply being black tea and natural passion fruit flavor, I feared the heightened scent of the fruit would mimic the flavor profile in the green blueberry. Even from a distance, it’s hard to determine if the scent is pleasant or not.

Once the required amount of water is added, any redness there before becomes nothing more than a hint of color; however, the strong fragrance stands firm. The scent of the tea is immediately transported to the palate, although it doesn’t become overwhelming in flavor. The taste of black tea does make an appearance after the tropical fruitiness dissipates, although the tang of the fruit hangs on into the aftertaste.

I can see how this brew will be a choice others may flock to, as it is fruity and refreshing. However, after tasting the other teas on this list, I find this one leans slightly more into an artificial flavor than the ones ranked higher. And for that reason alone, it ranks lower than those with a more natural flavor and aroma.

This is a simple blend of organic black tea and organic peach flavor meant to be mellow yet invigorating. The color after steeping reminds me of a peach pit and gives off a strong scent of the fruit. Not to be outshone, the black tea also carries through the air as it wafts in a bit more subtly after the peach.

This brew maintains a brilliant color and aroma even after adding the additional six cups of water to the original steep. The peach flavor is surprisingly subtle and could easily be lost if the fragrance were not so prominent. However, it is quite lovely in that respect. The black tea is nice and strong, but not so intense that it battles being an iced version of itself. It stays smooth while leaving its mark on the palate.

The quality of this tea is juicy without being overly flavored, and I can see it having mass appeal to tea drinkers, whether they enjoy a flavored tea or not. This tea is somehow bold yet delicate and overall refreshing. And while I appreciate all those characteristics, I have to say I enjoy the teas in this lineup that rank higher and have a stronger flavor.

The tropical mango has a lovely, yet potent, fruity aroma that is obvious from the dry bag and only grows as it steeps. The brew is made of black tea, orange peel, mango pieces, and coconut pieces, as well as mango, pineapple, coconut, and orange flavor. And knowing the ingredients and being surrounded by the scent, my hopes for flavor from this tea are high.

Once steeped, the tea is a beautiful golden brown and gives off refreshing vibes. And the first taste does reward the drinker with a fruity, mango sweetness that is hard to resist. There is a faint tartness that flows across the palate briefly that bears a resemblance to orange. But the mango stays the headliner in the overall performance, while the coconut seems to be entirely elusive, yet unmissed.

Overall, this is a subtle, revitalizing drink that does its name proud. With the flavor of mango and citrus, it does feel tropical. The flavor is bolder than the teas ranked lower on the list, but stays soft to the taste buds. However, the teas that rank higher pleasingly have even more flavor to be had, which sets this option right in the middle.

Before being diluted, the coloring of this brew is faint, and only the scent of mint escapes from the steep. Made with spearmint, green tea, strawberry flavor, and watermelon flavor, this tea is characterized as being fruity and rejuvenating as an ode to the tastes of summer.

And although it only carries the fragrance of the spearmint, on first taste, the juicy flavor of watermelon slides across the palate softly and subtly sweet. After letting more of the flavor hit the tongue, the watermelon increases into a crescendo that meets the mint at a higher level. The two profiles pair excellently together, allowing the flavor of the green tea to stand as a base and offer a taste that is truly representative of the days of summer.

With all flavors bringing their own attributes, this brew offers something refreshing and uplifting, fruity and clean. While I don’t think this is something I would crave through the colder months, it is definitely a taste that would hit the spot through all the warmer months. While the level of flavor stays at an even middle ground, there is a subtle strength to this pairing that is so delightful that it amplifies its refreshing qualities. This tea takes the blend and height of flavors up a notch and throws in a bit more refreshment, which allows it to rank higher than all the ones falling lower.

This iced tea is also an herbal infusion that is a mixture of flowers and fruit. Made up of raspberry flakes, hibiscus, honey flavor, butterfly pea flower, raspberry flavor, lemongrass, apple pieces, lemon peel, and rose hips, this herbal infusion steeps to a dark, purple color that is nothing less than intriguing. The aroma is also strongly sweet and fruity, making everything about this brew enticing.

Even after adding water to the steep, this brew stays a delightful indigo color that is simply beautiful. And the flavor does the color justice. This concoction is sweet and bright with layers of fruit, citrus, and floral notes. It’s very berry and creates its own levels of sugar without needing anything added.

Well-balanced and full-bodied, there is a sharp, clean finish to this drink that makes it necessary to have another sip. Although flavorful and visually striking, it seems to take as much as it gives, leaving a dryness to the tongue that I’ve only experienced with red wine. But as easy as this is to drink, I feel the dry finish is somewhat inconsequential. Although it is a factor that the top two do not have it, it is the reason this selection sits at number three.

This tea brews up to a dark amber color with just a slight hue of purple. Made from black tea (ideal for iced teas) and natural black currant flavor, this freshly steeped brew gives off a soft aroma of sweet wildflowers and berries. It is a lovely, delicate fragrance that is in stark contrast to its strong appearance.

The first flavor to hit the tongue from this brew is the black currants, which are sweet and juicy. That is quickly followed by the black tea, which remains subdued to match the berry and not overpower it. The body is full and soft, offering a robust, refreshing, lusciousness that leaves the palate moist.

There seems to be a middle ground of sweet and blunt in the overall flavor, needing nothing more from either side to make this tea taste complete. While this brew does not carry with it a varied profile like some of the others, it is incredibly fulfilling in flavor, reaching heights that those ranked lower did not reach. Rich but subtle, sharp yet fruity, this tea is completely unexpected in its simple complexity, allowing it to win the No. 2 spot on the list. While the flavor, aroma, and visual appeal of this tea are all strong, the next tea takes it up another level.

The steeped brew of this herbal infusion is a dark purple in color with the delicate fragrance of flowers and mint. It’s reminiscent of a breeze that would waft through a backyard summer garden. The aroma is fresh and inviting, created by rosehips, peppermint, hibiscus, raspberry flakes, orange peel, spearmint, raspberry flavor, lemon peel, and apple pieces. With every sniff, you are sure to pull back another bit of the nature infused in this concoction.

The flavor is tart and juicy, making the mouth water. Mint hits right on the back of the taste of this tea in a surprising and elevating manner. A symphony of berries and herbs seems to swirl around the palate with each subsequent sip, creating something invigorating and transportive.

The herbal infusions ranked lower on this list leave a little something to be desired and seem to need the flavor of actual tea to make their profiles complete. However, this creation leaves nothing to be missed. With the flowers, mint, and fruit, this tea hits every profile one could want in an iced tea or any beverage. Both refreshing and restorative, I could drink glass after glass of this brew in hot or cold weather. This one is truly an experience in taste and solidly earns the number one spot.

I followed the specific steeping instructions on each bag of these teas. Each tea was given the same treatment and time in the tasting process. And while sweet tea is generally the rule of thumb for me, I decided to taste these as they were, nothing added. I was more than surprised that most of them didn’t need any added sweetness, as they offered their own.

I went looking for an iced tea that was flavorful in actual tea, when tea was present, and offered the taste promised in the added flavors. However, I also looked for a beverage that embodies a natural aesthetic in look, scent, and taste. So the ones that were obvious in artificiality, regardless of which element fell that way, rank lower. It should look, taste, and smell natural in order to be the refreshing drink iced tea drinkers want.

With each higher ranking on this list, the refreshing aspects of iced tea become more fulfilling in flavor profile, visual aesthetic, and enticing aroma. Other than the two that fall to the bottom of this list, I’d recommend each of these teas. From subtle to stunning, most of these teas are quite pleasing. The top four blends are ones I will force upon friends and family if they venture to my house when I have some brewed. And the top tea has garnered a permanent spot in my glass pitcher, as it will look visually stunning and offer a unique natural refreshment to whoever is lucky enough to grab a glass.

Nu Nutridac is recommended for patients experiencing cognitive decline, anxiety-associated disorders, or early neurodegenerative changes

Cadila Pharmaceuticals has launched Nu Nutridac, a clinically proven nutritional replenisher designed to support patients with neurodegenerative conditions and anxiety-related disorders.

Nu Nutridac delivers a comprehensive nutrient profile that enhances cognitive function and regulates mood. Each cellulose capsule combines eight key ingredients Panax ginseng extract, Ginkgo biloba, Benfotiamine, Pyridoxal 5-phosphate, L-Methyl Folate, Chromium Picolinate, Biotin, and Vitamin B12—renowned for their neuroprotective and mood-stabilising properties.

Dr Rajiv I Modi, CMD, Cadila Pharmaceuticals, said, “At Cadila Pharmaceuticals, we believe healthcare should not only treat but also prevent and heal. With Nu Nutridac, we are addressing the growing need for evidence-based nutritional support in neurological and anxiety-related disorders. It’s unique blend of botanicals and essential vitamins offers patients and clinicians a trusted, holistic option for cognitive and emotional wellbeing.”

Nu Nutridac is recommended for patients experiencing cognitive decline, anxiety-associated disorders, or early neurodegenerative changes. It can also be used as an adjunct to standard therapy.

We’ve all heard dietitians say that it’s important to “eat the rainbow.” Sure, a diverse shopping cart makes our meals more novel and fun, but that’s not the only reason they emphasize the dictum. In fact, it’s really all about getting your vitamins. We’re not talking about a multivitamin supplement, either. The truth is, most healthy adults can meet their nutritional needs from the essential micronutrients in their regular diets, no supplementation necessary.

“Vitamins are the small but mighty nutrients that help our bodies function at their best. And we know that we don’t necessarily need huge amounts of vitamins, but we know that we want to get enough of each, and we can do that through our food first,” says Gina Rancourt, M.S., RD, CD.

But how do you ensure that you’re getting everything you need from your meals every day? This handy guide breaks down vitamins A through K, including all eight B vitamins. We’ll share their primary functions, what happens if you don’t get enough, and the best foods to get on your table to help you feel your best.

The takeaway here is that you can get what you need to power your body on a daily basis through everyday foods. Each trip to the grocery store is an exercise in both art and science—planning your meals with vitamin intake in mind should be a color-filled palette for your creativity. As long as you keep your diet varied, you will likely get the vitamins you need.

Dietitians encourage mixing and matching whole, minimally processed foods to create a rainbow of flavors and nutrition that covers the entire spectrum of our vitamin needs.

Several leading infant formula companies have reported growth in their infant formula sales in China for the first half of this year.

Danone’s Aptamil, Yili, Friesland Campina’s Friso, The a2 Milk Company, and Biostime from H&H Group are some examples that have continued to see growth, amid concerns on fluctuating birth rates in China.

The popularity of premium products and expanding sales in both offline mother-and-baby stores and online channels form a common thread.

Nestle has launched a screening tool for detecting diabetes risk among the Chinese population.

The tool is available via WeChat Mini Program YiYang, which is also a brand of Nestle’s nutritional products launched in China.

According to Nestle, it complements the company’s range of digital tools for supporting personalized nutrition recommendations.

It is also one of Nestle’s latest initiatives in building its range of products and services for supporting blood glucose management in China.

The a2 Milk Company (a2MC) is set to buy a manufacturing facility from Yashili New Zealand in the hopes of ramping up its China label infant formula business.

The company has been seeing sales growth for both its English and China label infant formula in FY25, with the former increased by 17.2% and the latter by 3.3%.

In China, growth was said to be led by effective new user recruitment initiatives, resulting in a record market share of 4% in stage 1 products in the mother-and-baby channels.

China health supplements giant BYHEALTH has continued to see a decline in its sales and profits, and the company said it would be pumping more resources to grow its international business, especially in South East Asia.

Net profit attributed to shareholders of the company dropped 17.34% to RMB736.5m (US$102.5m), while operating revenue fell 23.43% to RMB 3.5bn (US$491.7m).

A continually fragmented retail landscape was said to be one of the reasons for the decline.

Calcium and protein were the most used health supplements among China centenarians, according to a study involving over 2,800 centenarians.

According to findings published in Geroscience, about one in 10 Chinese centenarians used dietary supplements.

The prevalence was higher in men, with 12.3% of male centenarians taking health supplements, as compared to 10.7% among females.

The green-Mediterranean diet may protect against brain aging by reducing protein markers linked to cognitive decline.

Adopting a green-Mediterranean diet, which incorporates green tea and the aquatic plant Mankai, has been linked to slower brain aging, according to recent research.

The study, published in the journal Clinical Nutrition, was conducted by scientists from Ben-Gurion University, the Harvard T.H. Chan School of Public Health, and the University of Leipzig.

Neurological disorders such as mild cognitive impairment and Alzheimer’s disease are often associated with an increased brain age gap, meaning the brain appears biologically older than a person’s actual age. To explore whether diet could influence this process, researchers examined data from nearly 300 participants in the DIRECT PLUS trial, one of the most extensive long-term studies on diet and brain health.

Over an 18-month period, participants followed one of three diets: a standard healthy diet; a traditional calorie-restricted Mediterranean diet, which limited simple carbohydrates, emphasized vegetables, and replaced red meat with poultry and fish; or the green-Mediterranean diet, which included all of the above along with green tea and Mankai.

When the researchers measured protein levels in the participants’ blood, they found that higher levels of certain proteins were associated with accelerated brain aging. Further, they found that those protein levels decreased in participants who followed the green-Mediterranean diet. The researchers hypothesized that the protective effect of the diet could be a result of the anti-inflammatory molecules contained in green tea and Mankai.

“Studying the circulating proteins in blood allows us to observe, in a real-life setting, how the brain’s aging processes are influenced by lifestyle and dietary changes,” said Anat Meir, postdoctoral research fellow at Harvard Chan School, who co-led the study. “This approach gives us a dynamic window into brain health, helping to reveal biological changes long before symptoms may appear. By mapping these protein signatures, we gain powerful new insight into how interventions, such as diet, may help preserve cognitive function as we age.”

Reference: “Serum Galectin-9 and Decorin in relation to brain aging and the green-Mediterranean diet: A secondary analysis of the DIRECT PLUS randomized trial” by Dafna Pachter, Anat Yaskolka Meir, Alon Kaplan, Gal Tsaban, Hila Zelicha, Ehud Rinott, Gidon Levakov, Ofek Finkelstein, Ilan Shelef, Moti Salti, Frauke Beyer, Veronica Witte, Nora Klöting, Berend Isermann, Uta Ceglarek, Tammy Riklin Raviv, Matthias Blüher, Michael Stumvoll, Dong D. Wang, Frank B. Hu and Iris Shai, 23 August 2025, Clinical Nutrition.

DOI: 10.1016/j.clnu.2025.08.021

This study was supported by the German Research Foundation (DFG) project number 209933838 (SFB 1052; B11) (to I Shai); the Israel Ministry of Health grant 87472511 (to I Shai); the Israel Ministry of Science and Technology grant 3-13604 (to I Shai); and the California Walnut Commission (to I Shai).

Never miss a breakthrough: Join the SciTechDaily newsletter.

If you’re struggling to lose weight even with diet and exercise, some supplements promise to help you shred body fat. But which ones really work for guys?

This guide will reveal the top supplements, starting with Hunter Burn. Compare the benefits, drawbacks, and ingredients of these thermogenics to discover the best fat burner for men like you!

Let’s take a closer look at the best fat-burning supplements for men and what makes each one stand out.

As our #1 pick, Hunter Burn may be the best fat burner for men who want to trim body fat while bulking up those muscles. Created by Hunter Evolve, it could also be your ticket to a suppressed appetite, revved-up metabolism, and an overall performance boost.

>>Learn how Hunter Burn burns fat

PhenQ may be the best fat burner for men who prefer an all-around supplement that encourages weight loss from different angles. Made by Wolfson Brands, it aims to torch fat, suppress your appetite, stop new fat cells in their tracks, energize you, and elevate your mood.

>>Find out how PhenQ targets fat

PhenGold is the best fat burner for men hoping to speed up their metabolic rate to cut more body fat. This Health Nutrition supplement, which may be taken by vegans and vegetarians, also helps curb your appetite.

>>Discover how PhenGold promotes fat burning

PrimeShred might be the best fat burner for men who need more energy and focus to work out. As another Health Nutrition supplement, it aims to cut fat and kickstart your metabolism.

>>Explore how PrimeShred shreds fat

Capsiplex Burn might be the best belly fat burner for men because it promises to target stored fat in your body. This supplement is designed to boost your energy, keep those cravings at bay, and support muscle growth (provided you’re hitting the gym and doing strength training!).

>>See how Capsiplex Burn cuts stubborn fat

Instant Knockout Cut might be the best fat burner for men who are into sports and fitness. Aside from energizing your body to level up your physical performance, this Roar Ambition supplement helps you shred fat by revving up your metabolism and minimizing your appetite.

>>Learn how Instant Knockout Cut cuts fat

PrimeGENIX CalmLean is likely the best fat burner for men who aren’t a fan of the buzz that stimulants bring. Made by Leading Edge Health, It’s crafted to fire up your metabolism and curb your cravings without the jitters or sleep problems that caffeine may cause.

>>Find out how PrimeGENIX CalmLean reduces fat

A fat burner is a supplement that kickstarts thermogenesis, a process where your body literally churns up the heat inside you to convert fat into energy.

Most top fat burners for men are packed with ingredients like caffeine, green tea extract, and capsaicin, which help you torch more calories while you’re crushing it at the gym [1] [2] [3].

Natural fat burners encourage weight loss by affecting different processes in the body, such as increasing body heat, reducing appetite, boosting energy levels, and breaking down more fat.

Thermogenic ingredients turn up the heat inside your body, which can lead to more calories being burned off. A study suggests that thermogenesis could crank up your energy burning by up to 90 kJ [4].

The plant-based glucomannan helps you feel full without overeating. Research shows that users taking glucomannan might see more weight loss than those who don’t [5].

Caffeine boosts your energy and can make exercise feel less like a chore, possibly leading to longer, more intense sessions. A study reveals that caffeine consumption may enhance exercise performance and endurance [1].

Green tea extract helps your body turn fat into energy, especially when you’re doing physical activity. A study has shown that, when combined with physical exercise, green tea extract increases fat oxidation [2].

>>Discover how Hunter Burn promotes weight loss

The best weight loss supplements for men work in different ways to help guys shed pounds. Here are some of the most popular types.

Carb-burning supplements impede the breakdown and absorption of carbohydrates by blocking certain enzymes. This prevents the undigested carbs from contributing to calorie consumption as they are eliminated from the body. White kidney bean extract is a common ingredient found in carbohydrate blockers [6].

Fat-burning supplements promote thermogenesis, increase the body’s temperature, boost our resting metabolic rate, and aid in calorie burning. Fat burners often contain ingredients such as caffeine, green tea extract, and capsaicin sourced from chili peppers [1] [2] [3].

Fat blockers, like carb inhibitors, hinder the absorption of dietary fats in the intestines. What’s more, they may prevent new fat cells from forming, which may lead to overall weight loss.

Appetite suppressants regulate your cravings by making you feel full or by tweaking hunger-related hormones. These supplements usually contain glucomannan, a type of dietary fiber that absorbs water and creates a feeling of fullness [5].

Since there’s no one-size-fits-all supplement, keep these things in mind as you choose the right one for you.

First of all, it’s vital to understand your weight loss goals clearly. If you want to cut down on snacking, an appetite suppressant may be a good fit.

On the other hand, in case you want to figure out how to get lean or how to get rid of man boobs, a thermogenic fat burner could help you get rid of body fat. And if you wish to increase the intensity of your workouts, an energy-boosting supplement might be a great option.

Gentlemen like you have unique fitness needs. So, whether you’re hoping to learn how to lose belly fat, drop excess pounds, or reach your workout goals, make sure that the weight loss supplement you pick is designed for the male physique in terms of ingredients and dosage.

Read customer feedback from third party sites to get a good idea if the fat burners are really effective or not. What’s more, research the ingredients on the label. Look for products that include scientifically supported ingredients like green tea extract or glucomannan.

A healthcare provider can provide personalized guidance based on your medical history and current medications, as well as the common side effects of some ingredients. A doctor’s expertise can help identify any potential risks or interactions and determine the most suitable fat burners for your health needs.

Pills are simple and convenient to take and carry around, while powders can be mixed into beverages and are easier to swallow. The choice between the two depends on your personal preference and lifestyle.

>>Check how Hunter Burn can help with weight loss

These science-backed ingredients, which are typically included in the best fat-burning supplements for men, can help you get rid of body fat and shed pounds.

Caffeine speeds up your metabolism and boosts the amount of energy you burn. It could also aid in ramping up athletic performance, potentially leading to more effective workouts [1].

Green tea extract contains a lot of catechins, which are powerful antioxidants. These catechins may stimulate fat oxidation and boost metabolism, especially when combined with caffeine [2].

Capsaicin, the active component present in cayenne pepper, may amp up thermogenesis by increasing calorie burning and promoting fat oxidation [3].

Made from the konjac plant, glucomannan expands in the stomach. This creates a feeling of fullness, and ultimately, encourages you to eat fewer calories [5].

Carnitine helps your body convert fat into energy. It also plays a vital role in the functioning of the heart, brain, and metabolism. It’s also known to help prevent heart disease [7].

Green coffee bean extract packs a lot of chlorogenic acid, which helps the body metabolize fat and assists in fighting obesity [8].

As one of the polyunsaturated fatty acids, conjugated linoleic acid (CLA) is commonly found in dairy and beef products. It works by inhibiting the enzyme responsible for storing fat and promoting the breakdown of existing fat, ultimately reducing body fat [9].

>>Explore the fat-burning ingredients of Hunter Burn

In addition to taking weight loss supplements, there are various other sustainable ways to burn fat, reduce your body fat percentage, and improve your body mass index (BMI).

With high-intensity interval training, also known as HIIT, you’ll briefly exercise intensely and alternate it with low-intensity recovery periods. Along with whey protein and other fitness supplements, this workout method can aid in burning fat as it may boost your metabolism for hours afterwards, leading to increased calorie burning throughout the day [10].

Add various lean sources of protein, whole grains, fruits, vegetables, and amino acids to your healthy eating plan to improve your metabolism, reduce body fat, and control your blood glucose levels. These food choices are rich in fiber and protein, which are crucial for weight management.

For instance, chicken breast is a lean meat option that is low in fat and high in protein [11]. As a result, it requires more energy for your body to digest compared to fats or carbohydrates, leading to a higher calorie burn.

Constant stress can cause hormone imbalances, which may hinder weight loss or lead to weight gain, even when using other methods to burn fat.

Morning yoga stretches, meditation, and deep-breathing exercises are good practices for managing stress levels, ramping up metabolism, and encouraging fat reduction.

Eating too much of any food, regardless of its nutritional value, can lead to weight gain. Portion control involves understanding the appropriate serving size and the corresponding calorie content or amount of energy it provides.

By practicing portion control and maintaining a balanced diet, you can prevent overeating while still enjoying your favorite foods. This is possibly more sustainable than intermittent fasting or keto diets.

As a key male hormone, testosterone plays a role in the metabolism of fat, carbs, and protein [12]. However, your T-levels tend to drop as you grow older. Taking the best testosterone booster supplements can help boost your body’s natural production of this hormone.

In this section, we’ve got a list of some of the burning questions about the top fat burners for men.

The crown for the best fat burner for men goes to Hunter Burn. It’s got the science to back it up and a track record for shredding fat while preventing muscle loss, which can help guys sculpt their body.

PhenQ is like a fat-burning sprinter. Because it tackles weight loss from different angles, it may speed up fat loss, block new fat from forming, lift your mood, boost energy, and keep hunger in check.

No pill can promise to target just your belly, but Capsiplex Burn is a solid choice for overall slimming because it aims to eliminate stored fat, which includes whittling down the waistline and reducing visceral fat. However, hormonal belly fat might require other solutions to balance your hormones.

Here are 5 foods that may assist in burning belly fat:

Fat-burning supplements could be your allies in the battle of the bulge, revving up your metabolism, and keeping your energy high. Hunter Burn holds the title belt as the best fat burner for men for now, but make sure to scout out our lineup of supplements to find your perfect match.

>>Find out how Hunter Burn burns fat

As with the best protein powders, creatine is a supplement you may want to start stocking in your cabinet. Creatine is an extensively researched supplement, shown to support strength, muscle growth, and recovery. This supplement’s strong track record has made it a staple for athletes and fitness enthusiasts alike. And, with research showing that strength training can help workers in a wide variety of fields perform better on the job, adding creatine to your fitness plan might be the right step to help you dominate professional goals as well as personal.

To help identify the top creatine options on the market, we teamed up with a registered dietitian to test and evaluate creatine supplements. Here are the eight best creatine supplements that deliver both effectiveness and value.

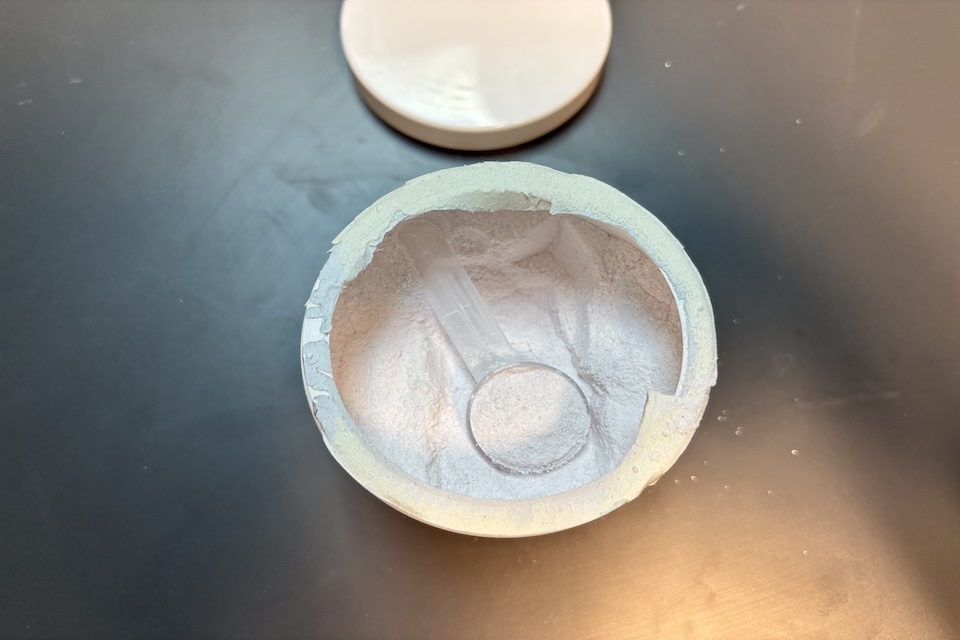

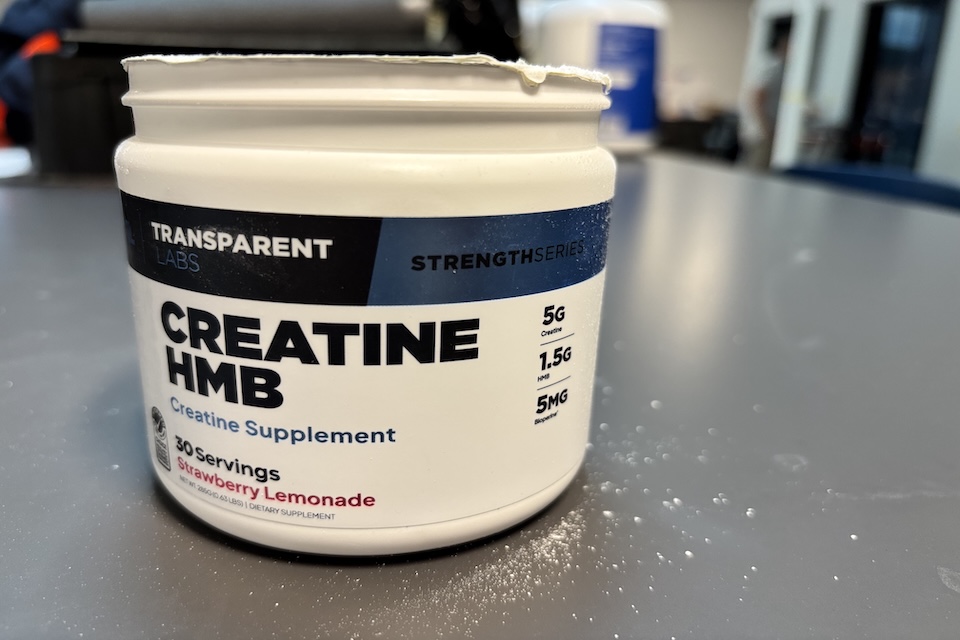

Transparent Labs Creatine HMB is our top creatine supplement overall because it pairs creatine monohydrate with clinically effective HMB, which may help boost muscle growth, strength, and recovery in one straightforward formula. We also like that it’s third-party tested, naturally sweetened, and contains no fillers. This offers peace of mind to competing athletes and fitness lovers alike. Our tester Pete, a registered dietitian, tried this creatine and pointed out its uniqueness, saying, “The combination of creatine monohydrate and beta-hydroxy-beta-methylbutyrate (HMB) is fairly unique, as most creatine supplements are solely creatine. HMB has been shown to have some positive benefits for protecting and building lean muscle mass, so it pairs nicely with a creatine supplement.”

Pete had a positive first impression of this product, rating it a 5 out of 5 in that category. “It’s a small, white plastic container with a screw top lid, which is easy to open and close. The label looks high quality with a glossy finish and is easy to read. They also provide a scoop.”

He rated the mixability of this product a 5 out of 5. “The product dissolved fully within sixty seconds, there were no visible chunks or clumping when mixing,” Pete said. So, you won’t need to worry about constantly shaking your bottle after you mix a scoop in water.

After tasting the creatine, he rated it a 5 out of 5 for taste as well. “I tested the strawberry lemonade flavor, and thought this product tasted great.” He also noted that its fairly uncommon to find flavored creatine supplements, so this one felt like a sweet treat. “It’s sweetened with stevia extract, and while it tastes sweet, it’s not overly sweet. It felt light and refreshing—the powder dissolved fully so there wasn’t any grittiness or chalkiness,” he said.

Transparent Labs’ creatine isn’t the most budget-friendly on our list (if you’re looking for a cheaper option, we recommend Nutricost Micronized Creatine Monohydrate) but given the third-party testing and clean formulation, we think it’s well worth the investment.

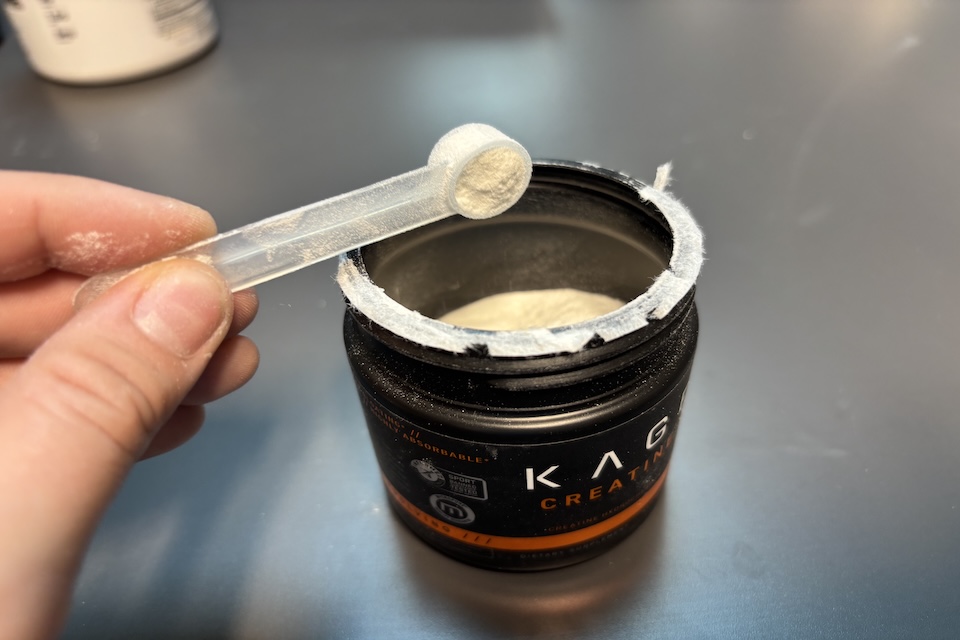

Kaged Creatine HCL stands out amongst other creatine powders on this list due to its patented formula of creatine hydrochloride. Many products on our list are made from the more standardized form of creatine monohydrate.

We also like that this creatine is third-party Informed Sport certified and free from banned substances, which is ideal for athletes currently competing or folks who want clean products with transparent labels.

Pete rated Kaged Creatine HCl a 5 out of 5 for first impressions, saying, “This creatine comes in a small black plastic container, the lid opens and closes easily. The label has a matte black finish and metallic orange lettering which looks great. It’s travel friendly.”

After testing out this creatine, Pete gave it a 5 out of 5 for both mixability and taste. “The product dissolved fully in water, and there was no clumping or visible chunks,” he said about the mixability.

“When mixed as directed using one scoop with only six ounces of water, I thought the supplement was a little sweet, but after adding a bit more water, it tasted great. The fruit punch flavor was true to taste.” So, you may need to vary the amount of water you add to the creatine powder to get the right level of sweetness for your preferences.

Our Thoughts on Nutricost Micronized Creatine Monohydrate

We chose Nutricost Micronized Creatine Monohydrate as our top pick for the best creatine for your budget. At 25 cents per serving, it’s the most affordable and straightforward creatine on our list. It contains only five grams of creatine, and then depending on the flavor, includes sucralose or artificial coloring. Each tub includes a whopping one-hundred servings and costs $23.37 (for the unflavored option).

Pete tested this creatine and rated it a 5 out of 5 for first impressions. “It’s a simple white container with a matte label,” he noted. The amount of creatine, servings per container, and the amount of creatine per container are listed on the label. We also like that this product comes in seven flavors, which is unique for creatine.

When testing Nutricost’s creatine, Pete found that the product dissolved after 60 seconds. “It’s almost fully dissolved in 10 ounces of water. There was a slight grit towards the bottom of the shaker bottle but it’s a very small amount that remained undissolved. There are no visible chunks,” he said. Despite a bit of grit, our tester still felt that this creatine mixed well, and rated it a 4.5 out of 5 for mixability.

Pete liked how simple and straightforward this creatine is, saying that he would drink it again. It’s a clinical dose of creatine monohydrate (5 grams per serving) that gets the job done. He tried the unflavored creatine, and felt that it does taste truly unflavored, earning it a 5 out of 5 for flavor.

Overall, Pete did not experience any negative side effects after testing Nutricost’s creatine. He does think some folks may experience bloating or water retention during the loading phase, so be aware of possible temporary weight gain.

Legion Recharge is our top pick for best muscle growth creatine, thanks to the inclusion of 5 grams of micronized creatine monohydrate along with l-carnitine l-tartrate and corosolic acid. These ingredients not only help support strength and lean mass growth but may also help improve post-workout recovery.

Pete rated Legion Recharge a 5 out of 5 for ease of rise, noting how straightforward the instructions are: “Mix one serving with 10 to 12 ounces of water and take with your post-workout meal. On non-training days, take with your largest meal of the day. For optimal results, take every day.”

For mixability, Pete also gave it a 5 out of 5. “This product mixed easily and there were no chunks or clumping. No further shaking was required.” So, all you need is a shaker bottle and some water—no blender necessary.

The flavor of this product was a huge hit with Pete. He rated it a 5 out of 5 for taste. “I love the taste of this product. It tastes very natural and true to the fruit punch flavor. It’s not overtly sweet, but is still packed with fruit punch flavor.”

Our tester notes that the product is sweetened with stevia, but there isn’t a strong stevia taste or aftertaste. “They did a great job figuring out the right amount of sweetness to use. It’s light, isn’t chalky or frothy, and is definitely something I would use regularly, since many creatine supplements are flavorless.”

Pete experienced no negative side effects or digestive issues after taking this creatine. Overall, he thinks this is a solid post-workout creatine supplement, with a few bonus ingredients that may have some benefits for post-workout recovery.

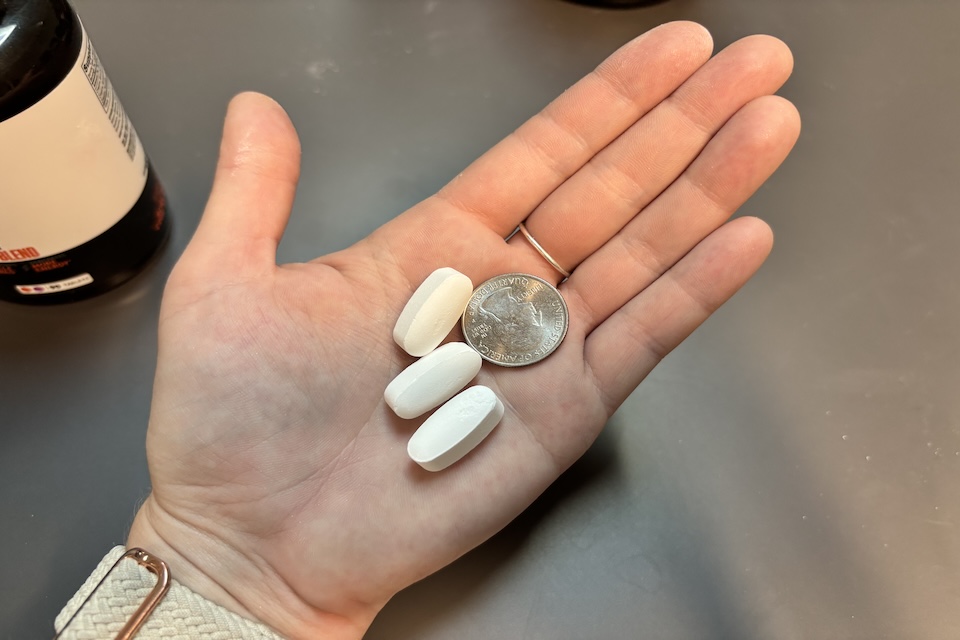

Crazy Muscle Three-Atine is our pick for the best creatine pills, as the tablets are ideal for folks who dislike mixing powders or want a portable, vegetarian-friendly option. Three-Atine delivers a dose of 5 grams of creatine—a clinically backed amount that has shown tangible results—in a solid capsule and may offer slightly faster absorption due to added croscarmellose.

Pete tested Crazy Muscle Three-Atine by carefully following the clear directions: “Take 3 tablets with fruit juice one to two times daily, before and/or after exercise or as directed by a healthcare professional.” He added, “It’s interesting that they mention taking this product with fruit juice only. This is probably because taking creatine along with some carbohydrates can slightly improve the uptake of creatine by your muscles. That said, I think it would be totally fine to take this product with just water as well.”

For ease of reading and following the instructions, Pete rated this creatine a 5 out of 5.

However, swallowing the pills wasn’t as easy. “Three-Atine pills are large, solid, compressed white tablets. At three pills per serving, I’d advise taking them one at a time if you have trouble taking pills,” he shared, rating swallowability a 3. Pete’s experience highlights the product’s strong points for guidance and dosage, but also a potential drawback for those who may struggle with big pills.

Pete also rated the taste of Crazy Muscle Three-Atine a 3 out of 5, saying, “The pills didn’t really have any taste to them. There wasn’t a sugary coating or any weird aftertaste.” This neutral flavor profile makes the pills easy for those who dislike flavored or artificially sweetened supplements.

Blonyx HMB+ Creatine is our pick for women thanks to its clean formulation and blend of both creatine monohydrate and HMB, which together may support muscle growth, recovery, and reduced soreness. However, it’s important to note that there’s no such thing as a gender-specific creatine: creatine’s benefits are equal for both men and women, and research confirms that all adults may notice strength and energy improvements when supplementing at a clinical dose. That said, women may appreciate the clean formula and additional HMB. Plus, the tub is small enough to toss in a gym bag or tote.

Pete gave his first impression of Blonyx HMB+ Creatine a perfect 5 out of 5, saying, “It comes in a small white tub with orange and blue lettering. The label is easy to read, and the container opens and closes easily. I consider this size tub to be travel friendly.”

Pete rated the ease of understanding the instructions for Blonyx HMB+ Creatine a 5. He noted the instructions were clear about the amount and timing, but gave mixability a 3, saying, “The reason I’m giving this a three on clarity is because it doesn’t say to mix it with water or a beverage of your choice, it just says take one scoop twice a day, ideally with food, which could be confusing for people who haven’t used a creatine supplement before.”

Our tester also said that it dissolved fully after sixty seconds of mixing with twelve ounces of water. He did note that the label doesn’t specify how much water or beverage of your choice to use in the directions. He felt that the product mixed well but could benefit from more explicit guidelines for new users.

Flavorwise, Pete rated it a 5 out of 5. “When mixed in water, it doesn’t really have much of a flavor. You can tell something is in your water, but it’s a very subtle, slightly bitter taste,” he said. This creatine is a great choice for folks looking for a supplement without any artificial flavoring or sweetness. For folks who prefer their creatine to have a particular flavor, we recommend trying out Jacked Factory’s Growth Surge.

We selected Jocko Creatine as the best creatine for men because it contains 5 grams of creatine monohydrate per serving, a clinically backed dose. This means it contains optimal support for building lean muscle, boosting energy, and supporting mental focus throughout your training. Our team also thinks this creatine is great for men who want to maximize strength and gains while maintaining a clean supplement regimen free from unnecessary sweeteners or flavors, though keep in mind that creatine isn’t gender specific.

Pete’s first impression of Jocko Creatine was the observation that it’s a “black bag with individual creatine packets inside, making it incredibly travel-friendly.” This earned it a rating of 5 out of 5 for packaging and convenience. He found it simple to use and appreciated the clarity of the instructions, also giving the directions a rating of 5 for ease of use. Pete’s experience highlights how the product makes supplementation straightforward, especially for men seeking a grab-and-go option.

Our tester rated this creatine a 5 out of 5 for both mixability and taste. “The product is almost fully dissolved in eight ounces of water after shaking for 60 seconds. There was a slight grit towards the bottom of the shaker bottle, but it’s a very small amount that remained undissolved,” he noted. For taste, Pete said, “There is no taste as it’s unflavored. There is no aftertaste and it feels just like water. Would I drink this regularly? Yes, it’s a simple creatine monohydrate supplement,” confirming the product’s ease for daily use and its clean, unobtrusive flavor profile.

He didn’t experience any negative side effects but did mention that it may potentially cause some minor issues for others: “This one may cause bloating or water retention during the loading phase for some people.”

Jacked Factory Growth Surge is our pick for the best pre-workout that includes creatine. Growth Surge is a combination of 3 grams of creatine monohydrate, 2.5 grams of betaine and 2 grams of L-carnitine. This combination of ingredients is designed to potentially aid muscle growth and fat loss. The creatine dose helps improve muscular strength, size, and reduces muscle damage during training. Both betaine and carnitine are included to help improve body composition through increasing muscle mass and reducing fat.

This formula also includes BioPerine (black pepper) for enhanced ingredient absorption, setting it apart among pre-workouts featuring creatine. However, more research is needed to confirm that this ingredient actually boosts absorption.

Pete’s experience with Jacked Factory Growth Surge was positive when it came to mixability. “The product mixes fully in sixty seconds, leaving no clumps or chunks visible,” he said, rating it a 5 out of 5 for mixability.

He tested the fruit punch flavor and remarked that, “It was very similar to other fruit punch-flavored supplements on the market and reminiscent of the children’s drink Hawaiian Punch.” Pete described it as “sweet, but not too sweet—and refreshing.” He also observed, “There was no grittiness or foaminess after mixing.” Both taste and sweetness earned 3 out of 5 scores.

Pete enjoyed this creatine overall and did not experience any digestive issues or negative side effects, rating it a 5 out of 5 for that category. He also noted that the container is small enough to be travel-friendly, so it’s great for folks on the go!

We tested and evaluated creatine supplements and scored them on a scale of 1-5 for factors such as first impressions, directions that are easily understood, taste, mixing, side effects, and value. Our testers evaluate the products based on their own individual experiences and preferences. We then review their testing feedback and data to share our findings and recommendations with you.

Flavor is an important part of our testing process. We ask our testers to provide feedback on the taste, texture, and flavor of each creatine supplement. We rate sweetness on a scale of 1 to 5, based on how strong the sweetness is. A score of 5 is best-tasting, 1 is not drinkable. We also consider texture, and ask our tester to record any grittiness, clumps, frothiness, or conversely, smoothness and creaminess, when tasting the mixed creatine drink.

We work with a registered dietitian (RD) during testing to find the most effective and safe creatine formulas. We primarily focus on creatine supplements without artificial sweeteners and other additives, while prioritizing clinically dosed formulations.

When mixing creatine into a liquid, we prepare the product exactly as advised by the brand. We then pay close attention to how well the powder dissolves, wanting to avoid grittiness in the taste and odd textures, like chunks.

We selected creatine supplements that have been third-party tested. Third-party testing ensures independent verification of safety, purity, as well as nutrition label accuracy. This helps to reduce the risk of mislabeling or underdosing. Third-party testing also checks for harmful substances such as heavy metals, pesticides, and more for safety. For athletes, third-party testing is paramount to knowing that the creatine supplement that they’ve chosen does not contain any banned substances. The FDA (U.S. Food and Drug Administration) does not regulate supplements, so it’s vital to have independent testing done to ensure safety, accuracy, and quality.

When considering value, we place a higher value on brands that source their ingredients in America and have certifications, such as Informed Sport.

Everyone has different creatine supplement needs depending on your fitness goals, dietary needs, allergies, and pre-existing health conditions.

Here’s what to consider when selecting the best creatine for you.

Each athlete and fitness enthusiast is driven by personal goals, whether that’s building muscle, burning fat, increasing energy, or improving endurance and strength. Because individual priorities and training styles vary, the best creatine supplement for one person may not be ideal for another. When choosing a creatine supplement, it’s important to factor in your workout intensity, performance goals, and personal preferences such as digestive tolerance, budget, and convenience.

Choosing a creatine supplement you actually enjoy taking can help make your fitness routine more consistent and rewarding. Great-tasting flavors can turn your daily dose into something you look forward to, supporting your motivation over time. Exploring flavors or forms you prefer can make sticking to your creatine regimen easier, which helps to support your goals.

The clinically recommended dose for creatine is a daily maintenance of three to five grams, which is shown to be effective and safe for most healthy adults. Some people choose to start with a “loading phase” of twenty grams per day, divided into smaller servings, for five to seven days before switching to the maintenance dose; however, skipping the loading phase and simply taking a consistent daily amount works well for most.

Creatine supplements are available in multiple forms, including powder, pills, tablets, and gummies. While powder is favored for its versatility and ease of mixing, some folks may prefer the convenience of pills or tablets, or you can opt for gummies for a more enjoyable daily routine. Choosing the form that best matches your schedule, habits, and taste can make it easier to stay consistent and get the full benefits of taking creatine.

It’s important to review a creatine supplement’s ingredient list and formulation before purchasing. Creatine products can differ in purity, added ingredients, and the specific form of creatine used, from standard monohydrate to newer varieties like hydrochloride or magnesium chelate. Some formulas may include added vitamins, flavorings, or fillers, so consider what fits your budget, dietary needs, and fitness goals ahead of making your purchase.

Creatine can be expensive, so it’s smart to consider your budget when choosing one for regular use. Formulas with cleaner ingredients, such as those without artificial sweeteners, fillers, or unnecessary additives often cost more due to their quality and ingredient sourcing.

Creatine is well-known for its performance-enhancing effects, with a range of benefits supported by scientific research. It helps the body to produce energy more efficiently, making it a popular choice in both athletic and everyday fitness settings.

Creatine has been extensively researched and considered safe for most people, but some side effects are worth considering. The most common is water retention, which happens as muscles store extra fluid, which can lead to quick, noticeable weight gain, especially in the first few weeks of adding creatine to your routine. This extra water might also cause bloating, a puffier appearance, and mild digestive complaints like cramps or diarrhea, particularly when large doses are taken or during the “loading” phase.

For healthy adults, these effects tend to be temporary and mild, but folks with a history of dehydration, kidney problems, or who participate in weight-class sports should talk with a healthcare professional before adding to your routine.

While creatine monohydrate remains the gold standard, several other forms have gained popularity on the market. Each type has a slightly different structure or delivery method, promising benefits like improved absorption, reduced bloating, or added convenience. Below is a breakdown of the most common types of creatine and what sets them apart:

We selected Transparent Labs Creatine HMB as our top creatine pick because it combines creatine monohydrate with clinically proven HMB, a pairing that may enhance muscle growth, strength, and recovery in a simple, effective formula. We also appreciate that its third-party tested, naturally sweetened, and completely free of fillers.

Creatine supplementation might lead to rapid weight gain due to water retention in your muscles. Some people have experienced gaining up to 10 pounds, especially during the first few weeks of using it. This is not fat gain; its extra water stored in your muscle cells.

Creatine is generally considered safe for healthy adults, but possible downsides include temporary water weight gain, muscle cramps, digestive discomfort, and dehydration for some folks. People with pre-existing kidney problems or specific medical conditions should avoid creatine unless advised by a healthcare professional.

The price of matcha has surged, with sales of the powdered tea up by 86% in the US, according to new research.

The green beverage has gone viral on social media thanks to a trend for sweet colourful drinks made from milk, sometimes called “bright lattes”.

As a result, the cost has risen as manufacturers have struggled to keep up with global demand.

Market research firm, NIQ, says retail sales in the US are up 86% from three years ago.

Donald Trump‘s tariffs may also be impacting costs in the US, although it is not clear if matcha will be exempt because it’s a natural product not grown in significant quantities in America.

President Trump previously made an exception for cork from the European Union.

China has also raised prices because of labour shortages and high demand.

Japan, one of the world’s biggest matcha producers, suffered a reduction in output in this year’s harvest owing to poor weather.

Aaron Vick, a senior tea buyer with California-based tea importer GS Haly, claims he paid 75% more for the highest-grade 2025 crop of Japanese matcha, which will arrive later this year.

He added that lower grades of matcha will cost 30% to 50% more.

Chinese matcha, which is generally cheaper than the tea from Japan, is also getting more expensive, he added.

Mr Vick said: “People should expect an enormous increase in the price of matcha this year.

“It’s going to be a bit of a tough ride for matcha devotees. They will have to show the depth of their commitment at the cash register.”

The report did not outline an increase in prices for UK customers.

But Starbucks, a major player in the UK’s coffee shop scene, says it sources matcha from China, Japan and South Korea.

Mixed Tocopherols Market is anticipated to reach USD 6987.38 million by 2032 with a magnificent Compound Annual Growth Rate (CAGR) of 4.8 % from 2026 to 2032. Primary growth drivers include Rising Demand for Natural Antioxidants, Growing Nutraceutical & Dietary Supplement Consumption, and Cosmetics & Personal Care Industry Growth.

Wilmington, DE, Sept. 16, 2025 – The latest premium report by Profshare Market Research, “Mixed Tocopherols Market by Product Types (Alpha Rich, Gamma Rich, Gamma-Delta Rich, and Others) by Applications (Animal Feed Nutrition, Cosmetics, Dietary Supplements, Food and Beverage, Pharmaceuticals and Others), Key Players Market Shares, Size and Forecast 2026-2032”

Mixed Tocopherols Market Segmentation:

By Product types, the Alpha Rich segment holds the largest market share and is projected to dominate the market during the forecast period.

The research study is based on the main types of Mixed Tocopherols, such as Alpha Rich, Gamma Rich, and Gamma-Delta Rich. Because of rising consumer preference for natural Vitamin E, growing supplement consumption and clean-label fortification, the Alpha Rich segment generated the largest revenue and continues to grow at a magnificent rate. Due to increasing use in animal nutrition and edible oil stabilisation, the Gamma Rich and Gamma-Delta Rich segments are also projected to show moderate growth in the upcoming years.

Access the Sample Report:

https://www.profsharemarketresearch.com/mixed-tocopherols-market/

By Applications, the Dietary Supplements application leads the global market and is projected to generate the highest revenue between 2026 and 2032.

Primary applications analysed in the study are Animal Feed Nutrition, Cosmetics, Dietary Supplements, Food and Beverage, and Pharmaceuticals. According to the report, the Dietary Supplements application generates the highest revenue and is estimated to continue strong growth in the upcoming years. Main reasons for the high demand of Mixed Tocopherols in Dietary Supplements are a Rising health-conscious consumer base, Aging population, and expanding e-commerce & direct-to-consumer brands.

Asia-Pacific is the largest market for Mixed Tocopherols and is projected to grow at the highest Compound Annual Growth Rate (CAGR) between 2026 and 2032.

Regional outlook focuses on the market revenue and latest developments in the various regions like North America, Europe, Asia-Pacific, the Middle East, South America and Africa. According to the latest study by Profshare Market Research on the Mixed Tocopherols Market, Asia-Pacific holds the largest market share and continues to dominate the market in the upcoming years. Expanding Food Processing Industry, Cosmetics & Personal Care Boom, Rising Nutraceutical & Supplement Consumption are some of the main reasons for the market growth in this region.

North America is one of the largest markets, and impressive demand resides in High consumption of dietary supplements and fortified foods, along with a Strong cosmetic and personal care industry. Strong focus on organic & natural antioxidants in food and nutraceuticals, as well as Stringent EU regulations driving the European Mixed Tocopherols Market. South America and the Middle East region are estimated to show strong growth between 2026 and 2032.

Major Key Players in the Mixed Tocopherols Market:

Mixed Tocopherols Market Report Key Takeaways:

Industry Top Reports:

Dietary Fiber Market: Dietary Fiber Market Analysis, Regional Outlook (North America, Europe, Asia-Pacific, Middle-East, South America, Africa) and Forecast 2032.

Color Cosmetics Market: Color Cosmetics Market Analysis, Regional Outlook (North America, Europe, Asia-Pacific, Middle-East, South America, Africa) and Forecast 2032.

Personal Care Ingredients Market: Personal Care Ingredients Market Analysis, Regional Outlook (North America, Europe, Asia-Pacific, Middle-East, South America, Africa) and Forecast 2032.

Functional Food and Beverage Market: Functional Food and Beverage Market Analysis, Regional Outlook (North America, Europe, Asia-Pacific, Middle-East, South America, Africa) and Forecast 2032.

About Proshare Market Research

Profshare Market Research is a leading Market Research & Consulting organisation that turns data into decisions and insights into impact. We are a global market intelligence firm committed to delivering actionable, accurate, and forward-looking market research that empowers businesses to stay ahead in an ever-changing marketplace.

From emerging startups to Fortune 500 companies, our clients trust us to decode complexity, spot opportunities, and reduce risk. With a robust network of data analysts and industry experts, we provide customised market research solutions that align with clients’ unique goals.

Media Contact

Company Name:Profshare Market Research

Contact Person: Rajeswari Deep

Email:Send Email

Phone: +13024988318

Address:1207 Delaware Ave. Suite 4459 DE 19806

City: Wilmington

State: Delaware

Country: United States

Website:https://www.profsharemarketresearch.com/

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Rising Shift Toward Clean Label and Plant-Based Ingredients Fuels Global Mixed Tocopherols Market Expansion – Profshare Market Research