The main category of Dietary Supplements News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Dietary Supplements News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

[ad_1]

On stage Mac Murad ‘26 performed as Javert in BHS’ “Les Misérables.” Off stage, he says, he sometimes performs another role. When I talked with Murad, he was shotgunning matcha – the trendy Japanese tea that has become synonymous with performative males. The green tea is just one of many ways “performative males” signal being different from mainstream masculinity – tote bags, wired headphones, layered jewelry, carefully curated outfits, the reading of feminist literature, an overall gentle-boyfriend vibe: all of this is intended to portray “I’m not THAT kind of guy, I’m a softer, more progressive guy.”

“[The] Performative male trend is very common nowadays,” Murad said. “Men will take these alter egos to almost perform for sometimes either social standing and more popularity, or sometimes to attract a mate.”

The trend itself is an evolution of the “nice guy” who seems kind only as a means to attract women. The performative male is very similar, acting and dressing differently as a means to attract women by seeming less threatening. The trend really took hold when men started to pretend to be performative as a joke, quite ironically.

Today’s performative male is part joke, part identity and entirely a product of our Instagram culture. But behind the aesthetic is a real question: how should we teach students to “be a man”?

Former BHS English teacher Hayden Chichester taught a class called “Men and Masculinity.” The course syllabus said the class is about “what it means to be a boy, man, and/or masculine-identified person in American society today.”

Chichester said that gender is something we learn.

“We are always teaching young people about gender, whether we know it or not,” Chichester said. “With our behavior or even our silence.”

Chichester believes that young men are receiving their messages about masculinity from social media and the internet and there is data to support this claim. A 2025 Common Sense Media Report said that nearly all boys aged 11-17 are online daily, 73% regularly see “masculinity content” and 69% of those kids encounter “problematic gender stereotypes” like “girls only date certain types of guys”, “girls use their looks to get what they want”, “boys are treated unfairly compared to girls” and “girls should focus on home and family.” The report says that this leads to boys feeling more pressure to avoid “unwritten rules” to avoid teasing, increased loneliness, bullying and more.

Chichester said that when he was 16, he started to “really question” what it meant to be a man.

“On the one hand, I had some examples in my family that were not great, to be honest, men who had struggled with addiction or low achievement or even domestic abuse and violence. And it scared me how normal all of these behaviors [were], not just in my family, but among my peers as well,” Chichester said. “Talking about masculinity via stories with an adult would have been deeply nourishing to me at that age.”

Chichester said one of the most memorable activities for students from the “Men and Masculinity” class was called “The Man Box”. Students wrote down all of the qualities that a “real man” should have inside a box, and then wrote on the outside of the box all of the insults and behaviors people do to keep men inside of that box.

“I still have the papers we used,” Chichester said. “I always felt like that activity framed the class better than anything else.”

Linnea Johnson is a sex educator from Planned Parenthood. They said that masculinity in our society is associated with power, violence, dominance, recklessness, and suppression of emotions.

“Being perceived as masculine by others (especially other male peers) often entails portraying outwardly harmful attitudes and behaviors like misogyny, homophobia, transphobia and gender-based violence,” Johnson said. “To perform masculinity, to put on this “man mask,” requires someone to eradicate their sense of empathy and compassion.”

Johnson said men and boys are pressured to bottle up their feelings, to never discuss them, to never ask for help, unless they want to be seen as weak.

“But we need empathy. Empathy is crucial to all of us maintaining healthy and fulfilling relationships not only with others, but with ourselves,” Johnson said. “If we pretend that we are emotionless for too long, it results in overwhelming amounts of self-hatred, shame and self-harm.”

Avery Shearer ‘27, a self-proclaimed social critic, explained that the trend of performative males could stop men from actually being feminists if it’s now seen as just something to be made fun of.

“I would say that that’s kind of an enforcement of more rigid cultural norms of masculinity,” Shearer said.

Lucas Sommerville ‘26 is a self-proclaimed performative male. He believes the impact of the trend isn’t so bad.

“But really with it being such a joke, I feel like that malicious intent is sort of entirely removed. At least in my eyes, and it’s more… just kind of funny,” Sommerville said.

Murad shared Sommerville’s more ironic take on “performative males”. In fact, Murad said that he has completed an online course in performative males that he admits was less than credible.

“It was in-credible,” Murad said. “In-credible.”

Still, Murad is aware of the possible damage the trend could cause.

“If we are taking the more joking side of this performative male trend and saying, ‘oh, ha ha, any men who display these feminine traits are immediately performative males,’ then that could be easily damaging because that means men that cannot show their masculinity,” Murad said.

Johnson said the performative male trend might actually be a sign that our views of masculinity are changing positively.

“It shows that even if men and boys aren’t necessarily working on examining their behaviors in their relationships or the values they hold, they recognize on some level that being perceived as self-aware and critical of traditional masculinity is good,” Johnson said.

Murad shares Johnson’s hopes. He believes the trend could be beneficial to the feminist movement because it would allow men to understand the perspective of women.

“This could be a great flip of the coin compared to the issue that we had in 2023 and 2024 with the Andrew Tate alpha-male epidemic, where men were much more misogynistic,” Murad said. “This is a much better take on that, and we could see another rise in feminism.”

Johnson said that there are more examples of “healthy masculinity” in the media and that more men are “examining the messages they’ve received since childhood.”

Sommerville agrees that society could be moving in a new direction.

“I think that as we go into the future, we’re going to see, or I’d like to see at least, a lot more emphasis on morality and just being good people in general and liking what you like instead of liking what your gender or what your sex dictates you liking,” Sommerville said.

“Whatever your vision of masculinity is,” Chichester said, “if it brings you together with others, to fulfill a positive role, I think it’s beautiful. If it is held flexibly, like an offering to the world, rather than like a club to dominate it, that makes it strong.”

“My biggest piece of advice,” Johnson said, “is to give yourself the space and time to figure it all out. And talk to some trusted adults who you look up to about their journey with gender identity and expression, too. You’re not alone.”

[ad_2]

Source link

[ad_1]

Dublin, Jan. 06, 2026 (GLOBE NEWSWIRE) — The “Japan Vitamin K2 Market Report by Product, Dosage Form, Source, Application, Distribution Channel, City and Company Analysis, 2025-2033” has been added to ResearchAndMarkets.com’s offering.

The Japanese Market for Vitamin K2 is estimated to grow substantially from US$ 12.68 million in 2024 to US$ 36.20 million by 2033, demonstrating a strong Compound Annual Growth Rate (CAGR) of 12.36% over the period from 2025 to 2033. The growth may be explained by heightened awareness regarding the health value of Vitamin K2 and greater consumer interest in dietary supplements and fortified foods.

Rising Awareness of Cardiovascular and Bone Health

A rapidly aging population in Japan is driving demand for bone density and cardiovascular health nutrients. Vitamin K2 has come into prominence for its role in calcium metabolism, which ensures bones become stronger and fractures are avoided, conditions often found among older people. Furthermore, its efficacy in preventing arterial calcification renders it desirable for heart well-being. Public awareness campaigns and medical professional recommendations are increasing consumer consciousness, propelling uptake of Vitamin K2 in supplements and functional foods nationwide. In September 2023, Fujitsu Limited and iSurgery Co., Ltd. initiated a field trial for their “bone health promotion project” between October 2023 and March 2025, in partnership with Jikei University School of Medicine. The trial will determine the efficacy of chest radiographs for bone evaluations and their effect on the health behavior of Fujitsu employees, Japan’s first action aimed at employee health utilizing this technique in examinations.

Expansion of Functional Foods and Nutraceuticals

Japan already has a solid history of functional foods, with a growing focus on incorporating Vitamin K2 into products like dairy products, beverages, and fortification foods. With increasing focus on preventive care among consumers, nutraceuticals with Vitamin K2 are gaining popularity. In response to this trend, Japanese businesses are creating convenient formats for products such as fortified yogurts, capsules, and powders to suit the varied tastes of consumers. The increasing demand for functional and fortified foods is a tremendous opportunity for Vitamin K2 expansion in urban and rural markets alike. Significantly, J-Oil Mills was granted trademarking for Menatto, a branded Vitamin K2 in MK-7 form, in major markets such as the U.S., Japan, Europe, and Australia in December 2022.

Growing Use of Natural and Fermented Ingredients

Japanese consumers show a very strong predisposition toward using natural, plant-derived, and fermented ingredients for food and supplements, in line with their food culture and a preference for clean-label products. Of these, Vitamin K2, specifically from fermented food sources such as natto – a traditional Japanese food staple – has been the subject of increasing interest and matches consumers’ desires. This demand for natural supplements is supported by widespread suspicion of the use of synthetic additives. As such, the natural Vitamin K2 market is seeing strong expansion, fueled by consumers’ faith in known local sources and their move towards holistic and wellness-based lifestyles. In a significant development, Kirin Holdings Co. and Takanofoods Co., a leading natto producer, announced they would collaborate in August 2024 and introduce their products in eastern Japan.

High Production Costs of Natural Vitamin K2

Extracting Vitamin K2 from natural and fermented sources involves complex and resource-intensive processes, which elevate production costs. These costs often translate into higher prices for end products such as supplements or fortified foods, making them less accessible to price-sensitive consumers. For manufacturers, maintaining profitability while ensuring competitive pricing remains a challenge. This cost barrier limits broader market penetration, particularly in mass-market retail channels, despite strong demand for natural ingredients.

Limited Consumer Awareness Outside Urban Centers

Although urban dwellers in Tokyo, Osaka, and other major metropolitan areas are familiar with Vitamin K2, the level of awareness in rural areas is low. Urban consumers are less exposed to functional food and supplements outside cities, and adoption is slower. Filling this gap involves increased marketing activity, promotions, and distribution through neighborhood pharmacies or local supermarkets. Without specific effort at targeting, Vitamin K2 adoption is likely to be driven primarily in Japan’s principal cities, thereby restricting overall market expansion throughout the country.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 200 |

| Forecast Period | 2024-2033 |

| Estimated Market Value (USD) in 2024 | $12.68 Million |

| Forecasted Market Value (USD) by 2033 | $36.2 Million |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Japan |

Key Topics Covered

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Japan Vitamin K2 Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.2 By Dosage Form

6.3 By Source

6.4 By Application

6.5 By Distribution Channel

6.6 By City

7. Product

7.1 MK-7

7.2 MK-4

8. Dosage Form

8.1 Powder & Crystalline

8.2 Capsules & Tablets

8.3 Oils & Liquid

9. Source

9.1 Natural

9.2 Synthetic

10. Application

10.1 Health Supplements

10.2 Functional Foods and Beverages

11. Distribution Channel

11.1 Offline

11.2 Online

12. Top 10 City

12.1 Tokyo

12.2 Kansai

12.3 Aichi

12.4 Kanagawa

12.5 Saitama

12.6 Hyogo

12.7 Chiba

12.8 Hokkaido

12.9 Fukuoka

12.10 Shizuoka

13. Value Chain Analysis

14. Porter’s Five Forces Analysis

14.1 Bargaining Power of Buyers

14.2 Bargaining Power of Suppliers

14.3 Degree of Competition

14.4 Threat of New Entrants

14.5 Threat of Substitutes

15. SWOT Analysis

15.1 Strength

15.2 Weakness

15.3 Opportunity

15.4 Threats

16. Pricing Benchmark Analysis

17. Key Players Analysis

17.1 NOW Foods

17.2 Life Extension

17.3 Nestle

17.4 Bronson

17.5 NatureWise

17.6 Solaray

17.7 Natural Factors

17.8 Source Naturals

For more information about this report visit https://www.researchandmarkets.com/r/acvb0y

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

[ad_2]

Source link

[ad_1]

Many famous brands are behind Costco’s Kirkland line, delivering beloved food and beverage items hidden under a private label. Most often, the behind-the-scenes intrigue occurs in the liquor department, with consumers speculating about who makes Costco’s vodka or Kirkland Signature scotch. Yet even something as simple as a box of bagged Kirkland Signature Green Tea comes from an interesting origin.

As listed on the package, Costco sources this product from Japan, where it is made by the Ito En brand. The huge multinational beverage company is Japan’s biggest green tea seller, with a presence in over 45 countries. Its products span from the classic bagged green tea available at Costco to pre-bottled beverages, as well as a growing range of matcha items — a major source of revenue in recent years. The brand has even taken over the chain Tully’s Coffee, operating café outlets throughout Japan.

Such a giant tea venture is a perfect match for Costco’s mega-sized scale, with the collaboration spanning well over a decade. So the next time you’re grabbing tea bags at the warehouse retailer, know you’re buying from a reputable Japanese source.

Read more: Every Costco Price Tag Code, Explained

A box of Kirkland and Ito En green tea – ZikG/Shutterstock

Boasting a 4.7/5 rating with over 1,800 reviews as of December 2025, Costco’s green tea is a beloved retail item. Apart from concerns over the plastic-based bags, consumers rave about the brewed flavor, noting a balanced yet pleasant palate. The box — which retails at $13.99 for 100 tea bags — blends matcha and sencha, creating a beverage with a beautiful light green appearance.

The leaves are processed in a traditional Japanese manner. As opposed to the baking or pan-frying methods often employed for Chinese teas, Ito En steams its green tea, which establishes a light, vegetal palate. Once cooled, pressed, rolled, and dried, the product is well predisposed to retaining freshness, accounting for the slightly shorter shelf life of tea bags compared to loose-leaf teas.

The incorporated matcha also adds to the flavor, although it is simply blended into the bag — which means it doesn’t require a traditional metal or bamboo whisk. Instead, you’ll just need to steep Ito En’s Kirkland Signature tea for 30 to 45 seconds, and it’s ready to enjoy.

Want more food knowledge? Sign up to our free newsletter where we’re helping thousands of foodies, like you, become culinary masters, one email at a time. You can also add us as a preferred search source on Google.

Read the original article on Food Republic.

[ad_2]

Source link

[ad_1]

Revenue,

2025

USD 2.81 Bn

Forecast Year,

2035

USD 6.61 Bn

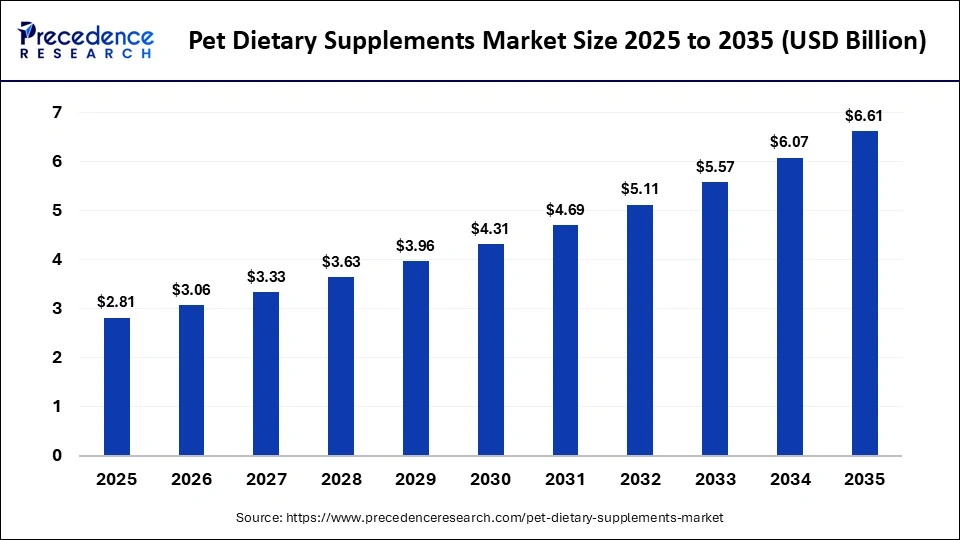

The global pet dietary supplements market size accounted for USD 2.81 billion in 2025 and is predicted to increase from USD 3.06 billion in 2026 to approximately USD 6.61 billion by 2035, expanding at a CAGR of 8.93% from 2026 to 2035. The pet dietary supplements market is driven by increasing pet humanization and rising focus on preventive animal healthcare.

The pet dietary supplements market represents a broad area of nutraceutical products developed to improve the health of pets in general and to fill certain nutritional deficiencies in a standard diet. These are vitamins, minerals, amino acids, omega fatty acids, probiotics, and botanical extracts, which are aimed at promoting joint mobility, digestive, immune, skin and coat, and cognitive functions. The increase in pets and the tendency to ascribe human traits to them have made their owners act on long-term wellness in opposition to reactive treatment. As the attractiveness of companion animals as pets surges, there is an increasing need across the industry for premium, functional, and condition-specific supplements, such as those for dogs, cats, and other pets that belong to the family.

The market forces are the increasing knowledge on proactive pet care and the increasing cases of age- and lifestyle-related diseases that involve arthritis, obesity, allergies, and digestive disorders. The rising number of geriatric pets has raised the demand for joint, heart, and immunity-support supplements. Moreover, the improvement of animal nutrition science and clean-label, natural ingredient formulations is improving consumer trust and acceptance. Growth of veterinary services, online health services for pets, and subscriptions is expected to enhance the growth of the market around the world.

Artificial intelligence is becoming a trend in the pet dietary supplements sector, as it allows for the creation of products and customization to create more intelligent interaction between consumers. In order to identify the most common nutritional deficiencies and new trends in the well-being of pets, AI-based analytics is applied to analyze the big data of veterinary data, pet health applications, and clinical research.

Artificial Intelligence is supportive of personalized nutrition websites because pet owners could specify their breed, age, weight, activity, and health conditions to be offered specific recommendations concerning supplements. As the digital pet healthcare ecosystems increase, AI integration will probably be the subject of the development of precision nutrition and preventive care of companion animals.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.81 Billion |

| Market Size in 2026 | USD 3.06 Billion |

| Market Size by 2035 | USD 6.61 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.93% |

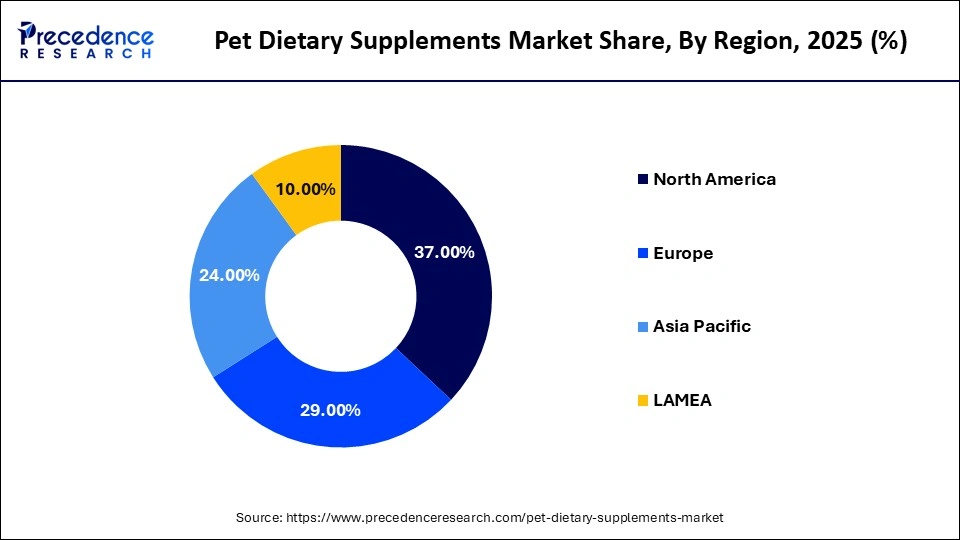

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Form, Supplement Type, Function, Pet Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Why Did Chewable and Soft Chews Contribute the Most Revenue in 2025?

Chewable and soft chews contributed the most revenue in 2025 and are expected to dominate throughout the projected period, as these chews are highly palatable and easy to administer. The soft chews are commonly viewed as either a treat or medicine, which keeps up with the current trend of humanizing pets and supplementing their wellness regularly. Their flexibility in formulation enables the manufacturers to incorporate several functional benefits, joint support, immunity, skin and coat, calming effects, etc., into one chew. In addition, the distribution of chewables through electronic commerce, pet specialty retail outlets, and veterinary hospitals is also high and contributes to the high volumes of sales. More innovation in both natural flavors and clean-label ingredients, together with breed- or life-stage-specific formulations, is also a factor in the long-term dominance of chewable and soft chew supplements.

The liquid and gel segment is expected to grow substantially in the pet dietary supplements market. The rising demand among elderly pets, small breeds, and those with dental problems or those that cannot swallow solid supplements is leading to growth. The liquid and gel formulations are easily administered and offer the right dosage, potentially allowing the pet owners and the veterinarians to modify the dosage based on the weight, age, and health condition. Emerging technologies for better flavor and natural preservatives have also served to improve palatability and shelf stability, which has overcome the challenge of adoption. Due to the current increase in awareness of geriatric pet care and proactive health, liquid and gel supplements will become more accepted both in the veterinary prescription market and in the direct-to-consumer market.

Why Did the Multivitamins Segment Lead the Pet Dietary Supplements Market in 2025?

The multivitamins segment led the pet dietary supplements market and accounted for the largest revenue share in 2025. Multivitamin supplements are a diverse source of the necessary nutrients, such as vitamins, minerals, and trace elements, and help to maintain health, immunity, metabolism, and vitality in all life stages. Their preventative placement is highly endorsed by the vet and readily accepted by those who are new to the use of supplements. Increased knowledge on balanced dieting and increased concerns about nutrient imbalances in commercialized pet food have further contributed to demand. The multivitamins also come in various forms, including chewable, powder, and liquid, and this increases access and convenience.

The CBD and hemp segment is expected to grow at a significant CAGR over the forecast period. These supplements are gaining popularity owing to the potential advantages they could have in the management of anxiety, reduction of pain, and improvement of mobility, specifically in older pets. Increase in regulatory clarity of the key markets, particularly North America, and in some sections of Europe, has facilitated product novelties and product commercialization. Owners of pets that are seeking another solution to pharmaceutical therapy are increasingly choosing to use CBD-based supplements to treat chronic diseases such as arthritis and behavioral disorders. This has been further improved by the formulation of standardized dosing, quality formulations, and third-party testing, which has boosted consumer confidence. Also, there is a slowing but growing interest of the veterinary community in cannabinoid-based therapies, which positively contributes to market growth.

Why Did Hip and Joint Health Supplements Contribute the Most Revenue in 2025?

The hip and joint health supplements contributed the most revenue in 2025 and are expected to dominate throughout the projected period. The increasing population of companion animals and the increasing rate of mobility-related illnesses such as arthritis, hip dysplasia, and joint stiffness are the primary sources of this leadership. Owners of pets are also spending more on preventive and long-term mobility products to enhance the quality of life and postpone surgical procedures. There is a rapid substitution of the traditional glucosamine only products with advanced formulations with UC-II collagen, green-lipped mussel, turmeric, and boswellia serrata. These are next-generation ingredients that have been supported by clinical research that has shown better pain reduction, inflammation, and cartilage protection. The demand is further enhanced by the availability in chewables, liquids, and powders, and hip and joint health supplements are the largest and oldest functional segments.

The calming and anxiety relief segment is expected to grow substantially in the pet dietary supplements market. Changes in lifestyle in the post-pandemic period, such as more owners being away and no longer having routines, have also added to stress, separation anxiety, and noise sensitivity in pets. The L-theanine, chamomile, valerian root, tryptophan, and CBD product line are becoming widely accepted to use every day with stress, with anxiety before traveling, and before any situation to calm down. These are supplements that are increasingly being included in evening routines, grooming routines, and travel preparations. A new market growth segment is likely to take shape as emotional wellness comes to be a central component of the holistic care of pets, and calming and anxiety relief supplements become a central part of pet care.

Why Did the Dogs Segment Lead the Pet Dietary Supplements Market in 2025?

The dogs segment led the pet dietary supplements market and accounted for the largest revenue share in 2025, because of the rate of adoption of the supplements and the wider availability of the supplements compared to other pets. The preventive care practices in dogs are firmly established, and the owners of this species understand the payback on the investment in early supplementation more and more. The most important demand drivers in the canine segment are joint health and digestive support and dental care supplements, as mobility problems, gastrointestinal sensitivity, and oral health-related issues are prevalent. Also, the high prevalence rates of obesity in dogs have driven the demand for weight management and metabolic health supplements. Manufacturers are still increasing the number of breed-specific, size-specific, and life-stage-based formulations and making their products more relevant and purchaseable again.

The cat segment is expected to grow at a significant CAGR over the forecast period due to the growing awareness of feline-specific health needs and the growing contribution to research and development. Historically underpenetrated because of poor appreciation of the supplements, the segment is resounding because of the manufacturers focusing on the special dietary needs and the health conditions of cats, especially chronic kidney disease, health of the urinary tract, and digestive sensitivity. Increased palatability by use of sophisticated flavor systems and texture has highly contributed to compliance effects in cats. Liquid, gel, and powder preparations are gaining more popularity because they dissolve readily in wet food. There are increases in demand for preventive and condition-specific supplements as the population of indoor cats increases, and the lifespan of cats also increases.

Why Did Specialty Stores Contribute the Most Revenue in 2025?

The specialty stores contributed the most revenue in 2025 and are expected to dominate throughout the projected period. These outlets have an exclusive stock of quality and condition-specific supplements so that pet owners can make informed purchases. Proficient personnel and in-store advisors give advice on the benefits of supplements. their dosage and intake, which creates confidence and increases the rates of conversion. The location of the supplements should be at the point of contact with high-end pet food, grooming, and products recommended by the veterinarian, as this raises the value of the basket and the buying value. Specialty stores remain one of the main points of sale of dietary supplements, as consumers are more interested in pet wellness products of high quality and customization.

The online channel segment is expected to grow substantially in the pet dietary supplements market. The factors that promote growth include convenience, fair prices, and the rise in the number of people who buy the supplements on a subscription basis so that they can guarantee constant delivery. Mechanized delivery discounts and wellness packages make customers stay with them longer. Authenticated customer reviews and ratings are essential in the decision to purchase products, especially in the case of a first-time buyer. Online channels can also provide a wider variety of products, including niche and premium formulations that might not be found in physical stores. As the digital pet care ecosystems evolve and the consumers become more comfortable with the online healthcare purchase, the online channel will likely be a major growth driver in conjunction with the traditional specialty retail.

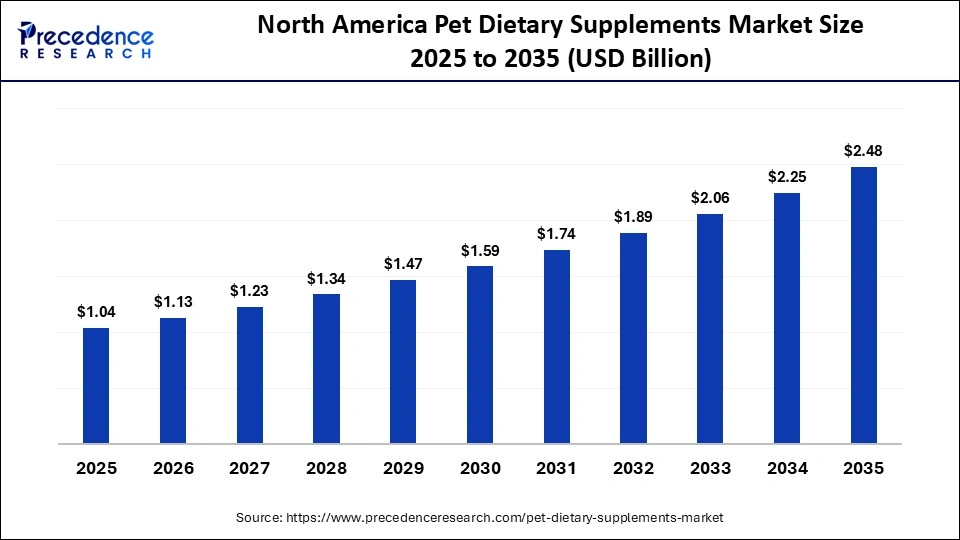

The North America pet dietary supplements market size is estimated at USD 1.04 billion in 2025 and is projected to reach approximately USD 2.48 billion by 2035, with a 9.15% CAGR from 2026 to 2035.

Why Did North America Lead the Global Pet Dietary Supplements Market in 2025?

North America held the dominating share of the pet dietary supplements market in 2025, with its growth based on a high level of consumer awareness, the presence of a well-developed veterinary healthcare infrastructure, and the high level of expenditure on pet wellness. The pet care ecosystem of the U.S. and Canada is well established, comprising veterinary clinics, specialty pet stores, and online platforms enabling people to get easy access to a wide variety of dietary supplements. Preventive care, joint health, digestive support, and immune functionality, and the adoption of premium formulations are increasing among consumers in the region. The frequent and repeated purchases of the products are supported by the availability of breed- and age-specific supplements, and they can be made by household and double incomes. Also, palatability, mode of delivery, and bioactive ingredients have enhanced the dominance of the market in North America.

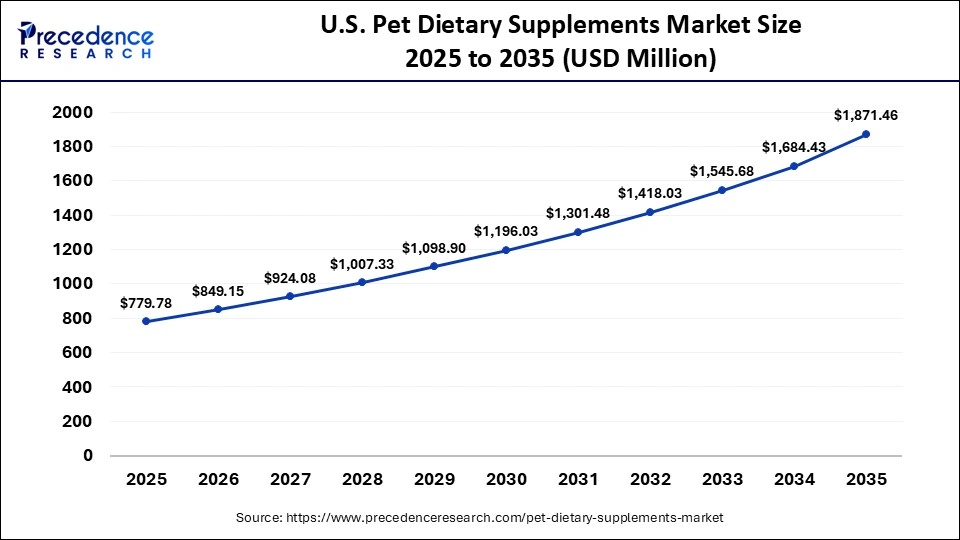

The U.S. pet dietary supplements market size is calculated at USD 779.78 million in 2025 and is expected to reach nearly USD 1,871.46 million in 2035, accelerating at a strong CAGR of 9.15% between 2026 and 2035.

U.S Pet Dietary Supplements Market Analysis

The U.S. is the biggest and most developed market of the North American pet dietary supplements market because of the advanced veterinary care, strong consumer awareness, and effective distribution channels. The high rate of adoption is due to the rising demand among pet owners for supplements that address the health of the joints, the digestive system, the skin and coat, and the immune system. The growing interest in prevention and wellness and the growing expenditure on high-quality pet products contribute to the growth of the market. The innovativeness of the form of delivery that ensures high compliance and efficacy includes soft chews, liquids, powder, and functional treats.

Why is Asia Pacific undergoing the Fastest Growth in the Pet Dietary Supplements Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. The adoption of pets is increasing rapidly in countries like China, India, Japan, and South Korea, which is increasing the demand for preventive and specialty supplements. Increasing the veterinary base, such as clinics, diagnostic facilities, and specialty hospitals, enhances the availability of nutritional products. Awareness about the wellness of pets, the development of e-commerce, and online subscriptions also contribute to the penetration of the market. Also, the increased impact of social media, educational campaigns, and veterinary prescriptions is encouraging uptake of quality formulations. Asia Pacific is the most rapidly developing market in the pet dietary supplement sector, with goods being launched, flavor innovation, and customized feline and canine products that are driving the growth of the region.

China Pet Dietary Supplements Market Trends

China has led the growth of the Asia Pacific pet dietary supplements market, which portrays significant growth in pet ownership and increasing awareness of preventive health. Urban families are now willing to accept pets as a part of the family, which increases the demand for joint, digestive, immune, and skin-care supplements. The introduction of e-commerce intake and internet veterinary consultation has led to increased access to the vast array of quality and functional formulations. The market enjoys the perks of regulatory reformation, quality certification rules, and expanded faith of consumers in branded goods. With the increasing awareness and disposable incomes, China should continue to play a key role in the fast growth of the pet dietary supplements market in the Asia Pacific.

Why Is the European Pet Dietary Supplements Market Experiencing Notable Growth?

The European pet dietary supplements market is recording significant growth owing to the high consumer awareness, well-established pet care industry, and good veterinary infrastructure. Germany, France, Italy, and the UK are examples of countries that show strong usage of joint health, digestive, skin and coat, and immune support supplements. Multi-functional formulation, breed-specific, age-specific, and premiumization are very popular. The presence of high regulatory standards provides safety and efficacy of products and will increase consumer confidence. The adoption is also increased by veterinary recommendations and professional advice in specialty stores and clinics. Constant innovation in products and promotion by the leading manufacturers makes them grow steadily.

UK Pet Dietary Supplements Market Trends

The UK pet dietary supplements market is on a continuous rise, and this is backed by the increasing number of pets, knowledge of preventive health, and the well-established networks of veterinarians. Supplements that are aimed at promoting joint health, digestive support, skin and coat care, and immune functionality are on the demand list by pet owners. Dedicated shops, animal clinics, and websites help to make it easy to access and get professional assistance and choose the products. Also, awareness and adoption are further enhanced by the educational campaigns and digital marketing initiatives.

Why Is the MEA Pet Dietary Supplements Market Gaining Momentum?

The Middle East and Africa pet dietary supplements market is expanding due to improvements in veterinary healthcare infrastructure, rising pet ownership, and growing acceptance of preventive nutrition for companion animals. Dietary supplements are becoming more accessible in countries such as the United Arab Emirates, Saudi Arabia, and South Africa, where the number of veterinary clinics, specialty pet retailers, and regulated online platforms is increasing. Stronger veterinary engagement is also improving awareness of condition-specific supplementation for pets across different life stages.

Premium and functional supplements targeting joint health, digestive function, immune support, and skin and coat condition are gaining traction, particularly among urban and higher-income households. Rising disposable incomes, urbanization, and the humanization of pets are encouraging pet owners to spend more on preventive and wellness-oriented nutrition rather than reactive care. Growth in e-commerce, including subscription-based purchasing models, home delivery, and diversified formats such as chews, powders, and flavored liquids, is improving adherence and repeat purchases while supporting broader market penetration.

UAE Pet Dietary Supplements Market

The UAE pet dietary supplements market is gaining steady traction, driven by rising pet ownership, increasing humanization of pets, and growing awareness of preventive animal healthcare. Urban households in the United Arab Emirates are increasingly treating pets as family members, which is translating into higher spending on nutritional supplements that support long-term health, immunity, and quality of life. This trend is particularly visible among dog and cat owners in major cities, where demand is rising for supplements targeting joint health, skin and coat condition, digestion, and overall vitality.

Market growth is further supported by expanding access to veterinary care and pet specialty retail channels. Veterinary clinics, pet hospitals, and premium pet stores are playing an important role in educating pet owners about the benefits of dietary supplementation, especially for aging pets and breed-specific health concerns. Supplements formulated with omega fatty acids, probiotics, vitamins, minerals, and glucosamine are seeing higher uptake as part of preventive care routines rather than reactive treatment.

Why Is the Latin American Pet Dietary Supplements Market Emerging Rapidly?

The Latin American pet dietary supplements market is developing at an extremely high pace because of the growing number of pets, the rise of preventive care, and the growth of the healthcare network. Brazil, Mexico, and Argentina are among other nations working towards the investment in veterinary clinics, specialty stores, and online platforms that enhance premium and useful supplements. The increase in disposable incomes, urbanization, and humanization of pets is stimulating the expenditure on quality formulations. Soft chews, flavored powders, and liquid supplements increase compliance and uptake. More education and trust are achieved through education campaigns, recommendations by the veterinarians, and digital marketing.

Brazil Pet Dietary Supplements Market

The Brazil pet dietary supplements market is experiencing steady growth, supported by rising pet ownership, increasing awareness of animal health, and the growing humanization of pets across urban households. Brazil has one of the largest companion animal populations globally, and pet owners are increasingly viewing dietary supplements as an essential part of preventive healthcare rather than optional add-ons. This shift is driving demand for supplements that support overall wellness, longevity, and quality of life for dogs and cats.

Veterinary influence plays a central role in market development. Expanding veterinary clinic networks and pet hospitals across Brazil are actively recommending supplements for joint mobility, digestive health, immunity, and skin and coat maintenance, particularly for aging pets and large dog breeds. Products containing glucosamine, chondroitin, probiotics, omega fatty acids, vitamins, and minerals are seeing higher adoption as part of routine care plans prescribed by veterinarians.

The major players in the pet dietary supplements market include Ark Naturals, Bayer, Blue Buffalo Pet Products, Food Science Corporation, Four Paws, Mars PetCare, Nestle Purina PetCare, Nutramax Laboratories, PetHonesty, Virbac, Zesty Paws, and Zoetis.

By Product Form

By Supplement Type

By Function

By Pet Type

By Distribution Channel

By Region

[ad_2]

Source link

[ad_1]

CLAIM: The amount of catechins in a single cup of green tea is too low to cause meaningful weight loss, with studies showing only modest effects at much higher doses. Consuming green tea in excess to achieve such doses may pose health risks rather than benefits.

FACT: True. Experts caution that relying on green tea alone for weight loss is misleading, and excessive consumption may cause side effects such as iron absorption issues, interactions with medications, and increased caffeine-related risks.

Weight loss trends come and go, but certain “healthy” fixes seem to return again and again. Green tea is one of them. From celebrity endorsements to daily wellness routines, it is often promoted as a simple drink that can boost metabolism and shrink waistlines. But how much of this claim actually holds up?

In a viral Instagram reel, dietician Bhawesh Gupta, who has 7.16 lakh followers, addresses the belief that green tea leads to weight loss. Referring to actor Shraddha Kapoor’s advertisement for Lipton Green Tea, he points out how celebrity promotions have shaped public perception around the drink. “You must have seen Shraddha Kapoor’s famous ad,” he says, adding that she claims drinking green tea daily boosts metabolism and reduces waist size.

Bhawesh explains that green tea contains a special polyphenol called catechin, which is often linked to fat loss. Citing research studies, he says that when 500 to 1,000 mg of catechins were given in an isolated form, participants lost only 1–2 kg of weight and 2–3 cm of waist size over three months. However, he stresses that “in one cup of green tea, only around 70 mg of catechins are present.”

“To get even a little weight loss, you would have to drink at least 10 cups of green tea every day,” he says, warning that such high consumption is not good for health. He notes that green tea also contains antinutrients like tannins and oxalates, which in large amounts can interfere with iron absorption and increase the risk of kidney stones. He further adds that high doses of catechins can raise liver enzymes such as ALT and AST. “So, avoid this misleading marketing of companies,” Bhawesh says, advising people to consume green tea only in moderation, and for taste.

The reel, which has garnered 1.74 lakh views, over 6,200 likes, and more than 1,000 shares, has reignited debate around whether green tea is genuinely effective for weight loss, or simply another example of misleading health marketing dressed up as wellness advice.

Green tea is rich in nutrients and antioxidants and may offer some health benefits. However, further research is necessary to determine how much it may help with weight loss and the best consumption method.

According to the National Centre for Complementary and Integrative Health (NCCIH), green tea is commonly included in weight-loss products, yet it does not cause significant weight loss in adults with overweight or obesity. “The catechins and caffeine in green tea and its extracts may have a modest effect on body weight. However, the effects of green tea products may vary depending on the composition of the product and the individual’s level of physical activity,” the NCCIH notes.

Green tea contains polyphenols, catechins, and caffeine, which may contribute to modest weight-loss benefits. A 2023 review suggests that catechins can influence metabolism and fat markers, while caffeine may support weight loss when consumed in amounts above 300 mg daily.

Research in animals and lab studies also indicate that catechins may reduce total blood cholesterol, LDL, and triglycerides, which are linked to weight management. However, these benefits are generally small, and achieving measurable effects would require consuming large amounts consistently over time.

A 2023 meta-analysis highlights mixed results regarding green tea’s weight-loss effects. Within the analysis, some randomised controlled trials found that green tea supplementation significantly reduced weight, BMI, and waist circumference in women with overweight or obesity. The researchers concluded that taking up to 1,000 mg of green tea catechins daily for 8 weeks or less could provide modest benefits.

Similarly, a 2020 review suggested that lower doses (under 500 mg daily) for 12 weeks also led to small reductions in body weight. Overall, green tea may support weight management when combined with a balanced diet and regular exercise, but its effects are generally modest.

Another 2022 review reported that green tea could reduce total cholesterol, low-density lipoprotein (LDL), and triglycerides in animals on obesity-inducing diets. However, similar effects were not consistently observed in human studies, indicating that more research is needed to confirm these benefits in people.

Green tea may interact with certain medications. The NCCIH notes that high doses of green tea can reduce blood levels of some drugs, including the beta-blocker nadolol (Corgard).

While caffeine and catechins in green tea have known health benefits, they can also cause side effects in some people, especially when consumed in large amounts. Excessive caffeine may lead to anxiety, sleep disturbances, stomach upset, and headaches. During pregnancy, high caffeine intake may increase the risk of birth defects or miscarriage.

Research recommends limiting caffeine to 300 mg daily, though a review of over 400 studies found that healthy adults consuming up to 400 mg per day did not experience adverse effects.

The caffeine content in green tea varies depending on the leaves and steeping time. One gram of green tea contains 11–20 mg of caffeine, and a typical serving of 1 tablespoon (2 grams) in 240 ml of water provides roughly 22–40 mg of caffeine per cup.

Green tea catechins can also reduce iron absorption, and consuming large amounts may lead to iron deficiency anaemia. Those at risk, including infants, young children, pregnant or menstruating women, and people with internal bleeding or on dialysis, should drink tea between meals and wait at least an hour after eating.

Catechins may additionally interfere with certain medications, including those used to treat anxiety and depression, potentially reducing their effectiveness. Toxic effects are most common with green tea supplements, which contain much higher concentrations of catechins than brewed tea.

Rajeshwari Panda, Head of the Dietetics Department at Medicover Hospital, Mumbai, emphasised that a single cup of green tea contains too little catechin to significantly reduce weight or waist size. She also highlighted that regular exercise and a balanced lifestyle play a major role in weight management. “Excessive green tea intake may harm your health by interfering with medications, reducing iron absorption, and even increasing the risk of kidney stones,” she noted.

She pointed out that while catechins and caffeine in green tea may support fat metabolism, the amount present in typical servings is very small. “It requires a lot of catechins to see measurable results, which is not practical, or advisable, because consuming that much tea would lead to excessive caffeine intake, impacting nutrient absorption.”

Panda stressed that green tea can only act as a supportive element, not a primary solution for weight loss. “There are studies showing that catechins have antioxidant properties, and caffeine may slightly boost fat burning, but the effect is modest. Claiming that green tea alone causes weight loss is misleading,” she said.

On recommended consumption, she advised, “We usually suggest two to three cups a day. Even then, it should be seen as support, not a magic solution. People need to understand that lifestyle and dietary changes are the real drivers of weight loss.”

She also cautioned specific groups about green tea intake. “Pregnant women, individuals with liver conditions, and people with iron deficiency should avoid or limit green tea, as caffeine can affect iron absorption and other health parameters. Reading product labels carefully is important to avoid being misled by exaggerated claims,” Panda added.

This story is done in collaboration with First Check, which is the health journalism vertical of DataLEADS.

[ad_2]

Source link

[ad_1]

India is witnessing a profound transformation in how its citizens approach health and wellness. The nutritional supplements market of the country has evolved from a niche segment into a mainstream industry serving millions of health-conscious consumers. This shift reflects changing lifestyles, increased awareness about preventive healthcare, and growing disposable incomes. The market encompasses protein powders, vitamins and minerals, omega fatty acids, probiotics, herbal supplements, and sports nutrition formulations, catering to diverse segments from fitness enthusiasts to senior citizens. According to IMARC Group, the market was valued at USD 20.64 Billion in 2024, and it is projected to reach USD 57.53 Billion by 2033, at a CAGR of 11.14% during the forecast period (2025-2033).

Explore in-depth findings for this market, Request Sample

The contemporary Indian consumer has fundamentally altered their relationship with health and nutrition. Preventive healthcare has emerged as a priority, driven by increased health literacy and awareness campaigns. This paradigm shift has positioned nutritional supplements as essential components of daily wellness routines.

Young professionals and urban millennials view supplements as investments in long-term health outcomes. Immunity boosting has particularly resonated with vitamin C, vitamin D, zinc, and herbal formulations becoming household staples integrated into morning routines.

The fitness revolution has created massive demand for protein supplements and performance enhancers. Gym memberships have surged, home workout culture has flourished, and running communities have expanded exponentially. These enthusiasts view supplementation as fundamental to achieving their health goals.

Senior citizens represent another significant segment, increasingly recognizing the value of targeted nutritional support. Joint health supplements, calcium formulations, and multivitamins tailored for older adults have found substantial traction, often influenced by healthcare professionals.

Working adults facing demanding schedules have turned to supplements as convenient solutions for nutritional gaps. Energy boosters, stress management formulations, and cognitive support supplements address modern corporate life challenges.

The India nutritional supplements market presents a compelling growth story driven by demographic and economic factors. India’s large young population combined with rising per capita incomes creates an ideal environment for market development.

Protein powders have transcended bodybuilding to become mainstream nutritional products. Whey protein, plant-based protein, and blended formulations cater to diverse dietary preferences at multiple price points, making supplementation accessible to middle-class consumers.

Vitamin and mineral supplements represent the most established category with consistent demand. Single-vitamin formulations compete alongside comprehensive multivitamins, normalized through public health campaigns as preventive health measures.

Gummy vitamins have emerged as innovative products appealing to younger consumers and parents seeking child-friendly options. These combine functional benefits with enjoyable consumption experiences, successfully penetrating markets where traditional formats faced resistance.

Herbal and ayurvedic supplements leverage India’s traditional medicine heritage, resonating with consumers seeking natural wellness solutions. Ashwagandha and turmeric have been reformulated into convenient modern formats, bridging ancient wisdom with contemporary lifestyles.

Sports nutrition constitutes a high growth subsegment driven by fitness culture proliferation. Pre-workout formulations, post-workout recovery products, and amino acid supplements serve increasingly sophisticated consumer needs beyond elite athletes.

Organized retail expansion, modern trade channels, and e-commerce infrastructure have dramatically improved product accessibility. Consumers in tier-two and tier-three cities now access brands previously available only in metropolitan markets, unlocking new growth opportunities.

The fitness ecosystem in India has undergone remarkable expansion, creating substantial demand for nutritional supplements. Commercial gyms have proliferated with growing memberships, serving as important distribution and recommendation channels where trainers influence purchasing decisions.

Home fitness gained unprecedented momentum, with consumers investing in equipment and following digital workout programs. This expanded the market beyond traditional gym-goers to home exercisers. Online fitness platforms have democratized professional guidance while normalizing supplement consumption.

The running community has experienced explosive growth, with marathons attracting thousands of participants. Endurance athletes require specialized nutritional support including energy gels, electrolyte supplements, and recovery formulations. Running clubs facilitate knowledge sharing about supplementation strategies.

Whey protein has become synonymous with muscle building, establishing itself as the cornerstone sports nutrition product. Multiple domestic and international brands compete intensely, offering products with varying protein concentrations, flavors, and value propositions. For instance, in June 2025, Nutrabay announced the release of BioAbsorb, a next-generation whey protein intended to address poor absorption and digestive pain, two of the most prevalent but untreated problems that protein consumers encounter. Similarly, GNC Pro Performance 100% Whey + Keto Surge, a cutting-edge protein supplement that combines premium whey protein with fat-burning ingredients to support weight loss and lean muscle gain, has been introduced by GNC in May 2025.

Functional fitness and CrossFit-style workouts have introduced consumers to specialized supplements including branched-chain amino acids (BCAAs), creatine, and beta-alanine. Fitness influencer content has accelerated awareness and adoption of these performance products.

Women’s fitness has emerged as a distinct rapidly growing segment, with products formulated for female physiology addressing hormonal balance, bone health, and lean muscle development. Destigmatization of strength training among women has opened substantial opportunities.

Supplement brands have strategically partnered with gyms, fitness studios, and sports academies for brand awareness and trial. In-gym sampling, trainer endorsements, and co-branded events create multiple touchpoints with high-intent consumers, building credibility during the consideration phase.

The digital revolution has transformed how Indian consumers discover and purchase nutritional supplements. Online pharmacies have emerged as preferred destinations, offering convenience, competitive pricing, and extensive selection. Consumers can compare formulations, read reviews, and access detailed product information.

Direct-to-consumer (D2C) brands have disrupted traditional distribution by building direct customer relationships. These digitally native brands leverage social media, content marketing, and influencer partnerships to build awareness. By eliminating intermediary margins, many offer competitive pricing while maintaining premium positioning through brand storytelling.

Fast delivery capabilities have become essential, with leading platforms offering same-day or next-day delivery in major cities. Quick commerce platforms deliver supplements within hours of ordering, addressing the immediacy barrier to online purchasing.

Influencer marketing has proven exceptionally effective where trust influences decisions. Fitness influencers, nutritionists, and wellness creators provide authentic recommendations resonating with followers. User-generated transformation stories create powerful social proof driving conversions.

Subscription models have gained traction with recurring deliveries offering pricing benefits and eliminating reordering friction. Brands benefit from predictable revenue streams and increased customer lifetime value.

Personalization has emerged as a differentiator, with platforms offering customized recommendations based on health assessments and fitness goals. AI-driven engines analyze inputs to suggest optimal product combinations, enhancing satisfaction and average order values.

Digital payment infrastructure enables seamless transactions through wallets, UPI, cards, and buy-now-pay-later schemes. Educational content marketing—through blogs, videos, and podcasts—positions brands as trusted information sources, building credibility that translates into sales.

The India nutritional supplements market features dynamic competition with domestic players, multinationals, and D2C brands vying for market share, offering consumers extensive choice while driving innovation and competitive pricing.

The India nutritional supplements market stands poised for sustained expansion driven by fundamental shifts in consumer behavior and health consciousness. The convergence of rising incomes, increased health awareness, digital infrastructure development, and demographic advantages creates a uniquely favorable environment.

The transition from reactive to preventive healthcare represents a cultural shift with lasting implications. Consumers increasingly view supplements as long-term wellness investments rather than immediate health responses, creating sustained demand beyond short-term trends.

Innovation in product formats, delivery mechanisms, and personalization will differentiate successful brands. Companies investing in understanding evolving consumer needs will capture disproportionate market share. Technology, data analytics, and consumer insights integration will separate market leaders.

Opportunities ahead are substantial for stakeholders across the value chain. Strategic investments in distribution infrastructure, brand building, and consumer education will yield significant returns as the market matures. What developments will shape the next chapter of India’s nutritional supplements revolution?

At IMARC Group, we empower businesses with intelligence to succeed in India’s evolving wellness market.

[ad_2]

Source link

[ad_1]

The Europe brain health supplements market size was valued at USD 2.54 billion in 2024 and is projected to reach USD 7.05 billion by 2033 from USD 2.84 billion in 2025, growing at a CAGR of 12.03%.

Brain health supplements refer to orally consumed dietary formulations containing bioactive compounds, such as omega 3 fatty acids phosphatidylserine bacopa monnieri and B vitamins designed to support cognitive function memory focus and neurological resilience, across the lifespan. These products are food supplements under Regulation EC No 1924 2006 and must comply with the European Food Safety Authority’s stringent assessments on health claims and ingredient safety. As per the Organisation for Economic Co-operation and Development, Europe is home to 110 million people aged 55 and over, a demographic projected to grow by 25% by 2035 by intensifying demand for scientifically backed cognitive support. Brain health supplements occupy a critical niche at the intersection of preventive nutrition regulatory science and consumer empowerment within Europe’s evolving health and wellness ecosystem.

The rapid aging demographic structure for sustained demand in brain health supplements, as individuals seek non pharmaceutical strategies to preserve cognitive function, which is driving the growth of Europe brain health supplements market. According to Eurostat, over 21% of the EU population was aged 65 or older in 2023 with projections indicating this will rise to 29% by 2050. Concurrently, the World Health Organization estimates that over 15.5 million Europeans live with mild cognitive impairment, a precursor to dementia with prevalence doubling 5 years after age 65. In response, consumers are proactively adopting nutritional interventions, where a 2023 survey by the European Consumer Organisation found that 58% of adults over 55 use omega 3 or B vitamin supplements specifically for memory support. National health agencies reinforce this trend, France’s National Agency for Food Safety recommends daily DHA intake of 250 milligrams for cognitive maintenance in older adults. This preventive mindset transforms brain health supplements from optional wellness products into essential components of healthy aging strategies across Europe’s graying population.

The younger generations are increasingly using brain health supplements to enhance focus academic performance and mental resilience in high pressure educational and professional environments. The growing mental performance expectations among younger people is additionally propelling the growth of Europe brain health supplements market. In the UK, the Office for National Statistics found that 31% of adults aged 18 to 35 purchased nootropic or adaptogenic supplements in 2023, including bacopa rhodiola and L theanine to manage cognitive fatigue and improve productivity. The rise of remote and hybrid work has further intensified this demand as professionals seek natural alternatives to stimulants for sustained mental clarity. Social media and digital wellness platforms amplify awareness with neuroscience backed content normalizing cognitive self-care.

The European Food Safety Authority’s rigorous scientific evaluation process severely limits the ability of brain health supplement manufacturers to communicate cognitive benefits to consumers. The stringent EFSA regulations restrict health claim substantiation is limiting the growth of Europe brain health supplements market. Under Regulation EC No 1924 2006, all health claims must undergo EFSA scrutiny and receive formal authorization before use in marketing. As per EFSA’s, public database over 95% of submitted cognitive health claims, including those for ginkgo biloba omega 3 and bacopa have been rejected due to insufficient human evidence or ambiguous wording. For instance, despite extensive research EFSA has not approved any claim linking DHA to memory improvement in healthy adults stating evidence is “not sufficiently substantiated.” This regulatory environment forces companies to use vague phrasing like “contributes to normal cognitive function” without specifying memory focus or mental clarity, significantly weakening consumer appeal. According to the European Federation of Associations of Health Product Manufacturers, 78% of supplement brands report that claim restrictions are the top barrier to product differentiation.

Many European consumers lack clear understanding of key brain health ingredients their mechanisms and realistic benefits leading to confusion and inconsistent usage is additionally impeding the growth of Europe brain health supplements market. The knowledge gap is exacerbated by inconsistent labelling products often list complex botanical names without explaining function or dosage relevance. In Italy, the National Institute of Health found that many supplement users discontinued brain health products within three months due to perceived lack of effect often because they used sub therapeutic doses or expected immediate results. Furthermore, the proliferation of unregulated “smart drugs” and exaggerated online claims has eroded trust in legitimate supplements. The European Commission’s 2023 Consumer Market Study confirmed that 47% of shoppers view brain health supplements as “marketing hype” due to unclear science communication. Until public health campaigns or digital tools bridge this literacy divide consumer adoption will remain fragmented and vulnerable to misinformation hindering the category’s mainstream credibility and growth potential.

The emergence of genetic testing wearable data and AI driven health apps for personalized brain health supplementation tailored to individual cognitive needs and biomarkers is creating new opportunities for the growth of Europe brain health supplements market. According to the European Institute of Innovation and Technology, many digital health startups in Europe launched cognitive wellness platforms in 2023 that combine cognitive assessments blood biomarker tracking and lifestyle data to recommend customized supplement regimens. In Sweden, the national digital health initiative “Vardval” piloted a program where users receive omega 3 or B vitamin formulations based on at home blood tests measuring homocysteine and DHA levels biomarkers linked to cognitive risk. Companies like MyFitnessPal and Lifesum now integrate brain health modules that adjust supplement suggestions based on sleep stress and cognitive performance tracked via wearables. The European Commission’s Digital Europe Programme has allocated 230 million euros to support such personalized nutrition services under its 2021 2027 health strategy. As consumers demand individualized solutions, over one size fits all products brain health supplements are evolving from static formulations to dynamic components of data driven cognitive wellness ecosystems creating high value engagement models.

Emerging scientific insights into hormonal impacts on cognition to position brain health supplements among women, particularly around menopause is also to expand the growth of the Europe brain health supplements market in coming years. According to the European Menopause and Andropause Society, over 52 million European women are in perimenopause or post menopause with 70% reporting “brain fog” memory lapses and reduced mental clarity linked to declining estrogen levels. Recent studies published in the European Journal of Clinical Nutrition confirm that omega 3 DHA and phosphatidylserine supplementation can mitigate these symptoms by supporting neuronal membrane fluidity and neurotransmitter function. In response, brands like Femal and MenoBalance have launched menopause specific cognitive formulas in Germany, France, and the UK, featuring clinically studied doses of these actives combined with adaptogens like ashwagandha. The UK’s National Health Service now includes nutritional guidance for cognitive symptoms in its menopause care pathways legitimizing the category.

The variable quality and authenticity of botanical ingredients in herbal nootropics like bacopa ginkgo and ashwagandha due to fragmented global supply chains and inadequate testing protocols kis significantly impeding the growth of Europe brain health supplements market. According to the European Directorate for the Quality of Medicines, many of herbal supplement samples tested in 2023 contained undeclared fillers substitutes or contaminants, including heavy metals and undeclared pharmaceuticals. In Germany, the Federal Office of Consumer Protection recalled 12 brain health products in 2023 after DNA barcoding revealed substitution of genuine bacopa with cheaper unrelated plants lacking active bacosides. The problem is exacerbated by the fact that many European supplement brands source raw materials from multiple countries without standardized cultivation or extraction practices. As per the European Botanical Forum, few of herbal suppliers provide full traceability from farm to finished product. This inconsistency undermines clinical efficacy studies show bacoside concentration in commercial bacopa extracts can vary by over 300% by leading to unreliable consumer experiences.

The absence of standardized dosing recommendations and validated cognitive endpoints for brain health supplements creates significant ambiguity in product development consumer expectations and regulatory evaluation across Europe. Unlike pharmaceuticals dietary supplements are not required to demonstrate dose response relationships or use clinically accepted cognitive assessment tools in their evidence dossiers. According to the European Food Safety Authority, submissions for cognitive claims often rely on heterogeneous study designs using different cognitive batteries durations and populations making cross product comparisons impossible. For example, omega 3 trials for memory support have used doses ranging from 200 to 2000 milligrams of DHA with outcomes measured by everything from simple word recall to complex executive function tests. The European Commission’s 2023 Scientific Committee on Health noted that this methodological inconsistency is a primary reason for claim rejections. Consequently, consumers cannot reliably compare products or anticipate results, leading to trial and error purchasing and high discontinuation rates. Until Europe adopts harmonized biomarkers clinical endpoints and minimum effective doses for key brain health ingredients the category will struggle to establish scientific credibility and consistent consumer trust across the single market.

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.03% |

|

Segments Covered |

By Product Type, Dosage Form, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Teva Pharmaceutical Industries Ltd, Natural Factors Nutritional Products Ltd, HVMN, Onnit (Unilever), AlternaScript, Intelligent Labs, Mind Lab Pro, Reckitt Benckiser Group Plc, ReMind Brain Health Supplements, and Prepare Your Mood |

The nootropic supplements segment was accounted in holding 63.2% of the Europe brain health supplements market share in 2024 with the growing consumer preference for targeted cognitive enhancement over general multivitamin approaches. The rising demand for evidence backed botanical and bioactive ingredients that address specific cognitive concerns, such as memory focus and mental fatigue is also accelerating the growth of Europe brain health supplements market. Herbal extracts like bacopa monnieri and ginkgo biloba are also gaining traction, Germany’s Federal Institute for Risk Assessment reported a 34% increase in sales of standardized bacopa extracts between 2021 and 2023 due to emerging clinical data on memory support. Unlike generic vitamins nootropics offer perceived precision appealing to both aging populations seeking cognitive preservation and younger adults optimizing performance. The European Food Safety Authority’s acceptance of the claim that DHA “contributes to the maintenance of normal brain function” provides a rare sanctioned message that retailers leverage in labeling and education. This regulatory foothold combined with strong consumer interest in natural cognitive support ensures nootropic supplements remain the core of the European brain health market.

The herbal extracts segment is anticipated to witness a fastest CAGR of 10.6% from 2025 to 2033 with the renewed scientific validation of traditional botanicals and strong cultural acceptance across Southern and Central Europe. The accumulation of high quality clinical evidence supporting cognitive benefits of standardized herbal extracts is also to elevate the growth of Europe brain health supplements market. A 2023 meta-analysis published in the European Journal of Clinical Nutrition confirmed that bacopa monnieri extract with 55% bacosides significantly improved memory acquisition and retention in adults over 12 weeks. Similarly, ginkgo biloba EGb 761 has demonstrated neuroprotective effects in age related cognitive decline through multiple randomized controlled trials endorsed by the European Academy of Neurology. Unlike synthetic nootropics herbal extracts benefit from long standing traditional use in European phytotherapy in Germany, where Commission E monographs have recognized ginkgo for cognitive symptoms since 1987.

The capsules segment was the largest by accounting for 58.3% of the Europe brain health supplements market share in 2024. The perception of capsules as cleaner more precise and easier to swallow compared to tablets among older adults, who constitute a significant portion of the brain health user base is majorly escalating the growth of segment. According to a 2023 Eurobarometer survey, many European supplement users aged 55 and over prefer capsules due to their smooth texture lack of aftertaste and absence of binders or disintegrants. Germany’s Federal Institute for Drugs and Medical Devices confirms that bioavailability of DHA from softgel capsules is 25 to 30% higher than from compressed tablets due to better lipid dissolution. Leading brands like Solgar and Pharma Nord exclusively use capsules for their premium brain formulas to ensure efficacy and consumer compliance. In retail, capsules also convey a premium aesthetic glass bottles of clear capsules signal purity and quality more effectively than opaque tablets, further driving selection in competitive shelf environments.

The softgels dosage form segment is likely to grow at a fastest CAGR of 12.1% from 2025 to 2033 with the rising use of lipid based nootropics and demand for enhanced bioavailability in premium cognitive formulations. The dominance of omega 3 fatty acids, like DHA in brain health regimens, which require oil based delivery for optimal absorption is also fuelling the growth of segment. Softgels encapsulate fish or algal oil in a sealed gelatin or plant-based shell that prevents oxidation rancidity and gastric reflux common issues with liquid or tablet alternatives. Clinical studies published in the European Journal of Clinical Nutrition confirm that DHA from softgels achieves 30% higher plasma concentrations than from emulsified tablets. Brands like Wiley’s Finest and Testa Omega 3 have leveraged this advantage by using nitrogen flushed softgels with enteric coatings to further enhance delivery by appealing to scientifically literate consumers. In Germany, and the Netherlands, where omega 3 usage is highest softgel penetration exceeds 80% among regular users as confirmed by national health surveys.

The drug stores and retail pharmacies segment was accounted in holding 47.3% of the Europe brain health supplements market share in 2024 from high consumer trust in pharmacist guidance strong in store education and regulatory legitimacy in a category, where efficacy claims are restricted. The consultative role of pharmacists in recommending evidence based cognitive support products for older adults managing age related memory concerns. According to the European Pharmaceutical Association, many of Europeans aged 55 and over consult a pharmacist before purchasing brain health supplements due to confusion about ingredient efficacy and safety. Retail pharmacy chains like DM Drogerie in Germany and Boots in the UK train staff to explain the limited EFSA approved claims and differentiate clinically studied brands from generic alternatives. The physical presence of supplements alongside regulated health products also confers implicit credibility, unlike online or general retail channels where consumers face information overload and authenticity risks. This trust-based model ensures consistent high value sales particularly for premium nootropic and omega 3 brands that rely on professional endorsement rather than mass marketing.

The online distribution channel segment in the Europe brain health supplements market is projected to expand at a CAGR of 14.3% from 2025 to 2033 owing to the rise of direct to consumer brands that leverage digital storytelling clinical transparency and subscription models to build loyalty among younger health-conscious consumers. Companies like Heights in the UK and Nootrobox in Germany use online platforms to provide detailed ingredient sourcing third party test results and cognitive tracking tools by addressing the transparency gap that plagues traditional supplement marketing. Social media and influencer partnerships amplify awareness such as TikTok hashtags like #brainhealth and #nootropics generated over 1.2 billion views in Europe in 2023, as per platform analytics are driving traffic to e-commerce sites. The ability to offer sample kits personalized bundles and auto replenishment further enhances retention in a category requiring consistent use.

Germany was the top performer of the Europe brain health supplements market with 21.3% of share in 2024 with its strong phytotherapy tradition aging population and highly trusted pharmacy retail model. Germany is home to Europe’s oldest and most scientifically rigorous herbal medicine framework Commission E monographs, which includes ginkgo biloba for cognitive support, since 1987. The Federal Statistical Office reports that many adults over 60 use omega 3 or ginkgo supplements regularly with sales growing at 9% annually. Furthermore, Germany hosts leading supplement manufacturers like Dr Willmar Schwabe and Abtei that invest heavily in clinical research and GMP certified production.

The United Kingdom brain health supplements market was positioned second by holding 17.3% of share in 2024 with its high health literacy digital innovation and proactive aging population. According to the UK Office for National Statistics, 42% of adults aged 50 and over use brain health supplements with omega 3 and B vitamins as top choices. The National Health Service increasingly acknowledges nutrition’s role in cognitive aging with its “Midlife Health Check” program includes dietary advice for brain resilience. The UK is also Europe’s epicenter of direct-to-consumer nootropic brands like Heights and Nootropics Depot, which use subscription models and cognitive tracking apps to engage younger demographics.