The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

I wrote on the 19th October that the best trades for the week would be:

None of these trades set up until Friday’s close, so there were no trades last week.

A summary of last week’s most important data:

Last week’s big event was Friday’s lower than expected US CPI (inflation) data, which effectively gave the Federal Reserve every reason to make a rate cut of 0.25% at its meeting this week, and again at its meeting in December. This pushed major US stock market indices to new all-time highs, most strongly in the tech-focused NASDAQ 100 Index.

We saw UK inflation data surprise analysts to the downside, which triggered a dip in the British Pound. However, inflation data released in Canada and New Zealand were higher than expected, suggesting there are still inflationary pressures alive and well in the global economy.

It was a relatively minor detail but the broadly better than expected PMI data in major economies probably added a little to the generally bullish mood in stocks.

US President Trump has begun a tour of Asia, which will conclude on Thursday in a meeting with Chinese leader Xi. This dovetails with the 1st November deadline on which President Trump’s new 100% tariff on Chinese imports will be take effect, unless he stops or amends it. It is widely expected that Trump and Xi will make a mutually beneficial deal on tariffs and rare earths export restrictions, and whether that is concluded well or not, we can expect some strong volatility is likely in markets at the end of the week. Trump’s meetings with leaders during the earlier part of the forthcoming week might also trigger movement in particular markets and currencies from day to day.

There will be four major central bank policy meetings over the coming week.

The US government shut down goes on but is having little effect.

Keep in mind that many countries have put their clocks back an hour over this weekend to switch away from summer time but North America has yet to move, so time zone differentials have changed by an hour between North America and elsewhere.

The coming week will probably see more activity in the market, due to the Trump / Xi meeting, and the four major central banks which will be holding policy meetings this week. Two of the banks (The US Federal Reserve and the Bank of Canada) are expected to announce rate cuts of 0.25%.

This week’s most important data points, in order of likely importance, are:

Due to the ongoing government shutdown in the USA, US data may be postponed indefinitely.

Currency Price Changes and Interest Rates

For the month of October 2025, I forecasted that the EUR/USD currency pair would rise in value. Its performance so far this month is shown in the table below.

October 2025 Monthly Forecast Performance to Date

I made no weekly forecast last week.

Although there were notably larger price movements in the Forex market last week, there were still no unusually large price movements in currency crosses, so I have no weekly forecast this week.

The Australian Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Directional volatility increased last week, with 37% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility is quite likely to increase.

You can trade these forecasts in a real or demo Forex brokerage account.

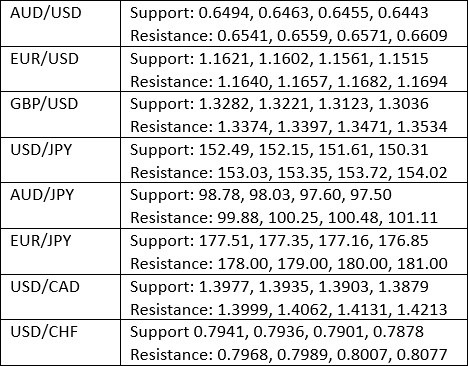

Key Support and Resistance Levels

Last week, the US Dollar Index printed a bullish inside bar pattern with small wicks on both the upper and lower side. However, what is most significant here is the fact that the price has again failed to make a weekly close above the key resistance level at 98.60. If we do eventually get a breakout above this level by the US Dollar, we have already seen a real bottom put in so this could be the start of a major long-term upwards trend. Despite being just below its level of 26 weeks ago, the price is above where it was 13 weeks ago, so by my preferred metric, I can declare the long-term bearish trend is over. This places the US Dollar in an interesting position and very close to technically starting a new long-term bullish trend.

The Dollar may take a hit over the coming days if China does not back down over its proposed rare earth export restrictions in the face of President Trump’s 100% China tariff threat, but this situation is producing much more predictable movement in other currencies such as the Australian and New Zealand Dollars (heavily linked to the Chinese economy) and the Japanese Yen (the current haven currency of choice). The Canadian Dollar, as a proxy for Crude Oil, is also sensitive to perceived changes in risk-on demand. President Trump and President Xi will be meeting Thursday, and the tariff deadline is next weekend, so it should be an interesting and decisive week.

The Federal Reserve will be holding a policy meeting this week and is almost unanimously expected to cut its interest rate by 0.25%. That meeting will likely also trigger USD volatility.

I will be most comfortable being long of USD above 98.31 and even more so above 98.60.

US Dollar Index Weekly Price Chart

The USD/JPY currency pair weekly chart printed a large, bullish candlestick with little upper wick which engulfed the real body and upper wick of the previous week’s range. These are bullish signs, and we are in a bullish long-term trend which was triggered by a recent breakout to a new 6-month high price, and such breakouts in this currency pair have historically tended to give traders a trend-following edge.

It should be noted on the bearish side, that the long-term price chart below shows that there is an important upper trend line in the dominant narrowing triangle pattern which has not even been tested yet. However, this probably will not happen until the price reaches the ¥155 area, so bullish action still has a meaningful way to run.

This is likely to be an important week for this currency pair, with the US Federal Reserve and the Bank of Japan both holding policy meetings, an incoming Japanese Prime Minister whose policies are sending the Yen lower, and a tariff showdown between President Trump and China’s President Xi scheduled for this Thursday.

If the developments of this week, especially Thursday’s meeting, are seen as good for the global economy and trade, we will probably see this pair rise significantly.

Like many trend traders, I am already long of this currency pair, but for a new long trade entry, I would like to see a daily (New York) close above ¥153.08.

USD/JPY Weekly Price Chart

The Index started last week higher and showed a muted bullishness until Friday’s lower-than-expected CPI (inflation) data was released, which looks likely to put the Fed more firmly on a path of rate cuts, with two cuts in 2025 virtually assured.

Markets reacted to this by moving firmly though not excessively higher, with tech stocks leading the way, which caused this index to underperform the tech-based NASDAQ 100 Index but close at a new record high, very near the high, which was a short way above 6,800.

US stock market indices going to a new record high is one of the best bullish signs you can get, as is a rate cut and a trade deal, and both of those latter two are on the cards to happen later this week. These events could send this index even higher, so I think it makes sense to be long here already without any conditions.

If Thursday’s meeting between President Trump and President Xi does not lead to a satisfactory deal on rare earths export from China – which would be surprising – we would certainly see this Index fall strongly at the end of this week.

It is very easy to assume this trend is overstretched and cannot last. For traders, trying to pick the top of a stock market rally is very unlikely to be useful.

S&P 500 Index Weekly Price Chart

Everything I wrote above about the S&P 500 Index also applies to the NASDAQ 100 Index, but it is worth noting that the NASDAQ 100 outperformed the S&P 500 last week, and the price chart shown below is more bullish.

The tech-base index’s outperformance against the broader market suggests that markets believe China and the USA will make a deal about rare earth exports and tariffs.

I remain long here and think it makes sense to be long of this index without any conditions.

NASDAQ 100 Index Weekly Price Chart

The main South Korean equity index has put in a stunning performance this year, significantly surpassing even the traditionally dominant US market. The Index is up almost 70% since April, an astonishing advance, driven partly by the global tech boom and partly by legal reforms affecting corporate governance and the stock market.

The last two weekly candlesticks have been long, strong, and both closed very near their respective highs.

A new long trade is certainly likely to be late to the party, but maybe a quarter-sized long position using a trailing stop could be a sensible trade.

The main Japanese equity index the Nikkei 225 has put in a great performance this year, surpassing even the traditionally dominant US market. The Index is up by more than 60% since April, an astonishing advance, driven partly by the global bull market and partly by an increasing sense that Japan is really coming back economically after a long period of deflation.

A new long trade is certainly likely to be late to the party, but maybe a quarter-sized long position using a trailing stop could be a sensible trade.

Although the price closing at a record high is certainly a bullish sign, there are two things here bulls should watch out for:

For these reasons, I would only want to take a small long trade, and that only after we get a daily close above 50,000.

Nikkei 225 Index Price Chart

I see the best trades this week as:

Ready to trade our weekly Forex forecast? Check out our list of the top 10 Forex brokers in the world.

Gold extends its consolidative phase into a fourth trading day on Monday, after having failed once again above the $4,100 mark.

The latest leg down in Gold could be attributed to the renewed market optimism surrounding a US-China trade deal after a preliminary consensus on topics including export controls, fentanyl and shipping levies was reached by both sides during their two-day talks in Malaysia.

On Sunday, US Treasury Secretary Scott Bessent noted: “So I would expect that the threat of the 100% has gone away, as has the threat of the immediate imposition of the Chinese initiating a worldwide export control regime.”

In an ABC News interview, Bessent further said that China would delay its rare-earth restrictions “for a year while they reexamine it.”

These optimistic comments ramped up the odds of a trade deal likely to be reached when Trump and Chinese President Xi Jinping meet on Thursday in South Korea.

Risk flows extended into Asia on increased dovish bets surrounding the US Federal Reserve’s (Fed) easing outlook and the US-China trade deal hopes.

Markets are almost fully pricing in two interest rate cuts this year, with a 25 basis points (bps) cut seen on Wednesday.

On Friday, the Bureau of Labor Statistics (BLS) showed that the US Consumer Price Index (CPI rose 0.3% in September, which drove the annual inflation rate from 2.9% to 3%, the highest it’s been since January. The annual CPI inflation came in softer than the market forecast of 3.1%.

The US-China trade deal hopes seem to have offset the dovish Fed sentiment, undermining Gold price.

Moreover, investors continue to take profits off the table on their Gold longs ahead of the Fed’s two-day monetary policy meeting that begins on Tuesday.

Therefore, a further corrective decline cannot be ruled out in the upcoming sessions, as the US government shows no signs of reopening, and hence, trade and Fed sentiment continue to emerge as the key drivers for the bright metal.

The four-hour chart shows that Gold price has once again breached the powerful support near $4,100.

That area is the confluence of the 21-Simple Moving Average (SMA) and the 100 SMA.

Meanwhile, the Relative Strength Index (RSI) stays below the midline, currently near 42.50.

Adding credence to the bearish bias, the 21 SMA closed below the 100 SMA on a four-hourly candlestick closing basis, validating a Bear Cross.

If the declines accelerate, Gold could challenge the $4,000 round level, below which the $3,950 psychological barrier will be targeted.

The next critical support is located at $3,920, the 200 SMA.

Alternatively, if buyers find a strong foothold above the aforesaid key support-turned-resistance at around $4,100, a fresh advance toward the $4,150 level could be in the offing.

Further north, Gold buyers could challenge the 50 SMA at $4,193.

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

– Written by

Frank Davies

STORY LINK Pound to Dollar Forecast: Focus Turns to Fed, UK Budget

The Pound to Dollar exchange rate (GBP/USD) steadied just above 1.33 heading into the new week after briefly dipping to 10-day lows late Friday.

Pound Sterling struggled to find lasting traction despite encouraging UK data, as markets digested US inflation figures and renewed trade tensions.

The US September inflation release came broadly in line with expectations, with headline CPI edging up to 3.0%, below the 3.1% consensus. The outcome reinforced expectations of a Federal Reserve rate cut this month, though traders remain wary of further geopolitical and fiscal risks.

According to UoB, “Downward momentum has increased further, but for a continued decline, GBP must first close below 1.3295.”

Scotiabank noted some tentative optimism for the Pound, stating that “options market data show a continued fade in the premium for protection against GBP weakness.” The bank, however, added that the UK’s fiscal backdrop remains a major headwind: “Media remain intensely focused on potential measures to be included in the November 26 budget release.” Near-term support is pegged at 1.33.

Danske Bank maintains a 12-month GBP/USD forecast of 1.37, citing expectations of a weaker dollar over the longer term.

The greenback held firm after Friday’s inflation data, supported by slightly higher oil prices and lingering caution over trade and government shutdown risks.

MUFG highlighted that persistent policy uncertainty continues to undermine confidence: “The constant uncertainty over trade policy cannot be a positive for US business planning and prospects of a deal between the US and Canada took a knock when President Trump announced that trade negotiations were off following anti-tariff ads aired by Ontario.”

Meanwhile, ING warned that energy developments could bolster the dollar: “A meaningful reduction in Russian oil supply could drive Brent prices back to the $70-75 range. These are levels that would drive some noticeable dollar appreciation.”

Domestic data offered mild encouragement for the UK. Retail sales volumes rose 0.5% in September versus expectations for a 0.2% decline, while the UK composite PMI climbed to a two-month high of 51.2, underpinned by a rebound in manufacturing.

For those with upcoming USD purchases or international payments, recent volatility shows how quickly market sentiment can shift around economic data and fiscal speculation. Compare today and secure a stronger rate before further swings.

With another pivotal Bank of England meeting and the November budget approaching, both monetary and fiscal narratives are likely to dominate the week ahead.

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

“This includes export controls, tariff suspensions, fentanyl-related measures, anti-drug cooperation, trade expansion, and US Section 301 fees.”

The prospect of lower US duties on Chinese shipments could draw Prime Minister Takaichi’s attention. President Trump is reportedly meeting with Japan’s prime minister on Monday, October 27.

Takaichi criticized the US-Japan trade deal inked in August before being elected. While defense spending could be a key topic, the US-China trade deal could provide Takaichi an opportunity to discuss the 15% levy on Japanese goods, affecting businesses. Reports suggesting President Trump is open to further trade talks and lower tariffs on Japan could strengthen demand for the yen.

BoJ board members have raised concerns over the impact of US tariffs on the Japanese economy and have called for delays to rate hikes to assess the effect of duties on the broader economy.

Lower tariffs could lift demand for Japanese goods and raise expectations for a BoJ rate hike. For context, the S&P Global Japan Manufacturing PMI fell from 48.5 in September to 48.3 in October.

Across the Pacific, durable goods orders will be in focus later on Monday. Economists forecast durable goods orders to rise 0.3% month-on-month in September after August’s 2.9% surge.

A higher reading could signal resilient business demand. Sustained demand may boost hiring and wages, potentially fueling inflation. A higher inflation outlook could support a less dovish Fed rate path. A less dovish Fed policy stance could lift demand for the US dollar and send USD/JPY toward 155.

On the other hand, an unexpected drop in orders could lead to job cuts and slower wage growth. Job cuts and softer wage growth may curb consumer spending and dampen inflationary pressures. A softer inflation outlook would support a more dovish Fed rate path, potentially pushing USD/JPY toward 150.

While US data will influence demand for the US dollar, traders should also closely monitor developments on Capitol Hill. A prolonged US government shutdown could reinforce expectations of a more dovish Fed policy outlook. However, a Senate vote passing a stopgap funding bill could expedite the release of delayed labor market reports, potentially fueling uncertainty about a Fed rate cut in December.

– Written by

Tim Boyer

STORY LINK Euro to Dollar Forecast: EUR/USD Implied Volatility Lowes in 11 Months

The Euro to Dollar exchange rate (EUR/USD) held firm on Friday, finding support near 1.1600 before edging to around 1.1640 as softer-than-expected US inflation data curbed dollar demand.

The pair settled close to 1.1620 into the weekend, with stronger Euro-Zone PMI figures offering additional support.

The latest US consumer prices data came in slightly below expectations, reinforcing market conviction that the Federal Reserve will cut interest rates at next week’s meeting. The headline CPI rose 0.3% in September, lifting the annual rate to 3.0% from 2.9%, just under the 3.1% consensus forecast. Core CPI also undershot expectations, increasing 0.2% on the month and easing to 3.0% year-on-year.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex, commented; “The headline was a bit softer than expected. The dollar was sold on the news, even though markets were already fully confident of Fed cuts in both October and December.”

He added; “Because those cuts are already priced in, this kneejerk dollar weakness may not be sustained.”

ING also pointed to near-term uncertainty; “Markets are fully pricing in 50bp of easing by year-end, and without any jobs data at hand, it will be hard to speculate much beyond the December meeting.”

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

Meanwhile, Euro-Zone PMI data came in stronger than expected, offering reassurance on growth momentum and helping the euro to consolidate gains.

UoB noted the technical backdrop remains stable: “The price movements still appear to be part of a range-trading phase.”

Commerzbank’s Volkmar Baur observed that EUR/USD implied volatility has fallen to its lowest level in 11 months, cautioning that “given the current geopolitical environment, I would not bet too much on this calm persisting.”

Trade headlines added a layer of uncertainty. US President Trump confirmed his meeting with Chinese President Xi is set for next week, even as talks with Canada were abruptly suspended.

Ben Bennett, Head of Investment Strategy for Asia at L&G Asset Management, commented; “Expectations are quite high for the Trump–Xi meeting, with the upside risk of a significant de-escalation following the face-to-face. Investors are getting used to the pattern of threats followed by compromise.”

For readers planning Euro or Dollar purchases, recent swings highlight how swiftly sentiment can shift on key data and trade headlines. Get in touch to discuss your euro currency purchase requirements.

The euro’s resilience above 1.16 underscores that while Fed cuts are largely priced in, volatility could rise again as traders weigh the upcoming policy statement and any fresh US-China developments.

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Euro Dollar Forecasts

Gold’s price architecture spans centuries of monetary regime shifts, but the current setup is as binary as any in modern history. The march from the Bretton Woods peg of $35/oz, through the 1971 convertibility break, to January 1980’s $850 spike and the 2011 breakout to $1,920 established the playbook: inflation shocks, currency debasement, and flight-to-quality episodes pull capital into XAU/USD. Fast forward to 2024–2025 and the same structural drivers just printed an all-time high at $4,381.44/oz, followed by a weekly settle at $4,114.12—a −$139.85, −3.29% decline that carved a weekly closing price reversal top. That pattern doesn’t automatically negate the uptrend, but it places the market on watch for a two-to-three week corrective phase unless buyers reassert control quickly.

Price expanded vertically into the record, then failed to hold gains as profit-taking hit precisely when the macro narrative looked most supportive. That failure is textbook for a reversal top: an upside exhaustion high early in the week, then a close below prior support despite bullish catalysts. If sellers press the advantage, XAU/USD opens room toward the first visible retracement pivot at $3,846.50, with a deeper Fibonacci waypoint at $3,720.25 (61.8%). Those aren’t arbitrary lines; they coincide with where late longs would be forced to decide whether to defend or liquidate, and where value-oriented buyers historically probe size.

The latest inflation print—core CPI +0.2% m/m, +3.0% y/y—locked in expectations for another 25 bp ease at the October 28–29 FOMC, taking the target range to 3.75%–4.00% with 98.3% market-implied odds. Crucially, the driver of policy isn’t a hot CPI; it’s labor risk. Payrolls momentum softened, prior months saw an aggregate ~900,000 downward revision, and August missed. Chair Powell’s messaging has shifted toward “insurance” cuts to preserve employment even if inflation lingers near 3%. That stance is historically constructive for gold because it depresses real yields and challenges the dollar’s carry appeal. The paradox is timing: gold pulled back in the same week the cut became a near-certainty, which tells you positioning was crowded and the market demanded fresh catalysts beyond “one more 25.”

Equities set fresh records into the weekend, while XAU/USD backed off its peak. The explanation is not that gold’s secular case cracked; it’s that the marginal liquidity impulse favored beta when tariff rhetoric cooled and risk appetite widened. The S&P 500 (+0.79%) and Nasdaq (+1.15%) extended gains as the 10-year U.S. Treasury hovered near 4.02%, siphoning flows from defensive sleeves. That rotation can unwind on a dime if the Fed under-delivers on dovish guidance, if forward QT language tightens financial conditions, or if the incoming backlog of economic releases (once the shutdown distortions clear) prints risk-off. Keep in view that spot gold still trades above $4,100 after a record, a resilience that indicates strategic demand hasn’t left—tactical profit-taking did.

The tape sent a bizarre signal set this month: gold near records, silver at $54.48 intra-month, and equities also at highs. That triad screams stagflation anxiety more than simple growth optimism. Inflation has re-accelerated from this year’s trough, drifting from 2.3% back to 3.0% y/y, while unemployment ticked up to 4.3%, the highest in four years, and headline job gains were revised sharply. Meanwhile, the national debt has ballooned to $37.6 trillion, and repeated shutdown risks keep fiscal confidence brittle. In that environment, it’s coherent for investors to bid risk for liquidity reasons and bid gold for policy and solvency insurance—until one of those impulses breaks.

If there’s an “insider transaction” equivalent in bullion, it’s central bank accumulation and ETF inventory behavior. The run to $4,381.44 occurred alongside heavy official-sector buying earlier in the cycle and persistent retail/institutional allocation via physically backed products. Last week’s downswing coincided with ETF outflows—classic profit-taking after a parabolic run—while price-sensitive official buyers are known to fade strength and reload into weakness. That mix is exactly what a reversal top captures: not an exodus, but a handoff from momentum money to balance-sheet buyers at lower prices. Watch whether those ETF outflows stabilize as XAU/USD tests the mid-$3,800s; that’s your confirmation that strong hands are re-engaging

Money supply expanded materially through the pandemic era, and although the impulse slowed during the 2022–2023 hiking cycle, the combination of balance-sheet policy and renewed cuts is re-steepening liquidity. With real yields easing from their peaks and the dollar unable to make new cycle highs, the opportunity cost of holding a non-yielding asset is falling again. Translate that into price regime terms: what $2,000 meant for resistance in 2020–2023 is what $4,000 is trying to become now—an area of battle that eventually flips into long-term support if policy remains accommodative. The fact that gold is consolidating above $4,000 after a blow-off attempt argues for regime change rather than a simple round-trip.

The nearest historical rhyme is the October 1979 drop from $444.50 to $365 that shook out weak longs before the sprint to $873 by January 1980. Obviously, today’s macro inputs differ, but the behavioral pattern—vertical extension, violent but contained shakeout, then trend resumption—fits a market where structural buyers dominate the medium term and speculators police the short term. The present reversal top serves the same function: clearing late momentum while leaving the secular thesis intact unless critical support breaks.

The immediate battleground is $4,112–$4,150. Hold that shelf into the FOMC and XAU/USD keeps a live shot at re-testing $4,250–$4,300 swiftly on a dovish press conference. Lose it decisively, and the market will seek $3,846.50, with spill risk to $3,720.25 if forced liquidation accelerates. The single sentence to parse from Powell: anything that softens the balance-sheet runoff path or amplifies labor-risk asymmetry relative to inflation risk. That’s the green light for duration and for gold. Conversely, a surprise nod to maintaining QT pace or a lean against forward-cut expectations would extend the correction.

Bitcoin’s break above $113,000–$114,000 coincided with gold’s reversal, aided by rate-cut odds near 98% and a rotation out of metals after an eight-week gold surge. Don’t over-fit that correlation. In 2020–2021 both assets rallied in tandem on liquidity, and in mid-2022 both fell as real yields spiked. The current divergence is a positioning story, not a verdict against XAU/USD. Should the Fed’s tone underwhelm risk assets or the backlog of macro data hit growth, the same liquidity that chased crypto and megacaps can snap back into bullion without warning.

The bear trigger is narrow but real: a hawkish surprise on QT or guidance that convinces the market the cutting path is shallower than priced, combined with continued ETF outflows and a weekly close below $3,846.50. The bull trigger is equally clear: reaffirmed easing path, labor-first mandate emphasis, and stabilization of ETF balances as central-bank and long-horizon buyers add into the mid-$3,800s. In the latter case, a swift reclaim of $4,200–$4,250 would put $4,381.44 back on the tape, and a clean weekly close above that high would open a measured move toward $4,600–$4,750 over the following legs.

The facts argue for bullish with discipline. All-time high at $4,381.44, weekly settle $4,114.12 (−3.29%), reversal top that likely enforces a time/price correction, CPI cool enough to validate the 98.3% cut probability, unemployment drifting up to 4.3%, and debt at $37.6T that anchors a robust structural bid for insurance assets. Tactically, respect the pattern: allow the market to test the $3,846.50–$3,900 demand zone; watch ETF outflows for stabilization; listen for any QT softening. As long as $3,720.25 holds on a weekly closing basis, the secular uptrend remains intact and pullbacks are opportunities, not warnings. My call, stated plainly: Gold (XAU/USD) — Buy / Bullish, accumulate into $3,850–$3,900, add on a dovish FOMC reclaim of $4,200+, and only downgrade to Hold on a weekly close beneath $3,720.

Friday’s inflation report came in cooler than expected. Core CPI rose just 0.2% month-over-month and 3.0% annually, reinforcing the view that the Federal Reserve will cut rates by 25 basis points at its October 28–29 meeting. The cut would lower the fed funds range to 3.75%–4.00%, and markets are still leaning toward a second cut in December.

Despite the dovish data, gold couldn’t regain traction. Broader risk appetite picked up as equities rallied on soft inflation and optimism around U.S.–China trade talks. Treasury yields climbed early in the week, and the dollar gained modestly, both contributing to gold’s downside pressure. The inability to hold weekly gains suggests buyers are now waiting for deeper value zones to re-enter.

The Fed’s easing path is now driven by labor market risks rather than inflation. Job creation has slowed sharply, with August’s payrolls missing estimates and prior data revised lower by over 900,000 jobs. Fed Chair Powell has framed the cuts as preemptive — aimed at preserving employment, even if inflation remains slightly above target.

This policy pivot still favors gold in the bigger picture, but right now the market is correcting. Traders are watching whether the Fed adds any signal of continued easing beyond October. If Powell sounds cautious or data-dependent, gold may stay under pressure short-term.

The closing price reversal top is not yet confirmed, but if sellers follow through this week, downside targets come into focus. A 2–3 week correction could unfold, with $3846.50 as the next likely target, followed by the 61.8% retracement at $3720.25. Until those levels are tested or the Fed delivers a strong dovish surprise, gold remains vulnerable to further profit-taking.

More Information in our Economic Calendar.

This week, the Bank of Japan will take center stage, with economists widely expecting policymakers to keep interest rates at 0.5%. Forward guidance will be pivotal, given recent economic data and Takaichi’s election win. Although the BoJ interest rate decision, forward guidance, and GDP and inflation forecasts will influence USD/JPY trends, traders should closely monitor upcoming economic data releases.

On Wednesday, October 29, consumer confidence figures will provide insights into household spending trends. Economists forecast the Consumer Confidence Index to rise from 35.3 in September to 35.6 in October.

A higher-than-expected reading could signal a pickup in consumer spending, fueling demand-driven inflation. Uptrends in household spending and inflation would support a more hawkish BoJ rate path, lifting demand for the yen. On the other hand, a lower print may suggest a softer inflation outlook, weighing on the yen.

While consumer confidence is a key stat, the Bank of Japan’s interest rate decision on Thursday, October 30, will be the main event. GDP and inflation forecasts and Governor Kazuo Ueda’s press conference will also be key drivers for the week.

Barring a surprise rate hike, traders should consider the BoJ’s forecasts and Governor Kazuo Ueda’s press conference. Upward revisions to GDP and inflation could fuel speculation about a December or January hike, lifting the yen. Conversely, weaker forecasts could sink bets of monetary policy tightening and weigh on the yen.

However, Governor Ueda will have the final say. Views on Prime Minister Takaichi’s monetary policy stance and plans for fiscal stimulus would likely be crucial near-term USD/JPY trends.

The 50-day line, aligned with the rising trend channel’s centerline, delivered a clear bullish reaction, forming a higher swing low. The quick recovery of the 20-day average and a downtrend line after their failure as support underscores buyer resolve. Such intraday reclamations signal strength, setting the stage for another test of recent highs.

Today’s high tested a long-term uptrend line, marking a significant pivot if cleared. The $3.46-$3.59 resistance zone, anchored by the 200-day average and October’s $3.59 swing high (B), has repelled three prior attempts. This first test of the 200-day as resistance since its July support failure adds weight. A fourth push could succeed, given today’s support response.

The rally from August’s low, the third counter-trend leg since July, eyes a higher swing high above $3.59 to confirm uptrend continuation. A rising ABCD pattern targets $3.71, matching the prior AB leg’s magnitude. Sustaining above $3.27 keeps bulls in control, with $3.46 the next hurdle.

The $3.27 close is key—above it locks in the hammer and targets $3.59, below it risks retesting $3.20. The 50-day support and quick recovery favor buyers, but $3.46-$3.59 remains a battleground. Today’s action hints at $3.71 potential if momentum holds—watch for breakout confirmation to fuel the next leg. Further up is the 78.6% Fibonacci retracement at $3.80.

For a look at all of today’s economic events, check out our economic calendar.

Gold, silver, platinum, and palladium price analysis and forecast indicate a correction phase in the global metals market. The movement reflects a mix of inflation data, central bank policy expectations, and geopolitical developments.

Gold prices fell on Friday, trimming earlier losses after softer-than-expected U.S. inflation data reinforced hopes for an upcoming Federal Reserve interest rate cut. Despite the rebound, gold is expected to post its first weekly decline in ten weeks.

Spot gold slipped 0.2% to $4,118.29 per ounce by 01:42 p.m. ET after an intraday drop of nearly 2%. It remains down by over 3% for the week. U.S. gold futures for December settled 0.2% lower at $4,137.8 per ounce.

Analyst Tai Wong stated that both gold and silver rose briefly after September’s core CPI came in slightly below expectations but predicted that the metals may face another dip before stabilizing.

Gold reached a record high of $4,381.21 earlier this week but dropped over 6% as investors booked profits and easing U.S.–China trade tensions reduced demand for safe-haven assets.

Spot silver fell 0.6% to $48.65 per ounce, recording a weekly loss of over 6%. The metal mirrored gold’s trend as market sentiment shifted toward optimism on trade relations and expectations of lower interest rates.

The U.S. Labor Department reported consumer prices rose 3.0% in the year through September, slightly under market forecasts. Investors now expect a Federal Reserve rate cut next week and possibly another in December.

Lower rates reduce the opportunity cost of holding non-yielding metals like gold and silver, leading to cautious trading.

The White House confirmed that President Donald Trump and Chinese President Xi Jinping will meet next week before the November 1 trade deadline. The planned meeting signaled possible easing of trade tensions that previously boosted safe-haven demand for gold.

Analyst Phillip Streible noted that if gold falls below $4,000, the next major support level could be near $3,850. Despite short-term weakness, gold has gained 55% in 2025 amid central bank buying, geopolitical tension, and rate-cut expectations.

Platinum slipped 1% to $1,608.77 per ounce, while palladium declined 0.5% to $1,450.05. Both metals tracked the broader trend in the precious metals market as traders adjusted positions ahead of next week’s U.S. policy announcement.

Rahul Kalantri, Vice President of Commodities at Mehta Equities, identified gold support at $4,055–4,005 and resistance at $4,135–4,160. Silver has support near $48.40–47.90 and resistance at $49.25–49.60.

In global trading, spot gold fell 0.2% to $4,118.68 per ounce as of 03:15 GMT. It marked a 3% weekly decline, the sharpest drop since mid-May. Silver also declined 0.6% to $48.62, its largest weekly fall since March.

The U.S. dollar index rose for a third consecutive session, making gold more expensive for holders of other currencies.

Gold, silver, platinum, and palladium prices are expected to stay under pressure until the Federal Reserve confirms its next rate cut. If inflation continues to ease, the metals market may stabilize. Analysts expect gold to find support near $4,000 and rebound if geopolitical risks or currency fluctuations increase.

Investors remain focused on the upcoming U.S. CPI data, potential rate decisions, and developments in U.S.–China trade relations, which continue to shape precious metal trends.

1. What caused the recent fall in gold, silver, platinum, and palladium prices?

The decline was caused by easing U.S.–China trade tensions, profit booking, and expectations of a Federal Reserve interest rate cut.

2. What is the gold price forecast for next week?

Analysts expect gold to find support near $4,000, with a possible rebound depending on U.S. inflation data and upcoming Federal Reserve decisions.