The main category of The Gold News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of The Gold News.

You can use the search box below to find what you need.

[wd_asp id=1]

The price of 24-carat gold climbed Rs 10 in early trade on Thursday, with ten grams of the precious metal trading at Rs 67,430, according to the GoodReturns website. The price of silver rose Rs 100, with one kilogram of the precious metal selling at Rs 78,600.

The price of 22-carat gold also rose Rs 10 with the yellow metal selling at Rs 61,810.

Click here to follow our WhatsApp channel

The price of ten grams of 24-carat gold in Mumbai is in line with prices in Kolkata and Hyderabad, at Rs 67,430.

In Delhi, Bengaluru, and Chennai, the price of ten grams of 24-carat gold stood at Rs 67,580, Rs 67,430, and Rs 68,030, respectively.

In Mumbai, the price of ten grams of 22-carat gold is at par with that in Kolkata and Hyderabad, at Rs 61,810.

In Delhi, Bengaluru, and Chennai, the price of ten grams of 22-carat gold stood at Rs 61,960, Rs 61,810, and Rs 62,360, respectively.

The price of one kilogram of silver in Delhi, Mumbai, and Kolkata stood at Rs 78,600.

The price of one kilogram of silver in Chennai stood at Rs 81,600.

Gold prices edged higher on Friday and were set for a fourth weekly rise in five after the Federal Reserve maintained its interest rate cut projections for the year, boosting investor sentiment.

Spot gold was up 0.1 per cent at $2,183.93 per ounce, as of 0117 GMT, after hitting an all-time high on Thursday. Bullion has risen 1.3 per cent so far this week.

US gold futures were also up 0.1 per cent at $2,186 per ounce.

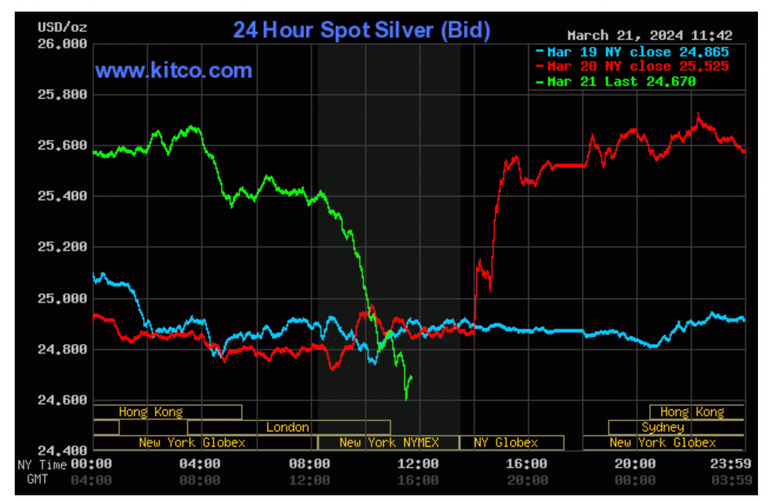

Spot silver was flat at $24.77 per ounce, platinum slipped 0.3 per cent to $904.95 and palladium eased 0.1 per cent to $1,009.21.

(With inputs from Reuters)

The price of gold in India today is 6,181 per gram for 22 karat gold and 6,743 per gram for 24 karat gold

Advertising

Advertising

The price of gold in Mumbai is 6181 per gram for 22 karat gold and 6743 per gram for 24 karat gold.

The gold price today in Kolkata is 6181 per gram for 22 karat gold and 6743 per gram for 24 karat gold.

The Gold price today in Chennai is 6236 per gram for 22 karat gold and 6803 per gram for 24 karat gold.

The gold price today in Delhi is 6196 per gram for 22 karat gold and 6758 per gram for 24 karat gold.

The gold price today in Thane is 6181 per gram for 22 karat gold and 6743 per gram for 24 karat gold.

The gold price today in Surat is 6186 per gram for 22 karat gold and 6748 per gram for 24 karat gold.

The gold price today in Pune is 6181 per gram for 22 karat gold and 6743 per gram for 24 karat gold.

The gold price today in Nagpur is 6181 per gram for 22 karat gold and 6743 per gram for 24 karat gold.

Published Date:March 22, 2024 7:49 AM IST

Updated Date:March 22, 2024 7:49 AM IST

The group tricked the Third Reich with deceptive battlefield tactics.

With the so-called “Ghost Army,” its World War II mission of fooling the enemy was so secret because most of the people who knew about it took it to the grave.

A secret no more and nearly 80 years after the end of the war, the Ghost Army on Thursday was recognized with the Congressional Gold Medal and credited with helping American troops achieve key victories in Germany and Italy during the conflict.

The Ghost Army — comprised of 1,300 U.S. soldiers — helped trick the Third Reich with deceptive battlefield shenanigans that protected their fellow Americans and helped defeat Nazi Germany. Some of those tactics included using inflatable tanks, camouflage and innovative acoustic sound effects to misdirect German forces, according to details of their actions that were finally declassified in 1996, more than 50 years after they happened.

“The soldiers included technicians and artists from around the country and they used their talents to deceive and divert the Nazis,” Speaker Mike Johnson said during the event Thursday. “Some of them paid the ultimate price, but because of the courageous work of this group, it is estimated that 15,000 to 30,000 lives were saved.”

Three surviving veterans from the “Ghost Army” were in attendance at the Capitol to participate in the ceremony: John Christman, Seymour Nussenbaum and Bernie Bluestein.

Author Rick Beyer, who has dedicated a career to telling the Ghost Army’s story and advocating for its members to receive the Congressional Gold Medal, said that many of the veterans who have passed away since he began researching the unit would be surprised to learn of the recognition bestowed upon its members Thursday. Four soldiers from the operation were killed in action.

“No soldier who served in this unit considers himself a hero. I have talked to many veterans of the Ghost Army and each told me that the real heroes were the infantrymen and the tankers who bore the brunt of the frightening,” Beyer said. “But it has always struck me that the Ghost Army’s deception mission demanded a special kind of courage: to protect strength when you have none, [and] to purposely draw any fire to keep it from falling on others. A dangerous business, not for the faint of heart.”

Senate Minority Leader Mitch McConnell credited the unit’s efforts for having a lasting impact on post-war counterintelligence operations.

“They weren’t just helping win a World War,” McConnell said. “Whether they knew it or not, they were developing top secret ways to help preserve a hard-won peace through the Cold War.”

That sentiment was echoed by Secretary of the Army Christine Wormuth, who said current Army planners are taught that the basis of military deception is storytelling — and the Ghost Army was made up of master storytellers, whose techniques can still be found on the battlefield.

“Even though technology has changed quite a bit since 1944, our modern techniques build on a lot of what the Ghost Army did and we are still learning from your legacy,” she said. “Our experience observing the war in Ukraine has shown us that even with an increasingly transparent battlefield, military deception can still have a significant impact on military operations.”

Johnson read from a now-declassified report, which summed up the contributions of the unit, quipping “This would be recommended reading if you can get your hands on it.”

“Rarely, if ever, has there existed a group of such few men, which had so great an influence on the outcome of a major military campaign,” Johnson said, quoting the report. “That’s really something.”

The Congressional Gold Medal is the highest honor that Congress can bestow on any group or individual. The Ghost Army soldiers are the 185th entity to receive the award. George Washington was the first recipient in 1776.

Right after this month’s FOMC meeting concluded and Chairman Powell held his regular press conference, gold began to move into uncharted territory. As of 5:40 PM EDT, gold futures basis most active April contract is currently fixed at $2183.80,which is a net loss of $6.30, or 0.29% today. However, the history that was made today was not in gold’s closing price but rather its intraday high. Gold traded to an intraday high over $20 above the former record high of $2203 when traders pushed gold to $2225.30 in today’s trading.

On Tuesday, we identified a Western technical chart pattern called a bullish flag formation. This pattern occurs after a strong uptrend. Gold price began a strong advance on February 29 when gold futures were trading at $2053.10. What followed was six consecutive days in which gold traded to a higher high, a higher low, and a higher close than the previous day.

On March 11, gold traded to a higher close, gaining $2.80 and closing at $2189. The strong price advance over the seven days created the “pole” of the bullish flag formation. For the next six days, from March 12 through March 19, the flag was created as gold consolidated with a downside bias.

The chart above is a four-hour Japanese candlestick chart of gold futures. The pole is colored green, and the flag is colored red. Yesterday, following the conclusion of the FOMC meeting, the release of the SEP, and the press conference, gold prices spiked to their highest level in history.

Although gold has retraced from those highs at the time of writing, the pattern identified (Bull Flag) can be used to project where the current rally in gold could conclude. The projection (black dashed line) is based upon measuring the price move from the beginning to the end of the “pole”, and then projecting that same distance from the bottom of the flag.

This particular bull flag pattern suggests that gold could trade above $2300 by the completion of this pattern.

For those who wish to learn more about our service, please go to the links below:

Information, Track Record, Trading system, Testimonials, Free trial

Wishing you as always good trading,

Gary S. Wagner

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Washington — Members of the Ghost Army, a top-secret military unit credited with saving thousands of Americans during World War II using distraction techniques, received Congressional Gold Medals on Thursday.

The unit was tasked with deceiving the Germans. Using inflatable tanks and artillery, along with sonic deception like soundtracks, they tricked adversaries into thinking that Allied forces were in one location, while they advanced elsewhere. The effort, made up of a group of artists, designers, audio technicians and others, resulted in an estimated 30,000 American lives saved, and remained classified for decades after the war ended.

Steve Pfost/Newsday RM via Getty Images

President Biden signed legislation honoring the service members into law in 2022, noting in a statement “their unique and highly distinguished service in conducting deception operations in Europe during World War II.”

House Speaker Mike Johnson, Senate Minority Leader Mitch McConnell, House Minority Leader Hakeem Jeffries and other lawmakers delivered remarks honoring the service members on Thursday, before bestowing Congress’ highest honor.

“This Congressional Gold Medal reaffirms our commitment to remembrance and reverence as we honor all of these patriots,” Jeffries said. “We thank and honor the members of the Ghost Army for their unique service to our nation.”

McConnell called the Ghost Army’s legacy a “story of commitment and resolve, bravery and devotion — and remarkable talent and ingenuity.”

“A grateful nation knows how you answered the call in its time of need,” McConnell said.

Three of seven surviving members of the Ghost Army — Bernard Bluestein, John Christman and Seymour Nussenbaum — attended the event on Thursday. Family members of the late members were also in attendance.

“I’m very proud and happy to be here to receive this honor,” Bluestein said.

Because of the classified nature of the unit, the service members went unrecognized for nearly half a century. On Thursday, the speakers celebrated the legacy of the long-unsung Ghost Army.

“The Ghost Army’s tactics were meant to be invisible,” Sen. Ed Markey, a Massachusetts Democrat, said Thursday. “But today their contributions will no longer remain unseen in the shadows.”

Expand

(Kitco News) – Gold prices are just modestly higher in midday U.S. trading Thursday after scoring strong gains and hitting a record high of $2,225.30, basis April Comex futures. Silver prices are slightly down after hitting a 3.5-month high overnight. With prices backing well down from their intra-day highs, gold and silver bulls appear tired and in need of a brief pause. April gold was last up $12.70 at $2,173.70. May silver was last down $0.24 at $24.86.

The marketplace is still buzzing about the Federal Open Market Committee (FOMC) monetary policy meeting that ended Wednesday afternoon and saw the Federal Reserve keep its monetary policy unchanged, as expected. The FOMC and Fed Chairman Powell leaned a bit dovish. The FOMC statement said the U.S. economy is growing and inflation has eased but is still elevated. The statement said no rate cuts will occur until the Fed has more confidence inflation has been tamed. Still, the statement said the Fed sees three interest rate cuts this year, which is what the marketplace focused more on. The Fed appears willing to tolerate slightly higher inflation for longer and still cut rates.

The U.S. dollar index initially weakened on the FOMC/Powell statements and U.S. Treasury yields dipped a bit. However, today the USDX is posting solid gains and Treasury yields have up-ticked just a bit. The much stronger move in gold Wednesday afternoon is puzzling to many long-time gold watchers, given the more modest price moves in the U.S. dollar index and U.S. Treasuries. It makes one wonder if a big player, like a bank, put on a huge long-side trade in gold futures in the afternoon after-hours market, when volume may have been thinner. That same big player could have quickly taken profits on the big position, which if was the case would explain prices backing well off their daily highs.

Asian and European stock indexes were mixed overnight. U.S. stock indexes are higher and at record highs in midday U.S. trading. The stock market rally to new highs is also probably limiting fresh buying interest in the competing asset class of precious metals.

The key outside markets today see the U.S. dollar index solidly higher. The USDX has seen a solid rebound from the March low and the bulls have the slight technical advantage. Nymex crude oil prices weaker and trading around $80.75 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching around 4.25%.

Technically, April gold futures prices hit a contract and record high overnight but then backed off sharply to suggest the bulls are near-term exhausted. The bulls have the solid overall near-term technical advantage. A four-week-old uptrend is in place on the daily bar chart. Price action has seen an upside “breakout” from a bullish pennant pattern on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at the contract and record high of $2,225.30. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,100.00. First resistance is seen at $2,203.00 and then at $2,225.30. First support is seen at this week’s low of $2,149.20 and then at $2.140.00. Wyckoff’s Market Rating: 8.5.

May silver futures prices hit a 3.5-month high early on today. The silver bulls have the firm overall near-term technical advantage but may now be near-term exhausted. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the December high of $26.575. The next downside price objective for the bears is closing prices below solid support at $24.00. First resistance is seen at last week’s high of $25.66 and then at $26.00. Next support is seen at this week’s low of $24.92 and then at $24.50. Wyckoff’s Market Rating: 7.0.

May N.Y. copper closed down 60 points at 404.55 cents today. Prices closed nearer the session low. The copper bulls have the solid overall near-term technical advantage but appear tired now. Prices are in a five-week-old uptrend on the daily bar chart. Copper bulls’ next upside price objective is pushing and closing prices above solid technical resistance at 425.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 400.00 cents. First resistance is seen at 410.00 cents and then at today’s high of 412.80 cents. First support is seen at this week’s low of 402.70 cents and then at 400.00 cents. Wyckoff’s Market Rating: 7.0.

Hey!! Try out my “Markets Front Burner” weekly email report. Front Burner is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to the Front Burner list.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

VANCOUVER, British Columbia, March 21, 2024 (GLOBE NEWSWIRE) — Great Pacific Gold Corp. (“Great Pacific Gold,” “GPAC,” or the “Company”) (TSXV: GPAC) (OTCQX: FSXLF) (Germany: 4TU) is pleased to announce high-grade gold assays from its initial follow up diamond drill hole of the Comet gold discovery at the Lauriston Gold Project in Victoria, Australia. Diamond drill hole CDH01A intersected 4m at 25.1 g/t Gold from 99.5m including 0.4m at 72.5 g/t Gold from 99.5m and 1m at 55 g/t Gold from 102.5m, within a broader interval assaying 9m at 11.6 g/t Au from 97m.

The high-grade intercept occurs within the core of the Comet Anticline at the fold axis, where the Comet Fault zone junctions with this fold. This high-grade gold mineralization is associated with strong quartz veining with large crystals of arsenopyrite and sulphidic stylolites within the quartz veins. Visible gold is occasionally present within the arsenopyrite crystals.

Figure 1 – Example of CDH01A drill core annotated with gold grades in g/t. Core tray is 100m to 104.23m

The Company set up diamond drill hole CDH01A in close proximity of the high-grade reverse circulation (RC) percussion discovery hole CRC07 (8m at 106 g/t Goldincluding 5m at 166 g/t Gold including 2m at 413 g/t Gold including 1m at 468 g/t Gold and 1m at 358 g/t Gold (from 95 metres) (see news release January 11, 2024)) as a conservative approach to determine extensions of mineralization. The hole CDH01A deviated once underway, steepening with depth and managed to drill about 8m down dip of the projected position of the CRC07 intercept.

Diamond drilling has confirmed the gold rich quartz veined fault zone is extending to depth and laterally with this CDH01A result, and the high-grade mineralization remains open in all directions.

Assays remain pending for two more diamond drill holes on the same section at Comet and will be reported once received. One of these diamond drill holes (CDH02) encountered multiple stacked zones of mineralization and due to this was extended by approximately 100m versus the originally planned target depth. CDH02 was drilled to 255.5m depth.

GPAC Chief Operating Officer and Director, Rex Motton, states, “The high-grade gold intercept in our first diamond drilling, post the reverse circulation discovery hole at Comet, is a great start to the program. In addition to the high-grade gold interval in the first diamond drill hole assaying 4 metres at 25.1 grams per tonne gold within a broader 9 meter mineralized zone, we also are very pleased with early information from the second hole. While no assays have been received for the second hole, it has already shown importance geologically as multiple zones of mineralization were encountered. The second hole, which was originally planned to a target depth of approximately 150 metres was continued until approximately 255 metres based on these stacked zones of mineralization encountered. We see this as early days for this extensive and highly prospective structure.”

The Comet prospect has epizonal characteristics of Au-As-Sb with geology similar to the Fosterville Mine gold deposit. The west dipping Comet fault zone is hosted by Ordovician slates and sandstones, which are folded in a series of north south striking concertina folds. This high-grade discovery is within the core of the Comet Anticline as determined by mapping and core orientation studies, which is a similar structural setting of the mineralization present at Fosterville.

Drill Results and Intercepts:

| HoleID | East | North | Azimuth (deg.) | Dip (deg.) | From (m) | To (m) | Downhole Interval (m) | Au g/t | ||||||||

| CDH01A | 263516.9 | 5850092.3 | 95.3 | -69.4 | 97.0 | 106.0 | 9.0 | 11.6 | ||||||||

| Includes | 99.5 | 103.5 | 4 | 25.1 | ||||||||||||

| includes | 99.5 | 99.9 | 0.4 | 72.5 | ||||||||||||

| includes | 102.5 | 103.5 | 1.0 | 55.0 |

The 9m intercept uses a 0.3 g/t Au cut-off grade and maximum 2m internal waste. The 4m intercept uses a 5.0 g/t Au cut-off grade and maximum 0.6m internal waste, while the higher-grade included intercepts use assays of greater than 40 g/t Au and no internal waste parameter. True widths are not known. Additional drilling is required to determine true widths. The assays are not capped.

Figure 2 – Updated Comet Cross Section 5850100mN

Quality Assurance / Quality Control

All assays were subject to quality control measures appropriate for percussion drilling with duplicates, blanks and commercially available standards with the expected results from the samples submitted. All assays were conducted by Onsite Laboratory Services Ltd (ISO: 9001), located in Bendigo, Victoria, using fire assay techniques with a 25g or 50g charge and ICP or AAS finish. The quality control results are consistent.

About GPAC

Great Pacific Gold has a portfolio of high-grade gold projects in Papua New Guinea (“PNG”) and Australia.

In PNG, Great Pacific Gold recently acquired a significant 2,166 sq. km mineral exploration land package in PNG. The land package comprises of exploration licenses (EL) and exploration license applications (ELA). It includes both early-stage and advanced-stage exploration targets with high-grade epithermal vein and porphyry-style mineralisation present.

The Arau Project consists of two exploration licenses, located in the Kainantu region, and includes the Mt. Victor Prospect, where previous drilling found a multiple phase intrusion complex hosting copper and gold mineralisation.

The Wild Dog Project consists of one granted exploration license, EL 2761, and one exploration license application, ELA 2516, located on the island of New Britain and about 50 km southwest of Rabaul and Kokopo, PNG.

The Kesar Creek Project consists of one exploration license, EL 2711, and is contiguous with the K92 Mining Inc. tenements.

In Australia, Great Pacific Gold began with two, 100% owned, high-grade gold projects called the Lauriston and Golden Mountain Projects, and has since acquired a large area of granted and application tenements containing further epizonal (low-temperature) high-grade gold mineralisation and associated intrusion-related gold mineralization all in the state of Victoria, Australia. The Great Pacific Gold land package, assembled over a multi-year period, notably includes the Lauriston Project which is a 535 sq. km property immediately to the south of and within the same geological framework that hosts Agnico Eagle Mines Ltd’s Fosterville Gold Mine and associated exploration tenements. The Golden Mountain Project is an intrusion-related gold project on the edge of the Strathbogie granite and occurs at the northern end of the Walhalla Gold Belt. The acquired projects include the epizonal gold Providence Project containing the Reedy Creek goldfield which adjoins the Southern Cross Gold’s Sunday Creek exploration project and a large group of recently consolidated granted tenements called the Walhalla Gold Belt Project, which contain a variety of epizonal and intrusion related style gold mineralisation. Additionally, Great Pacific Gold has another gold-focused project called the Moormbool project which has epizonal style gold mineralisation and associated potential intrusion-related gold mineralisation, as well as the Beechworth Project occurs in the northeast of the state and contains intrusion related and mesozonal gold mineralization.

All GPAC’s properties in Australia are 100% owned and have had historical gold production from hard rock sources despite limited modern exploration and drilling.

Qualified Person

The technical content of this news release has been reviewed, verified and approved by Rex Motton, AusIMM (CP), COO of GPAC, a Qualified Person under the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Motton is responsible for the technical content of this news release.

On behalf of GPAC

Rex Motton

Chief Operating Officer and Director

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Great Pacific Gold cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Great Pacific Gold’s limited operating history, its exploration and development activities on its mineral properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward looking information. Except as required under applicable securities legislation, Great Pacific Gold does not undertake to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information: Adam Ross, Investor Relations, Direct: (604) 229-9445, Toll Free: 1 (833) 923-3334, Email: info@greatpacificgoldcorp.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0c344d80-9ba1-47bc-8a7a-93accba0919f

https://www.globenewswire.com/NewsRoom/AttachmentNg/db76c6d2-645b-4636-b533-b11d77450c17

KARACHI: 24 karat gold per tola price witnessed an increase of Rs4,600 and was sold at Rs232,400 on Thursday compared to its sale at Rs227,800 on the last trading day.

According to All Sindh Sarafa Jewellers Association, the price of 10 grams of 24 karat gold also increased by Rs3,943 to Rs199,245 from Rs195,302 whereas the price of 10 gram 22 karat gold went up to Rs182,642 from Rs179,027.

The price of per tola silver increased by Rs.20 to Rs2,600 whereas that of and ten gram silver went up by Rs.17.15 to 2,229.08.

Read more: Gold hits fifth record high in March

The price of gold in the international market increased by $47 to $2,225 from $.2,178, the Association reported.

It is pertinent to mention here that IMF staff and Pakistan have reached a staff-level agreement on the second and final review under Pakistan’s Stand-By Arrangement.

According to the official statement issued by an International Monetary Fund team led by Nathan Porter, the IMF reached a staff-level agreement with Pakistan on the second and final review of the country’s stabilization program supported by the IMF’s US$3 billion (SDR2,250 million) SBA approved.

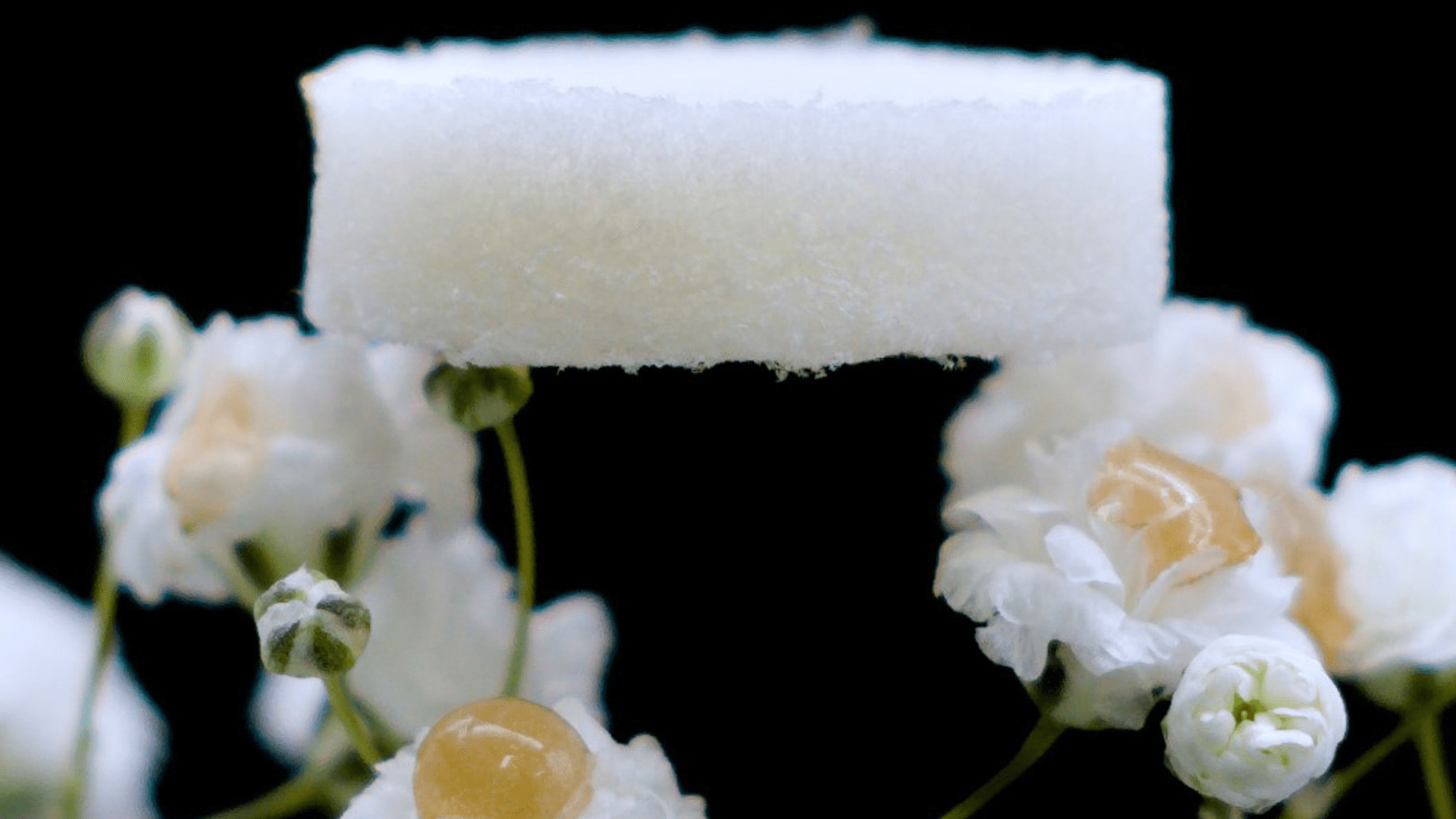

To make the sponge, ETH Zurich scientist Mohammad Peydayesh and his colleagues took away the natural properties of whey protein using acid and high temperatures. The whey proteins turn into protein nanofibrils in a gel. Scientists dried this gel and made a sponge with protein fibrils.

Researchers took over 20 computer motherboards and extracted the metal parts. They dissolved those parts in an acid bath to ionize the metals. Once everything dissolved, they placed the protein fiber sponge in the metal ion solution. Metal ions adhered to the sponge but they found gold ions do so more efficiently.

After extracting the gold ions, researchers heat the sponge to turn the ions into gold flakes that are melted down into a nugget. Out of the 20 motherboards, they obtained a nugget of around 450 milligrams. 91% of that nugget was gold, and the remaining parts were copper, similar to 22 carats.

Mezzenga believes this technique has potential in a commercial setting. According to his calculations, the cost of obtaining the materials added to the energy costs for the entire process is 50 times lower than the gold’s value that can be recovered. Next, the researchers want to make the technology ready for the market. While electronic waste is the most promising product to extract gold, they say there are possibly other sources. For example, they believe other sources include waste from microchip manufacturing or gold-plating processes.

In addition, researchers want to investigate the possibility of manufacturing sponges from protein-rich byproducts or waste products from the food industry. Mezzenga said, “The fact I love the most is that we’re using a food industry byproduct to obtain gold from electronic waste.”