Category: Gold News

Gold price backs off from record high; bulls short-term exhausted

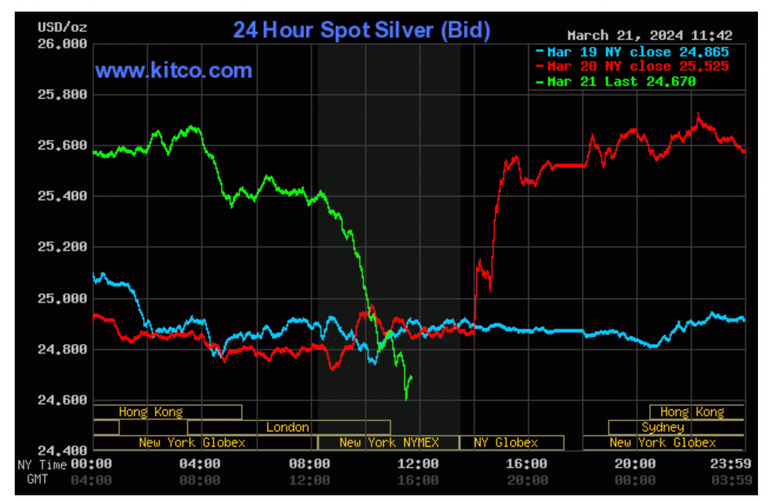

(Kitco News) – Gold prices are just modestly higher in midday U.S. trading Thursday after scoring strong gains and hitting a record high of $2,225.30, basis April Comex futures. Silver prices are slightly down after hitting a 3.5-month high overnight. With prices backing well down from their intra-day highs, gold and silver bulls appear tired and in need of a brief pause. April gold was last up $12.70 at $2,173.70. May silver was last down $0.24 at $24.86.

The marketplace is still buzzing about the Federal Open Market Committee (FOMC) monetary policy meeting that ended Wednesday afternoon and saw the Federal Reserve keep its monetary policy unchanged, as expected. The FOMC and Fed Chairman Powell leaned a bit dovish. The FOMC statement said the U.S. economy is growing and inflation has eased but is still elevated. The statement said no rate cuts will occur until the Fed has more confidence inflation has been tamed. Still, the statement said the Fed sees three interest rate cuts this year, which is what the marketplace focused more on. The Fed appears willing to tolerate slightly higher inflation for longer and still cut rates.

The U.S. dollar index initially weakened on the FOMC/Powell statements and U.S. Treasury yields dipped a bit. However, today the USDX is posting solid gains and Treasury yields have up-ticked just a bit. The much stronger move in gold Wednesday afternoon is puzzling to many long-time gold watchers, given the more modest price moves in the U.S. dollar index and U.S. Treasuries. It makes one wonder if a big player, like a bank, put on a huge long-side trade in gold futures in the afternoon after-hours market, when volume may have been thinner. That same big player could have quickly taken profits on the big position, which if was the case would explain prices backing well off their daily highs.

Asian and European stock indexes were mixed overnight. U.S. stock indexes are higher and at record highs in midday U.S. trading. The stock market rally to new highs is also probably limiting fresh buying interest in the competing asset class of precious metals.

The key outside markets today see the U.S. dollar index solidly higher. The USDX has seen a solid rebound from the March low and the bulls have the slight technical advantage. Nymex crude oil prices weaker and trading around $80.75 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching around 4.25%.

Technically, April gold futures prices hit a contract and record high overnight but then backed off sharply to suggest the bulls are near-term exhausted. The bulls have the solid overall near-term technical advantage. A four-week-old uptrend is in place on the daily bar chart. Price action has seen an upside “breakout” from a bullish pennant pattern on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at the contract and record high of $2,225.30. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,100.00. First resistance is seen at $2,203.00 and then at $2,225.30. First support is seen at this week’s low of $2,149.20 and then at $2.140.00. Wyckoff’s Market Rating: 8.5.

May silver futures prices hit a 3.5-month high early on today. The silver bulls have the firm overall near-term technical advantage but may now be near-term exhausted. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the December high of $26.575. The next downside price objective for the bears is closing prices below solid support at $24.00. First resistance is seen at last week’s high of $25.66 and then at $26.00. Next support is seen at this week’s low of $24.92 and then at $24.50. Wyckoff’s Market Rating: 7.0.

May N.Y. copper closed down 60 points at 404.55 cents today. Prices closed nearer the session low. The copper bulls have the solid overall near-term technical advantage but appear tired now. Prices are in a five-week-old uptrend on the daily bar chart. Copper bulls’ next upside price objective is pushing and closing prices above solid technical resistance at 425.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 400.00 cents. First resistance is seen at 410.00 cents and then at today’s high of 412.80 cents. First support is seen at this week’s low of 402.70 cents and then at 400.00 cents. Wyckoff’s Market Rating: 7.0.

Hey!! Try out my “Markets Front Burner” weekly email report. Front Burner is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to the Front Burner list.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: