Leading DeFi Tokens By Market Activity Today – Chainlink, Polkadot, Sky, Cosmos

Join Our Telegram channel to stay up to date on breaking news coverage

The decentralised finance (DeFi) ecosystem continues to demonstrate robust growth and relentless innovation, bridging traditional finance with cutting-edge blockchain capabilities. With the Total Value Locked (TVL) across DeFi protocols holding strong around $120 billion, the sector underscores its significant role in the evolving digital economy, driven by ongoing advancements and strategic integrations that enhance utility and market reach.

This weekly analysis of leading DeFi tokens highlights the market performance and critical recent updates from their respective platforms. We’ll explore Chainlink’s new compliance framework enabling reusable digital identities, Polkadot’s focus on accessible nomination pools for staking, Sky’s successful launch of SKY Staking and new institutional credit protocols, and Cosmos’s “SOVEREIGN” event showcasing new EVM innovations and cross-chain opportunities. These developments highlight the continuous evolution and increasing sophistication within the DeFi space.

Biggest DeFi Token By Market Activity Today – Top List

Chainlink (LINK) is a decentralised oracle network that connects smart contracts with real-world data. Polkadot (DOT) enables cross-chain communication and shared security among multiple blockchains. Sky (SKY) is a decentralised AI agent network for autonomous digital interactions and services. Cosmos (ATOM) is an ecosystem of interoperable blockchains built for scalability and cross-chain compatibility. Let’s fully dive into why these tokens are among the leading DeFi tokens by market activity today.

1. Chainlink (LINK)

If smart contracts are the brains of DeFi, Chainlink is the nervous system that connects them to the outside world. It’s not just a data oracle, it’s a decentralised trust engine that brings real-world truth into blockchain logic. By feeding DeFi apps tamper-proof data feeds, Chainlink enables businesses to operate confidently from stablecoins and synthetic assets to insurance protocols and lending markets.

Chainlink continues to prove it’s indispensable to the DeFi ecosystem. Its Cross-Chain Interoperability Protocol (CCIP) is now adopted by leading platforms like Avalanche, Base, and Ethereum L2S to enable seamless token transfers and data messaging. Meanwhile, partnerships with SWIFT and major banks underscore Chainlink’s role in bridging traditional finance with DeFi infrastructure. The recent push into Proof of Reserve mechanisms also draws institutional players seeking transparency and risk management.

LINK is showing strong bullish momentum. Over the past 7 days, it has gained more than 2%, with a fresh surge of 2.9% in the last 24 hours, now priced at $13.57, signalling renewed investor confidence. Even on the monthly scale, LINK has maintained a steady climb, bouncing off support levels and confirming higher lows, an encouraging sign for swing traders and long-term holders alike.

Reusable identities will completely transform both onchain and existing compliance processes.

Chainlink Automated Compliance Engine (ACE) + @GLEIF‘s verifiable digital identity (vLEI) introduces a groundbreaking new framework for creating reusable identities and using them to… pic.twitter.com/IzDg1I8zNu

— Chainlink (@chainlink) July 2, 2025

Chainlink has introduced a new compliance framework that could reshape how digital identity works across blockchain and traditional finance. Through its Automated Compliance Engine (ACE), combined with GLEIF’s verifiable LEI (vLEI), Chainlink enables reusable digital identities that can automate KYC/AML checks and other compliance tasks.

This approach reduces the cost and complexity of onboarding, shortens settlement times, and expands market access, especially for institutions. Chainlink aims to streamline regulatory workflows and make global compliance infrastructure more efficient and interoperable by turning identity into a programmable asset.

2. Polkadot (DOT)

Polkadot aims not just to connect blockchains; it’s engineering a multichain future where networks can talk, trade, and evolve together. Built with Substrate and powered by a unique relay chain, Polkadot allows independent blockchains (parachains) to run in parallel while enjoying shared security. It’s not one chain to rule them all; it’s the operating system of a decentralised internet.

DOT is catching attention again as new parachains secure slots and build across DeFi, gaming, and real-world assets. The Polkadot 2.0 roadmap is in motion, and with JAM (Join-Accumulate Machine) pushing for even more modular architecture, developers now have more flexibility to build cross-chain financial protocols. Recent integrations with Moonbeam, Acala, and the growing activity on the Asset Hub further cement Polkadot’s role in scalable DeFi solutions.

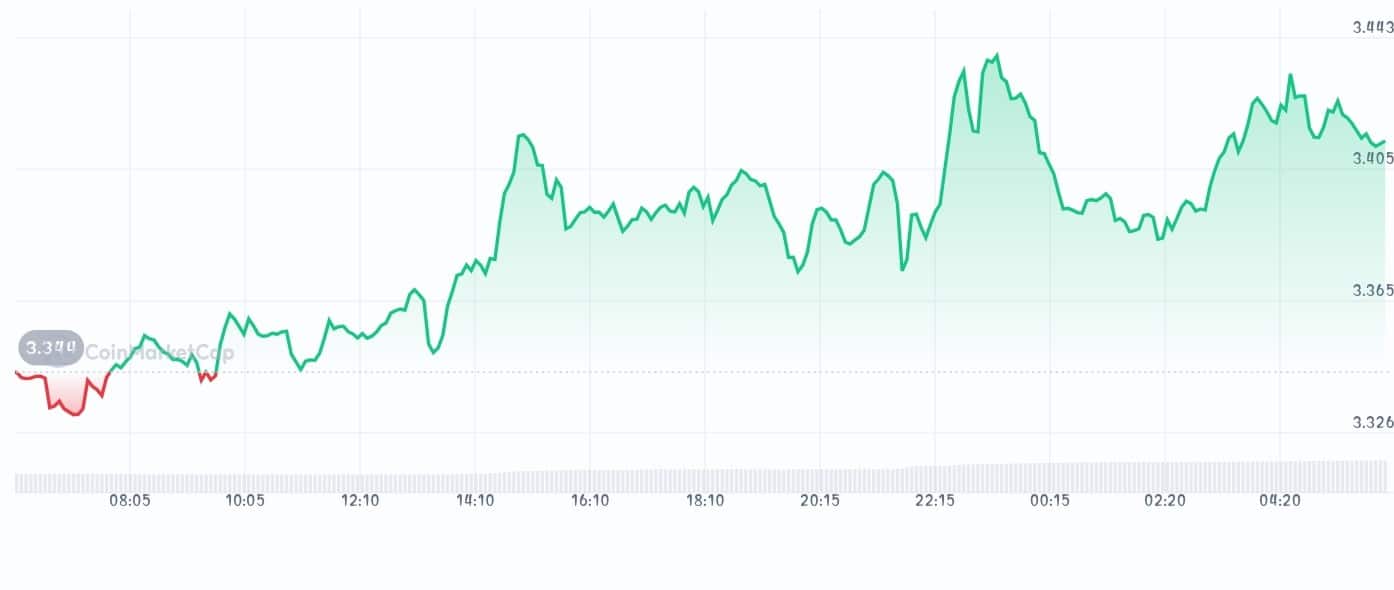

Price-wise, DOT has been on a subtle but steady rebound. It has been flat over the past week, with an encouraging 2.2% jump in the last 24 hours, now priced at $3.14. This uptick follows a clean breakout from a short-term downtrend, putting it back on the radar for technical traders. With momentum building and support levels holding firm, DOT looks primed to continue if broader market sentiment remains favourable.

Polkadot A-Z

“N” is for Nomination Pools

Nomination pools allow users to pool their tokens together on-chain to nominate validators and receive rewards.

Nomination pools differ from staking on CEXs because they are non-custodial, native to Polkadot’s protocol, permissionless,… pic.twitter.com/ID837uxLFy

— Polkadot (@Polkadot) July 1, 2025

Polkadot is spotlighting nomination pools as a key feature of its ecosystem, which are designed to make staking accessible to everyone. With just 1 DOT, anyone can join a pool and earn rewards.

What sets them apart? They’re non-custodial, fully on-chain, and managed by the community, not a centralised exchange. It’s a simple, permissionless way to stake natively through wallets like Nova, Talisman, or SubWallet.

3. SUBBD Token (SUBBD)

SUBBD is an AI-driven platform transforming content monetisation within the creator-subscriber space. It combines AI tools with Web3 technology, empowering creators to manage and monetise their content efficiently, bypassing intermediaries. Featuring AI live streams, voice generators, and a 24/7 personal assistant, SUBBD presents a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.05585, having raised over $754,000, the token provides exclusive benefits, VIP access, and a 20% annual return through staking. A tenth of the total supply is designated for airdrops and rewards.

SUBBD has garnered attention on prominent cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, underscoring its growing presence in the AI and Web3 domains. The platform’s expanding influence is evident, with the launch of the AI Personal Assistant enhancing creator-fan engagement and support. As AI and Web3 reshape digital content, SUBBD is at the forefront of the future of creator earnings.

4. Sky (SKY)

Sky is one of those under-the-radar DeFi plays that blends utility with ambition. Designed as a decentralised infrastructure layer for the Sky Network ecosystem, it supports various financial dApps, including lending, liquidity markets, and governance modules, all while pushing for faster throughput and cost-efficiency in transaction processing.

SKY stands out because of its tight integration with ecosystem-native tools and a growing list of DeFi protocols plugging into its framework. The team recently teased interoperability enhancements and collaborations that could connect SKY-based protocols with larger ecosystems like Arbitrum and Optimism. Developers have praised its SDKs for simplifying dApp deployment, and the network’s lightweight governance model is attracting smaller DAOs and agile DeFi startups.

SKY has been delivering quietly impressive gains. Currently priced at $0.07913, in the last 24 hours, it jumped 3.9%; over the past month, it’s up 12%, outperforming many DeFi peers. The monthly chart is even more compelling, SKY has rallied over 30%, signalling sustained interest and a possible breakout from its previous consolidation zone. It’s the kind of stealth rally that often precedes stronger moves as liquidity deepens.

Sky’s June report highlights a month of major achievements, headlined by the launch of SKY Staking, the first Star Token (SPK by SparkFi), and the onboarding of Grove Finance as a new institutional-grade credit protocol. With over 947M SKY now staked and SPK farming live, user participation surged, fueling $500M+ in USDS supplied within days.

USDS continues its strong momentum with $950M+ supplied through Sky Token Rewards and $3B in TVL held at a 4.5% yield. Sky Protocol, a leading DeFi token‘s buyback program, also crossed the $80M mark, with daily repurchases averaging $250K, reinforcing value for holders amid growing ecosystem utility.

5. Cosmos (ATOM)

Cosmos doesn’t just scale blockchains, it lets them evolve. Known as the “Internet of Blockchains,” Cosmos empowers sovereign chains to interoperate through its IBC (Inter-Blockchain Communication) protocol, all while using the Cosmos SDK as a modular builder toolkit. For DeFi, Cosmos offers a vision beyond single-chain dominance, an open universe where specialised chains can coordinate without bottlenecks.

ATOM is standing tall again thanks to a fresh wave of IBC-enabled integrations. dYdX’s full migration to Cosmos, plus new DeFi apps launching on chains like Neutron and Osmosis, have put ATOM back in the spotlight. Cosmos Hub’s push toward Interchain Security and Liquid Staking has also reinvigorated validator dynamics and DeFi participation. These structural shifts attract developers and yield-seeking capital back into the Cosmos orbit.

ATOM has been climbing steadily, now priced at $4.086, up by 2.7% in the past 24 hours. On the monthly chart, ATOM has reversed its prior downtrend and shows consistent higher lows, technical signs suggesting strength and potential for continued upside. Traders watching RSI and MACD indicators are eyeing a bullish continuation if the momentum holds.

That’s a wrap for the first-ever event in the ▚▚ SOVEREIGN ▚▚ series.

✦ Featuring: 18 ecosystem partners building and debating meaningful and sovereign EVM tech on Cosmos.

✦ Announcing the mainnet launch of the @Ripple XRPL EVM Sidechain, powered by Cosmos, introducing… pic.twitter.com/5NzYLHt7X6

— Cosmos – The Interchain ⚛️ (@cosmos) July 1, 2025

Cosmos wrapped the inaugural SOVEREIGN event series, spotlighting a new era of EVM innovation across its ecosystem. The gathering brought together 18 projects pushing the boundaries of sovereign and modular blockchain design, all built on Cosmos tech.

Key announcements included the mainnet launch of XRPL’s EVM Sidechain, unlocking a $130B DeFi opportunity for XRP; Stride’s new IBC-powered DEX, enabling seamless cross-chain liquidity; TacBuild’s Cosmos EVM L1, aiming to onboard 1 billion Telegram users; and Babylon’s dual VM architecture, merging Bitcoin smart contracts with Cosmos EVM to shape the BTCFi future.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: