The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

BOCA RATON, FL, Nov. 19, 2025 (GLOBE NEWSWIRE) — DeFi Development Corp. (Nasdaq: DFDV) (the “Company”), the first US public company with a treasury strategy built to accumulate and compound Solana (“SOL”), today announced the filing of its Quarterly Report on Form 10-Q for the period ended September 30, 2025.

The Company reported a gain from changes in fair value of digital assets of $74M for the quarter and $96M year-to-date.

The brief delay in filing was due to a recent information technology disruption that impacted the Company’s information technology, accounting, and reporting systems.

The delay does not impact the Company’s current or future eligibility to use Form S-3. The Form 10-Q is available on the SEC’s website and on the Company’s investor relations page.

For more information, visit defidevcorp.com. To stay up to date with the latest developments and insights, subscribe to our blog.

About DeFi Development Corp.

DeFi Development Corp. (Nasdaq: DFDV) has adopted a treasury policy under which the principal holding in its treasury reserve is allocated to SOL. Through this strategy, the Company provides investors with direct economic exposure to SOL, while also actively participating in the growth of the Solana ecosystem. In addition to holding and staking SOL, DeFi Development Corp. operates its own validator infrastructure, generating staking rewards and fees from delegated stake. The Company is also engaged across decentralized finance (DeFi) opportunities and continues to explore innovative ways to support and benefit from Solana’s expanding application layer.

The Company is an AI-powered online platform that connects the commercial real estate industry by providing data and software subscriptions, as well as value-add services, to multifamily and commercial property professionals, as the Company connects the increasingly complex ecosystem that stakeholders have to manage.

The Company currently serves more than one million web users annually, including multifamily and commercial property owners and developers applying for billions of dollars of debt financing per year, professional service providers, and thousands of multifamily and commercial property lenders, including more than 10% of the banks in America, credit unions, real estate investment trusts (“REITs”), debt funds, Fannie Mae® and Freddie Mac® multifamily lenders, FHA multifamily lenders, commercial mortgage-backed securities (“CMBS”) lenders, Small Business Administration (“SBA”) lenders, and more. The Company’s data and software offerings are generally offered on a subscription basis as software as a service (“SaaS”).

Investor Contact:

ir@defidevcorp.com

Media Contact:

press@defidevcorp.com

Wizzwoods has secured a fresh $10 million investment. The round included Animoca Brands, IVC, and several angel investors. The team says this funding will help them build faster and deliver a bigger experience for players.

Wizzwoods is an open-world farming strategy game. It lives inside the Telegram Mini-app and Twitter Extensions ecosystem. Players explore a large digital world. They farm resources, craft items, and complete strategic tasks. They can also trade assets, interact with others, and create unique content.

The game mixes blockchain ownership with simple gameplay. This makes it easy for new players to join while still giving advanced users room to build deeper strategies.

Wizzwoods focuses on a blend of creation, management, and competition. Players gather resources, build structures, and shape their land. The world is open and encourages exploration.

The game includes user generated content tools. Players can design items, create mini experiences, or contribute to the growing in-game ecosystem.

Multiplayer features allow players to team up or compete. Cross chain trading lets users move digital items across supported networks. This creates a dynamic market where rarity and skill can influence value.

The project says its goal is to build a community driven game world that grows over time. The new funding will speed up this process.

The investment will help the team expand the Wizzwoods universe. Key areas of focus include:

The team says they want to deliver an experience that feels alive. They also want to make onboarding simple for everyday players who are not familiar with blockchain.

This milestone also positions Wizzwoods as a rising name in web3 gaming. Animoca Brands continues to back projects that combine digital ownership with strong gameplay. Their involvement gives the project more credibility and industry access.

Even with the funding success, the Wizzwoods token has faced heavy pressure in the market.

WIZZ is currently priced at $0.000748. It has dropped 18.9 percent over the past twenty four hours. The token is down 97.4 percent from its all time high of $0.0286 on April 1, 2025.

The circulating supply sits at 423 million tokens. The maximum supply is 1.8 billion tokens. The token’s market cap is $316 thousand. Its trading volume over the past twenty four hours is just under $10 thousand. Gate remains the main exchange where it is traded.

The project holds 0 percent share of the broader crypto market. The team has not commented on price action. For now, they remain focused on building and expanding the game world.

Even with token volatility, investor confidence remains strong. Web3 gaming continues to attract long term capital. Investors see potential in games that bridge simple gameplay with blockchain features that give users ownership.

The Telegram Mini-app ecosystem is also growing fast. Games like Hamster Kombat and Notcoin have shown the power of viral mini games. Wizzwoods wants to tap into this momentum with a deeper strategy experience.

Investors believe the game is positioned to reach millions of users. The blend of farming, trading, and content creation makes it accessible to a wide audience.

More News: Jeff Bezos Bets $6.2 Billion on Physical AI

The team says development will move faster from here. Players can expect more features, better graphics, and new systems that enrich the world.

Wizzwoods plans to focus heavily on user generated content. They want players to build structures, design items, and even create storylines. This helps the world grow without limits.

The team also plans to expand trading tools. They want to make cross chain trading smooth and secure. This will help users build real value inside the game.

Wizzwoods is now one of the latest projects pushing web3 gaming into a new phase. The team has funding, a growing community, and a clear vision.

The game blends fun gameplay with blockchain ownership in a way that feels natural. If the team delivers on its roadmap, Wizzwoods could become one of the next big names in the Telegram gaming universe.

To stay updated on crypto venture capital funding and market trends, visit our venture capital news section for more insight.

For more than a decade, the DeFi sector has operated on a fractured promise. The theoretical pitch of a fairer, more accessible global financial system has consistently crashed against the rocks of practical reality.

In practice, DeFi has delivered a user experience defined by hostility of confusing interfaces, punitive gas fees, risky workflows, and the terrified clutching of seed phrases. It created a system where only the technically literate or those willing to take risks dared to tread, leaving the vast majority of the world’s savers on the sidelines.

But the launch of Aave’s new mobile savings application marks a distinct departure from this exclusionary history.

By radically re-engineering the user journey to mimic the seamlessness of modern fintech, Aave is making a strategic wager that the path to onboarding a billion users isn’t about teaching them to navigate the blockchain, but about making the blockchain entirely invisible.

The most formidable barrier to DeFi adoption has never been the lack of yield; it has been the abundance of friction.

The “tech tax” of the ecosystem, requiring users to manage browser extensions like MetaMask, navigate complex signing pop-ups, and calculate gas fees in Ethereum, effectively capped the market size at power users.

The Aave App represents a fundamental break with this pattern. Leveraging advanced account abstraction, the application removes the vestiges of crypto’s technical burden.

There are no ledger devices to connect, no hexadecimal wallet addresses to copy and paste, and no manual bridging of assets between disparate chains. The interface simply asks the user to save.

This way, users can deposit euros, dollars, or connect debit cards, and the protocol handles the backend complexity of converting fiat into yield-bearing stablecoins.

By stripping away the “crypto” aesthetics and presenting itself as a clean, neo-banking interface, Aave is targeting the demographic that Revolut and Chime captured: digital natives who want utility without technical overhead.

The structural ambition of the app is to function as a bank in the front and a decentralized liquidity engine in the back.

This is not a trivial pivot. Aave currently manages over $50 billion in assets through smart contracts. If structured as a traditional financial institution, its balance sheet would rank it among the top 50 banks in the United States.

However, unlike traditional banks, where liquidity is often opaque, Aave’s ledger is transparent and auditable 24/7.

To operationalize this for the mass market, Aave Labs’ subsidiary recently secured authorization as a Virtual Asset Service Provider (VASP) under Europe’s comprehensive MiCA (Markets in Crypto-Assets) framework.

This regulatory milestone is the linchpin of the strategy. It provides the app with a legally recognized gateway into the traditional SEPA banking system, enabling compliant and regulated fiat on-and-off ramps.

This moves Aave out of the “shadow banking” categorization and into a recognized tier of financial service providers, granting it the legitimacy required to court mainstream depositors who would otherwise never touch a DeFi protocol.

If complexity is the first barrier to entry, trust is the second.

Numerous exploits, bridge hacks, and governance failures mark the history of DeFi. For the average saver, the fear of total loss outweighs the allure of high returns. No amount of yield is worth the risk of a drained wallet.

Aave is attempting to shatter this ceiling by introducing a balance protection mechanism of up to $1 million per user. This figure quadruples the standard $250,000 insurance limit for FDIC-insured accounts in the US.

While this protection is protocol-native rather than government-backed, the psychological impact is profound. It signals a shift in responsibility from the retail user to the protocol. In doing so, Aave is repositioning DeFi from a “buyer beware” frontier experiment into a product with institutional-grade safety rails.

For a middle-class saver in Europe or Asia, this reframes the proposition from “speculating on crypto” to “saving with better insurance than my local bank.”

While protection solves the trust deficit, yield solves the incentive problem.

The macroeconomic timing of Aave’s rollout is fortuitous. As central banks globally, including the Federal Reserve and the ECB, begin to cut rates, traditional savings yields are projected to compress back toward the low single digits.

Aave’s yield engine, however, operates on a different fundamental driver.

According to analytics from SeaLaunch, Aave’s stablecoin APY (denominated in USD and EUR) has consistently outperformed risk-free instruments, such as US Treasury bills. This is because the yield is derived from on-chain borrowing demand rather than central bank policy.

This creates a persistent premium. As traditional rates fall, the spread between a bank savings account (offering perhaps 3%) and Aave (offering 5–9%) widens.

For global users, particularly in developing economies with unstable banking sectors or high inflation, this access to dollar-denominated, high-yield savings is a necessary financial lifeline and not just a luxury.

Ultimately, the most understated component of Aave’s strategy is distribution.

By launching on the Apple iOS App Store, Aave is attaching its decentralized rails to the world’s largest fintech distribution engine. In 2024, the App Store received 813 million weekly visitors across 175 markets, according to Apple.

Considering this, Sebastian Pulido, Aave’s Director of Institutional & DeFi Business, captured it perfectly by describing the new application as “DeFi’s iPhone moment” because the platform will “abstract away all complexity and friction around getting access to defi yields.”

Essentially, just as the browser made the internet accessible to non-coders, the App Store makes DeFi accessible to non-traders.

Aave is tapping into the same infrastructure that scaled PayPal, Cash App, and Nubank to global dominance.

So, for the first time, a user in Lagos, Mumbai, or Berlin can onboard into DeFi with the same simplicity as downloading a game. There are no barriers, no distinct “crypto” learning curve, and no friction.

Essentially, if DeFi is ever to reach a billion users, it will not happen through browser extensions or technical whitepapers. It will happen through an app that looks like a bank, protects like an insurer, and pays like a hedge fund.

The recent tweet from Robbie Ferguson, co-founder of Immutable, has sparked significant interest in the cryptocurrency community, highlighting the massive potential of onchain gaming. According to Ferguson, when platforms like Roblox transition to blockchain technology, they could generate over $10 billion in annual economic activity. This projection underscores how these virtual economies already rival the GDPs of small countries, and their migration to onchain systems promises a transformative shift in the gaming and crypto sectors. As an expert in cryptocurrency markets, this development points to lucrative trading opportunities in gaming-related tokens, particularly those facilitating blockchain integration in games.

Robbie Ferguson’s insights, shared on November 18, 2025, emphasize the breathtaking scale of this migration. Immutable, the company behind the IMX token, is at the forefront of blockchain gaming with its layer-2 scaling solution for Ethereum. Traders should note that IMX has shown resilience in volatile markets, often correlating with broader Ethereum ecosystem trends. For instance, if Roblox’s move onchain materializes, it could drive substantial on-chain activity, boosting transaction volumes and token utility. Historical data from similar gaming blockchain adoptions, such as those seen in projects like Axie Infinity during its peak in 2021, demonstrated price surges exceeding 500% in short periods. Currently, without real-time data, market sentiment around IMX remains bullish, with analysts predicting support levels around $1.50 and resistance at $2.50 based on recent trading patterns. Integrating such news into trading strategies involves monitoring Ethereum gas fees and NFT marketplace volumes, as increased gaming activity could propel ETH prices upward, indirectly benefiting IMX holders.

To capitalize on this narrative, traders might consider long positions in IMX and related tokens like MANA or SAND, which power decentralized virtual worlds. A detailed analysis reveals that on-chain metrics, such as daily active users in blockchain games, have been climbing steadily, with a 15% month-over-month increase reported in Q3 2025 from various blockchain analytics sources. This correlates with rising trading volumes; for example, IMX’s 24-hour volume often spikes during positive gaming news, sometimes reaching $100 million. Risk management is crucial—set stop-loss orders below key support levels to mitigate downside from market corrections. Additionally, watch for institutional flows into gaming cryptos, as venture capital investments in web3 gaming hit $2 billion in 2025 alone, signaling strong long-term potential. Pair trading with ETH could hedge against volatility, given IMX’s dependency on Ethereum’s network health.

Beyond immediate trades, the broader implications for the crypto market are profound. Ferguson’s vision of onchain economies exceeding $10 billion annually could attract mainstream adoption, driving liquidity into the sector. This might influence cross-market dynamics, such as correlations with tech stocks like those of Roblox Corporation (RBLX), where positive blockchain news could lift share prices and, in turn, boost crypto sentiment. For diversified portfolios, allocating 10-15% to gaming tokens offers exposure to this growth narrative. As the migration unfolds, keep an eye on key indicators like total value locked (TVL) in gaming protocols, which stood at $5 billion across major platforms as of late 2025. In summary, this development not only highlights explosive growth potential but also presents actionable trading insights for savvy investors navigating the intersection of gaming and blockchain.

Overall, the tweet serves as a catalyst for reevaluating positions in the gaming crypto niche. With no current real-time data to contradict the optimistic outlook, traders are advised to stay informed on upcoming announcements from Immutable and similar projects. This could lead to short-term volatility trading opportunities, where scalpers target 5-10% intraday moves following social media buzz. Long-term holders might benefit from compounding gains as onchain gaming matures, potentially mirroring the DeFi boom of 2020-2021. Remember, while the projections are exciting, base decisions on verified on-chain data and market trends to avoid speculative pitfalls.

Toncoin was hit with what it described as a “major outage,” while Arbitrum’s block explorer, Arbiscan, also went down on Tuesday, as per a Coindesk report. Other websites, including social media platform X (Twitter) and data site DefiLlama, displayed intermittent “internal server errors” as the outage unfolded, as per the report.

Cloudflare acknowledged the problem at 11:48 UTC, saying that, “Cloudflare is aware of, and investigating an issue which impacts multiple customers: Widespread 500 errors, Cloudflare Dashboard and API also failing,” as quoted by the CoinDesk report.

ALSO READ: What is Cloudflare? How a major outage crashed parts of the internet and made X go down today

A 500 error typically signals an internal server issue that prevents a website from loading, so that means that website users will not be able to access a web page as long as the error persists, as per the report.

The disruption comes only weeks after Amazon Web Services (AWS) suffered a major outage of its own, which knocked thousands of websites and applications offline, as per the CoinDesk report. Platforms affected during that incident included Coinbase’s trading service, its Base layer-2 network, and the trading app Robinhood, as per the report.ALSO READ: Bull or bear market? Investors are tracking two key events – Nvidia earnings and September jobs report

Crypto exchange BitMEX also reported that it was investigating an outage linked to the latest Cloudflare issues, as reported by CoinDesk.

The internet services company previously announced NET Dollar, a US dollar–backed stablecoin, in September, although it has yet to launch, as per the report.

Cloudflare Inc (NET) shares fell 3.5% in pre-market trading following the outage, reported CoinDesk.

Is X (Twitter) down because of Cloudflare?

Yes, X saw intermittent internal server errors linked to the Cloudflare outage.

Is Cloudflare fixing the outage?

Cloudflare said it is investigating the issue and working on a fix.

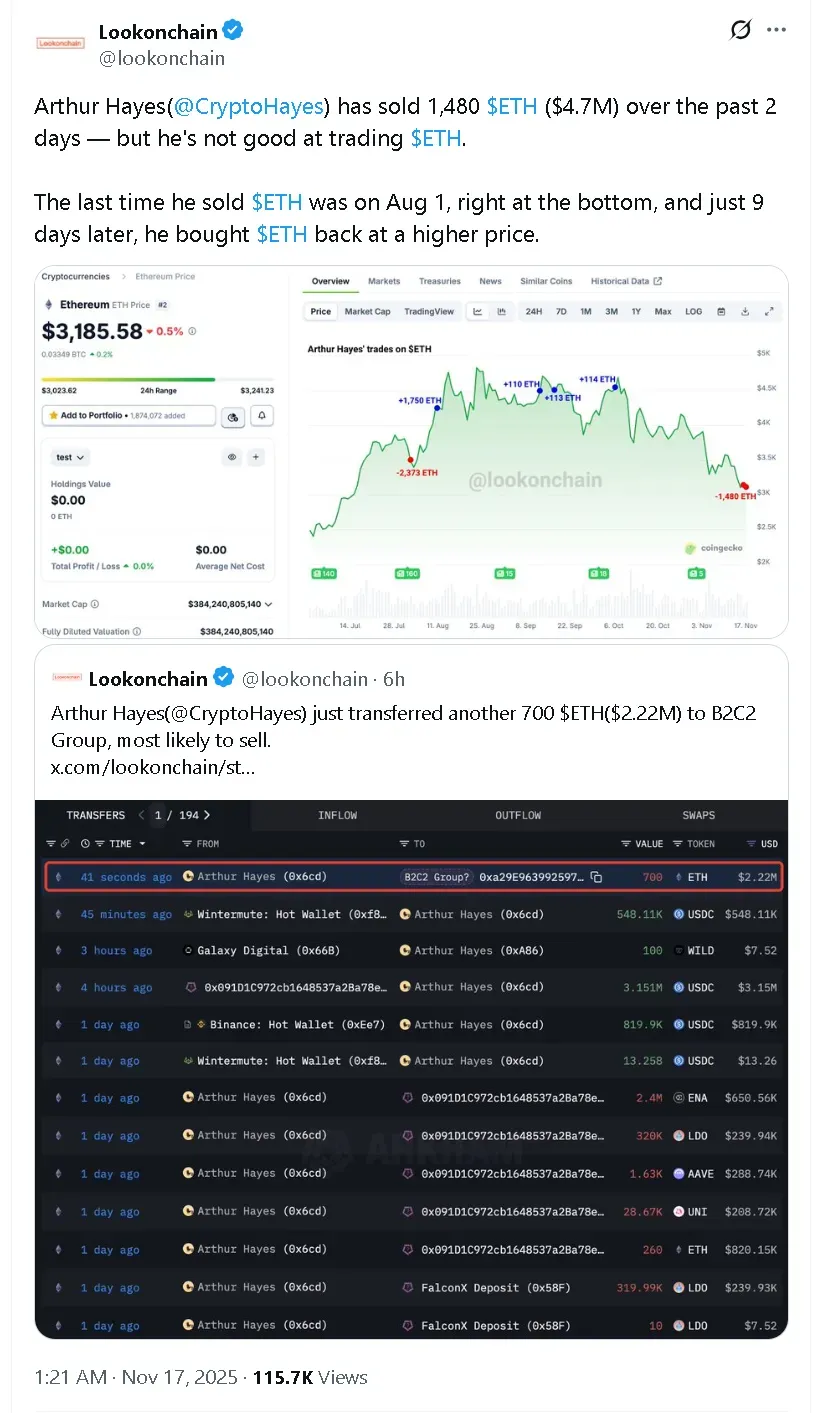

Ethereum holdings of the co-founder and former CEO of Bitmex fell from 6,500 ETH to 5,000 ETH over the weekend.

Arthur Hayes, co-founder and former CEO of BitMEX, offloaded nearly 1,500 Ethereum (ETH) over the weekend, according to on-chain analysis.

According to data from Akham Intelligence, Hayes’ ETH stash dipped to around 5,000 ETH from 6,500 ETH between November 15 to November 17. His current Ethereum holdings are valued at $16.11 million and unrealised profit of 0.94%.

Data showed that, in addition to Ethereum, Hayes also reduced his positions in several other tokens, including Enzyme (ENA), Lido (LDO), Aave (AAVE), Uniswap (UNI), and ETHFi (ETHFI).

According to Lookonchain, Hayes has been selling his stake, not just relocating it. In a post on X, the firm noted that the last time Hayes sold Ethereum was on August 1, when the token’s price was near market lows. It added that he bought it back just nine days later at a higher price.

Ethereum’s price rebounded in early morning trade on Monday, up more than 1% in the last 24 hours. On Stocktwits, however, retail sentiment continued to trend in ‘bearish’ territory with chatter at ‘normal’ levels over the past day. The leading altcoin’s price is now more than 35% below its all-time high of over $4,900, seen in August, at $3,182.

Fundstrat’s Tom Lee said on Sunday that Ethereum may be on a similar supercycle as Bitcoin. Lee stated that he first recommended Bitcoin (BTC) to clients in 2017 when it traded around $1,000 and that the cryptocurrency experienced multiple declines of up to 75% in subsequent years before hitting 100x gains.

“We believe ETH is embarking on that same Supercycle,” he wrote on X. Ethereum had lagged behind Bitcoin for much of early 2025, with ETH peaking at $4,946 in August while Bitcoin’s price reached over $126,000 in October. Lee added, “To have gained from that 100x Supercycle, one had to stomach existential moments to HODL.”

Shares of Tom Lee-backed BitMine Immersion Technologies (BMNR) edged 0.3% higher in pre-market trade, with retail sentiment also in the ‘bearish’ zone amid ‘normal’ levels of chatter over the past day. The company is the leading digital asset treasury (DAT) with Ethereum as its primary token. It currently has more than 3.5 million tokens in its coffers.

Read also: Bitcoin Price Struggles While Crypto Liquidations Top $500 Million – Analyst Flags Retail Pressure

For updates and corrections, email newsroom[at]stocktwits[dot]com.

After founding Valour Inc. with Mr. Wattenström nearly a decade ago, Mr. Roussy Newton was appointed CEO of DeFi Technologies on October 6, 2022, during one of the most severe bear markets in crypto history. At that time, the Company’s shares traded at approximately

“I am proud of what our team has delivered over the past three years. We scaled and institutionalized Valour’s ETP platform, strengthened our capital base, executed strategic M&A, and delivered record financial results for our shareholders,” said Mr. Roussy Newton. “I’m deeply grateful for the support of our employees, partners, and investors, and am confident that Johan, having been by my side since the inception of the company, is the right person to lead DeFi Technologies through its next phase of growth.”

Highlights under Mr. Roussy Newton’s leadership

Leadership Succession

The Board of Directors has appointed Johan Wattenström, Co-Founder of DeFi Technologies, as Chief Executive Officer and Executive Chairman.

Mr. Wattenström is a seasoned entrepreneur and executive with nearly two decades of experience at the intersection of digital assets, trading, and financial infrastructure. He co-founded Valour, DeFi‘s European ETP platform, and has been instrumental in shaping the Company’s product strategy, trading architecture, and global exchange relationships since inception.

Prior to DeFi Technologies, Mr. Wattenström founded and served as CEO of XBT Provider, the issuer of the world’s first Bitcoin ETP, which quickly surpassed

Mr. Wattenström also previously founded Nortide Capital, a global digital-asset trading and market-making firm, which provides liquidity and structured solutions to some of the world’s largest exchanges and token issuers. His combined experience across product structuring, market-making, and institutional trading uniquely positions him to lead DeFi Technologies into its next phase of growth.

“Olivier and I have built this company together from the ground up,” said Mr. Wattenström. “I’m grateful for his leadership and friendship, and I look forward to leading DeFi Technologies into its next phase of growth. We will continue to scale our ETP platform globally, expand our trading operations both internally and through Stillman Digital, and continue to bridge traditional capital markets with the digital asset ecosystem.”

Following the transition, Mr. Roussy Newton will be a strategic advisor to the Company and remain a cornerstone shareholder of the Company, ensuring continuity of vision and execution as DeFi Technologies enters its next stage of expansion. He is also deeply focused on strengthening the bridge between DeFi Technologies and BTQ Technologies, leveraging BTQ’s quantum-secure infrastructure to enhance the resilience, security, and long-term competitiveness of DeFi‘s product ecosystem.

About DeFi Technologies

DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and decentralized finance (“DeFi“). As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to the broader decentralized economy through its integrated and scalable business model. This includes Valour, which offers access to one hundred of the world’s most innovative digital assets via regulated ETPs; Stillman Digital, a digital asset prime brokerage focused on institutional-grade execution and custody; Reflexivity Research, which provides leading research into the digital asset space; Neuronomics, which develops quantitative trading strategies and infrastructure; and DeFi Alpha, the Company’s internal arbitrage and trading business line. With deep expertise across capital markets and emerging technologies, DeFi Technologies is building the institutional gateway to the future of finance. Follow DeFi Technologies on LinkedIn and X/Twitter, and for more details, visit https://defi.tech/

DeFi Technologies Subsidiaries

About Valour

Valour Inc. and Valour Digital Securities Limited (together, “Valour“) issues exchange traded products (“ETPs”) that enable retail and institutional investors to access digital assets in a simple and secure way via their traditional bank account. Valour is part of the asset management business line of DeFi Technologies. For more information about Valour, to subscribe, or to receive updates, visit valour.com.

About Stillman Digital

Stillman Digital is a leading digital asset liquidity provider that offers limitless liquidity solutions for businesses, focusing on industry-leading trade execution, settlement, and technology. For more information, please visit https://www.stillmandigital.com

About Reflexivity Research

Reflexivity Research LLC is a leading research firm specializing in the creation of high-quality, in-depth research reports for the bitcoin and digital asset industry, empowering investors with valuable insights. For more information please visit https://www.reflexivityresearch.com/

Cautionary note regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to appointment of directors and officers and other non-executive positions; investor confidence in digital assets generally; the regulatory environment with respect to the growth and adoption of decentralized finance; the pursuit by the Company and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited the acceptance of Valour exchange traded products by exchanges; growth and development of decentralised finance and digital asset sector; rules and regulations with respect to decentralised finance and digital assets; fluctuation in digital asset prices; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

THE CBOE

View original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-announces-leadership-transition-olivier-roussy-newton-resigns-as-ceo-and-chairman-co-founder-johan-wattenstrom-appointed-as-successor-302617113.html

SOURCE DeFi Technologies Inc.

Share this article

DappRadar, a platform that tracked decentralized applications across blockchain networks, has shut down today after seven years of operations. The platform highlighted financial difficulties as a key factor leading to its closure.

The shutdown marks the end of one of the industry’s longstanding analytics providers for the dapp ecosystem. DappRadar provided data and insights on decentralized application usage, rankings, and performance metrics across multiple blockchain networks.

The closure comes as blockchain gaming and dapp sectors face reduced activity and funding challenges, contributing to operational unsustainability for analytics providers in the space.

DeFi Technologies Inc.

/ Key word(s): Personnel

DeFi Technologies Announces Leadership Transition: Olivier Roussy Newton Resigns as CEO and Chairman; Co-Founder Johan Wattenström Appointed as Successor

17.11.2025 / 14:10 CET/CEST

The issuer is solely responsible for the content of this announcement.

TORONTO, Nov. 17, 2025 /PRNewswire/ — DeFi Technologies Inc. (the “Company” or “DeFi Technologies“) (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B), a financial technology company bridging the gap between traditional capital markets and decentralized finance (“DeFi”), today announced that Olivier Roussy Newton has resigned as Chief Executive Officer and Executive Chairman of the Board. The Company’s Board of Directors has appointed Johan Wattenström, Co-Founder of Valour and DeFi Technologies, as Chief Executive Officer and Executive Chairman effective upon Mr. Roussy Newton’s departure. Mr. Roussy Newton will be appointed Strategic Advisor of the Company beginning in December.

After founding Valour Inc. with Mr. Wattenström nearly a decade ago, Mr. Roussy Newton was appointed CEO of DeFi Technologies on October 6, 2022, during one of the most severe bear markets in crypto history. At that time, the Company’s shares traded at approximately $0.5, and it reported year-end 2022 cash of approximately $3.4 million and loans payable of approximately $37.6 million. Over the last three years under Mr. Roussy Newton’s leadership, DeFi Technologies scaled Valour’s ETP platform, executed strategic M&A, strengthened its balance sheet, and cemented its position as a leader in the digital asset industry through innovation, execution, growth, and profitability.

“I am proud of what our team has delivered over the past three years. We scaled and institutionalized Valour’s ETP platform, strengthened our capital base, executed strategic M&A, and delivered record financial results for our shareholders,” said Mr. Roussy Newton. “I’m deeply grateful for the support of our employees, partners, and investors, and am confident that Johan, having been by my side since the inception of the company, is the right person to lead DeFi Technologies through its next phase of growth.”

Highlights under Mr. Roussy Newton’s leadership

Leadership Succession

The Board of Directors has appointed Johan Wattenström, Co-Founder of DeFi Technologies, as Chief Executive Officer and Executive Chairman.

Mr. Wattenström is a seasoned entrepreneur and executive with nearly two decades of experience at the intersection of digital assets, trading, and financial infrastructure. He co-founded Valour, DeFi’s European ETP platform, and has been instrumental in shaping the Company’s product strategy, trading architecture, and global exchange relationships since inception.

Prior to DeFi Technologies, Mr. Wattenström founded and served as CEO of XBT Provider, the issuer of the world’s first Bitcoin ETP, which quickly surpassed $1 billion in assets under management and became one of Europe’s most relied-upon regulated on-ramps to crypto before its acquisition by CoinShares. His work establishing secure, exchange-listed Bitcoin exposure set the template for how institutions first entered digital assets and remains a foundational milestone for the industry today.

Mr. Wattenström also previously founded Nortide Capital, a global digital-asset trading and market-making firm, which provides liquidity and structured solutions to some of the world’s largest exchanges and token issuers. His combined experience across product structuring, market-making, and institutional trading uniquely positions him to lead DeFi Technologies into its next phase of growth.

“Olivier and I have built this company together from the ground up,” said Mr. Wattenström. “I’m grateful for his leadership and friendship, and I look forward to leading DeFi Technologies into its next phase of growth. We will continue to scale our ETP platform globally, expand our trading operations both internally and through Stillman Digital, and continue to bridge traditional capital markets with the digital asset ecosystem.”

Following the transition, Mr. Roussy Newton will be a strategic advisor to the Company and remain a cornerstone shareholder of the Company, ensuring continuity of vision and execution as DeFi Technologies enters its next stage of expansion. He is also deeply focused on strengthening the bridge between DeFi Technologies and BTQ Technologies, leveraging BTQ’s quantum-secure infrastructure to enhance the resilience, security, and long-term competitiveness of DeFi’s product ecosystem.

About DeFi Technologies

DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and decentralized finance (“DeFi”). As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to the broader decentralized economy through its integrated and scalable business model. This includes Valour, which offers access to one hundred of the world’s most innovative digital assets via regulated ETPs; Stillman Digital, a digital asset prime brokerage focused on institutional-grade execution and custody; Reflexivity Research, which provides leading research into the digital asset space; Neuronomics, which develops quantitative trading strategies and infrastructure; and DeFi Alpha, the Company’s internal arbitrage and trading business line. With deep expertise across capital markets and emerging technologies, DeFi Technologies is building the institutional gateway to the future of finance. Follow DeFi Technologies on LinkedIn and X/Twitter, and for more details, visit https://defi.tech/

DeFi Technologies Subsidiaries

About Valour

Valour Inc. and Valour Digital Securities Limited (together, “Valour“) issues exchange traded products (“ETPs”) that enable retail and institutional investors to access digital assets in a simple and secure way via their traditional bank account. Valour is part of the asset management business line of DeFi Technologies. For more information about Valour, to subscribe, or to receive updates, visit valour.com.

About Stillman Digital

Stillman Digital is a leading digital asset liquidity provider that offers limitless liquidity solutions for businesses, focusing on industry-leading trade execution, settlement, and technology. For more information, please visit https://www.stillmandigital.com

About Reflexivity Research

Reflexivity Research LLC is a leading research firm specializing in the creation of high-quality, in-depth research reports for the bitcoin and digital asset industry, empowering investors with valuable insights. For more information please visit https://www.reflexivityresearch.com/

Cautionary note regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to appointment of directors and officers and other non-executive positions; investor confidence in digital assets generally; the regulatory environment with respect to the growth and adoption of decentralized finance; the pursuit by the Company and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited the acceptance of Valour exchange traded products by exchanges; growth and development of decentralised finance and digital asset sector; rules and regulations with respect to decentralised finance and digital assets; fluctuation in digital asset prices; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

THE CBOE CANADA EXCHANGE DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

17.11.2025 CET/CEST Dissemination of a Corporate News, transmitted by EQS News – a service of EQS Group.

The issuer is solely responsible for the content of this announcement.

The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases.

View original content: EQS News

The Hamster Kombat Daily Cipher has become one of the most engaging features within the Hamster Kombat ecosystem, blending classic code-breaking with modern Web3 gaming rewards. On 17 November 2025, thousands of players across the globe will log into Telegram to decode secret messages, earn coins, and gain rewards, making this daily activity a highlight for the gaming community.

Designed to appeal to both casual and experienced players, the Daily Cipher integrates a Morse code-based puzzle system with real-time cryptocurrency rewards. The feature demonstrates how traditional puzzle-solving can meet modern gamification, offering players both entertainment and tangible crypto incentives.

The Daily Cipher is a 24-hour puzzle challenge in which players must decode a Morse code message consisting of dots (●) and dashes (▬) to reveal words or phrases. Successfully completing the challenge rewards players with $HMSTR coins, the primary token within the Hamster Kombat ecosystem.

This feature is unique because it combines:

Classic puzzle-solving mechanics: Players engage in logic, pattern recognition, and Morse code decoding.

Digital gaming incentives: Coins can be used for in-game bonuses, level progression, and other rewards.

Web3 integration: Telegram serves as both a front-end gaming interface and crypto wallet, allowing players to earn, store, and mine $HMSTR tokens seamlessly.

By linking traditional puzzles with a cryptocurrency reward system, Hamster Kombat has carved out a niche in the competitive Web3 gaming market.

At the time of publication, the cipher for today is “Coming Soon – Stay Tuned!”. Players can prepare in advance by understanding the mechanics and strategies needed to solve the daily challenge efficiently.

Also, read this article: Syntax Verse Daily Quiz Answer 13 November 2025 to discover more exciting tasks and rewards for challenges!

Decoding the Daily Cipher requires careful attention and step-by-step execution:

Step 1: Launch the Mode

Open the Telegram app and locate the Hamster Kombat bot.

Tap the icon to initiate the Daily Cipher mode. A red screen will confirm activation, signaling the start of the code-breaking challenge.

Step 2: Decode the Morse Code

Interpret short taps as dots (●) and long taps as dashes (▬).

Time pauses correctly; hold for approximately 1.5 seconds between characters.

Focus on accuracy, as precise decoding is required to unlock the reward.

Step 3: Input and Claim Bonus

Enter the decoded message into the submission field.

Once submitted, rewards are instantly credited to the user’s account in the form of $HMSTR coins.

Players looking to increase their $HMSTR holdings can leverage the following strategies:

Complete Daily Tasks and Participate in Events

Daily missions and events are essential for consistent earnings. Participation provides opportunities to earn significant amounts of coins, making routine engagement highly rewarding.

Toxin Challenge

Register for tournaments such as the Toxin Challenge to receive bonus rewards, including up to 1 million $HMSTR coins for successful participation.

Mini-Games and Elite Missions

Engage in mini-games and elite missions within the Telegram app. These activities are enjoyable while offering additional rewards and progression opportunities.

Maintain Daily Streaks

Consistency is key. Players who participate every day not only maximize their earnings but also unlock additional bonuses for streaks.

Community Collaboration

Telegram community groups often share tips, decoding hints, and strategies, making collaboration a valuable tool for faster and more efficient completion.

The Hamster Kombat Daily Cipher is more than a simple puzzle. It represents a new model for Web3 gaming, where:

Engagement meets reward: Players are incentivized to participate daily, increasing retention.

Learning is integrated: Classic Morse code skills are developed in a fun, interactive way.

Cryptocurrency is earned: Real-world value is tied to in-game activities, bridging entertainment with finance.

Accessibility is high: Telegram’s widespread use ensures a global audience can participate easily.

Gamification drives adoption: Combining puzzles with token rewards accelerates user growth and loyalty.

By merging these elements, Hamster Kombat sets itself apart from conventional mobile games, appealing to both casual gamers and those invested in Web3 technologies.

The Daily Cipher illustrates a broader trend in crypto-enabled gaming, where gamification and blockchain rewards converge:

Micro-tasks with meaningful rewards: Small daily activities translate into measurable benefits.

Community-driven engagement: Telegram channels provide a collaborative environment, enhancing user experience.

Flexible participation: Players can join at any time, fitting gameplay into daily routines.

Incremental progression: Rewards accumulate over time, creating long-term value for consistent players.

Bridging skill and play: Decoding puzzles sharpens analytical skills while remaining enjoyable.

This model of daily engagement, immediate rewards, and community involvement has become a hallmark of successful Web3 games.

The Hamster Kombat Daily Cipher for 17 November 2025 exemplifies how traditional puzzle-solving can be integrated into a modern crypto-gaming ecosystem. Daily participation allows players to:

Decode Morse code messages and complete challenges.

Earn $HMSTR coins, which can be used for in-game progression and staking.

Improve strategic thinking and problem-solving skills.

Engage with a global community on Telegram.

Whether you are a casual gamer or a dedicated Web3 enthusiast, the Daily Cipher provides a fun, educational, and profitable experience. Log in, solve the cipher, claim your $HMSTR coins, and embrace one of the most innovative features in modern gaming.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer

@Erlin

Erlin is an experienced crypto writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides insights into the latest trends and innovations in the digital currency space.

Check out other news and articles on Google News