Category: Forex News

NZDUSD Technical Analysis | Forexlive

USD

- The Fed left interest rates unchanged as

expected at the last meeting and dropped the tightening bias in the statement. - The US CPI

yesterday beat expectations for the second consecutive month but it didn’t

change the market’s pricing for rate cuts. - The NFP report beat

expectations on the headline number, but the unemployment rate and the average

hourly earnings missed notably. - The latest US ISM

Manufacturing PMI missed expectations by a big margin

remaining in contraction with the US ISM Services

PMI

following suit but holding on in expansion. - The US Consumer

Confidence missed expectations across the board. - The market expects the first rate cut in June.

NZD

- The RBNZ kept its official cash rate

unchanged dropping

the tightening bias and stating that the OCR will need to remain at restrictive

level for a sustained period. - The latest New Zealand inflation data printed in line with expectations

supporting the RBNZ’s patient stance. - The labour market report beat expectations across the

board with lower than expected unemployment rate and higher wage growth. - The Manufacturing PMI improved in January remaining in

contraction while the Services PMI jumped back into expansion. - The market expects the first cut in

August.

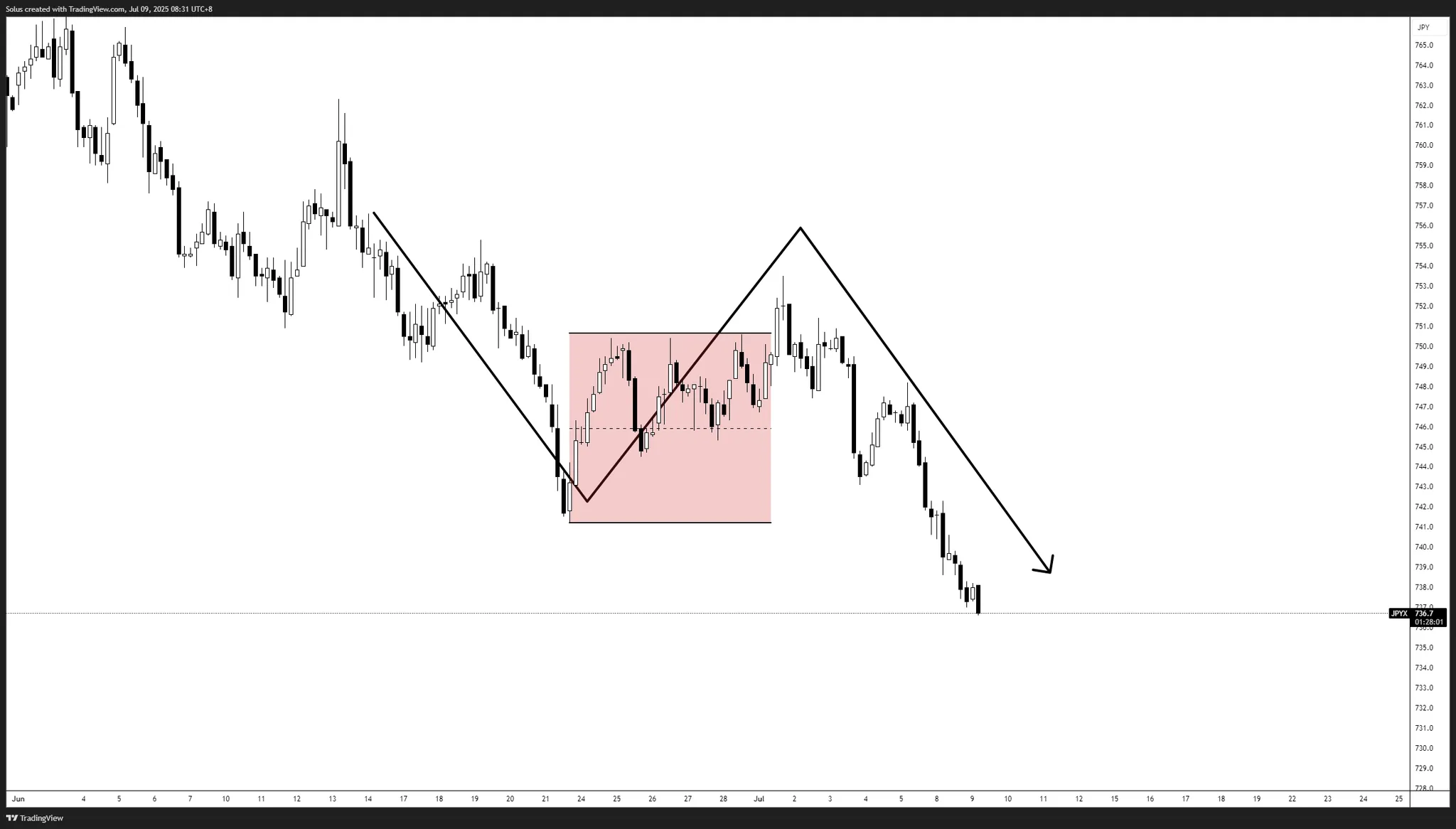

NZDUSD Technical Analysis –

Daily Timeframe

NZDUSD Daily

On the daily chart, we can see that NZDUSD bounced

on the key 0.6050 support and

rallied strongly into the swing level at 0.6218 where the price got rejected

from. This is the level that the buyers will need to break to start targeting

new highs. The sellers, on the other hand, will likely step in at the swing

level again if the price gets there to position for a drop back into the key

support targeting a break below it.

NZDUSD Technical Analysis –

4 hour Timeframe

NZDUSD 4 hour

On the 4 hour chart, we can see that the price

spiked to the downside following the US CPI report and eventually pulled back

into the resistance zone around the 0.6160 level where we had the confluence with the

red 21 moving average and the

downward trendline. This is

where the sellers stepped in with a defined risk above the resistance to

position for a drop into the key support zone. The buyers, on the other hand,

will want to see the price breaking higher to invalidate the bearish setup and

position for a break above the 0.6218 level.

NZDUSD Technical Analysis –

1 hour Timeframe

NZDUSD 1 hour

On the

1 hour chart, we can see more closely the recent price action with the sellers coming

into the market at the resistance zone. If the price were to break below the black

counter-trendline we can expect the sellers to increase the bearish bets into

the key support zone. The buyers, on the other hand, should lean on the

counter-trendline to position for a break above the downward trendline with a

better risk to reward setup.

Upcoming Events

Tomorrow we get the US PPI, the US Retail Sales and the

US Jobless Claims figures. On Friday, we conclude the week with the New Zealand

Manufacturing PMI and later in the day, the University of Michigan Consumer

Sentiment survey.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: