The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

XRP Slips Below $2 as CME Launches Spot‑Quoted Futures and ETF Inflows Near $1B

Updated: Dec. 15, 2025 — 11:30 a.m. ET (New York)

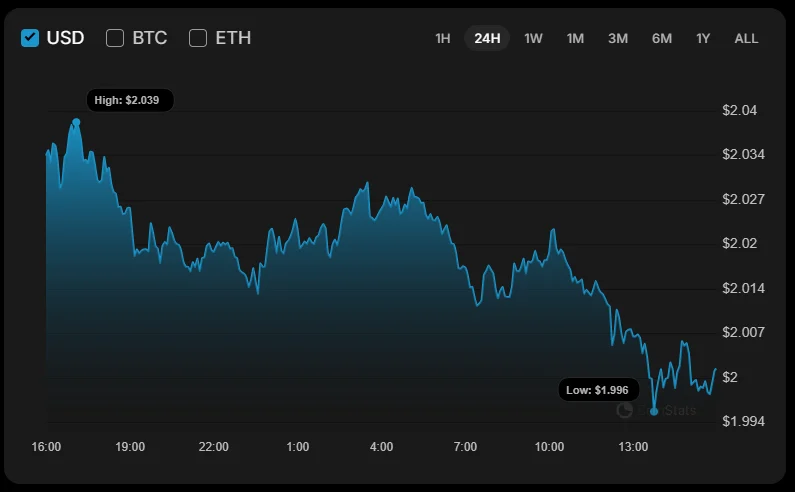

XRP (Ripple) is trading around $1.92–$1.93 as of 11:30 a.m. ET on Monday, Dec. 15, 2025, down roughly 3%–4% over the past 24 hours as sellers again defend the psychologically important $2.00 level. [1]

Across major price trackers, reported 24‑hour volume varies by methodology but broadly sits in the $1.7B–$2.7B range, with XRP’s market capitalization around $116B–$120B. [2]

Today’s action is unfolding against a busy backdrop for XRP: CME Group rolled out new XRP derivatives, U.S.-listed spot XRP ETFs are extending a notable inflow streak, and Ripple published new details on RLUSD multichain expansion—yet near-term price is still being driven by a tug-of-war between improving “institutional plumbing” and stubborn technical resistance at $2. [3]

XRP price today: quick market snapshot

- Price: about $1.92–$1.93 [4]

- Key level in focus:$2.00 [5]

- Day’s range (varies by venue): roughly $1.91–$2.01 [6]

- 24h volume: roughly $1.7B–$2.7B depending on aggregator [7]

What’s moving XRP today: the Dec. 15 news and analysis roundup

Here are the major XRP headlines, forecasts, and market analyses published today (Dec. 15, 2025) that traders are reacting to:

- CME launches Spot‑Quoted XRP futures (and SOL): CME Group announced it has launched Spot‑Quoted XRP and SOL futures, expanding its “Spot‑Quoted” crypto suite beyond Bitcoin and Ether. [8]

- Spot XRP ETFs keep pulling in money: FXStreet reports 20 consecutive days of inflows, cumulative inflows around $991M, and net assets around $1.18B, with specific fund-by-fund flow details. [9]

- ETF streak narrative strengthens: Other outlets highlight an even longer streak count (30 straight inflow days) and emphasize that XRP ETF flows have held up while other crypto ETF categories have seen choppier demand. [10]

- Ripple’s RLUSD multichain push: Ripple says RLUSD is expanding to Optimism, Base, Ink, and Unichain for testing ahead of a broader debut next year (subject to regulatory approval), using Wormhole’s NTT standard. [11]

- Price forecasts turn highly “level-driven”: Analysts largely frame today as a battle around $2.00, with many pointing to downside risk if support fails—and upside targets if XRP can reclaim/close above resistance. [12]

- Supply narrative re-enters the chat: Finbold flags Ripple’s next scheduled escrow unlock—up to 1B XRP on Jan. 1, 2026—as a near‑term talking point into year‑end liquidity conditions. [13]

- Macro tone is still cautious: A broad “risk‑off” crypto mood persists with Bitcoin below $90,000 in early trading, and markets watching upcoming macro releases for risk-asset direction. [14]

CME’s Spot‑Quoted XRP futures launch: why it matters for XRP price

Today’s biggest “market structure” headline is CME Group’s Spot‑Quoted XRP futures rollout.

According to CME’s announcement, the new Spot‑Quoted XRP and SOL futures are designed so traders can hold futures in spot-market terms with a longer-dated expiry, reducing the need to continually roll positions. CME also positioned these contracts as smaller and aimed at broader accessibility. [15]

Why this can matter for XRP—especially around key levels like $2.00:

- More hedging tools can change behavior at support/resistance. When more participants can hedge cleanly, it can increase two-way flow at major levels (sometimes damping volatility, sometimes increasing it around breakouts).

- Derivatives liquidity can pull attention. Even if spot price doesn’t jump immediately on the headline, futures availability can become a medium-term catalyst via improved price discovery and deeper institutional participation.

CME also highlighted strong activity in its existing Spot‑Quoted Bitcoin and Ether futures since launching in June, including a large cumulative contract count and a notable record day in late November—signaling the exchange sees a real market for this format. [16]

XRP ETFs: strong inflows, soft price — the core Dec. 15 contradiction

The second major theme today is the disconnect between:

- Consistent inflows into U.S.-listed spot XRP ETFs, and

- XRP’s repeated failures to break and hold above $2.00

FXStreet reports XRP spot ETFs extended a 20‑day inflow streak and puts cumulative inflows around $991 million with net assets around $1.18 billion. It also notes a recent day with about $20 million deposited and identifies fund leaders for that session, including Franklin Templeton’s XRPZ, Bitwise’s XRP, and Canary Capital’s XRPC. [17]

Other coverage leans into the “streak” framing, describing 30 straight days of inflows and emphasizing how unusual uninterrupted demand has been compared with other crypto ETF categories. [18]

Two key takeaways for traders:

- ETF demand supports the longer-term bid, but it does not guarantee immediate upside—especially if spot sellers use $2.00 as an exit point. [19]

- The $1B milestone is psychological too. Multiple analysts suggest that breaking above $1B in cumulative inflows could attract incremental attention to XRP investment products, even if price needs time to respond. [20]

Ripple’s RLUSD multichain update: a fresh fundamental headline on Dec. 15

Ripple added a new ecosystem narrative today: RLUSD on Ethereum Layer‑2 networks.

In a Dec. 15 post, Ripple said it is beginning testing for RLUSD on Optimism, Base, Ink, and Unichain, working with Wormhole and its Native Token Transfers (NTT) standard—ahead of an “official debut next year” that is framed as subject to regulatory approval. [21]

While RLUSD is a stablecoin story (not an XRP price story in the strictest sense), it can matter for XRP sentiment because it reinforces Ripple’s broader pitch around regulated onchain finance and multichain infrastructure—one of the narratives institutions often care about.

Notably, Ripple’s post also ties multichain expansion to practical end-user utility (payments, swaps, checkout, and apps), and explicitly references functionality for XRP holders across supported chains. [22]

XRP technical analysis today: $2.00 is the battleground

A striking number of today’s analyses—across very different outlets—land on the same point:

XRP’s near-term direction hinges on what happens around $2.00. [23]

Key support levels highlighted today

- $2.00: psychological pivot; a close below can embolden sellers. [24]

- $1.97: described by TipRanks as a “floor”/decision zone; losing it risks acceleration. [25]

- $1.96–$1.95: flagged as developing support zones in technical write-ups. [26]

- $1.92–$1.90: a commonly cited lower support band if $1.97 breaks. [27]

- $1.82: FXStreet points to November’s low as a potential destination if bearish momentum returns. [28]

Key resistance levels highlighted today

- $2.00–$2.01: a repeated “ceiling” after multiple rejections. [29]

- $2.12: FXStreet flags a nearby cap tied to a descending trendline. [30]

- $2.21: highlighted as the 50‑day EMA area; a close above can ease bearish pressure. [31]

- $2.54: cited as a higher resistance level if XRP can break out of its downtrend structure. [32]

Why $2 keeps rejecting price

TipRanks argues that XRP’s third rejection at $2.00–$2.01 was reinforced by a sharp volume spike (it cites a surge far above average), suggesting larger sellers are actively defending that zone. [33]

FXStreet adds that XRP remains below key moving averages, with indicators (RSI/MACD) still leaning bearish—meaning bounces can fail unless buyers reclaim pivotal levels decisively. [34]

Forecasts and price predictions published today: what analysts are saying

Today’s forecasts are less about one precise number and more about conditional scenarios:

Scenario 1: Relief rally if XRP reclaims $2.01 and holds

- TipRanks suggests a sustained close above $2.01 could open $2.15–$2.20 as a next target zone. [35]

- FXStreet sees a bullish path that strengthens if XRP can close above the 50‑day EMA (~$2.21), which could reduce bearish pressure and point toward higher resistance areas. [36]

Scenario 2: Range trade continues (the “most likely until proven otherwise” view)

- Several analyses effectively describe XRP as compressed between sellers near $2.00 and buyers trying to defend the upper‑$1.90s, with catalysts (ETF milestones, derivatives, macro data) potentially deciding the next impulse. [37]

Scenario 3: Deeper pullback if $1.97/$2.00 fails

- TipRanks warns a break below $1.97 could expose $1.90–$1.92 quickly. [38]

- A separate cluster of coverage points to the $1.90–$1.82 region as a broader demand zone if downside momentum strengthens. [39]

- One TipRanks piece also raises a much deeper downside scenario (down toward ~$1.40) tied to on‑chain dynamics and heavy selling pressure, underscoring how wide the distribution of opinions is today. [40]

The supply factor: Ripple’s Jan. 1 escrow unlock enters the narrative again

Even when markets “expect” it, supply still affects psychology—especially into year-end liquidity.

Finbold reports Ripple is scheduled to unlock up to 1 billion XRP from escrow on Jan. 1, 2026, and notes that historically Ripple often re-locks a majority of released tokens rather than pushing the full amount into the market. [41]

The practical implication: traders will likely watch on-chain movements around the turn of the month for signs of potential selling pressure—particularly if XRP is already trading weakly below $2.00. [42]

Macro backdrop: why XRP isn’t trading in a vacuum today

XRP’s story is packed with crypto-specific catalysts, but the whole market is still taking cues from broader risk sentiment.

Barron’s notes Bitcoin dipped below $90,000 early Monday and highlights that upcoming U.S. macroeconomic data this week could influence sentiment (including whether markets lean more toward a rate-cut narrative). [43]

For XRP, that matters because major altcoins often struggle to sustain breakouts when macro-sensitive risk assets are under pressure.

What to watch next for XRP (today and this week)

If you’re tracking XRP price today into the U.S. close and beyond, here’s what traders typically focus on from the headlines driving Dec. 15 coverage:

- CME Spot‑Quoted XRP futures early activity — initial volumes and whether derivatives participation grows after launch. [44]

- Daily spot XRP ETF flow prints — especially whether total cumulative inflows cleanly move above $1B and whether the streak continues without interruption. [45]

- $2.00 reclaim (or failure) — many technical outlooks treat this as the line separating a grind-down from a recovery attempt. [46]

- Ripple ecosystem headlines — RLUSD multichain testing and regulatory steps can affect sentiment, even if price impact is indirect. [47]

- Jan. 1 escrow positioning — watch whether traders begin front-running perceived supply risk into late December. [48]

Bottom line: XRP is getting “more institutional,” but price still needs a breakout signal

Dec. 15 brings a rare combination of structural positives (new CME products, continued ETF inflows, Ripple ecosystem expansion) and short-term caution (macro pressure, stubborn $2 resistance, and supply chatter heading into January).

Right now, the market’s message is simple: XRP can have good news and still go nowhere until $2.00 breaks cleanly. If bulls reclaim and hold above the $2.01–$2.21 zone, multiple analysts see room for continuation. If support fails, the $1.90–$1.82 area becomes the next magnet in many downside roadmaps. [49]

This article is for informational purposes only and is not financial advice.

References

1. coinmarketcap.com, 2. coinmarketcap.com, 3. www.prnewswire.com, 4. coinmarketcap.com, 5. www.tipranks.com, 6. www.investing.com, 7. coinmarketcap.com, 8. www.prnewswire.com, 9. www.fxstreet.com, 10. www.ccn.com, 11. ripple.com, 12. www.fxstreet.com, 13. finbold.com, 14. www.barrons.com, 15. www.prnewswire.com, 16. www.prnewswire.com, 17. www.fxstreet.com, 18. www.ccn.com, 19. www.tipranks.com, 20. www.fxstreet.com, 21. ripple.com, 22. ripple.com, 23. www.fxstreet.com, 24. www.fxstreet.com, 25. www.tipranks.com, 26. www.fxstreet.com, 27. www.tipranks.com, 28. www.fxstreet.com, 29. www.tipranks.com, 30. www.fxstreet.com, 31. www.fxstreet.com, 32. www.fxstreet.com, 33. www.tipranks.com, 34. www.fxstreet.com, 35. www.tipranks.com, 36. www.fxstreet.com, 37. www.tipranks.com, 38. www.tipranks.com, 39. cryptorank.io, 40. www.tipranks.com, 41. finbold.com, 42. finbold.com, 43. www.barrons.com, 44. www.prnewswire.com, 45. www.fxstreet.com, 46. www.tipranks.com, 47. ripple.com, 48. finbold.com, 49. www.tipranks.com